Georgia Banking Affidavit of Surviving Relative - Intestate Estate

Description

How to fill out Georgia Banking Affidavit Of Surviving Relative - Intestate Estate?

Obtain the most comprehensive collection of legal documents.

US Legal Forms provides a platform where you can discover any state-related form in just a few clicks, including the Georgia Banking Affidavit of Surviving Relative - Intestate Estate templates.

There's no need to squander hours of your time in search of a court-acceptable sample.

That's it! You should complete the Georgia Banking Affidavit of Surviving Relative - Intestate Estate template and review it. To confirm that everything is accurate, consult your local legal advisor for assistance. Register and effortlessly explore around 85,000 valuable samples.

- To access the forms library, select a subscription plan and create an account.

- If you have already signed up, just Log In and click Download.

- The Georgia Banking Affidavit of Surviving Relative - Intestate Estate file will immediately be saved in the My documents section (a section for all forms you download on US Legal Forms).

- To create a new account, follow the short instructions outlined below.

- If you need to use a state-specific form, ensure you select the correct state.

- If available, review the description to understand all the details of the document.

- Use the Preview option if it’s accessible to view the document’s details.

- If everything appears correct, click the Buy Now button.

- After choosing a pricing option, set up your account.

- Make your payment using a credit card or PayPal.

- Download the document to your computer by clicking Download.

Form popularity

FAQ

In Georgia, you can get a small estate affidavit by filing the appropriate forms with the local probate court, typically if the estate's value falls below a certain threshold. Collect documentation that proves heirship and the value of the estate. Online services like US Legal Forms offer templates that simplify creating a small estate affidavit while ensuring compliance with the Georgia Banking Affidavit of Surviving Relative - Intestate Estate requirements.

To obtain an affidavit of inheritance, begin by gathering documentation that verifies your relationship with the deceased. Consult legal resources or professionals familiar with the process in Georgia. Utilizing US Legal Forms can provide a structured approach to ensure your affidavit aligns with the necessary criteria for the Georgia Banking Affidavit of Surviving Relative - Intestate Estate.

A letter of proof of inheritance provides verification of the rightful heirs to a deceased's estate. This document is often required by banks and other institutions when accessing the deceased's assets. To effectively navigate the requirements associated with the Georgia Banking Affidavit of Surviving Relative - Intestate Estate, consider utilizing US Legal Forms to create this letter.

Typically, an affidavit of heirship can be drafted by any individual who has knowledge of the family relationships involved. However, for added legal validity, it's advisable to have this document prepared by an attorney or through reliable legal platforms like US Legal Forms, especially in contexts such as the Georgia Banking Affidavit of Surviving Relative - Intestate Estate.

An affidavit of heirship in Georgia serves as a legal document that outlines the heirs of a deceased person who died intestate. This document confirms the relationship between the heirs and the deceased and can assist in transferring assets without formal probate. When dealing with a Georgia Banking Affidavit of Surviving Relative - Intestate Estate, such an affidavit becomes vital for lawful claims on the estate.

You can secure an affidavit of inheritance by documenting your relationship to the deceased and collecting relevant estate documents. It is wise to consult with a legal professional or utilize the forms available on US Legal Forms to ensure compliance with Georgia's regulations regarding the Georgia Banking Affidavit of Surviving Relative - Intestate Estate.

To obtain a bank affidavit, start by contacting your bank and requesting their specific procedure for the Georgia Banking Affidavit of Surviving Relative - Intestate Estate. You will need to provide necessary documentation that proves your relationship to the deceased. Additionally, using platforms like US Legal Forms can simplify this process by providing templates and guidance tailored to Georgia's legal requirements.

Typically, any adult who has knowledge of the deceased's family and estate can fill out an affidavit of heirship online. With platforms like US Legal Forms, you can easily access templates and guidance for completing the Georgia Banking Affidavit of Surviving Relative - Intestate Estate. It's a straightforward process designed for your convenience.

The general affidavit of heirship is a legal document that declares the heirs of a deceased person who did not leave a will. This affidavit serves to establish rights to inherit property under the Georgia Banking Affidavit of Surviving Relative - Intestate Estate. It ensures clarity and legal legitimacy among surviving relatives and simplifies the transfer of assets.

