Transfer on Death Deed - Arizona - Individual to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Arizona Beneficiary Deed for Individual to Individual

Description

Key Concepts & Definitions

Beneficiary Deed: A legal document that allows property owners in Arizona to transfer their real estate to a beneficiary upon their death without the need for probate.

Right of Survivorship: A form of co-ownership where the surviving owners automatically receive the deceased owner's share of the property.

Real Property: Refers to land and anything permanently attached to it, such as buildings.

Estate Planning: The process of arranging the management and disposal of a person's estate during and after their life.

Transfer on Death: A provision that allows real property to be transferred directly to a designated beneficiary at the time of the owner's death, bypassing probate court.

Step-by-Step Guide

- Identify the Property: Ensure the real estate intended for transfer is clearly identified and eligible for a beneficiary deed.

- Choose a Beneficiary: Select a person or entity to inherit the property. This choice should align with your broader estate planning goals.

- Consult Legal Advice: Engage with estate planning attorneys, such as those specializing in real property and beneficiary deeds, to ensure compliance with Arizona state law and properly address complex factors like right of survivorship.

- Execute the Deed: The property owner must sign the beneficiary deed in the presence of a notary.

- Record the Deed: File the signed beneficiary deed with the local county recorder's office to make it official and enforceable.

Risk Analysis

- Lack of Flexibility: Once a beneficiary deed is recorded, it becomes challenging to change beneficiaries without executing a new document.

- Legal Challenges: If not properly structured, beneficiary deeds can be subject to disputes among potential heirs, leading to litigation.

- Financial Implications: Potential tax implications for the beneficiary, specifically regarding inheritance tax and capital gains tax.

Key Takeaways

- Beneficiary deeds offer a streamlined process to transfer real estate upon death, bypassing the complexities and costs of probate.

- Engaging with specialized estate planning legal services like Gottlieb Law can provide critical guidance and ensure legal compliance.

- Proper execution and recording of the deed are essential to ensure the property passes to the intended beneficiary smoothly and without disputes.

Common Mistakes & How to Avoid Them

- Not Regularly Updating the Deed: Life changes such as marriages, divorces, and deaths can alter one's intended plans for property disposition. Regular updates to the beneficiary deed can prevent unintended consequences.

- Failing to Record the Deed: A beneficiary deed must be legally recorded to be effective. Ensure the document is filed with the appropriate county office.

- Overlooking Tax Implications: Consult tax professionals to understand potential impacts on estate and inheritance taxes to avoid surprises for beneficiaries.

