Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

Key Concepts & Definitions

Special needs irrevocable trust agreement for is a legal device designed to provide financial security for someone with disabilities without affecting their eligibility for public assistance programs like Medicaid or Supplemental Security Income (SSI). This type of trust secures assets that may otherwise disqualify an individual from these benefits.

Step-by-Step Guide

- Identify the Beneficiary: Determine who the trust is for, considering their specific needs and eligibility for public benefits.

- Select a Trustee: Choose a reliable and competent trustee who will manage the trust assets according to the terms and in the best interest of the beneficiary.

- Create the Trust Document: Work with a legal professional to draft the trust document, specifying the terms, conditions, and stipulations of the trust.

- Fund the Trust: Transfer the assets intended to support the beneficiary into the trust.

- Maintain the Trust: Regular reviews and adjustments may be necessary to ensure the trust complies with changing laws and the needs of the beneficiary.

Risk Analysis

- Legal Non-Compliance: Failure to adhere to state and federal laws can invalidate the trust.

- Poor Management: Ineffective management by the trustee can deplete trust assets and fail to provide for the beneficiary's needs.

- Asset Misplacement: Incorrectly funding the trust can result in the loss of eligibility for governmental aid.

Best Practices

- Hire Specialized Legal Counsel: Ensure that the attorney drafting your trust specializes in disability and elder law.

- Regular Audits: Conduct regular audits with the trustee to ensure proper management of trust assets.

- Clear Documentation: Maintain clear and detailed records of all trust transactions to support transparency and accountability.

Common Mistakes & How to Avoid Them

- Overfunding the Trust: Avoid jeopardizing the beneficiary's eligibility for public benefits by consulting with a specialist to determine the appropriate amount of assets to transfer.

- Choosing the Wrong Trustee: Select a trustee with proven integrity and the ability to manage the trust effectively. Consider a professional trustee if personal connections are not suitable.

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Make use of the most comprehensive legal library of forms. US Legal Forms is the perfect place for finding up-to-date Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor templates. Our platform offers thousands of legal documents drafted by certified legal professionals and grouped by state.

To obtain a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and select the document you are looking for and purchase it. After purchasing templates, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

