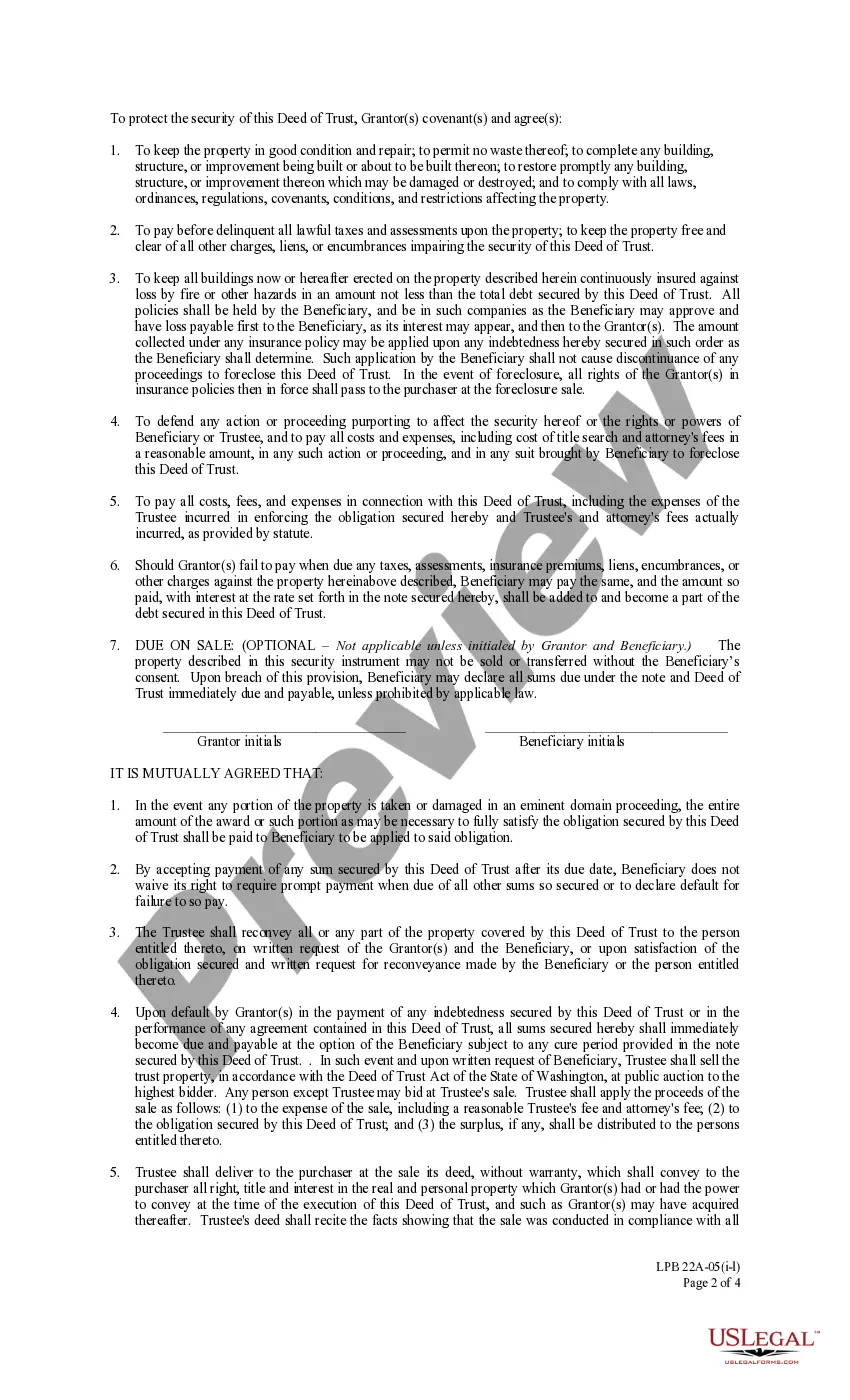

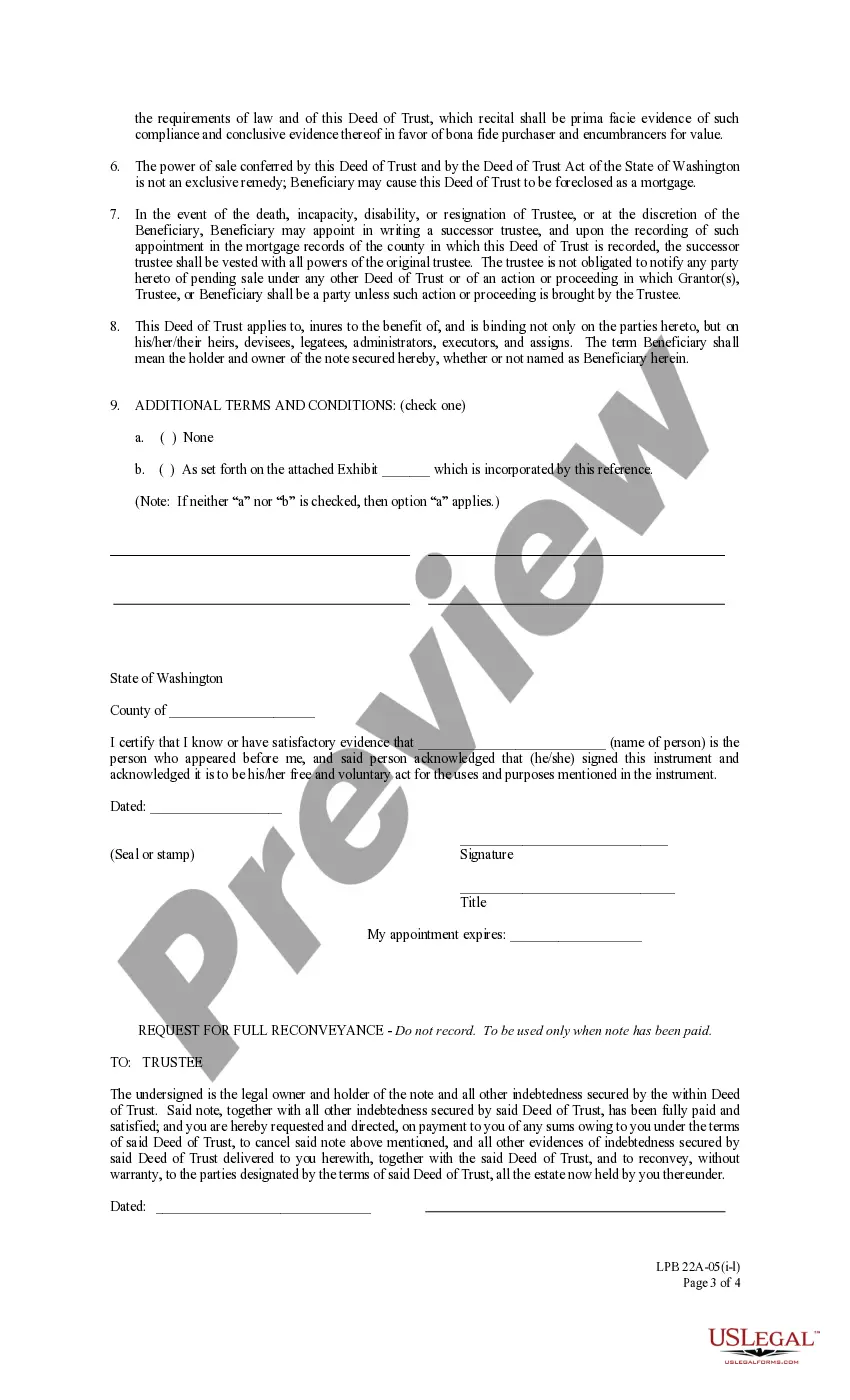

This is an official Washington form for use in land transactions, a Deed of Trust [Amended Long Form] (with individual acknowledgment).

Amended Deed Of Trust With Lien

Description

How to fill out Amended Deed Of Trust With Lien?

Precisely composed official documentation serves as one of the essential safeguards for preventing complications and legal disputes, although obtaining it without an attorney's assistance may require time.

Whether you need to swiftly find a current Amended Deed Of Trust With Lien or any other templates for employment, family, or business situations, US Legal Forms is always ready to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the desired file. Additionally, you can access the Amended Deed Of Trust With Lien at any time afterward, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and money on preparing official documentation. Try US Legal Forms now!

- Ensure that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the header.

- Click Buy Now when you find the suitable template.

- Select the payment plan, sign into your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