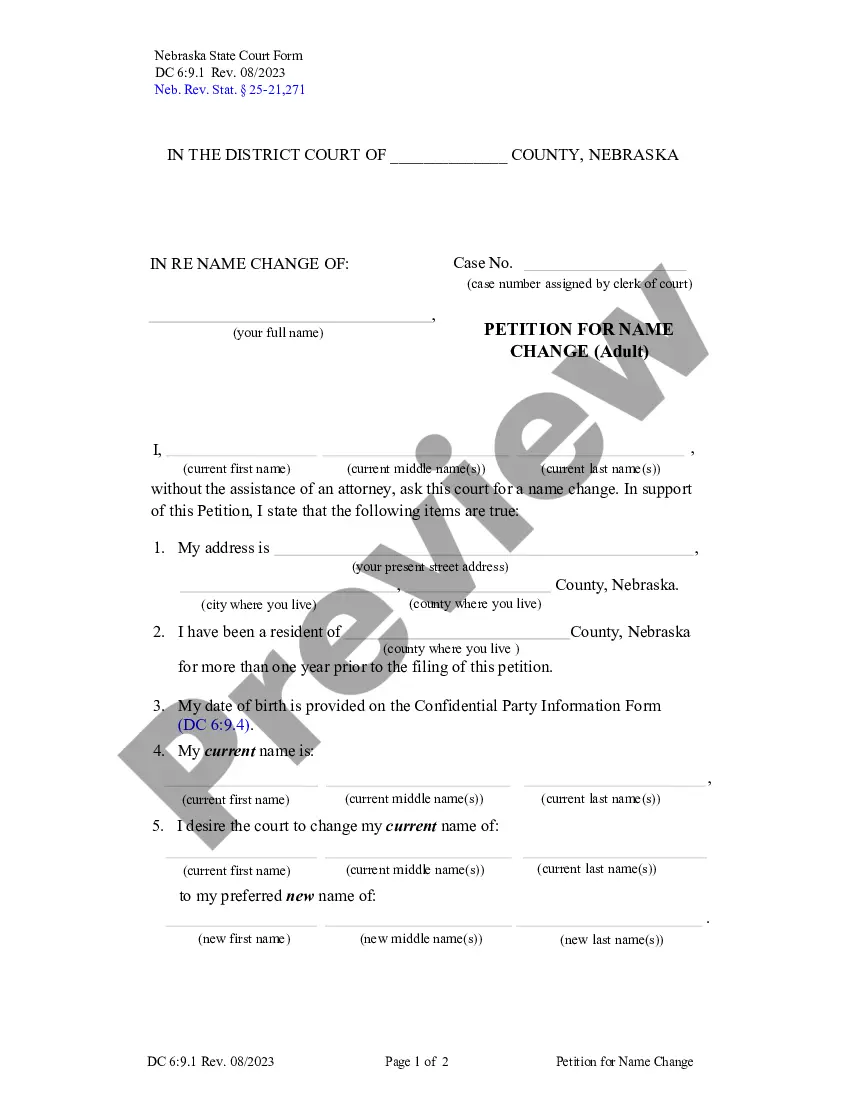

How to fill out Arizona Beneficiary Deed For Individual To Individual?

If you are looking for reliable Arizona Beneficiary Deed for Individual to Individual samples, US Legal Forms is exactly what you require; find documents supplied and verified by state-certified lawyers.

Using US Legal Forms not only alleviates your concerns regarding legal paperwork; you also save time, effort, and money! Downloading, printing, and completing a quality template is far more cost-effective than asking an attorney to draft it for you.

And that’s all. In just a few simple clicks, you obtain an editable Arizona Beneficiary Deed for Individual to Individual. Once you create your account, all future orders will be processed even more smoothly. If you possess a US Legal Forms subscription, simply Log In to your profile and click the Download button available on the form’s page. Subsequently, when you wish to access this template again, you will always be able to locate it in the My documents section. Don’t waste your time searching through numerous forms on various websites. Purchase accurate templates from a singular secure source!

- To begin, complete your registration process by providing your email address and creating a password.

- Follow the steps outlined below to establish an account and locate the Arizona Beneficiary Deed for Individual to Individual template to fulfill your requirements.

- Utilize the Preview feature or review the document description (if available) to ensure that the example is what you are looking for.

- Verify its validity in your jurisdiction.

- Click on Buy Now to finalize your purchase.

- Select a recommended pricing plan.

- Set up your account and pay using your credit card or PayPal.

- Choose an appropriate format and download the document.

Form popularity

FAQ

You can obtain an Arizona Beneficiary Deed for Individual to Individual through various online platforms, including uslegalforms. They provide comprehensive forms that are easy to understand and fill out. Ensure you have the correct documentation to make the process as smooth as possible.

To revoke an Arizona Beneficiary Deed for Individual to Individual, you must create a new deed that explicitly states the revocation. Sign and date this document, and then file it with the county recorder's office where the original deed is recorded. This process ensures that your intentions remain clear and legally recognized.

Yes, Arizona allows for a transfer on death deed, commonly known as a beneficiary deed. This type of deed is specifically designed for individuals wishing to transfer property directly to heirs upon death. Utilizing the Arizona Beneficiary Deed for Individual to Individual can help you avoid the lengthy probate process, making the transition smoother for your loved ones.

You can file an Arizona Beneficiary Deed for Individual to Individual at your county recorder's office. Make sure to bring the completed deed form along with any required identification. Once filed, the deed becomes part of public record, ensuring your intentions are clear for future reference.

When a house owner dies without a will in Arizona, the property typically enters probate, where a court decides how to distribute the estate. This can lead to delays and complications in transferring ownership. If the property had an Arizona beneficiary deed for individual to individual, however, it would automatically pass to the designated beneficiary, bypassing probate altogether.

Filling out a beneficiary designation form involves providing accurate information about the deceased individual, the property, and the beneficiaries. Ensure that all names are clearly spelled, and include legal descriptions of the property. By addressing these details correctly, the use of an Arizona beneficiary deed for individual to individual can prevent future disputes and complications.

To transfer a title from a deceased person in Arizona, you need a certified copy of the death certificate and relevant documentation for the property. If the title was set up under a beneficiary deed, transferring ownership becomes easier, and you may avoid the lengthy probate process. Utilizing the Arizona beneficiary deed for individual to individual ensures a more efficient transfer of property.

To transfer a property deed from a deceased relative in Arizona, you must first obtain a copy of the death certificate and locate the will, if one exists. If the property was designated through a beneficiary deed, the transfer can occur without going through probate. This streamlined process highlights the benefits of the Arizona beneficiary deed for individual to individual in estate transitions.

While it is not mandatory to have a lawyer for executing a transfer on death deed in Arizona, seeking legal guidance can help ensure that the deed is properly completed and recorded. A lawyer can also provide insight into how the Arizona beneficiary deed for individual to individual fits within your broader estate plan. However, many individuals successfully complete these deeds on their own using the appropriate forms.

Yes, Arizona allows transfer on death deeds, also known as beneficiary deeds. These deeds provide a clear method for transferring real estate to individuals without probate. By utilizing the Arizona beneficiary deed for individual to individual, property owners can easily designate who will receive their property after they pass away.