This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Vermont Limited Partnership Form

Description

Form popularity

FAQ

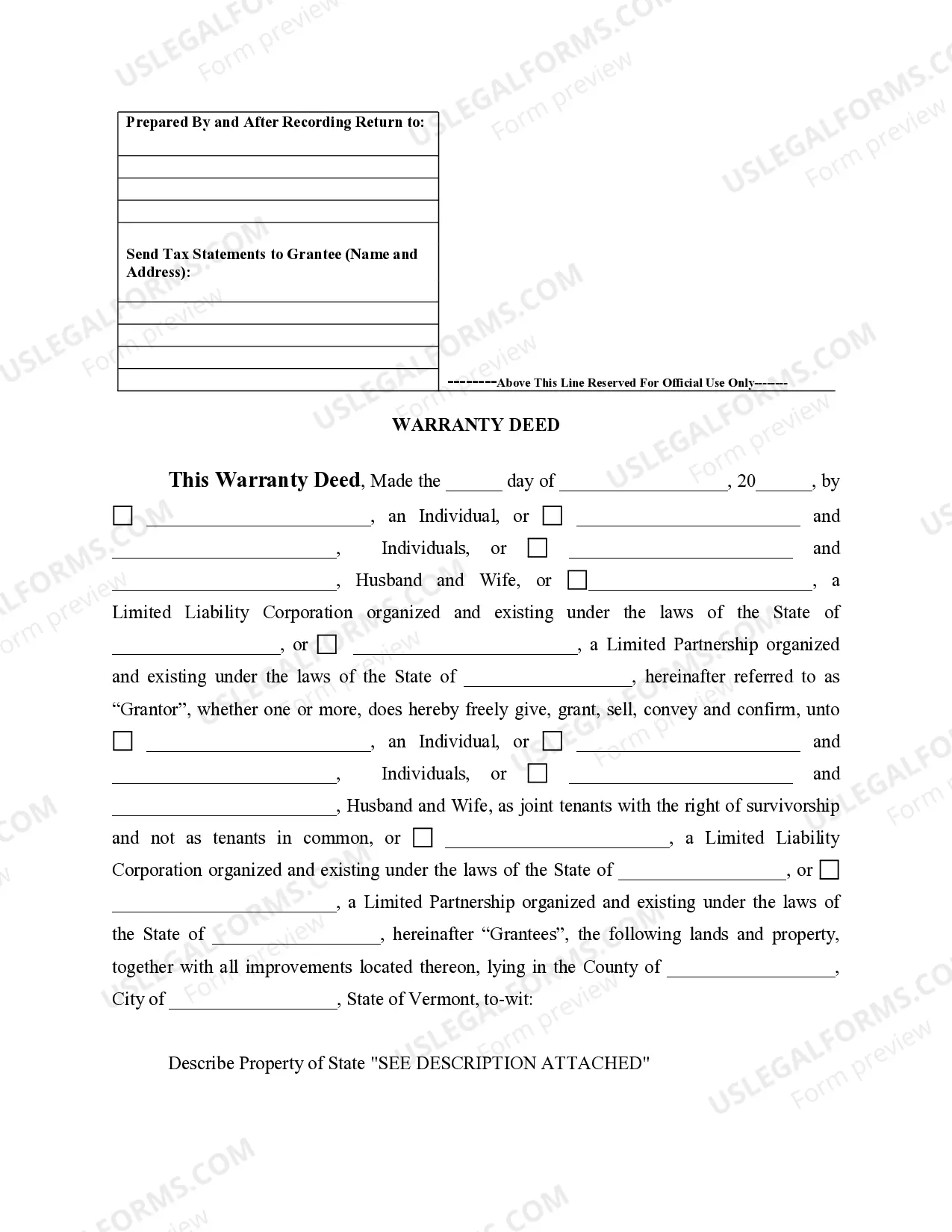

Forming a limited partnership involves several key steps. Begin by selecting at least one general partner and one limited partner. Draft the necessary legal documents, including a partnership agreement and the Vermont limited partnership form. Once completed, file the documents with the state to ensure your partnership is officially recognized and compliant.

To set up a limited partnership, start by choosing a unique name that complies with Vermont regulations. Next, draft a partnership agreement that outlines the roles and responsibilities of both general and limited partners. Finally, file the Vermont limited partnership form with the appropriate state agency to officially register your limited partnership.

Despite their benefits, limited partnerships have some disadvantages. One significant downside is that general partners have unlimited liability, which can expose them to significant financial risk. Additionally, the limited partners generally cannot participate in the management of the business without risking their limited liability status. Understanding these factors is essential when filling out the Vermont limited partnership form.

A limited partnership fund typically has two types of partners: general partners and limited partners. General partners manage the fund's operations and make investment decisions, while limited partners invest capital without participating in daily management. This structure allows investors to enjoy limited liability, making the Vermont limited partnership form an attractive option for those looking to invest while minimizing risk.

To form a limited partnership in Vermont, three key requirements must be met. First, you need at least one general partner who manages the business and assumes unlimited liability. Second, there must be at least one limited partner who contributes capital and has limited liability. Lastly, you must complete and file the Vermont limited partnership form to officially register your partnership.

Starting an S Corp in Vermont involves several key steps. Begin by choosing a unique business name, followed by filing Articles of Incorporation with the Secretary of State. Once you're incorporated, you can file Form 2553 with the IRS to elect S Corp status. Along the way, leverage resources like the Vermont limited partnership form to navigate the process smoothly.

To register a foreign LLC in Vermont, you'll need to file a Certificate of Authority with the Secretary of State. This process requires submitting specific documents, including proof of good standing from your home state. Also, consider consulting the Vermont limited partnership form if you're looking for ways to integrate your business structure for better management.

The best state to set up an S Corp varies depending on your specific business needs. Generally, states like Delaware and Florida are popular due to favorable regulations. While Vermont may not be the first choice, it offers a supportive environment. If you decide to register in Vermont, consider the Vermont limited partnership form to structure your business effectively.

There isn't a minimum income requirement for an S Corp. However, to benefit from S Corp status, your business should ideally generate sufficient profit to justify the tax savings. It's wise to evaluate your financial situation and consult an expert to determine how the Vermont limited partnership form may affect your income and tax strategies.

The best way to set up an S Corp involves making careful decisions. First, ensure that you meet the IRS requirements, including choosing eligible shareholders. Additionally, consider using the Vermont limited partnership form if necessary, and consult a professional for guidance to streamline the process effectively.