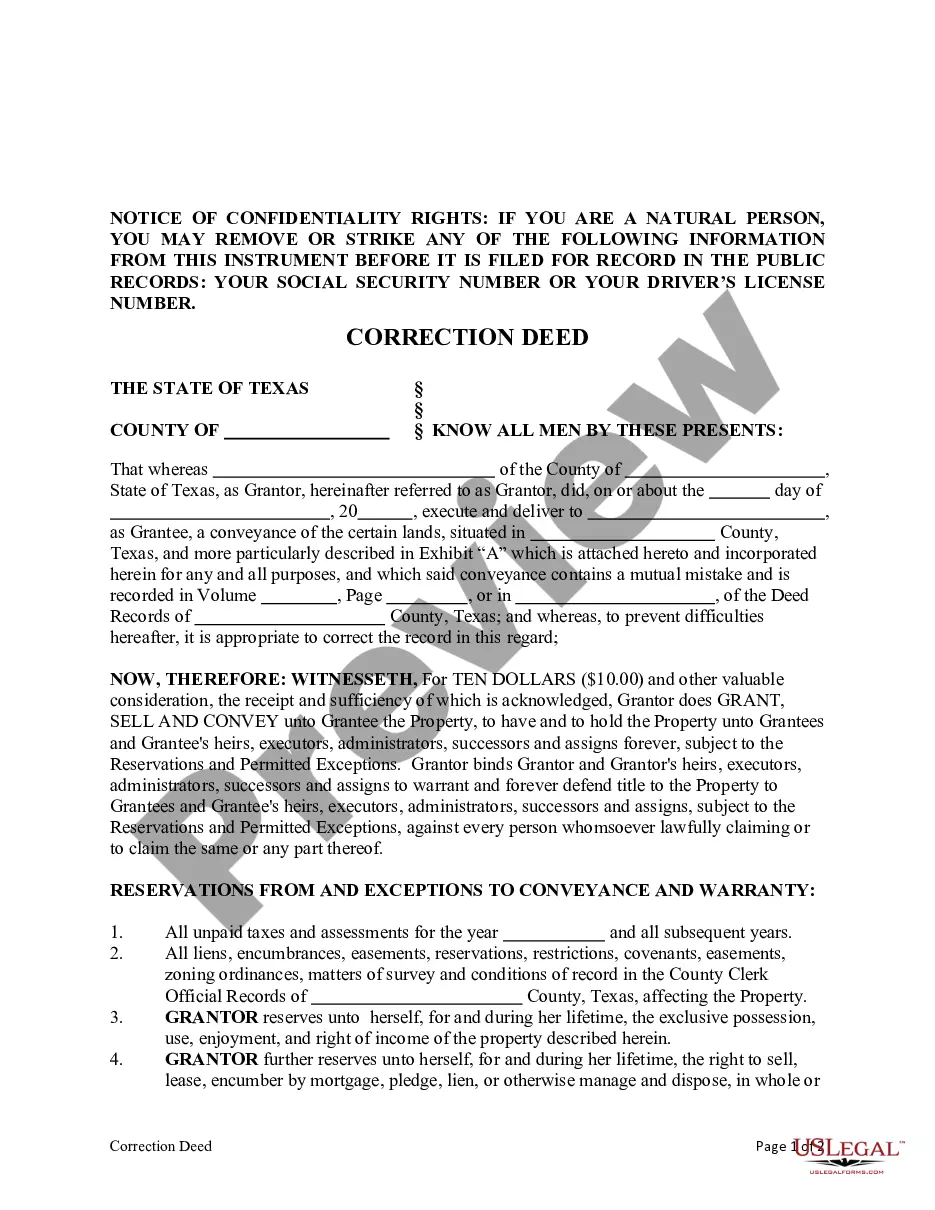

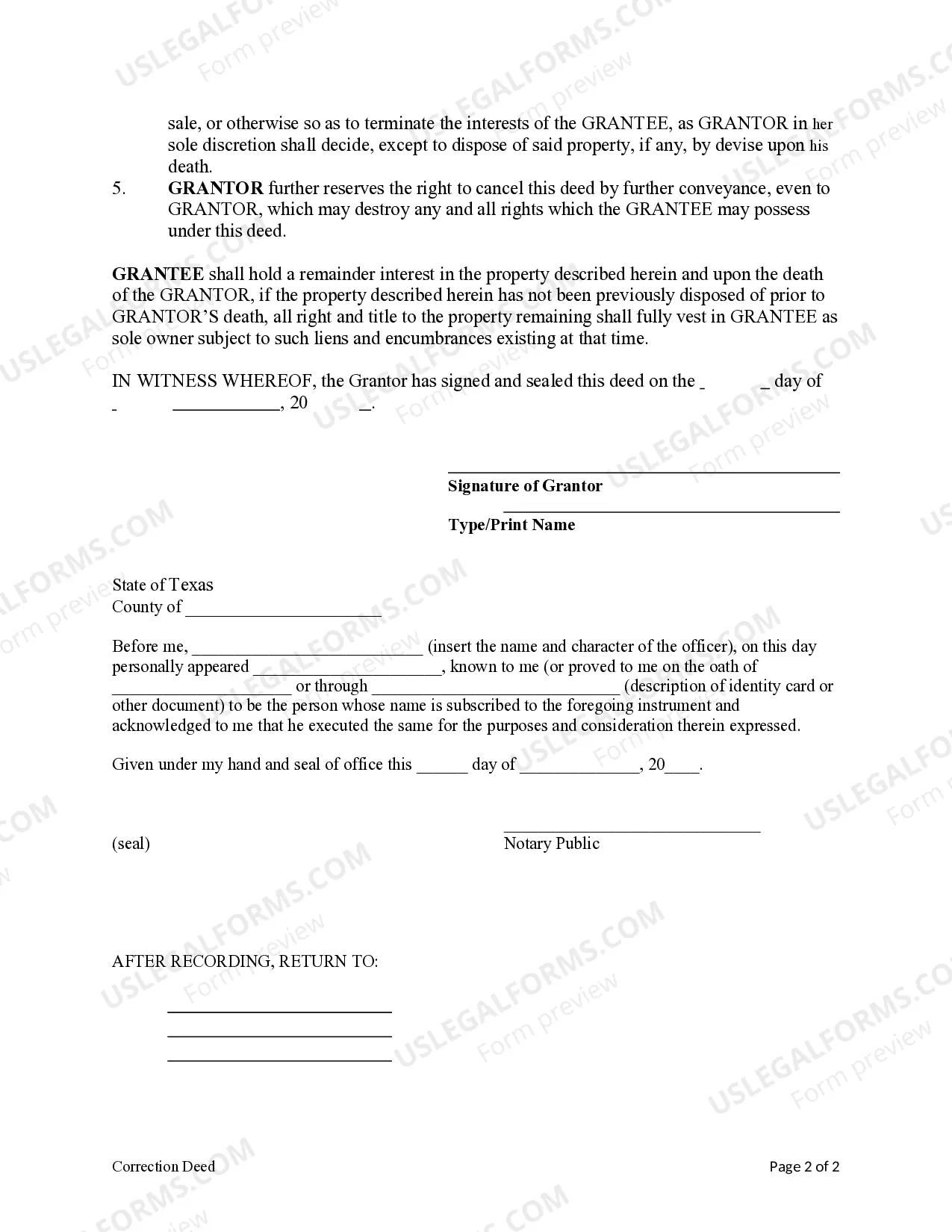

This form is a Deed of Correction where the Grantor is an Individual and the Grantee is an Individual. Grantor conveys and warrants the described property to the Grantee. This Deed is used to correct a mutual mistake. This deed complies with all state statutory laws.

Texas Correction Deed - Prior Deed from an Individual to an Individual

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

Access to high quality Texas Correction Deed - Prior Deed from an Individual to an Individual templates online with US Legal Forms. Prevent hours of lost time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get more than 85,000 state-specific authorized and tax samples that you could download and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Check if the Texas Correction Deed - Prior Deed from an Individual to an Individual you’re considering is suitable for your state.

- View the form utilizing the Preview option and read its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by card or PayPal to finish creating an account.

- Choose a favored file format to download the file (.pdf or .docx).

You can now open the Texas Correction Deed - Prior Deed from an Individual to an Individual template and fill it out online or print it and do it by hand. Think about giving the file to your legal counsel to make certain all things are completed correctly. If you make a mistake, print out and fill application once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and access much more templates.

Form popularity

FAQ

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

A rectification deed should be executed after mutual consent of all the parties to the main deed. All parties to the original deed should jointly execute the rectification deed as well. In case the original deed is registered, one should get the rectification deed also registered.

Gift the house When you give anyone other than your spouse property valued at more than $14,000 ($28,000 per couple) in any one year, you have to file a gift tax return. But you can gift a total of $5.49 million (in 2017) over your lifetime without incurring a gift tax.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office.

Check the mortgage. Get a copy of the property title. Fill out a property title transfer form. Submit the title transfer form. Pay the relevant fee. Wait for the processing of the form.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

Quitclaim Deeds can be complicated legal documents. They are commonly used to add/remove someone to/from real estate title or deed (divorce, name changes, family and trust transfers).

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.