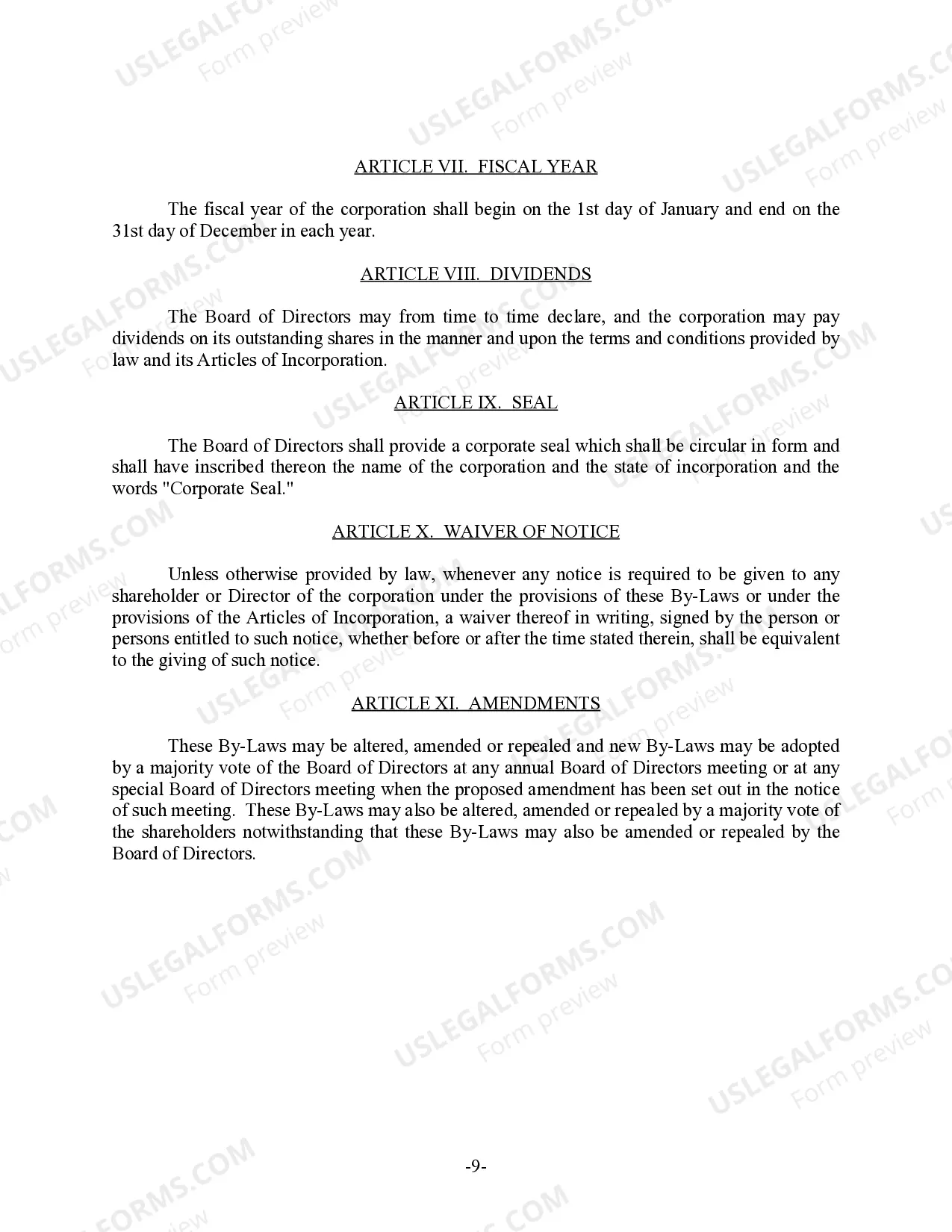

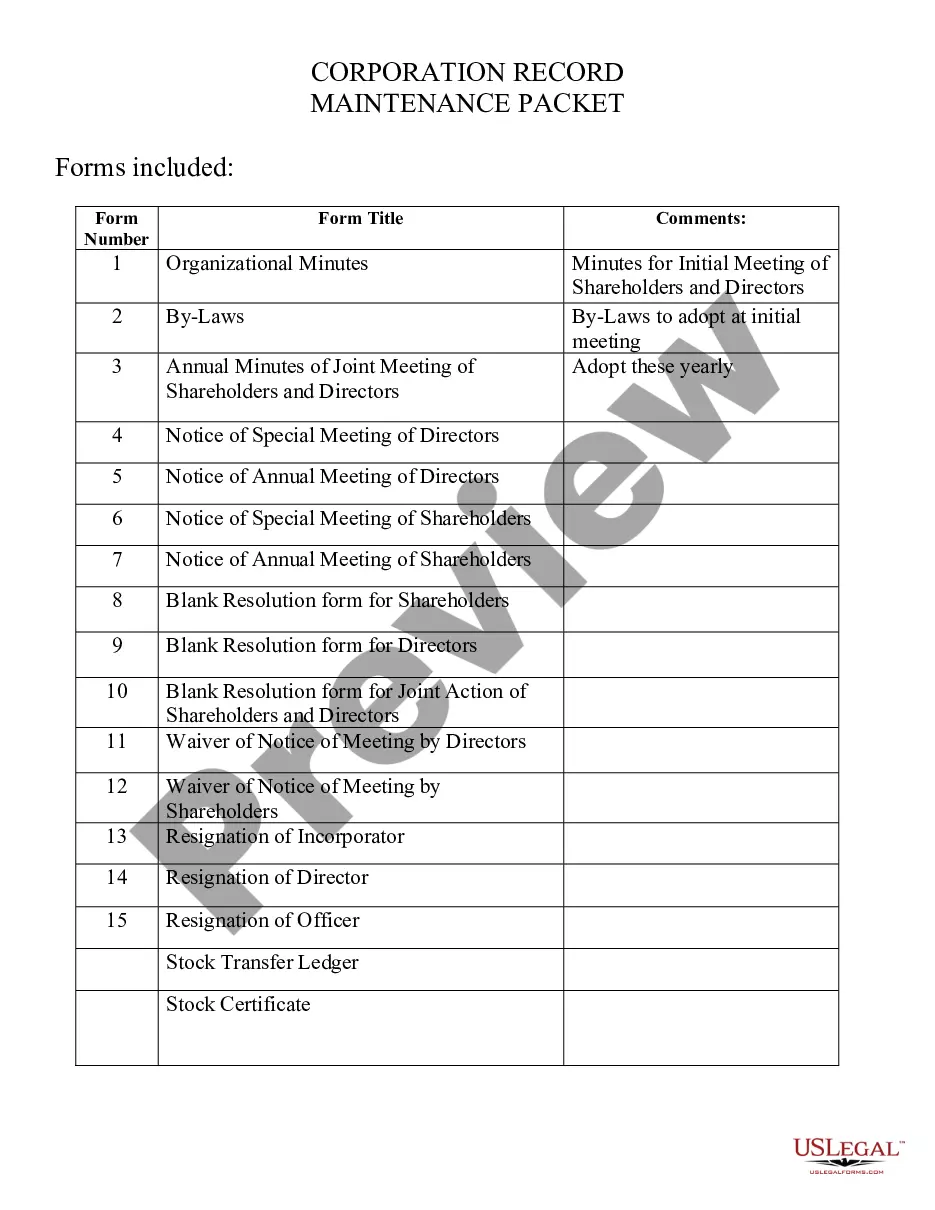

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Arizona Bylaws for Corporation

