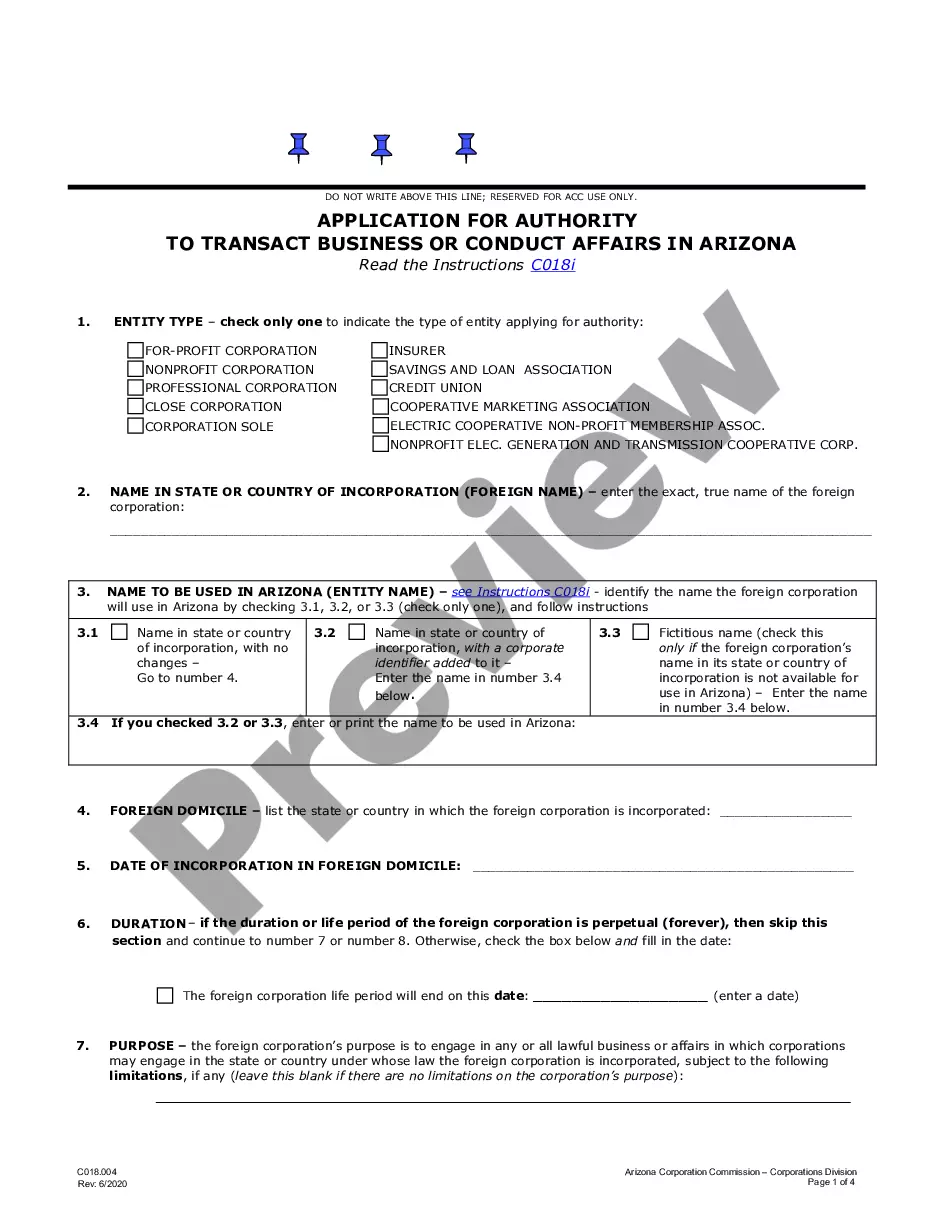

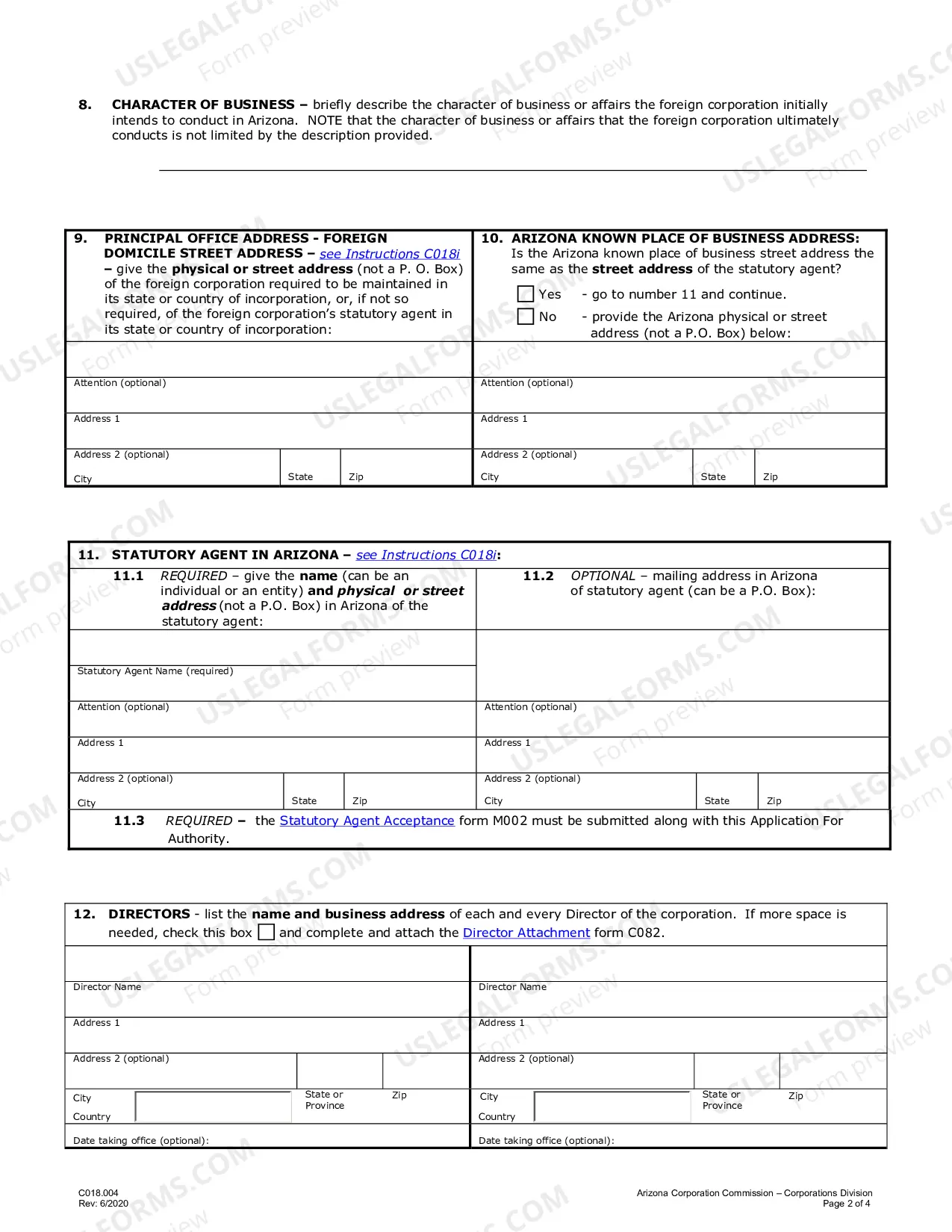

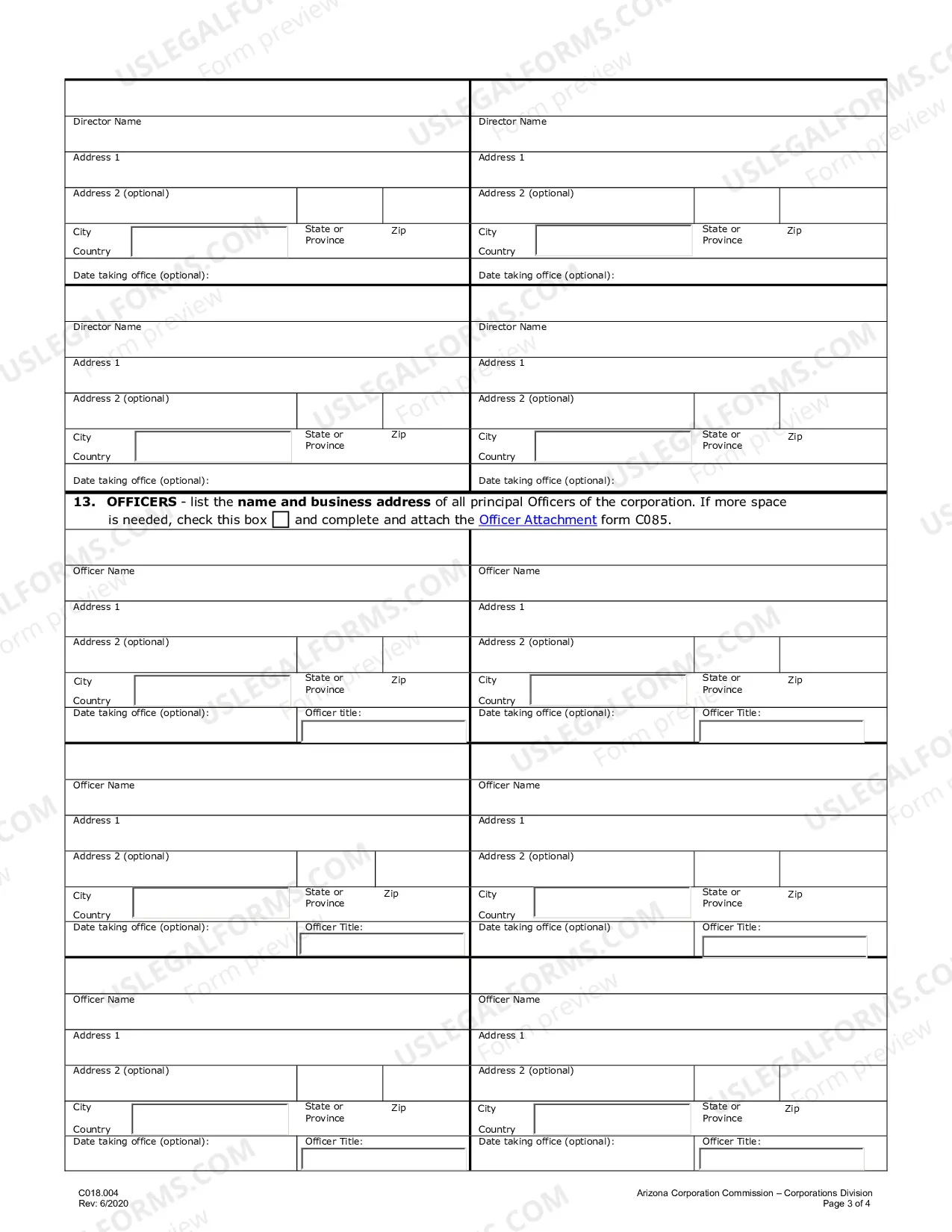

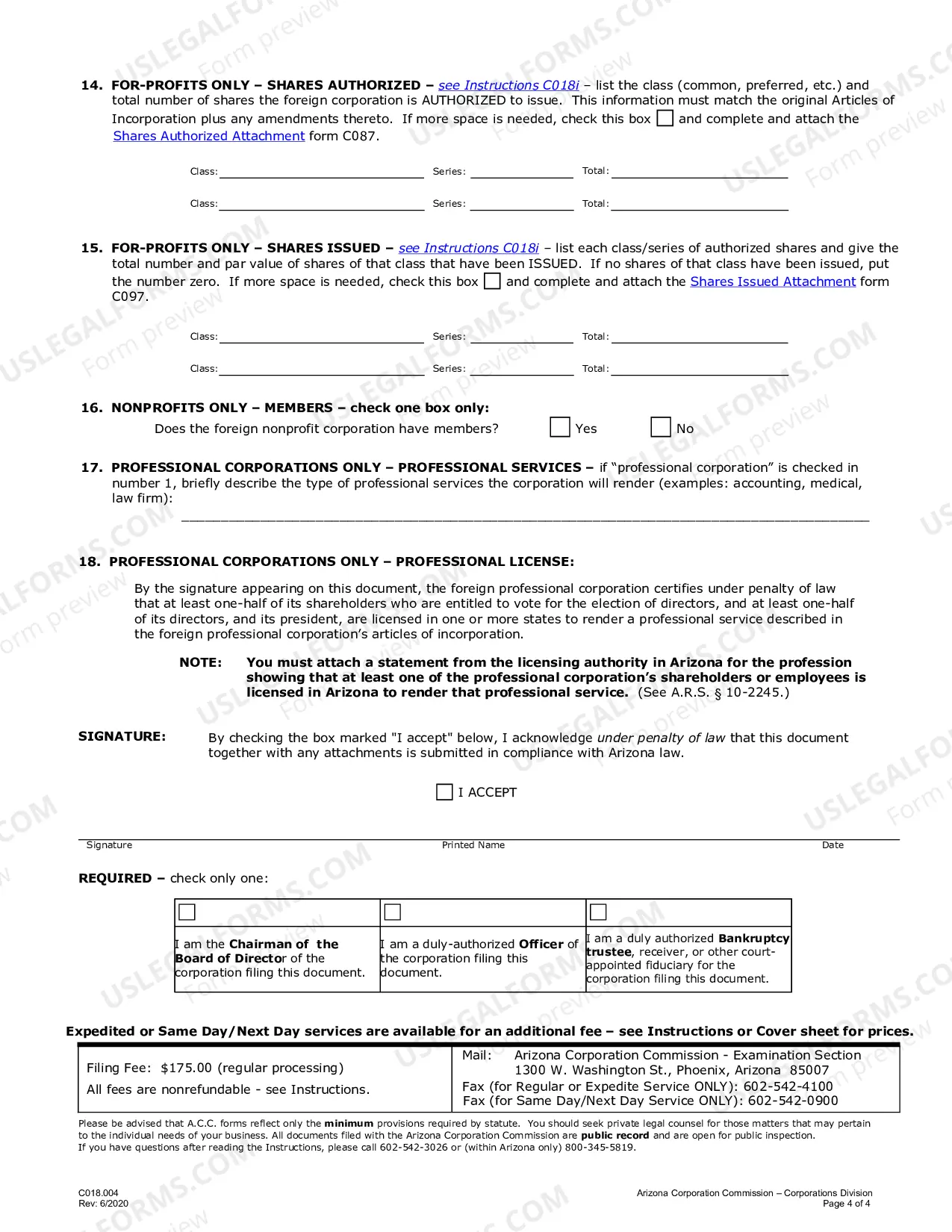

Arizona Registration of Foreign Corporation

Description

How to fill out Arizona Registration Of Foreign Corporation?

If you're in search of precise Arizona Registration of Foreign Corporation templates, US Legal Forms is precisely what you require; locate documents crafted and verified by state-authorized attorneys.

Utilizing US Legal Forms not only protects you from issues regarding valid documents; additionally, it conserves your time and effort, as well as money!

And there you have it. In just a few simple steps, you possess an editable Arizona Registration of Foreign Corporation. Once you create your account, all future requests will be handled even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form’s page. Then, when you wish to utilize this template again, you will always be able to locate it in the My documents section. Do not waste your time and effort sifting through numerous forms across various platforms. Purchase accurate documents from a single reliable service!

- Downloading, printing, and submitting a professional document is considerably less expensive than hiring a lawyer to draft it for you.

- To begin, finalize your registration process by providing your email and setting up a password.