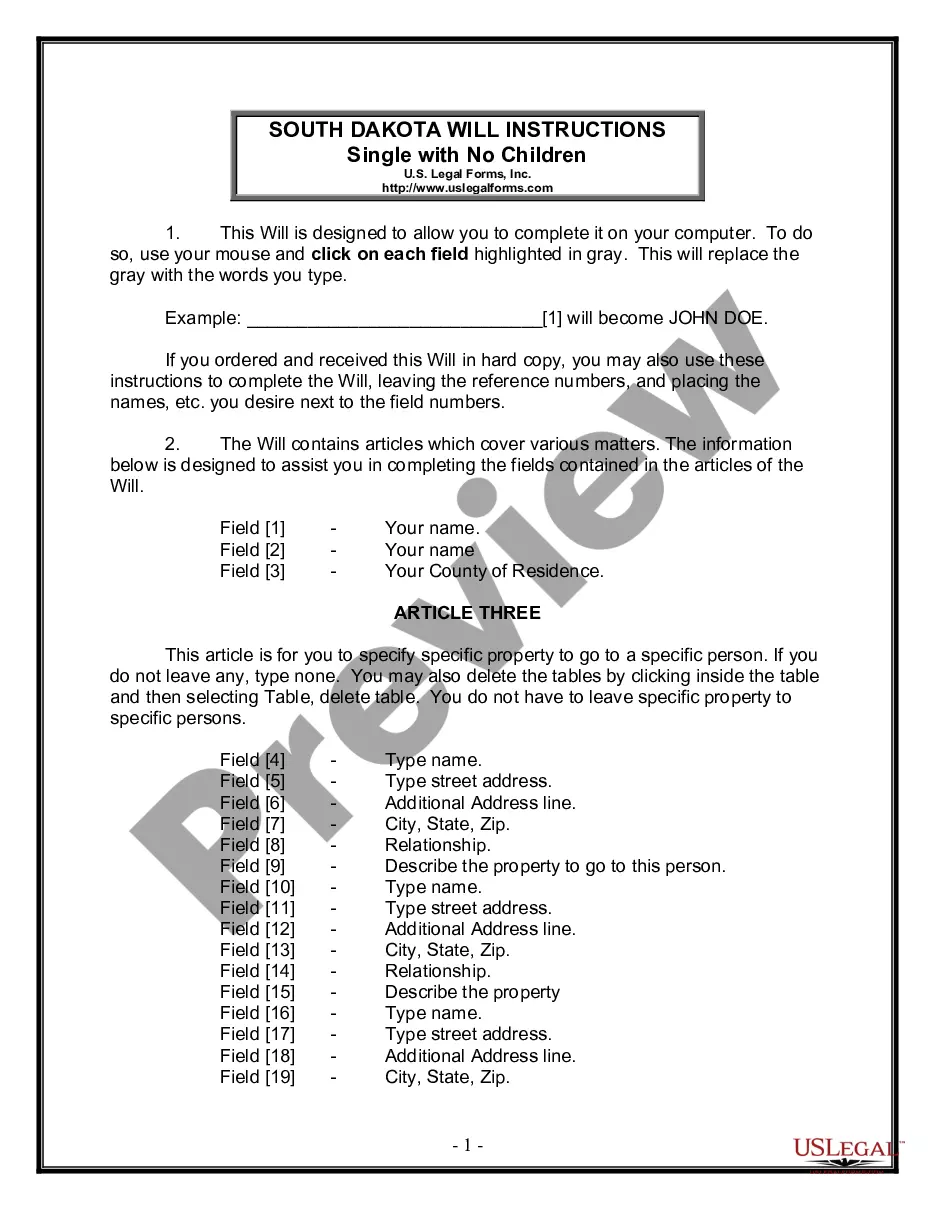

- Select PDF or DOCX format for your Amended Deed Of Trust With Lien.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

To release a deed of trust lien, you typically need specific forms that can be found at your local county recorder's office or online legal resources. An amended deed of trust with lien release forms helps in this process, clarifying the release of obligations. US Legal Forms offers a comprehensive selection of these forms, so you can easily find what you need to complete this transaction effectively. Using proper forms ensures a smoother title transfer and protects your legal interests.

To re-record a deed of trust with the incorrect legal description, you must first draft an amended deed of trust with lien, clearly stating the corrections. After that, file the amended deed with your local county recorder's office to ensure it is officially documented. It's essential to follow local regulations, as the process can vary by jurisdiction. For additional help, consider using platforms like US Legal Forms, which provides templates and guidance for such legal documents.

A lien is a legal claim against an asset as security for a debt, while a trust is an arrangement allowing a third party to hold assets for the benefit of someone else. An amended deed of trust with lien can impact both financial agreements and estate planning. Understanding these differences is key to managing your legal rights effectively.

In the UK, you can amend a trust, and this often involves creating an amended deed of trust with lien. The process requires adherence to specific legal standards to ensure the amendments are legitimate. Consulting a solicitor is advisable for compliance and clarity.

A deed of amendment to a trust deed is a legal document used to change specific terms of an existing trust. It functions as an amended deed of trust with lien that outlines the new provisions. It's crucial to ensure that this document is properly executed to maintain the trust's integrity.

Yes, a trust can be amended, often through an amended deed of trust with lien. This legal document specifies the updates and must be executed following state requirements. Working with a legal professional can help ensure a smooth amendment process.

You can amend a trust deed by executing an amended deed of trust with lien that reflects the desired changes. This document serves as a formal record of the modifications made. Legal guidance ensures that the amendments are valid and enforceable.

A trust deed can be changed by drafting an amended deed of trust with lien. This process allows for the addition, removal, or modification of terms in the original trust deed. Always seek legal advice to navigate this process correctly.

Yes, a trust can be changed once set up through specific legal processes. The method often involves creating an amended deed of trust with lien to smoothly incorporate the necessary changes. It is essential to consult with a legal expert to ensure that all modifications comply with state laws.

To change a member in a trust deed, you typically need to execute an amended deed of trust with lien. This document outlines the new member's rights and responsibilities. Be sure to follow the state's regulations and provide proper documentation to make the change official.