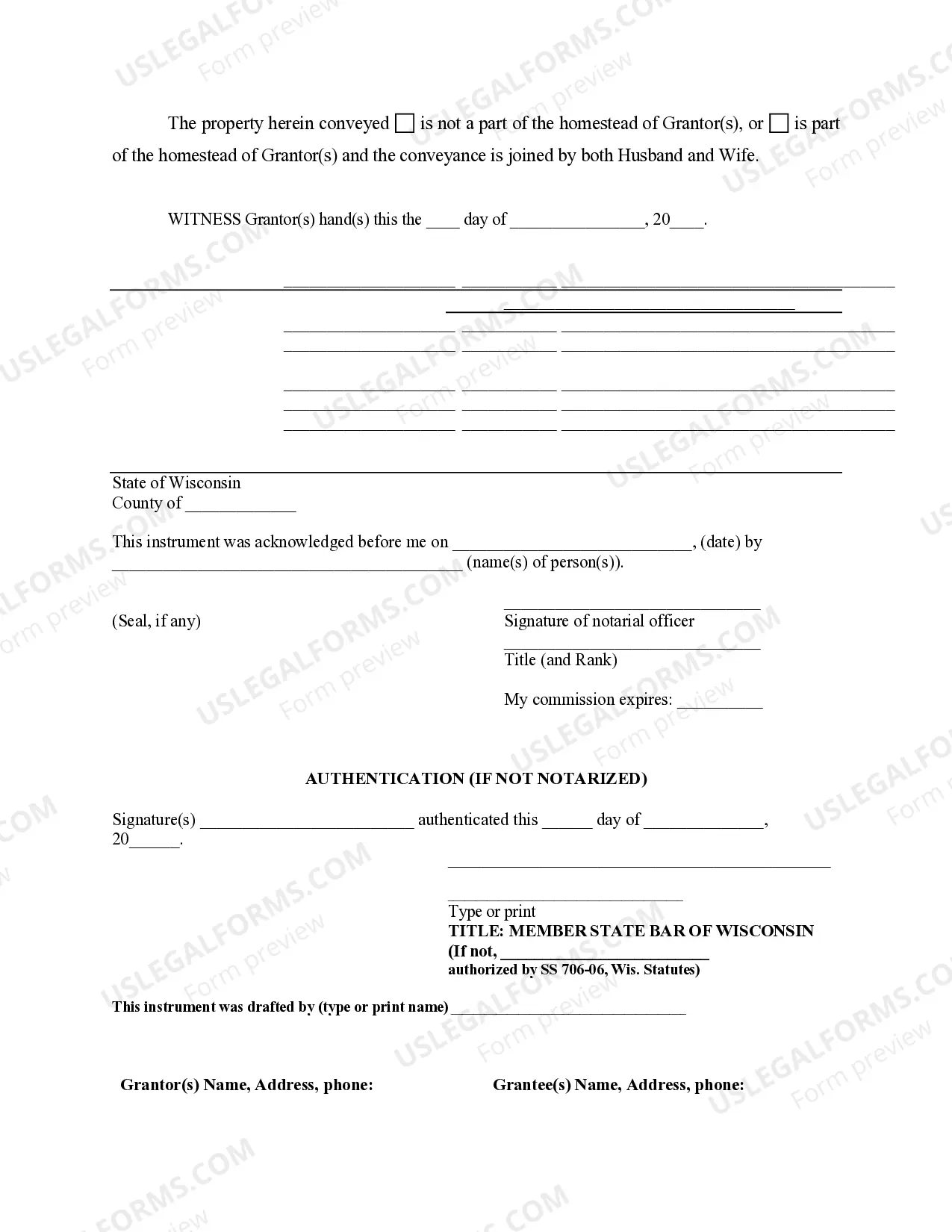

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Life Estate Deed In Wisconsin

Description

How to fill out Life Estate Deed In Wisconsin?

Individuals frequently link legal documentation with complexity that only a specialist can handle.

In a way, this is accurate, as preparing a Life Estate Deed in Wisconsin necessitates considerable expertise in the subject matter, encompassing both state and local laws.

However, with US Legal Forms, the process has become more straightforward: a collection of ready-to-use legal templates tailored to specific state legislation for various life and business scenarios is consolidated in one online library and is now accessible to all.

