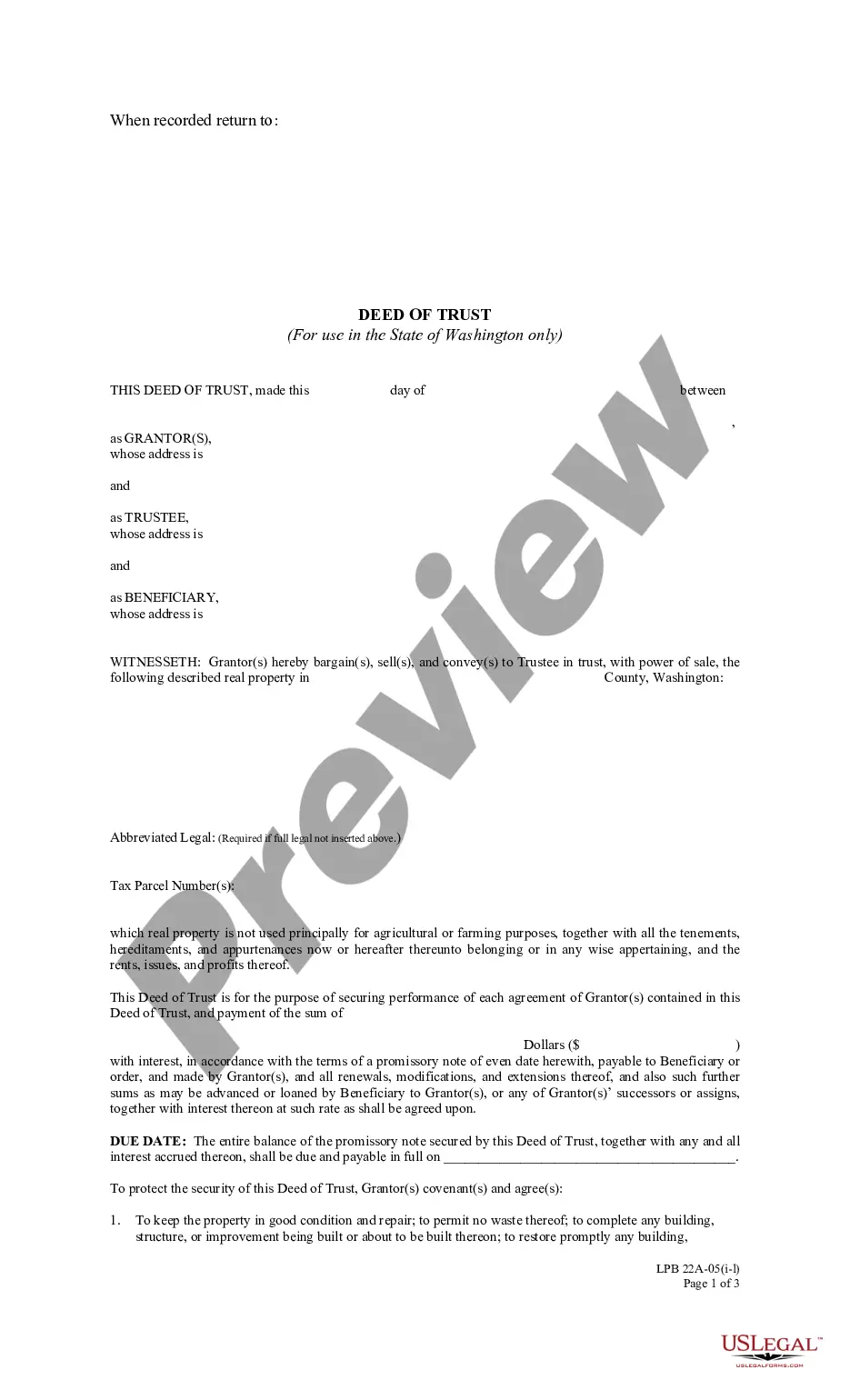

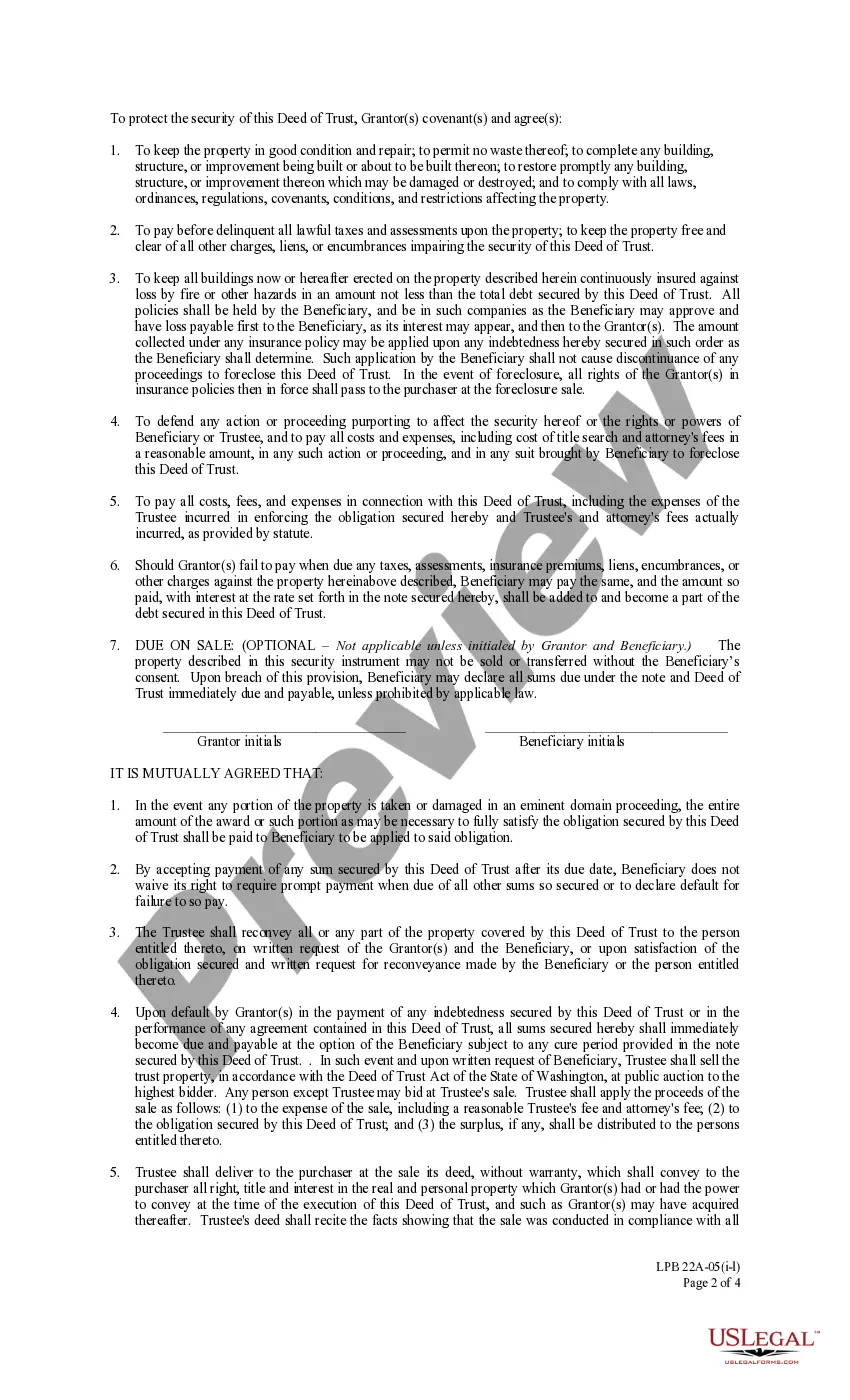

This is an official Washington form for use in land transactions, a Deed of Trust [Amended Long Form] (with individual acknowledgment).