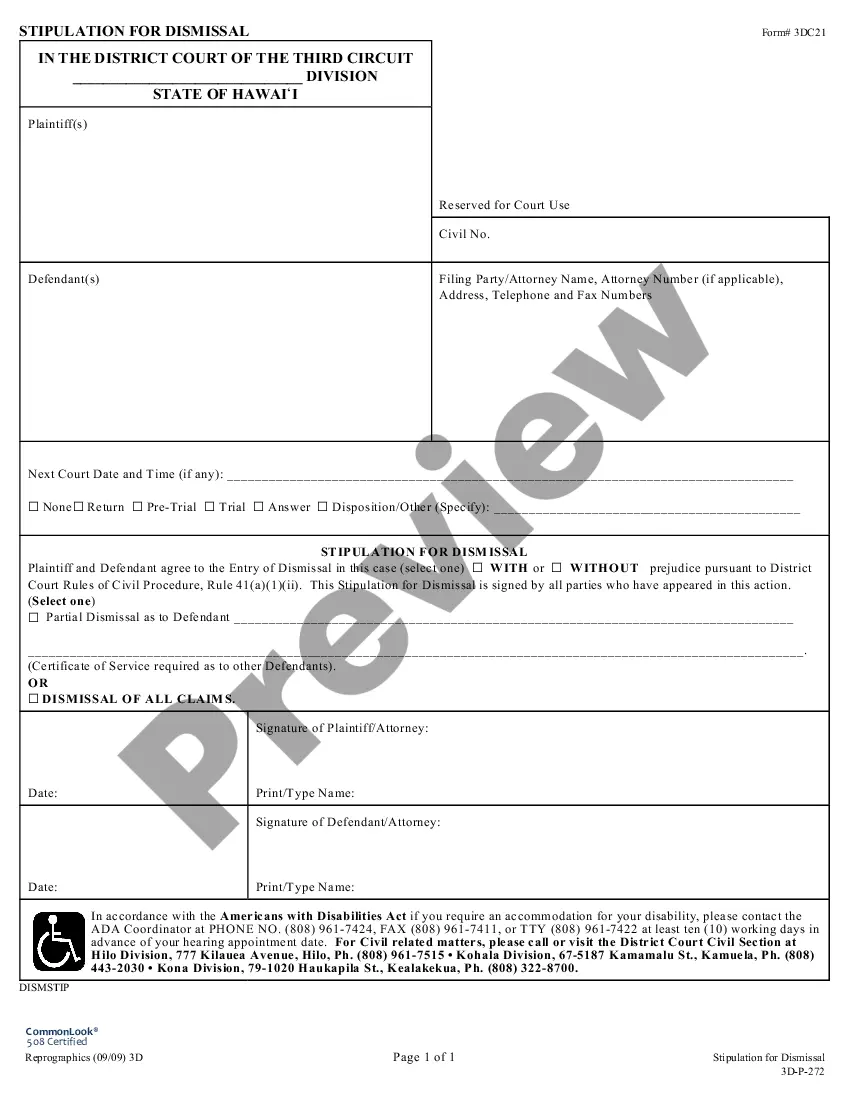

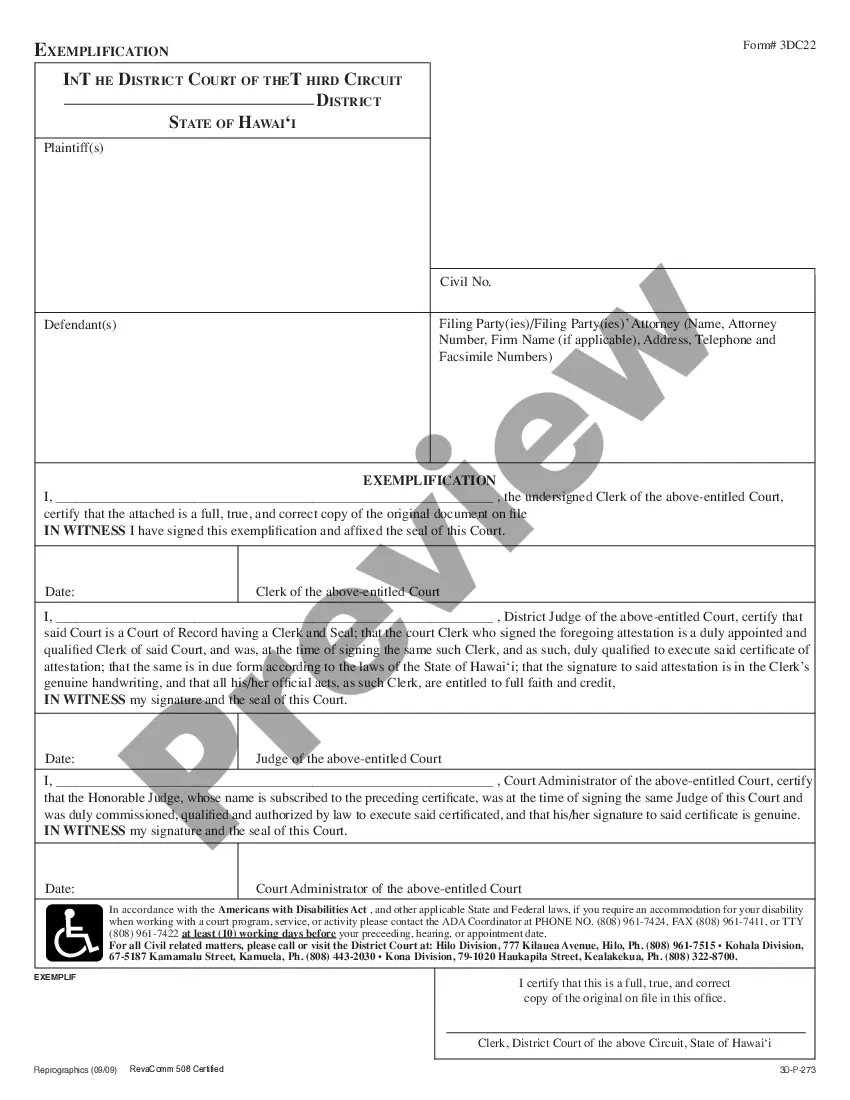

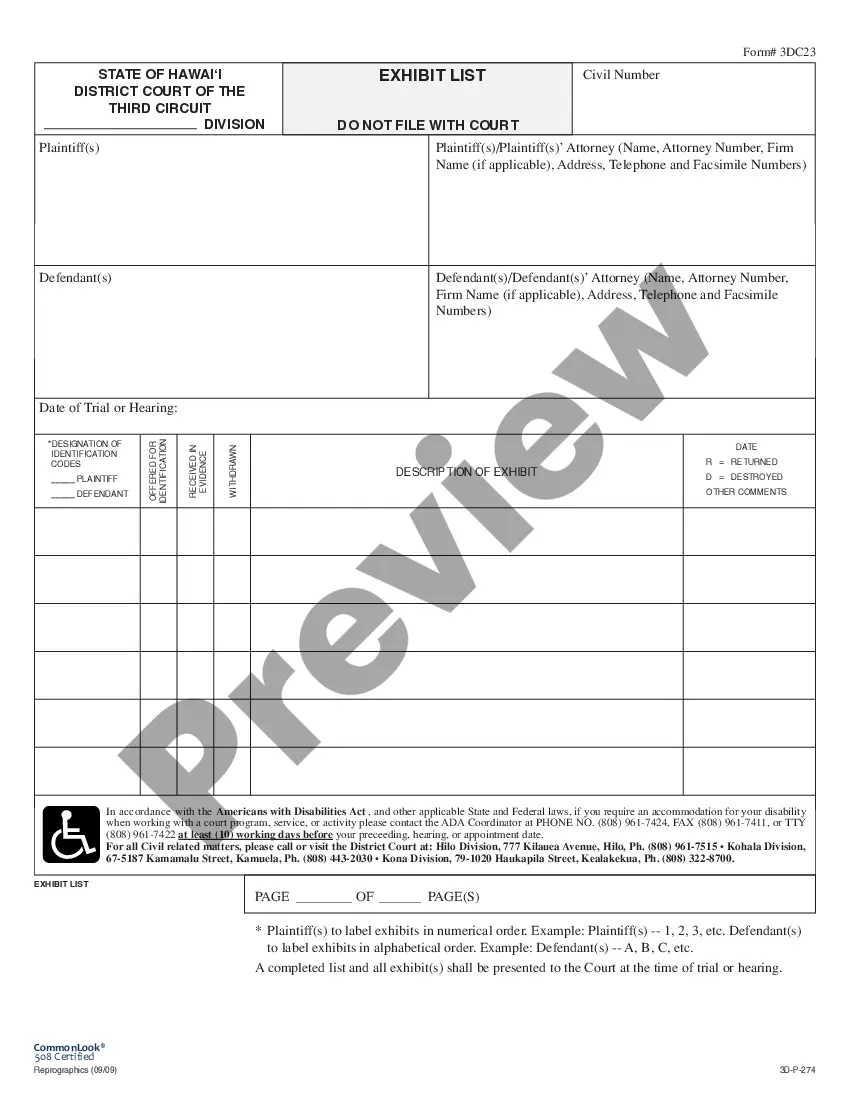

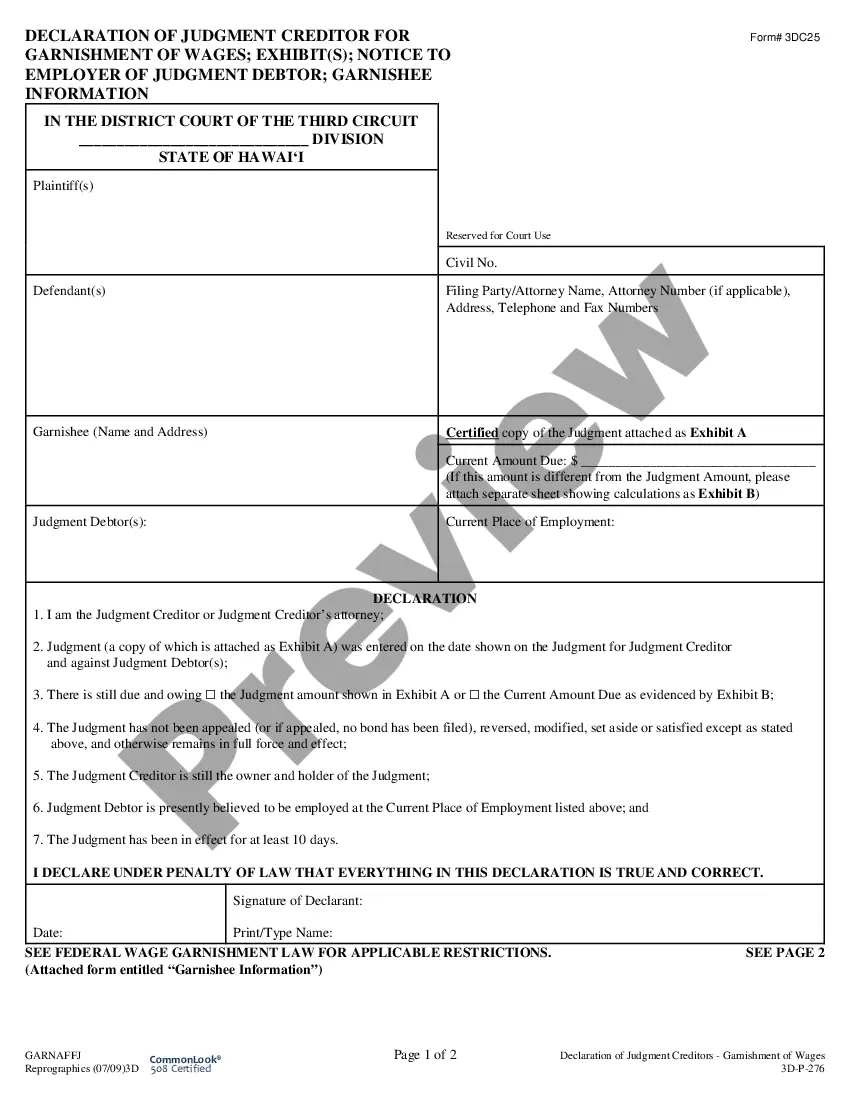

- When the form features a Preview function, utilize it to check the sample.

- In case the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join a huge number of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

Since most special needs trusts will be funded with the parents' own assets, including perhaps life insurance proceeds and gifts from other family members, they can be established and treated as qualified disability trusts.

A special needs trust is a trust tailored to a person with special needs that is designed to manage assets for that person's benefit while not compromising access to important government benefits. There are three main types of special needs trusts: the first-party trust, the third-party trust, and the pooled trust.

Special needs trust are trusts designed to improve the quality of life of a person with special needs, without affecting that person's eligibility for government benefits. To be effective, a special needs trust must be irrevocable.

In general, trust structures are intended to provide a legal way to title and hold assets to be used to support one or more beneficiaries. Special needs trusts are similar and are used to benefit someone who has physical or mental disabilities.

The person serving as trustee of the special needs trust can usually pay for anything for the person with special needs, as long as the purchase is not against public policy or illegal and does not violate the terms of the trust.

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.

People with Disabilities Can Now Create Their Own Special Needs Trusts. The Special Needs Trust Fairness Act, federal legislation that allows people with disabilities to create their own special needs trusts instead of having to rely on others, is now law.