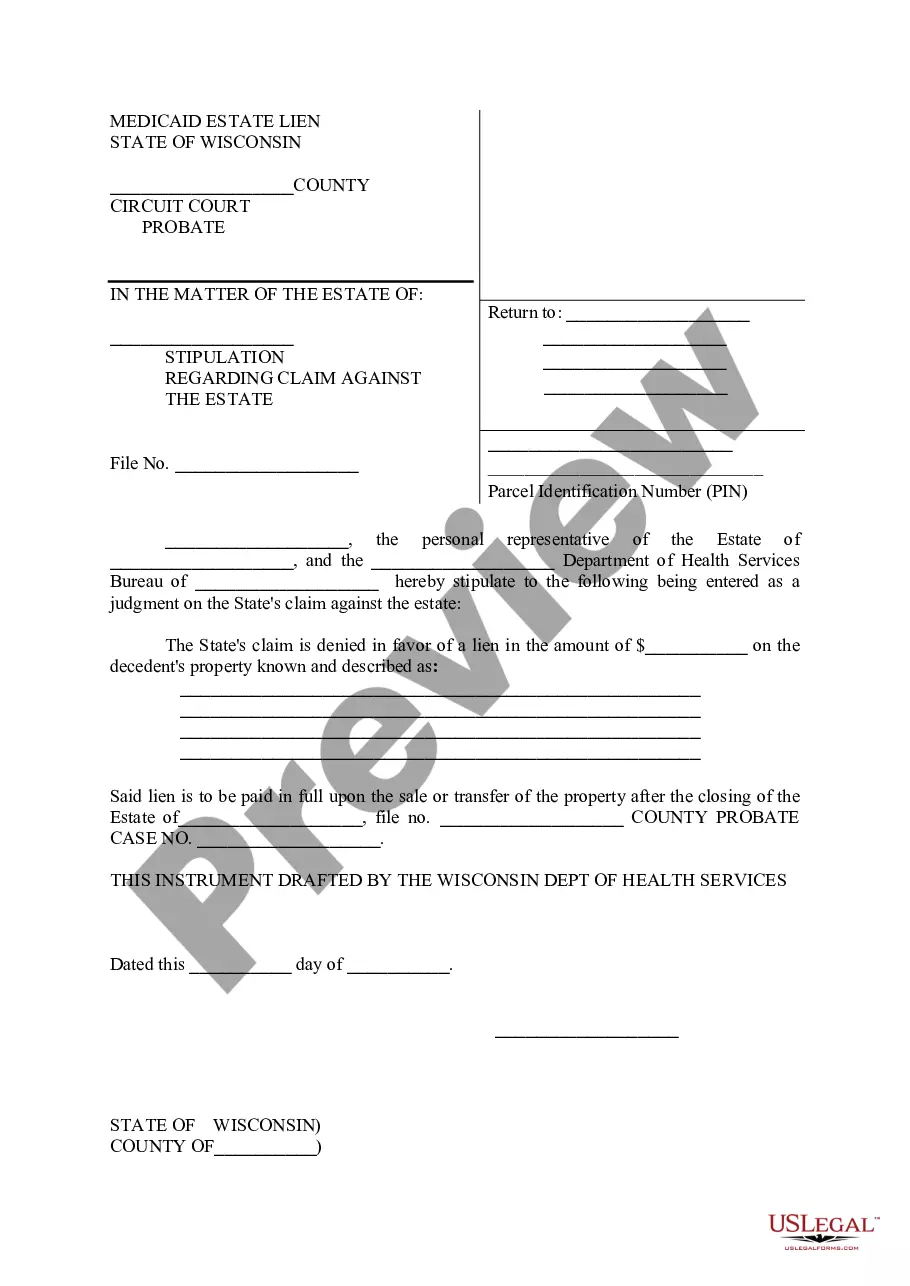

Wisconsin Claim Against Estate Form

Description

How to fill out Wisconsin Claim Against Estate Form?

