This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

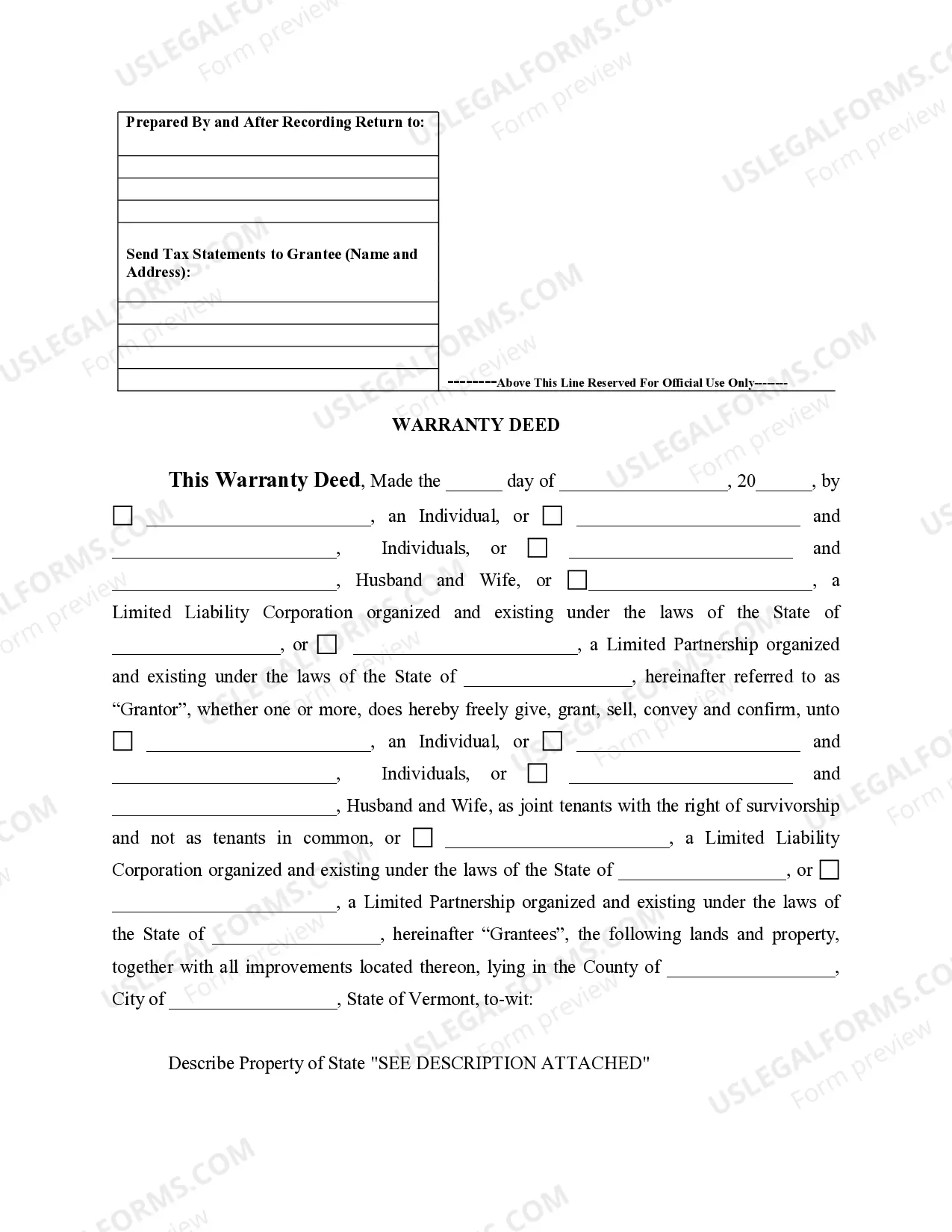

Vermont Limited Partnership With One Partner

Category:

State:

Vermont

Control #:

VT-SDEED-7

Format:

Word;

Rich Text

Instant download

Description

Free preview