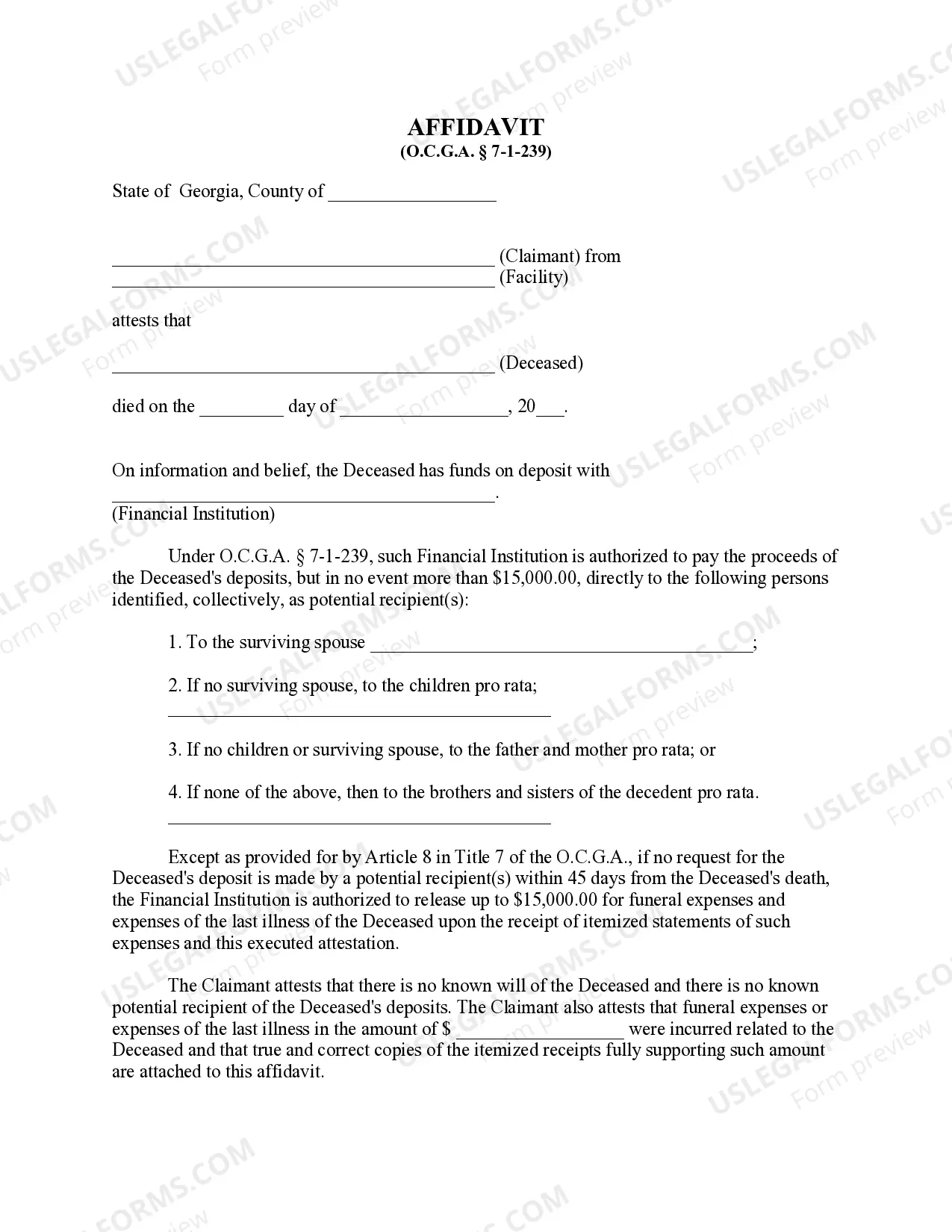

To fill out an affidavit form correctly, begin by following the structured format provided on the document. Include all necessary information, such as your name, relationship to the deceased, and relevant estate details in the context of the Georgia Banking Affidavit of Surviving Relative - Intestate Estate. Double-check for accuracy, and remember that a notarized signature may be required.