Description Bylaws

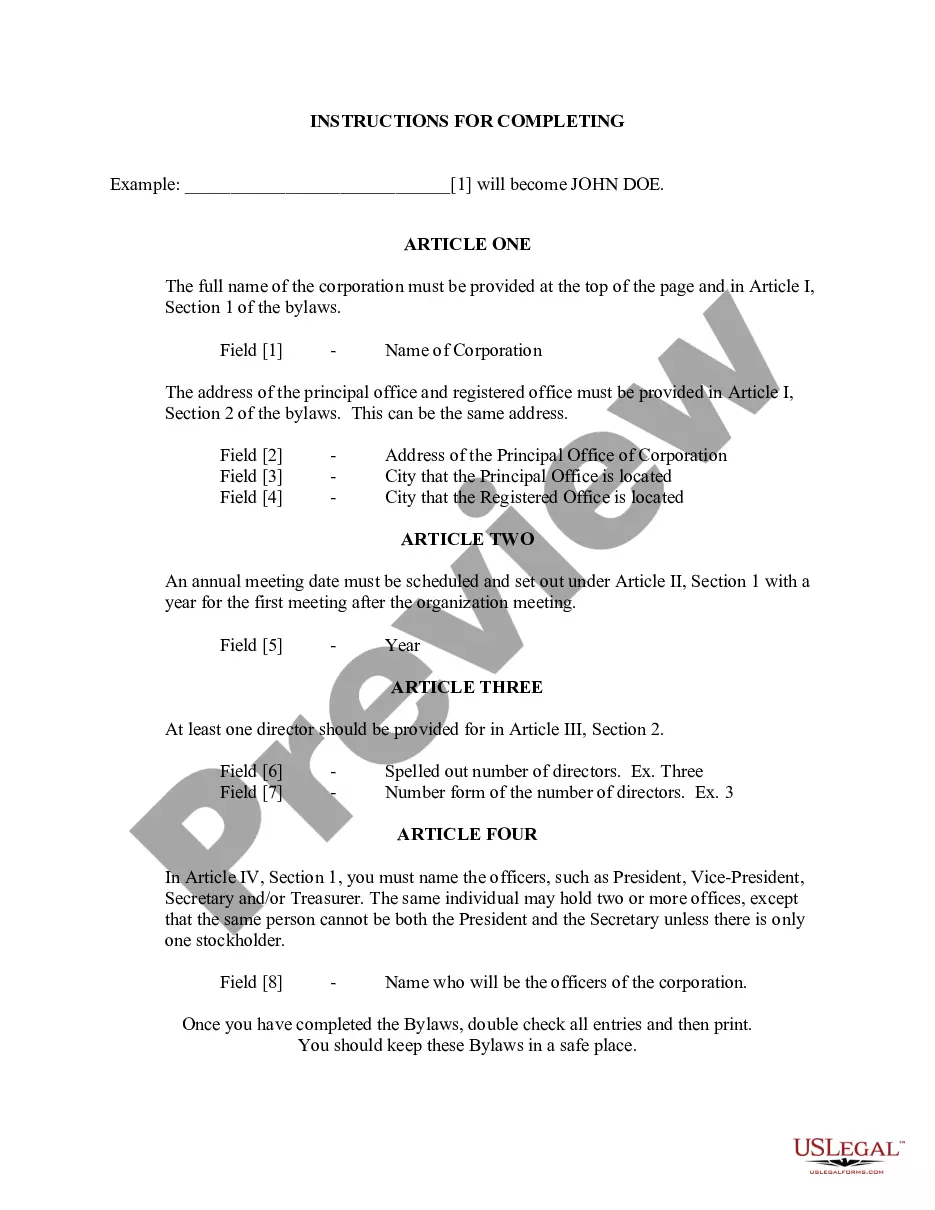

How to fill out Bylaws Corporation Agreement?

If you are in search of accurate Arizona Bylaws for Corporation templates, US Legal Forms is what you require; obtain documents crafted and reviewed by state-certified legal experts.

