Wisconsin Transfer Death Deed Without Probate

Description

How to fill out Wisconsin Transfer On Death Deed Or TOD - Beneficiary Deed From Two Individuals To An Individual?

Bureaucracy necessitates exactness and meticulousness.

If you do not manage completing documents like the Wisconsin Transfer Death Deed Without Probate on a regular basis, it may lead to some confusions.

Selecting the appropriate template from the outset will ensure that your document submission proceeds smoothly and avert any troubles of resubmitting a file or repeating the same efforts from the beginning.

If you are not a subscriber, locating the needed template will require a few additional steps.

- You can always find the perfect template for your documentation in US Legal Forms.

- US Legal Forms is the largest online collection of forms housing over 85 thousand templates across various domains.

- You can access the latest and most pertinent version of the Wisconsin Transfer Death Deed Without Probate simply by searching it on the platform.

- Find, store, and archive templates in your account or verify with the details to confirm you have the correct one available.

- With an account at US Legal Forms, you can obtain, store in one place, and navigate through the templates you save for quick access.

- When on the website, click the Log In button to Log In.

- Then, proceed to the My documents page, where your document history is kept.

- Review the descriptions of the forms and save those you require at any time.

Form popularity

FAQ

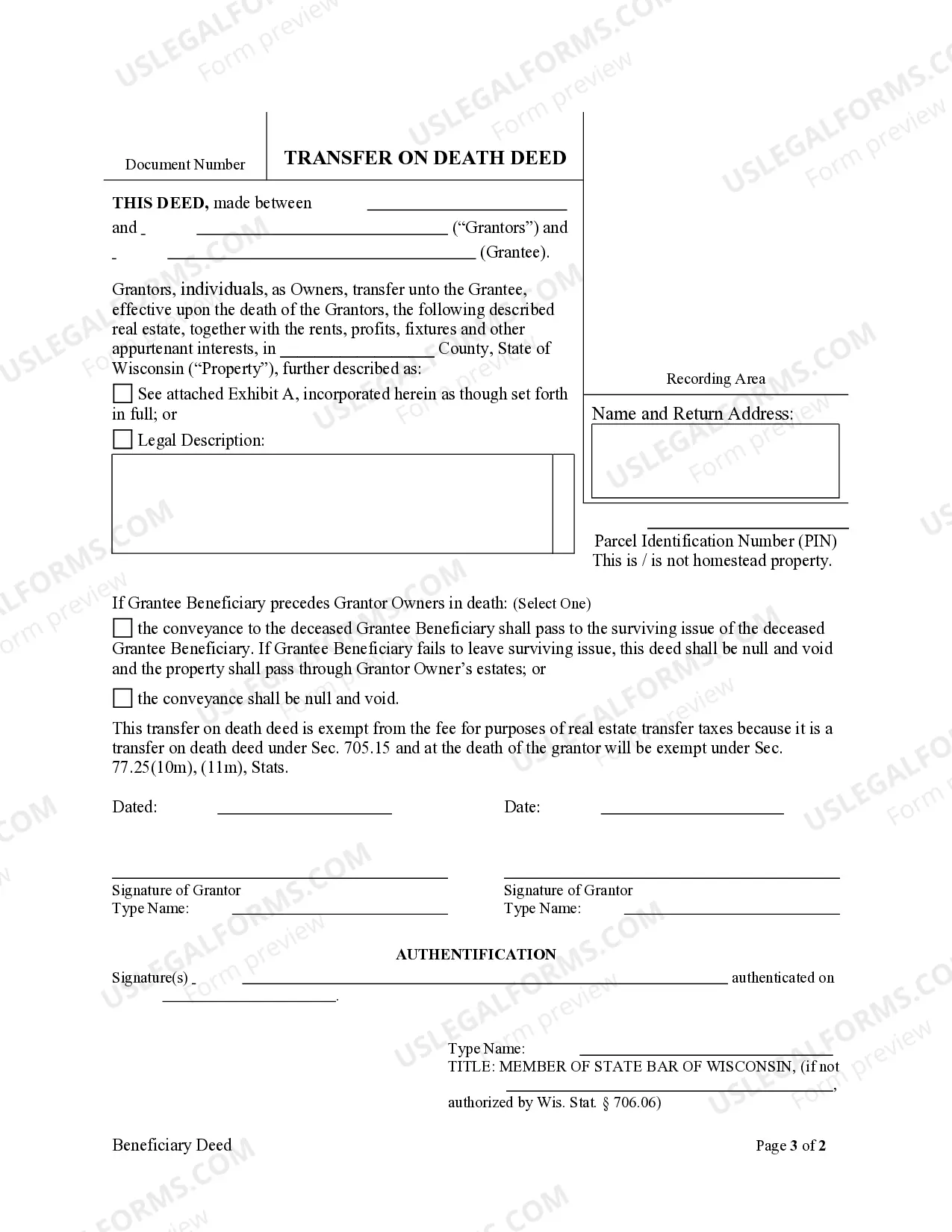

To obtain a transfer on death deed in Wisconsin, you will first need to complete the appropriate form that complies with state regulations. This deed allows you to designate a beneficiary to inherit your property upon your death, effectively avoiding probate. You can easily find and fill out the necessary documentation through platforms like US Legal Forms, which simplify the process for you. Once you finalize the deed, ensure you properly sign and record it with your local register of deeds to make it legally binding, ensuring a smooth transition of ownership without probate.

To avoid probate after death in Wisconsin, consider using a Wisconsin transfer death deed without probate as a primary tool. This deed allows you to designate beneficiaries for your property, allowing them to inherit directly without going through the probate process. Additionally, utilizing certain trust structures and joint ownership can further minimize probate issues. It's wise to discuss these options with a knowledgeable estate planning attorney for tailored advice.

