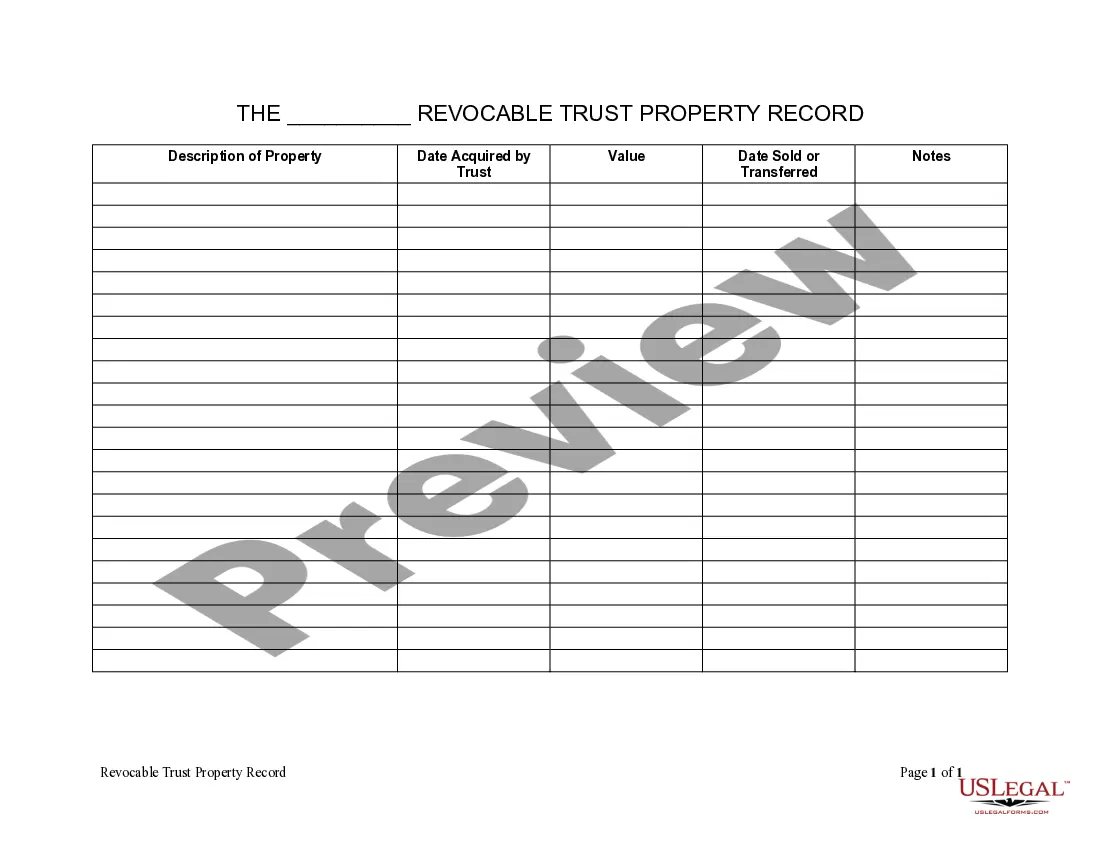

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Wyoming Living Trust For House

Description

Form popularity

FAQ

Filling out a Wyoming living trust for house requires careful attention to detail. Start by completing the trust document, which outlines the trust's purpose and designates beneficiaries. Next, list all assets you plan to include in the trust, ensuring accurate descriptions and valuations. With tools provided by resources like uslegalforms, you can easily navigate the paperwork and feel confident that everything is correctly completed.

The process of funding a Wyoming living trust for house involves several straightforward steps. First, you need to gather all assets you wish to include, such as real estate, bank accounts, and investments. Then, you can execute the transfer of these assets into the trust, ensuring that titles and account registrations reflect the trust's name. For a seamless process, consider leveraging a platform like uslegalforms that can guide you through the necessary legal documentation.

While there are benefits to placing your home in a Wyoming living trust for house, some disadvantages exist. For instance, transferring your home into a trust can lead to additional paperwork and potential fees associated with the transfer. Moreover, if not properly structured, you might lose certain benefits such as tax exemptions. It’s advisable to assess these factors carefully and consult with an expert to make informed decisions.

One major mistake parents often make when establishing a trust fund is failing to name a successor trustee. Without a named individual to carry out the terms of the trust, your intentions might not be fulfilled as you wish. It is crucial to clearly outline your objectives and regularly update your Wyoming living trust for house to reflect changes in your family dynamics or financial status. This will help ensure that your legacy remains intact.

When considering a Wyoming living trust for house, it is important to know which assets are better left out. Certain types of retirement accounts, like IRAs and 401(k)s, should usually remain outside the trust to avoid complications with tax implications. Additionally, personal items like vehicles and specific collectibles may not benefit from being in a living trust. It's wise to consult with a legal professional to ensure you make the best choices for your situation.

While a Wyoming living trust for your house offers several advantages, some assets may not be ideal for inclusion. For instance, retirement accounts like 401(k)s and IRAs typically should not be placed in a revocable trust, as they may lose their tax benefits. Furthermore, certain personal property, such as sentimental items, may not need the protection or management provided by a trust. Always consider your specific situation and consult with a legal expert if unsure.

Using a Wyoming living trust for your house may come with some disadvantages. One major concern is the potential loss of control, as once placed in trust, you may not make decisions regarding the property without going through the trust. Additionally, transferring your house to a trust can trigger property taxes or change the way your property is assessed. It's important to weigh these factors carefully before deciding to move your home into a trust.

Many people set up a Wyoming living trust for house because of the state's favorable laws. Wyoming offers strong privacy protections and no state income tax, making it an attractive option for estate planning. Additionally, trusts in Wyoming can help avoid probate, ensuring a smoother transfer of assets to beneficiaries. This strategic point helps many individuals secure their financial future.

Setting up a Wyoming living trust for house involves several steps. First, you need to choose the right type of trust, such as a revocable or irrevocable trust. Then, create a trust document that outlines your wishes and appoint a trustee. You can streamline this process by using UsLegalForms, which provides templates and guidance to help you establish your trust effectively.