This is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Arkansas Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children

Description

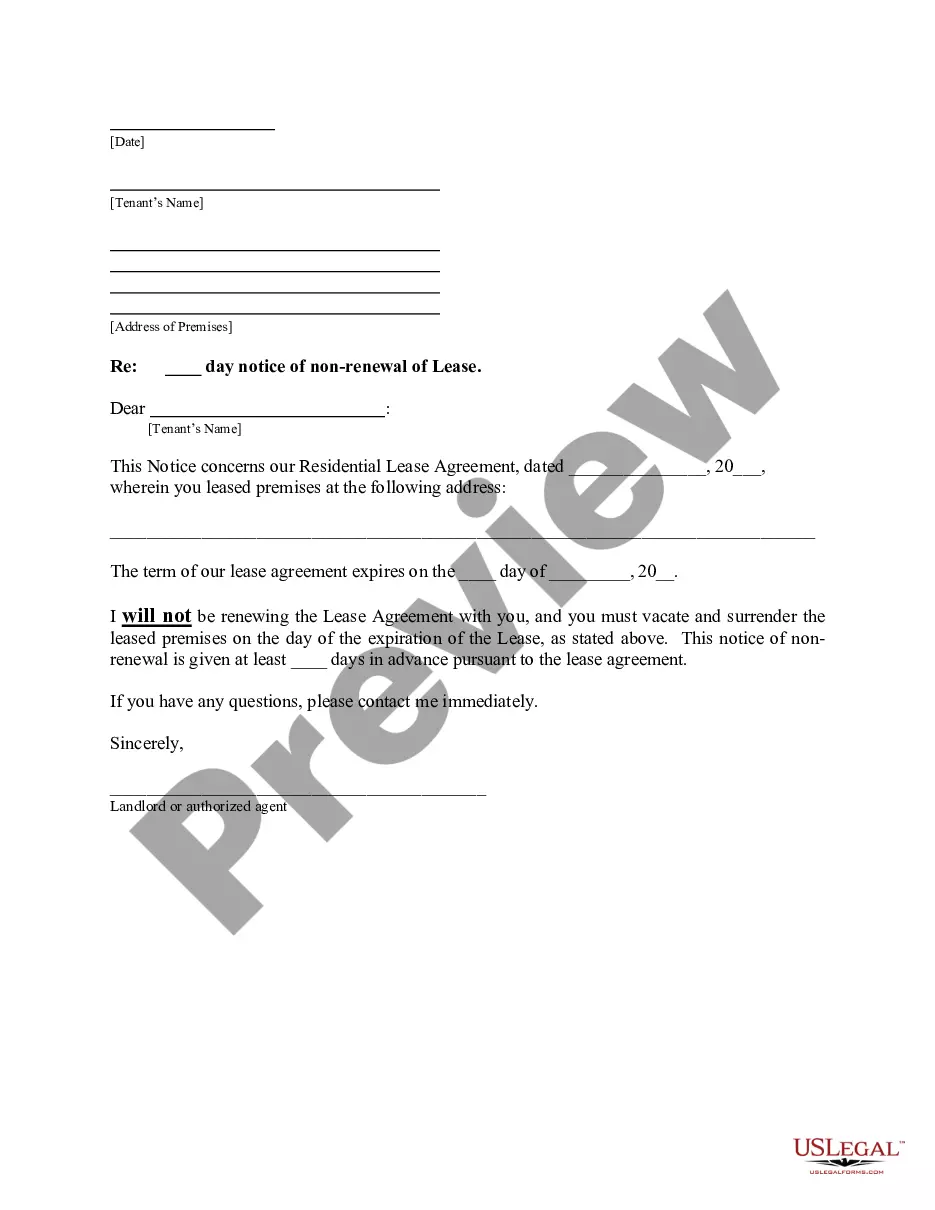

How to fill out Arkansas Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

Employing Arkansas Living Trust for Individuals who are Unmarried, Separated, or Bereaved Parents with Offspring examples crafted by skilled attorneys allows you to avoid stress when completing paperwork.

Simply download the template from our site, complete it, and have a lawyer review it. This can save you considerably more time and money than having a lawyer create a document from the ground up tailored to your requirements.