Maneuvering through the red tape of traditional forms and templates can be challenging, particularly if one does not engage in it professionally.

Even selecting the appropriate template for a Wisconsin Claim Against Estate Form will prove to be labor-intensive, as it must be legitimate and precise to the final digit.

However, you will require considerably less time discovering an appropriate template if it originates from a reputable source.

Acquire the correct form in a few simple steps: Enter the name of the document in the search box. Locate the appropriate Wisconsin Claim Against Estate Form from the results list. Review the description of the sample or open its preview. When the template meets your requirements, click Buy Now. Continue to select your subscription plan. Use your email address to create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment option. Save the template file on your device in your preferred format. US Legal Forms can significantly reduce the time spent verifying whether the form you encountered online fulfills your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of searching for the appropriate forms online.

- US Legal Forms is a singular place where you can locate the most up-to-date samples of forms, review their applications, and download these samples for completion.

- It boasts a repository of over 85K forms applicable across various fields.

- When searching for a Wisconsin Claim Against Estate Form, you won't have to doubt its legitimacy as all forms are authenticated.

- Creating an account at US Legal Forms guarantees that you have all the necessary samples at your fingertips.

- You can store them in your history or add them to the My documents collection.

- You can access your saved forms from any device by simply clicking Log In on the library website.

- If you do not yet possess an account, you can always search for the template you require.

Form popularity

FAQ

Yes, you can file a lien against an estate to secure payment for a valid claim. This can be particularly useful when an estate holds real property. To ensure legality and transparency, it is advisable to use the Wisconsin claim against estate form to clarify the details of your lien.

A claim on an estate refers to a debt or obligation that the deceased owed to a creditor. This claim must be presented during the probate process, allowing creditors to seek recovery. Completing the Wisconsin claim against estate form helps formalize your claim in alignment with estate laws.

Writing a claim against an estate involves clearly stating the nature of your claim, the amount owed, and any supporting documentation. Use the Wisconsin claim against estate form as a structured guide to ensure all necessary details are included. Be concise and straightforward to optimize the effectiveness of your claim.

The 3-year rule refers to the maximum period allowed for certain claims against an estate to be filed. Under Wisconsin law, claims for wrongful death or personal injury must be initiated within three years from the date of death. Utilizing the Wisconsin claim against estate form aids in maintaining proper documentation to adhere to this rule.

In Wisconsin, the timeframe to sue an estate depends on various factors but generally falls within a few months after the estate is opened for probate. Generally, you should file your claim promptly to ensure that it receives consideration. Using the Wisconsin claim against estate form can help you stay within the deadlines.

Examples of claims against the estate include unpaid medical bills, personal loans, and obligations from credit cards. Other claims may arise from services rendered before the individual's passing. Accurately using the Wisconsin claim against estate form can help you represent these debts effectively.

To file a claim against an estate in Wisconsin, begin by reviewing the estate laws in the state. Populate the Wisconsin claim against estate form with the required details about your claim. Submit it to the designated executor or administrator within the time limit set by Wisconsin probate law, usually within a few months after the estate is opened.

To file a claim against a deceased person's estate, you must first gather relevant documentation, including any evidence supporting your claim. Next, complete the Wisconsin claim against estate form, ensuring you provide accurate and necessary details. Finally, submit the form within the specified time frame to the executor or personal representative of the estate.

Filling out an estate document requires clear and accurate information, including details about the decedent, the estate’s assets, and any potential claims. Using a Wisconsin claim against estate form can simplify the process, as these forms guide you on what information to include. Always double-check for completeness and accuracy to ensure proper processing.

An estate provides a comprehensive framework for managing all of a person's assets and liabilities after death, while a will only directs asset distribution. With an estate, you can address any claims against it, ensuring that debts are settled before distributing assets. This can lead to smoother transitions and potentially lower tax implications.