Utilizing US Legal Forms not only alleviates concerns regarding legal documentation; it also saves you effort, time, and money! Downloading, printing, and filling out a professional template is significantly more economical than hiring a lawyer to create it for you.

And that’s it. With just a few simple clicks, you possess an editable Arizona Bylaws for Corporation. Once you register, all future transactions will be processed even more easily. After obtaining a US Legal Forms subscription, just Log In/">Log In to your account and click the Download button visible on the form’s page. Then, when you need to access this blank again, you can always find it in the My documents section. Don’t waste your time and energy comparing various forms across multiple websites. Acquire accurate copies from a single reliable service!

- To start, complete your registration by entering your email and creating a password.

- Follow the steps below to establish an account and acquire the Arizona Bylaws for Corporation template to address your needs.

- Utilize the Preview feature or review the document details (if available) to ensure that the sample is the one you need.

- Verify its relevance to your location.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a suitable file format and save the document.

Bylaws Corporation Officers Form popularity

Az Corporation Other Form Names

Az Corporation Document FAQ

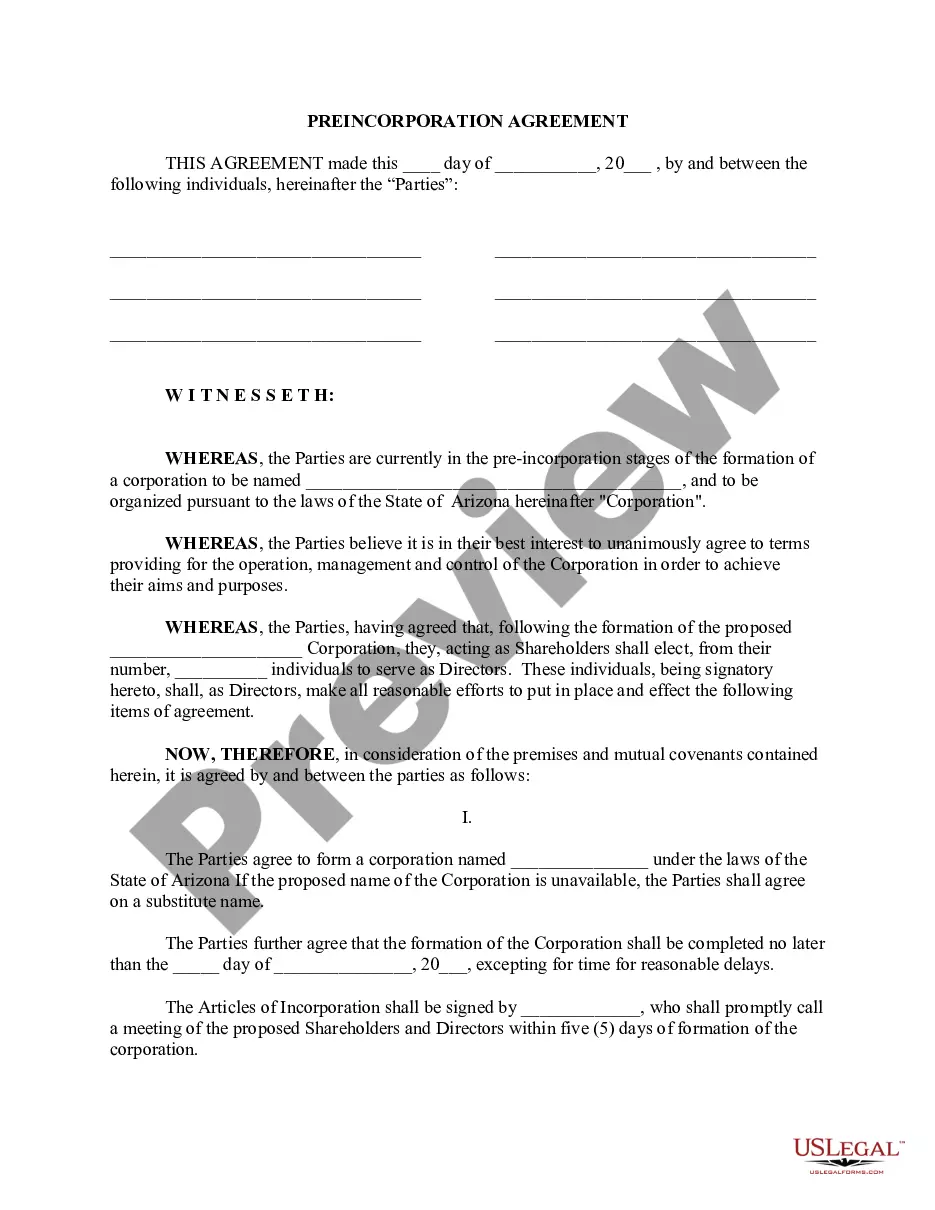

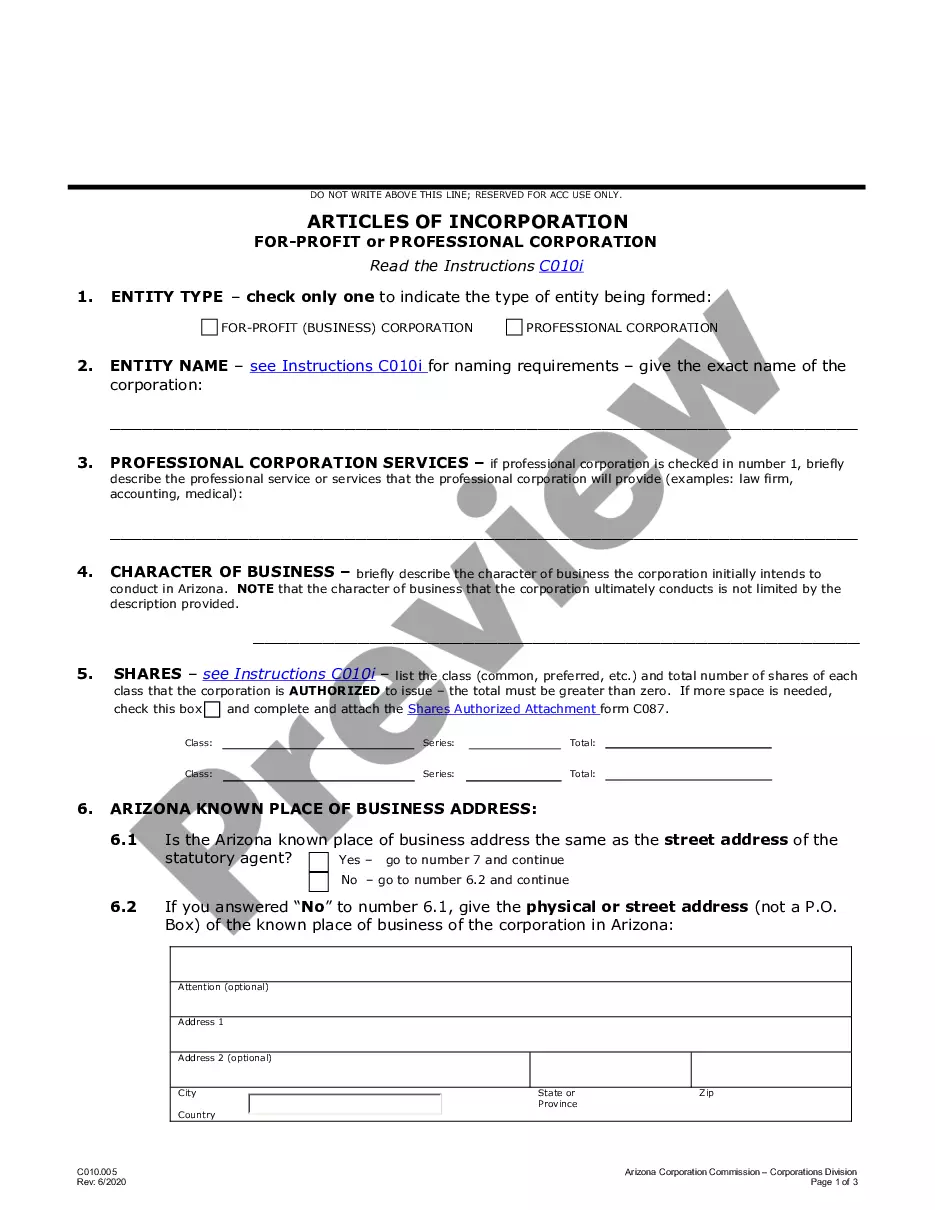

To register a company in Arizona, you first need to choose a suitable business structure like an LLC or a corporation. After deciding, file the necessary formation documents with the Arizona Corporation Commission, which includes your Articles of Incorporation or Organization. Creating Arizona Bylaws for Corporation is also important, as these establish the rules for your company’s operation and governance. This step ensures clarity and proper management from the beginning.