Amended Deed Of Trust With Vendor's Lien

Description

How to fill out Amended Deed Of Trust With Vendor's Lien?

What is the most reliable service to acquire the Revised Deed Of Trust With Vendor's Lien and other current iterations of legal documents.

US Legal Forms is the solution! It boasts the largest assortment of legal forms for any purpose.

If you don't yet have an account with our library, here are the steps you need to follow to obtain one: Form compliance assessment. Before procuring any template, ensure it meets your specific use case criteria and your state or county's regulations. Review the form description and use the Preview if it is available.

- Each template is expertly crafted and verified for adherence to federal and local regulations.

- They are categorized by area and state of use, making it simple to locate the document you require.

- Veteran users of the platform need only to Log In to the system, confirm their subscription status, and click the Download button next to the Revised Deed Of Trust With Vendor's Lien to retrieve it.

- Once saved, the document is accessible for future use in the My documents section of your profile.

Form popularity

FAQ

Yes, a trust deed can be varied if circumstances change or if all parties agree to the alteration. Variations often include changes to the conditions or terms outlined in the deed, including those related to an amended deed of trust with vendor's lien. You can find useful templates and legal advice through US Legal Forms to ensure your modifications meet all legal requirements.

Yes, you can modify a Deed of Trust by following the proper legal procedures. This modification can include changes to terms, interest rates, or other stipulations, especially if it involves an amended deed of trust with vendor's lien. Leveraging tools from US Legal Forms can streamline this process, providing necessary templates and guidance.

Indeed, a trust can be adjusted after its establishment. This alteration often requires formal amendments, particularly if it is an amended deed of trust with vendor's lien. Engaging with legal professionals or using resources from US Legal Forms can facilitate smoother changes, helping you navigate the necessary documentation.

Yes, a trust deed can be changed under certain circumstances. When you want to amend a deed of trust with vendor's lien, it often involves a formal process, which might require consent from involved parties. Utilizing a platform like US Legal Forms can help simplify this procedure, ensuring compliance with legal standards and protecting your interests.

A lien represents a legal claim against a property to secure payment obligations, while a trust involves a legal arrangement where one party holds property for the benefit of another. In an amended deed of trust with vendor's lien, the trust includes the lien elements, providing dual protection for the lender's interest. This distinction is crucial for property transactions, as understanding your rights and obligations can greatly impact your financial security.

In Texas, the vendor's lien acts as a security interest for sellers, ensuring they receive payment for the property sold. It protects the seller’s financial stake by granting them the right to reclaim the property if the buyer defaults on payment. Furthermore, when combined with an amended deed of trust with vendor's lien, it provides added security for the transaction, giving peace of mind to both parties involved.

Amended deed of trust with vendor's lien can present challenges. Firstly, a lien may limit your property’s marketability, making it less attractive to potential buyers. Additionally, if you fail to meet your financial obligations, the lien could result in foreclosure, taking away your property rights. It's essential to weigh these potential drawbacks against the benefits of obtaining a lien.

To file a release of lien in Texas, you must prepare a formal document stating that the lien has been cleared. This document should be signed and dated, and you will need to file it with the county clerk in the jurisdiction where the property is located. It's important to retain a copy for your records once filed. Ensuring the accuracy of this process helps maintain the integrity of the amended deed of trust with vendor's lien.

Yes, you can change beneficiaries of a trust if the trust document allows for it. Modifying who receives trust assets can be crucial for aligning with your wishes. An amended deed of trust with vendor's lien may also reflect these changes to maintain clarity in your estate plan. Always consult a professional to ensure you follow the required legal procedures.

A deed of amendment to a trust deed is a specific document that changes the terms of a trust deed. This deed clearly outlines the new provisions while ensuring that the original intent remains intact. By creating this document, you secure your interests and maintain transparency in your estate planning. It's wise to seek legal help to ensure accuracy during this process.