If you possess a US Legal Forms subscription, just Log In/">Log In to your account and navigate back to the sample page. Locate the Download button next to the templates you’re examining. Once you download a template, you will find your saved samples in the My documents section.

Choose a file format and download your document. After you’ve completed all the aforementioned steps, you will be able to finish, print, and sign the Arkansas Living Trust for Individuals who are Unmarried, Separated, or Bereaved Parents with Offspring sample. Remember to verify all provided information for accuracy before submitting or sending it out. Reduce the time spent on completing documents with US Legal Forms!

- If you lack a subscription, that's not a significant issue.

- Just adhere to the instructions below to register for an online account, obtain, and complete your Arkansas Living Trust for Individuals who are Unmarried, Separated, or Bereaved Parents with Offspring template.

- Verify and ensure that you’re downloading the correct state-specific form.

- Utilize the Preview function and read the description (if available) to determine if you need this particular template and if so, just click Buy Now.

- Search for another file using the Search field if necessary.

- Select a subscription that fits your needs.

- Begin with your credit card or PayPal.

Form popularity

FAQ

Trust funds can carry certain risks, especially if not well managed. For instance, an Arkansas Living Trust for Individuals, Who are Single, Divorced or Widows or Widowers with Children could be mismanaged by trustees, leading to financial loss. Moreover, beneficiaries might misuse funds if given direct access without proper restrictions. Therefore, it's crucial to choose a trusted trustee and establish clear guidelines to prevent potential issues.

Creating an Arkansas Living Trust for Individuals, Who are Single, Divorced or Widows or Widowers with Children can be a wise decision for your parents. It helps manage their assets effectively while ensuring their wishes are upheld. Trusts can offer flexibility and control over how assets are distributed after their passing. By placing their assets in a trust, they can potentially avoid probate and reduce estate taxes.

Common assets placed in a trust include real estate, investments, and business interests. Additionally, personal property, such as valuable collectibles and jewelry, can also be included. An Arkansas living trust for individuals who are single, divorced, or widowed with children typically serves to protect these assets and facilitate their management and distribution according to your wishes.

Yes, putting bank accounts into a trust can offer some benefits, particularly in estate planning. When you transfer your bank accounts to an Arkansas living trust for individuals who are single, divorced, or widowed with children, you can help ensure seamless access to funds for your assets' beneficiaries after death. This arrangement may also help avoid probate.

A primary residence is one asset that cannot be immediately placed into a trust without proper transition. You need to follow specific procedures to transfer ownership legally. This process becomes particularly relevant when considering an Arkansas living trust for individuals who are single, divorced, or widowed with children, as it ensures property management aligns with your estate planning goals.

Some assets cannot be held in a trust due to their nature or legal restrictions. For example, personal possessions that you intend to use during your lifetime, such as cars, cannot go into a trust until you transfer them. Furthermore, certain government benefits and assets subject to specific regulations are not allowed in a trust, making it essential to consult with a professional when creating your Arkansas living trust for individuals who are single, divorced, or widowed with children.

Certain assets may not be suitable for a living trust, including retirement accounts like IRAs and 401(k)s, where beneficiary designations are more effective. Additionally, you may want to keep life insurance policies outside of the trust, especially if you have designated beneficiaries. Consider using an Arkansas living trust for individuals who are single, divorced, or widowed with children to manage your main assets, while carefully evaluating others.

While a living trust can offer many benefits, it does have limitations. For instance, a living trust does not provide protection from creditors, and you cannot use it to reduce taxes. Additionally, a living trust does not replace a will; you still need a will to address any assets not included in the trust, especially for those creating an Arkansas living trust for individuals who are single, divorced, or widowed with children.

A living trust in Arkansas is a legal document that allows you to manage your assets during your lifetime and distribute them after your death. You, as the trust creator, can serve as the trustee, maintaining control over your assets. This arrangement helps you streamline the estate planning process and avoid the lengthy probate process, making it particularly beneficial for an Arkansas living trust for individuals who are single, divorced, or widowed with children.

Starting a living trust in Arkansas involves several key steps for the Arkansas Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children. First, decide what assets you want to place in the trust and determine your beneficiaries. You can create the trust document using resources available through uslegalforms, which offers step-by-step guidance and templates tailored for Arkansas. Once your trust document is ready, sign it in front of a notary to make it official and effective.