Yes, Wisconsin does allow transfer on death deeds, commonly referred to as Wisconsin transfer death deeds without probate. These deeds enable property owners to designate beneficiaries to receive their property upon death without the need for probate. This process not only streamlines the transfer of assets but also reduces administrative burdens on family members. To ensure compliance with Wisconsin laws, it’s best to consult with a legal advisor while drafting this deed.

To transfer a deed to a family member in Wisconsin, you must complete a new deed and file it with the county register of deeds. If you're looking to do this after a loved one's passing, a Wisconsin transfer death deed without probate can simplify the process, enabling the property to be transferred directly to the named beneficiary. Make sure to include all required information and documents, such as identification and the original deed. Engaging a legal professional can ensure everything is done correctly.

Yes, ladybird deeds are legal in Illinois, and they serve a similar purpose to Wisconsin's transfer on death deed. These deeds allow property owners to transfer their home to beneficiaries while retaining the right to live there until they pass away. Though Wisconsin does not utilize ladybird deeds, those looking to create a similar effect should consider using a Wisconsin transfer death deed without probate to manage property distribution effectively.

The best deed to avoid probate in Wisconsin is the transfer on death (TOD) deed, also known as the Wisconsin transfer death deed without probate. This deed allows property to be transferred directly to beneficiaries when the owner passes away, bypassing the lengthy probate process. By designating a beneficiary, you ensure that your property is distributed according to your wishes, with minimal legal hassle. It's advisable to work with a legal expert to draft this deed properly.

Wisconsin does not recognize ladybird deeds, which are a popular estate planning tool in some states. Instead, Wisconsin residents may consider a Wisconsin transfer death deed without probate as an alternative for transferring property upon death. This type of deed allows you to retain control of your property during your lifetime and conveniently transfers it to your beneficiaries without going through probate. Consulting an attorney can help you explore the best options for your situation.

To change the deed on a house after the death of a spouse in Wisconsin, you need to file a new deed with the county register of deeds office. You should cite the death of your spouse as the reason for the transfer. This process typically involves submitting a Wisconsin transfer death deed without probate, which simplifies the transfer by avoiding probate court. It's important to ensure all necessary documents, including a death certificate, are included to support your claim.