Once you locate the appropriate Life Estate Deed in Wisconsin, click Buy Now. Select a subscription plan that suits your needs and budget. Register or Log In to move to the payment page. Pay for your subscription using PayPal or with your credit card. Choose the file format you prefer and click Download. You can print your document or import it into an online editor for quicker completion. All templates in our library are reusable: once purchased, they remain saved in your profile, giving you access to them whenever needed via the My documents tab. Explore all benefits of the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and usage area, allowing a quick search for Life Estate Deed in Wisconsin or any other specific template within minutes.

- Existing users with an active subscription must Log In to their account and select Download to acquire the form.

- New users will need to create an account and subscribe before being able to download any documents.

- Follow this guide to obtain the Life Estate Deed in Wisconsin.

- Carefully review the page content to ensure it aligns with your requirements.

- Examine the form description or view it using the Preview function.

- If the first option does not meet your needs, find another example utilizing the Search bar above.

Form popularity

FAQ

To navigate around a life estate deed in Wisconsin, the remainderman may need to work directly with the life tenant to express their intentions. This may involve reaching an agreement to transfer the property or addressing specific concerns collaboratively. For those unsure of the legal implications, consulting a legal expert or utilizing resources from US Legal Forms can provide valuable insights into your options.

To prepare a life estate deed in Wisconsin, start by gathering information about the property and the individuals involved. You will need the legal description of the property, the names of both the life tenant and the remainderman, and the specific terms you wish to include. Utilizing the US Legal Forms platform can streamline this process, providing you with customizable templates and guidance throughout.

A life estate deed in Wisconsin can limit your control over the property. As the life tenant, you cannot sell or mortgage the property without the consent of the remainderman, which can complicate financial planning. Additionally, your estate will still incur property taxes, which can be a burden. It is essential to consider these factors before deciding on a life estate deed.

Filling out a transfer on death deed in Wisconsin involves providing key information about the property and the designated beneficiary. You will need to include details such as the legal description of the property, the names and addresses of both the owner and the beneficiary, and your signature. For ease and accuracy, consider using resources from US Legal Forms to guide you through the process and ensure all necessary details are correctly completed.

A transfer on death deed in Wisconsin allows property to transfer to a designated beneficiary upon the owner's death, but it is not the same as simply naming a beneficiary. While a beneficiary designation typically occurs in financial accounts or insurance policies, a transfer on death deed specifically applies to real estate. This legal option allows you to retain full control of your property during your lifetime, which is a distinct advantage.

To file a transfer on death deed in Wisconsin, begin by completing the appropriate form. You can find these forms online or use services from platforms like US Legal Forms for convenience. Once your form is filled out, you must sign it in front of a notary public. Finally, record the completed transfer on death deed with your county's register of deeds to ensure it is legally recognized.

To transfer a deed to a family member in Wisconsin, you will need to prepare a new deed that specifies the transfer details. This could involve using a life estate deed in Wisconsin if you want to retain certain rights while still transferring ownership. Once the deed is prepared, you will need to have it signed, notarized, and filed with the county register of deeds. Utilizing the right forms and understanding the legal steps involved will help streamline the process.

In a life estate deed in Wisconsin, the property is owned by both the life tenant and the remainderman. The life tenant holds the right to use and benefit from the property for their lifetime, while the remainderman has a future interest that will activate upon the life tenant's death. This arrangement provides a seamless transition of property ownership while enabling the life tenant to live in and control the property. Understanding these ownership rights is essential to effective estate planning.

A life estate deed in Wisconsin is a legal document that allows a property owner to retain the right to use the property during their lifetime while designating a remainderman to receive ownership upon their death. This arrangement creates a split interest where the life tenant has control while alive, and the remainderman inherits afterwards. This type of deed can be advantageous for estate planning, ensuring that the property doesn't go through probate. If you're considering this option, be sure to understand the implications and benefits involved.

Filling out the Transfer on Death (TOD) form in Wisconsin requires careful attention to detail. Begin by providing your full name, address, and a clear description of the property you want to transfer. You must also include the full names of the beneficiaries who will receive the property after your death. Using a life estate deed in Wisconsin might be an alternative to consider, but once you complete the TOD form, remember to file it with your county register of deeds to activate the transfer.