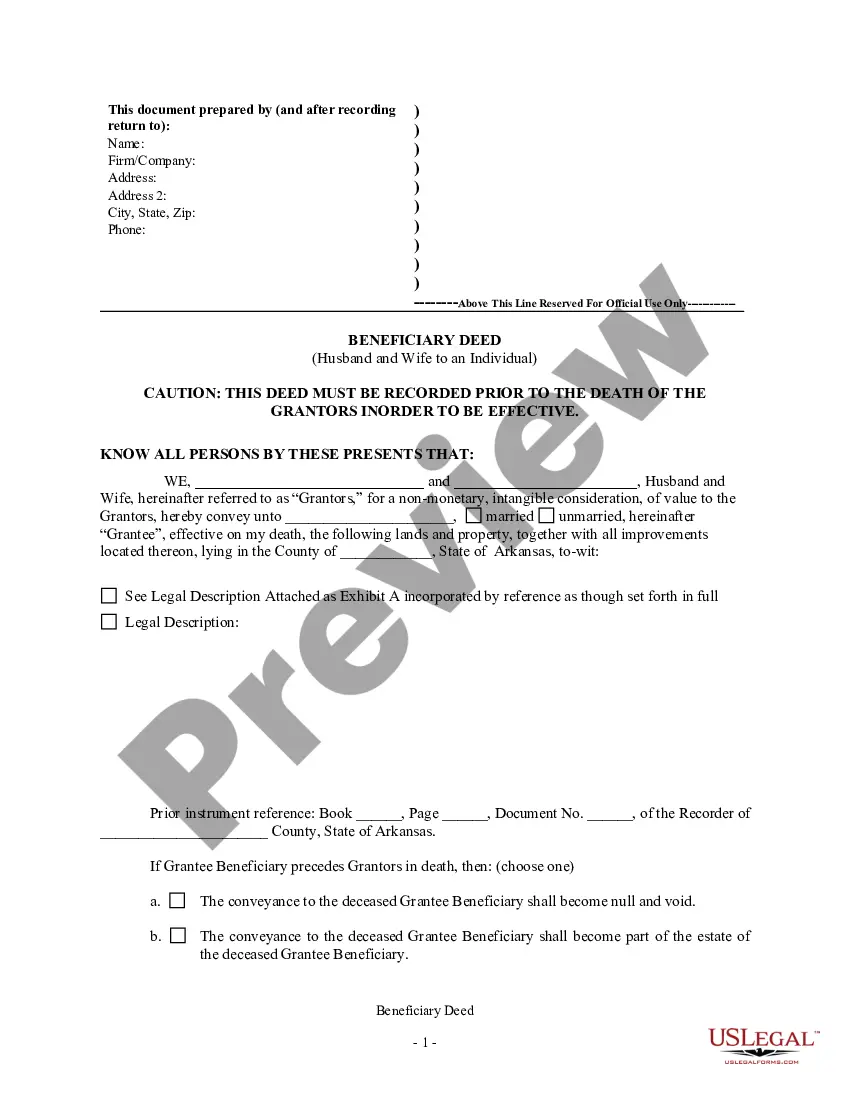

Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 1. General Provisions.

18-12-608. Beneficiary deeds � Terms � Recording required. (Amended March 9, 2007 by Act 243)

(a)(1)(A) A beneficiary deed is a deed without current tangible

consideration that conveys upon the death of the owner an ownership

interest in real property other than a leasehold or lien interest to a grantee designated

by the owner and that expressly states that the deed is not to take

effect until the death of the owner.

(B)(i) A beneficiary deed transfers the interest to the designated grantee effective upon the death of the owner, subject to:

(a) All conveyances, assignments, contracts, leases, mortgages, deeds of trust, liens, security pledges, oil, gas, or mineral leases, and other encumbrances made by the owner or to which the real property was subject at the time of the owner's death, whether or not the conveyance or

encumbrance was created before or after the execution of the beneficiary

deed; and

(b) A claim for reimbursement of federal or state benefits

by the Department of Health and Human Services from the estate of the grantor or the interest acquired by a grantee of the beneficiary deed under Section 20-76-436.

(ii) No legal or equitable interest shall vest in the grantee until the death of the owner prior to revocation of the beneficiary deed.

(2)(A) The owner may designate multiple grantees under a beneficiary

deed.

(B) Multiple grantees may be joint tenants with right of survivorship, tenants in common, holders of a tenancy by the entirety, or any other

tenancy that is otherwise valid under the laws of this state.

(3)(A) The owner may designate one (1)

or more successor grantees, including one (1) or more unnamed heirs of

the original grantee or grantees, under a beneficiary deed.

(B) The condition upon which the interest of a successor grantee vests, such as the failure of the original grantee to survive the

grantor, shall be included in the beneficiary deed.

(b)(1) If real property is owned as a tenancy by the entirety or as a

joint tenancy with the right of survivorship, a beneficiary deed that

conveys an interest in the real property to a grantee designated by all

of the then surviving owners and that expressly states the beneficiary

deed is not to take effect until the death of the last surviving owner

transfers the interest to the designated grantee effective

upon the death of the last surviving owner.

(2)(A) If a beneficiary deed is executed by fewer than all of the

owners of real property owned as a tenancy by the entirety or as joint

tenants with right of survivorship, the beneficiary deed is valid if the

last surviving owner is a person who executed the beneficiary deed.

(B) If the last surviving owner did not execute the beneficiary deed, the beneficiary deed is invalid.

(c)(1) A beneficiary deed is valid only if the beneficiary deed is

recorded before the death of the owner or the last surviving

owner as provided by law in the office of the county recorder of the county in which the real property is located.

