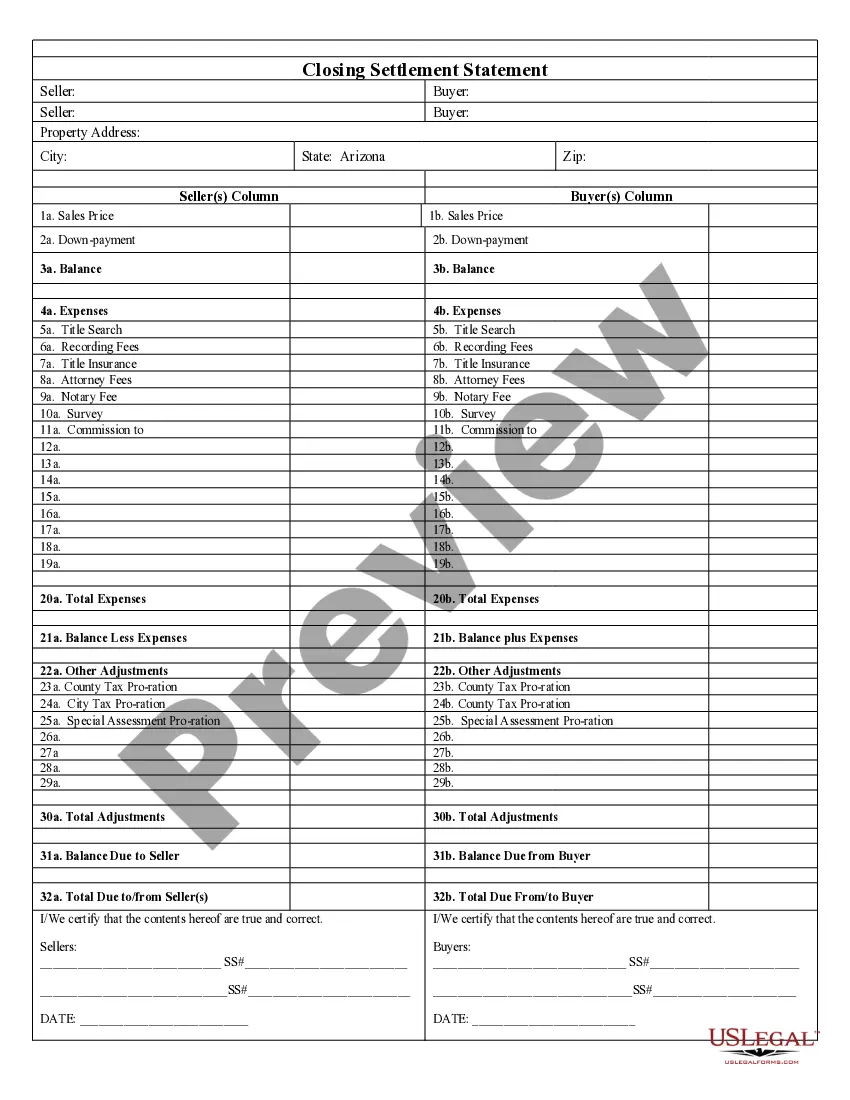

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Arizona Closing Statement

Description Arizona Closing Statement

How to fill out Settlement Statement Form Fillable?

If you are seeking suitable Arizona Closing Statement templates, US Legal Forms is precisely what you require; access documents created and validated by state-authorized attorneys.

Utilizing US Legal Forms not only saves you from issues related to legal documents; it also conserves time, effort, and money! Obtaining, printing, and filling out a professional template is significantly cheaper than hiring a lawyer to do it for you.

And that's it. With just a few simple clicks, you have an editable Arizona Closing Statement. After you create an account, all subsequent purchases will be processed even more effortlessly. Once you have a US Legal Forms subscription, just Log In to your account and click the Download button available on your forms page. Then, when you need to use this document again, you'll always be able to find it in the My documents section. Don't waste your time comparing numerous forms across multiple sources. Order professional templates from a single secure service!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions outlined below to set up your account and obtain the Arizona Closing Statement template to address your needs.

- Utilize the Preview option or review the document description (if available) to ensure that the sample is what you're looking for.

- Check its relevance in the state where you reside.

- Click Buy Now to proceed with your purchase.

- Select a recommended pricing plan.

- Set up your account and complete payment with a credit card or PayPal.

- Choose a preferred format and save the document.

Arizona Closing Online Form popularity

Arizona Closing Template Other Form Names

Arizona Closing Draft FAQ

Closing fees in Arizona can vary based on factors such as property location and transaction type. Generally, these costs may include title insurance, recording fees, attorney fees, and possibly escrow fees. Reviewing your Arizona Closing Statement will clarify which fees apply to your specific situation. By utilizing resources like US Legal Forms, you can better prepare for these fees and ensure a smooth closing experience.

In Arizona, the closing process involves several important steps to finalize a real estate transaction. You will typically review and sign various documents, including the Arizona Closing Statement. This document details the financial transactions of the sale, ensuring all parties understand their obligations. Working with a qualified real estate agent or attorney can streamline the process and provide clarity.

In Arizona, bank accounts that have designated beneficiaries typically do not go through probate, as they pass directly to the listed individuals. This can be beneficial, helping to expedite the transfer of assets. However, if there are additional complexities, such as other estate debts, preparing an Arizona Closing Statement might still be necessary to ensure all matters are properly addressed.

While it's not mandatory to hire a lawyer for probate in Arizona, having legal guidance can simplify the process greatly. A lawyer can help you navigate the paperwork, including the Arizona Closing Statement, ensuring all documents are complete and filed correctly. This assistance can save you time and minimize stress during a challenging period.

In Arizona, you typically have two years from the date of death to file probate. However, it is wise to start the process sooner to avoid complications, especially when handling assets. An effective Arizona Closing Statement can help track all estate assets and streamline the filing process.

Filing Arizona probate involves submitting the required forms to the probate court. Begin by completing the petition for probate and include necessary documents like the will and death certificate. After filing, the court will schedule a hearing, and you may also need to prepare an Arizona Closing Statement to summarize the estate's financial situation.

To start probate in Arizona, you need to file a petition with the appropriate court in the county where the deceased resided. You will also need to provide a copy of the death certificate and the last will, if available. It's important to understand the required documents, as an Arizona Closing Statement may be needed to detail the estate's assets and debts.

When an estate closes, it signifies the completion of all legal and financial procedures related to a deceased person's estate. This includes settling debts, distributing assets to beneficiaries, and filing necessary documents with the court. An Arizona Closing Statement helps summarize these final financial aspects. Closing the estate effectively releases the personal representative from their duties and provides closure for the remaining family members.

While you don't necessarily need an attorney to close on a house in Arizona, having legal guidance is often beneficial. An attorney can help you navigate the complexities of real estate transactions, ensuring that all paperwork, including the Arizona Closing Statement, is correctly handled. Whether you're buying or selling, professional support can lead to a smoother closing experience.

In Arizona, you generally have up to one year to settle an estate after the probate process begins. However, this timeline can vary based on the complexity of the estate and any disputes that may arise. Keeping track of deadlines is crucial, as some actions require settlement within specific time frames. So, be prepared to manage those expectations with accurate Arizona Closing Statements.