- Follow the instructions below to establish your account and locate the Arizona Registration of Foreign Corporation template to address your concerns.

- Utilize the Preview option or review the file details (if available) to confirm that the template meets your requirements.

- Verify its relevance in the state you reside.

- Click on Buy Now to place your order.

- Choose a preferred pricing package.

- Create your account and make your payment using a credit card or PayPal.

Form popularity

FAQ

Withdrawing a foreign LLC in Arizona requires filing a Certificate of Cancellation with the Arizona Corporation Commission. You should also address any outstanding tax obligations before initiating the withdrawal. For a seamless process, consider utilizing platforms like USLegalForms to assist with the Arizona Registration of Foreign Corporation, as they simplify legal procedures.

To register a corporation in Arizona, you need to file the Articles of Incorporation with the Arizona Corporation Commission. This process includes providing basic information about your business, such as its name and structure. If you’re considering Arizona Registration of Foreign Corporation, being familiar with these steps is essential to ensure a smooth operation.

A foreign LLC is taxed based on its structure and where it conducts business. Generally, it is subject to federal income taxes and may also owe state taxes, including in Arizona if applicable. Understanding the Arizona Registration of Foreign Corporation process is essential, as this can help you navigate your tax obligations effectively.

If your corporation is headquartered outside Arizona but will conduct business within the state, you are required to register as a foreign corporation. This registration ensures compliance with Arizona laws. The Arizona Registration of Foreign Corporation allows you to operate legally while protecting your company and assets.

To register a business in Arizona, you will need to choose a business name and ensure it meets state requirements. Next, you can file your registration online or by mail with the Arizona Corporation Commission. If you are registering as a foreign entity, consider the Arizona Registration of Foreign Corporation to facilitate your process.

Yes, you typically need a business license to operate an LLC in Arizona. This requirement ensures that your business complies with local regulations. It is essential to obtain the necessary licenses to maintain compliance after completing the Arizona Registration of Foreign Corporation.

Choosing the best state for a foreign owned LLC often depends on your business needs. Many entrepreneurs favor states like Delaware or Wyoming for their business-friendly laws. However, if you are operating in Arizona, registering under Arizona Registration of Foreign Corporation can simplify your compliance with local regulations.

To register your company name in Arizona, you must first ensure that your desired name is unique and not already in use by another business. You can conduct a name availability search on the Arizona Corporation Commission website. Once confirmed, you can register your business name by submitting the appropriate application along with any required fees. Remember, if you’re planning on registering a foreign corporation, understanding the Arizona Registration of Foreign Corporation process is essential.

Registering a foreign business in Arizona involves several key steps. First, you must obtain a Certificate of Good Standing from your home state. Next, you will need to complete and submit the Application for Registration of Foreign LLC to the Arizona Corporation Commission, along with the applicable fees. Utilizing services like uslegalforms can simplify the Arizona Registration of Foreign Corporation process, making it smoother and more efficient.

To dissolve a foreign LLC in Arizona, you must file a Certificate of Cancellation with the Arizona Corporation Commission. This document formally terminates your foreign LLC’s authority to operate within the state. Additionally, ensure that you settle any outstanding debts and obligations before proceeding. For a guided approach to the Arizona Registration of Foreign Corporation process, uslegalforms can provide the necessary documentation assistance.