(2) A beneficiary deed may be used to transfer an interest in real

property to a trustee of a trust estate even if the trust is revocable,

and may include one (1) or more unnamed successor trustees as successor

grantees.

(d)(1) A beneficiary deed may be revoked at any time by the owner or, if

there is more than one (1) owner, by any of the owners who executed the

beneficiary deed.

(2) To be effective, the revocation shall be:

(A) Executed before the death of the owner who executes the revocation; and

(B) Recorded in the office of the county recorder of the county in

which the real property is located before the death of the owner as

provided by law.

(3) If the revocation is not executed by all the owners, the revocation

is not effective unless executed by the last surviving owner and recorded

before the death of the last surviving owner.

(4) A beneficiary deed that complies with this section may not be

revoked, altered, or amended by the provisions of the owner's will.

(e) If an owner executes more than one (1) beneficiary deed concerning

the same real property, the recorded beneficiary deed that is last signed

before the owner's death is the effective beneficiary deed, regardless of

the sequence of recording.

(f)(1)This section does not prohibit other methods of conveying

real property that are permitted by law and that have the effect of

postponing enjoyment of an interest in real property until the death of

the owner.

(2) This section does not invalidate any deed otherwise effective by

law to convey title to the interests and estates provided in the deed

that is not recorded until after the death of the owner.

(g) A beneficiary deed is sufficient if it complies with other

applicable laws and if it is in substantially the following form:

"Beneficiary Deed

CAUTION: THIS DEED MUST BE RECORDED PRIOR TO THE DEATH OF THE GRANTOR IN ORDER TO BE EFFECTIVE.

KNOW ALL PERSONS BY THESE PRESENTS THAT:

For a non-monetary, intangible consideration, of value to the Grantor,

I (we) hereby convey to ____________ (grantee) effective on my (our) death

the following described real property:

(Legal description)

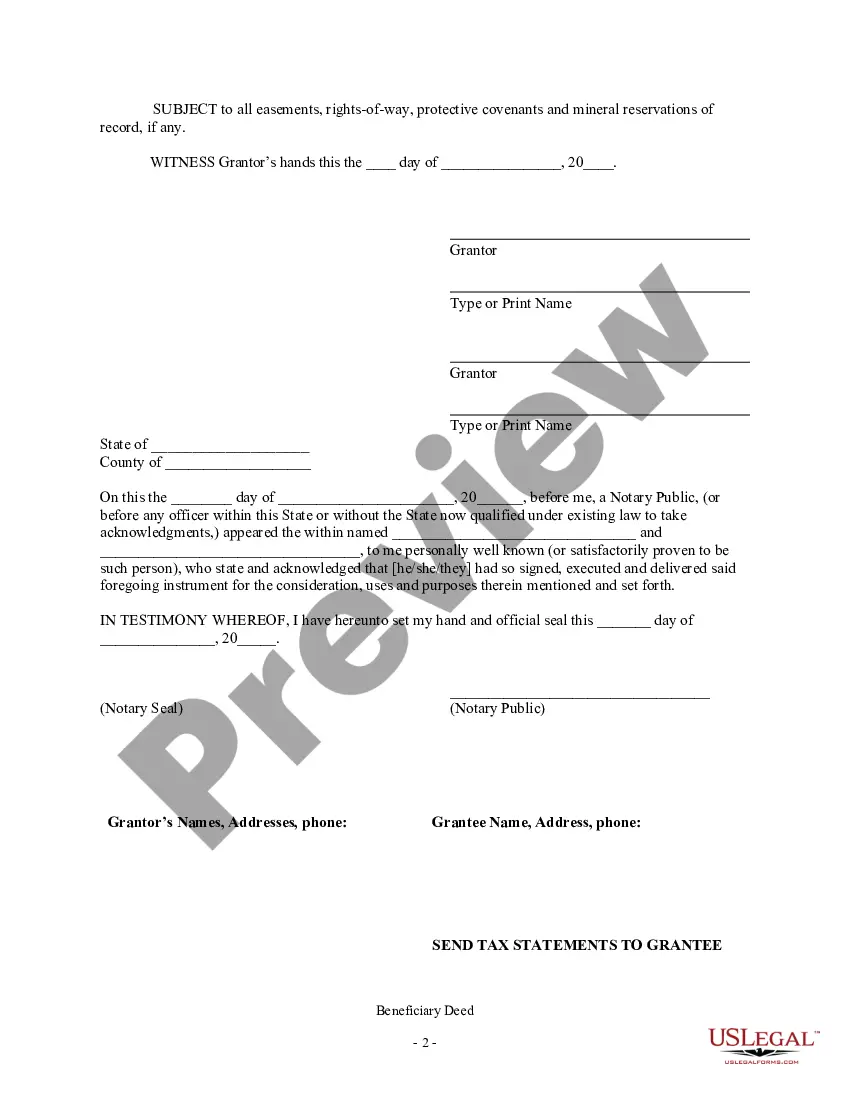

________________________________

(Signature of grantor(s))

(acknowledgment)."

(h) The instrument of revocation shall be sufficient if it complies

with other applicable laws and is in substantially the following form:

"Revocation of Beneficiary Deed

CAUTION: THIS REVOCATION MUST BE RECORDED PRIOR TO THE DEATH OF THE GRANTOR IN ORDER TO BE EFFECTIVE.

The undersigned hereby revokes the beneficiary deed recorded on

____________ (date), in docket or book ____________ at page ______, or

instrument number ______, records of ____________ County, Arkansas.

Dated: ____________

_____________________

Signature

(acknowledgment)."