To file an annual report for the Arizona Corporation Commission, you can complete the process online through their official website. Make sure to have your corporation's information ready, as you will need to include details about your officers and registered agent. Keeping your Arizona Bylaws for Corporation current can simplify this process, as these documents outline necessary details that must be verified during your filing.

In Arizona, corporations must file an Annual Report with the Arizona Corporation Commission. You need to report essential information, such as the current address and names of the officers and directors. Additionally, maintaining updated Arizona Bylaws for Corporation is crucial, as they act as a reference for governance and can assist during the reporting process. Always check for specific requirements to remain compliant.

Setting up an S Corp in Arizona involves filing your Articles of Incorporation and then electing S Corporation status with the IRS. First, ensure your corporation meets federal requirements, which include having eligible shareholders and only one class of stock. Remember to draft Arizona Bylaws for Corporation to lay out your operational structure. This will not only facilitate smoother operations but also ensure compliance with state regulations.

To form a corporation in Arizona, you need to file Articles of Incorporation with the Arizona Corporation Commission. It’s essential to include information about your corporation's name, purpose, and registered agent. Additionally, creating Arizona Bylaws for Corporation will help define your organization's internal governance and operational procedures. Once approved, you'll have a legal entity recognized by the state.

The primary difference between a corporation and an LLC in Arizona lies in their structure and taxation. Corporations are taxed as separate entities, while LLCs benefit from pass-through taxation, meaning profits go directly to the owners’ tax returns. Additionally, Arizona Bylaws for Corporation provide different guidelines for issuance of shares and governance, reflecting a more formal organization compared to the flexibility offered by LLCs.

Yes, you will need a business license to operate an LLC in Arizona. Each city or county may have specific requirements for obtaining a business license, so it’s essential to check local regulations. Ensuring compliance with local laws, along with adhering to Arizona Bylaws for Corporation, is vital for running a successful business.

An LLC in Arizona offers several benefits, including limited liability protection and flexibility in management. Another key advantage is the pass-through taxation, which avoids double taxation on profits. Additionally, Arizona Bylaws for Corporation lay out guidelines that allow LLCs to be tailored to meet specific business needs, making them an attractive option for many entrepreneurs.

The biggest advantage a corporation has over an LLC is the ability to issue shares of stock, which can attract investors more easily. This structure also provides limited liability protection, separating personal assets from business liabilities. Moreover, corporations can benefit from a more established market presence, which can enhance credibility compared to entities governed by Arizona Bylaws for Corporation.

Yes, Arizona requires corporations to file an annual report, which is crucial for maintaining good standing. This report provides the state with updated information about your corporation, including its structure and operations. Staying compliant with Arizona Bylaws for Corporation is essential to avoid penalties or administrative dissolution.