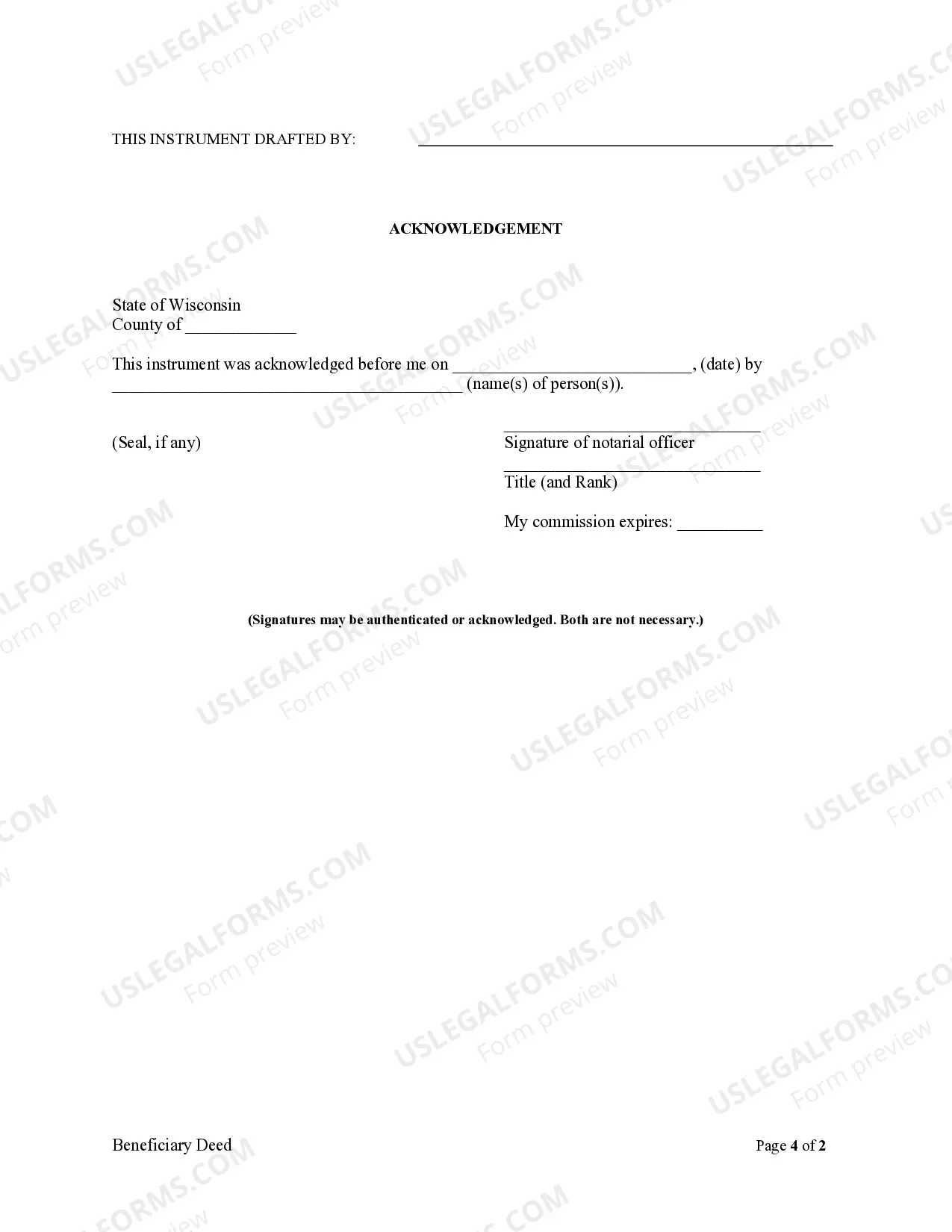

To file a transfer on death deed in Wisconsin, start by preparing the deed form with accurate property information and your chosen beneficiary. After signing the document in front of a notary, it's crucial to file it with the local county register of deeds office. This ensures that your wishes are legally documented, allowing your property to bypass probate. For assistance, consider visiting UsLegalForms, where you can find helpful resources and templates to streamline the process of creating a Wisconsin transfer death deed without probate.

Filing a transfer on death deed in Wisconsin involves several straightforward steps. First, you need to draft the deed, specifying the property and the beneficiary. Next, you must sign the deed before a notary public and then file it with the county register of deeds office where the property is located. It’s essential to follow these steps carefully to effectively use a Wisconsin transfer death deed without probate.