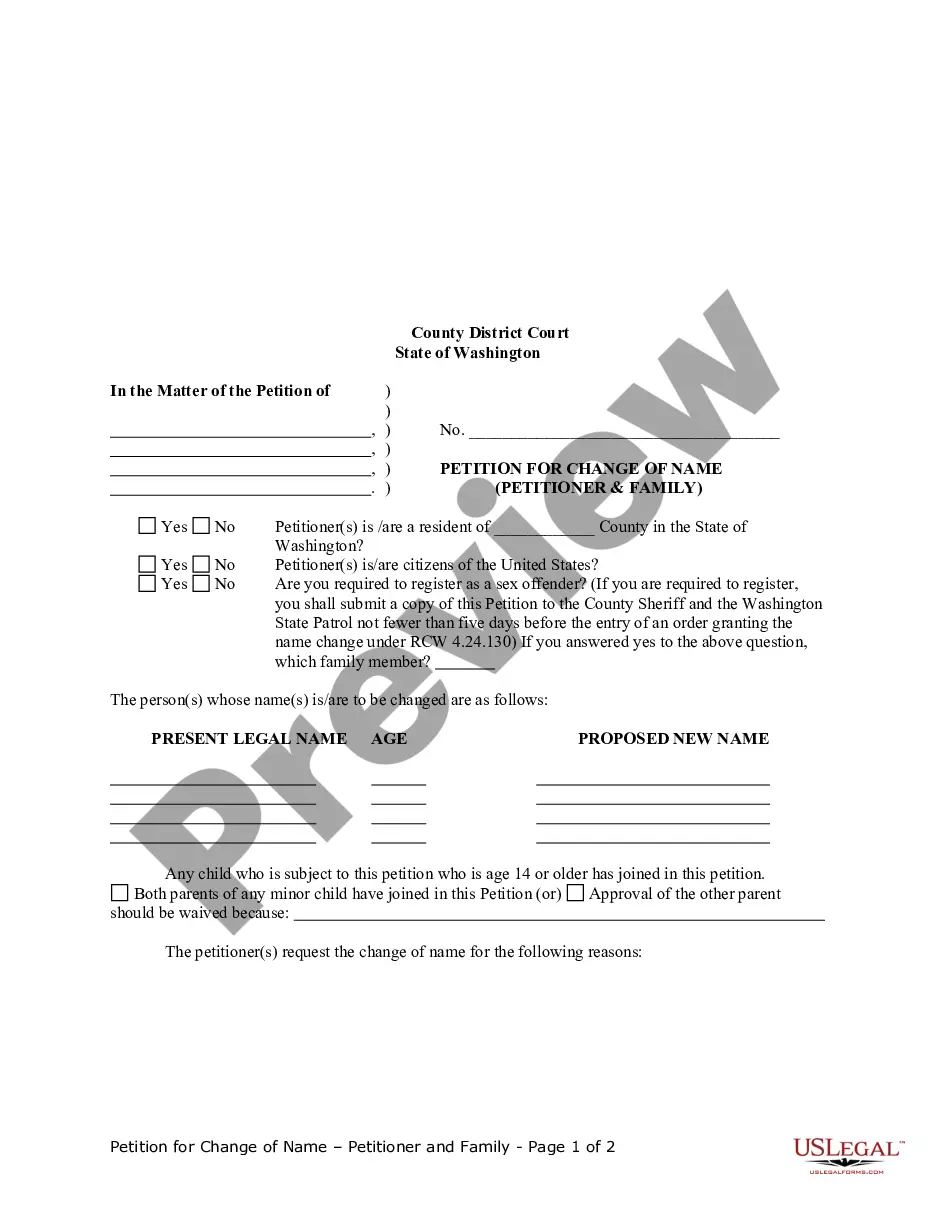

This document states the reasons and other required details for your name change.

Petition For Name Change Form With Irs

Description

Form popularity

FAQ

The best way to legally change your name involves filing the proper petitions with your local court and ensuring you have all supporting documents ready. Consider using the Petition for name change form with IRS to help you navigate the process smoothly. After obtaining a court order, remember to update your name on official documents like your ID and bank accounts. This ensures your new name is recognized everywhere.

To petition for a name change in California, you must complete the petition form and submit it to the appropriate court. Include any necessary supporting documentation, and expect a hearing where you can present your case. Afterward, if the court approves your petition, you will receive an official court order. The Petition for name change form with IRS can guide you through these steps effectively.

In California, you do not need to provide a specific reason for changing your name. However, your petition may be subject to scrutiny if it appears you are trying to evade legal obligations or commit fraud. Thus, it is crucial to be transparent in your application. Utilizing the Petition for name change form with IRS simplifies the entire process and ensures you follow the required legal steps.