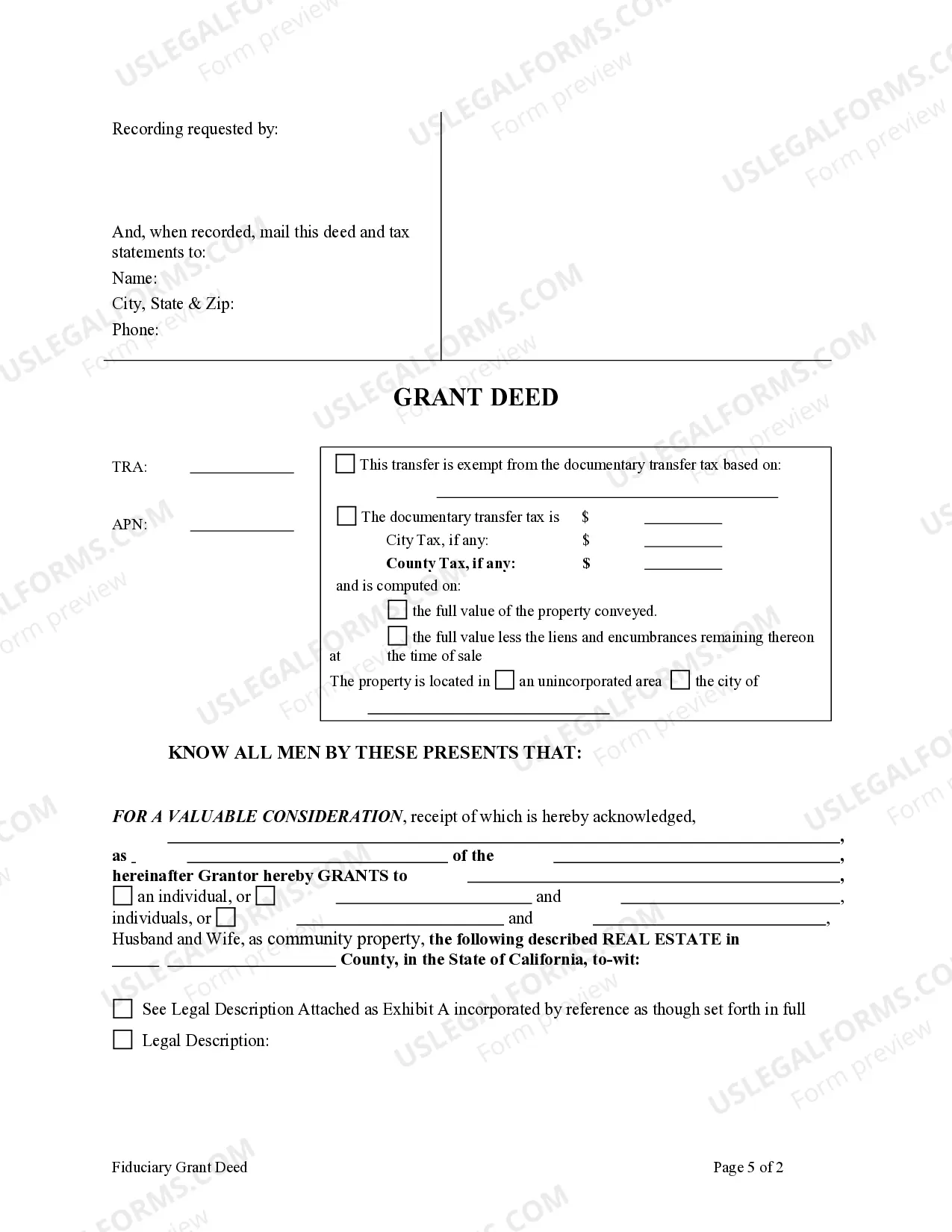

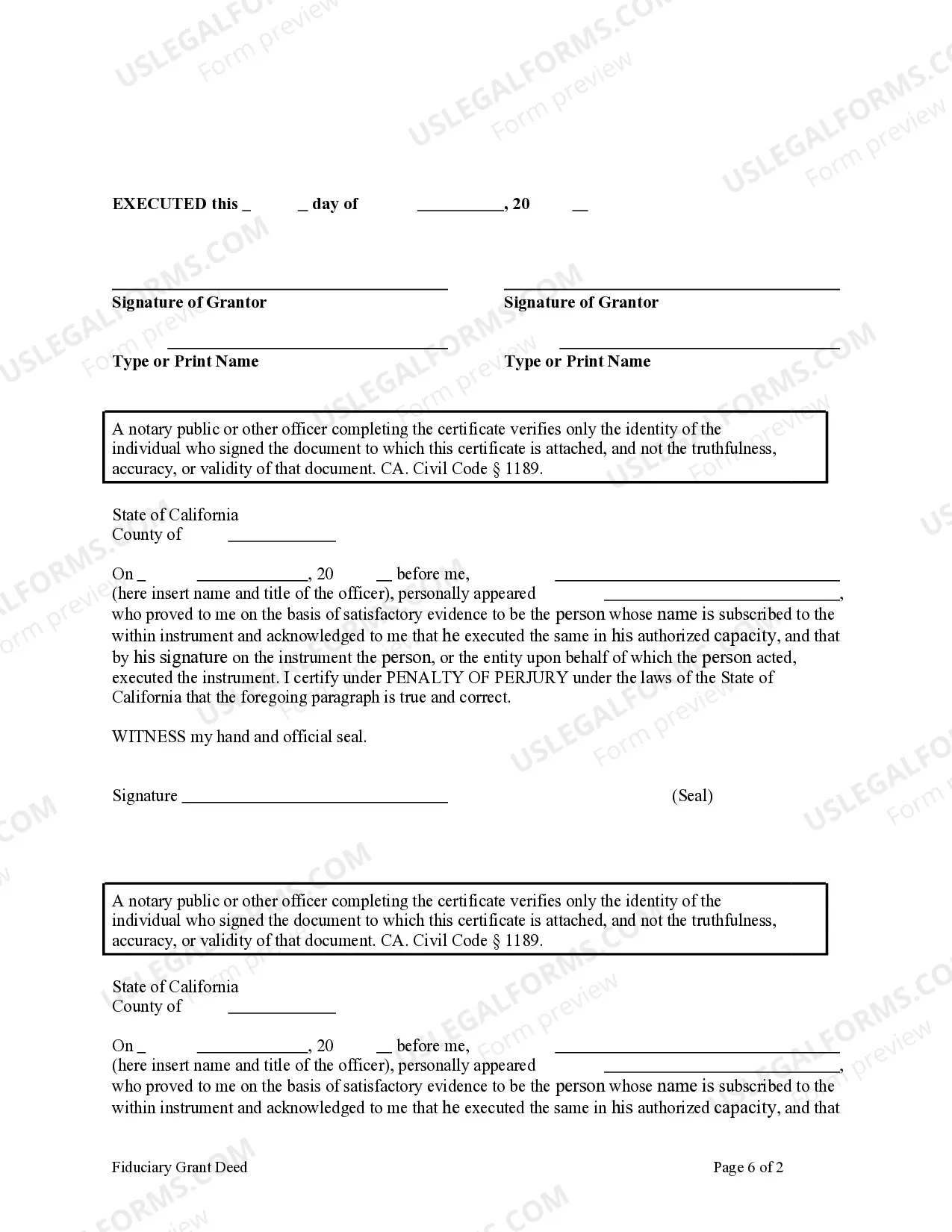

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

California Warranty Deed for Fiduciary

Description Deed Real Estate

How to fill out Real Estate Form Template?

Among numerous paid and complimentary samples you find online, you cannot guarantee their precision.

For instance, who created them or if they possess the necessary qualifications to handle what you require these for.

Always remain calm and utilize US Legal Forms!

Click Buy Now to initiate the ordering process or search for another template using the Search bar situated in the header. Select a pricing plan, register for an account, pay for the subscription using your credit/debit card or PayPal, and download the document in your chosen file format. Once you have registered and obtained your subscription, you can utilize your California Warranty Deed for Fiduciary as frequently as you wish while it remains active in your state. Edit it with your preferred offline or online editor, complete it, sign it, and produce a physical copy. Achieve more for less with US Legal Forms!

- Find California Warranty Deed for Fiduciary templates crafted by experienced legal professionals and steer clear of the expensive and lengthy task of searching for a lawyer and then compensating them to draft a document for you that you can effortlessly obtain yourself.

- If you possess an existing subscription, sign in to your account and locate the Download button adjacent to the form you are seeking.

- You will also be able to access your previously stored documents in the My documents section.

- If you are using our service for the first time, adhere to the instructions below to easily acquire your California Warranty Deed for Fiduciary.

- Confirm that the document you find is valid in your residing state.

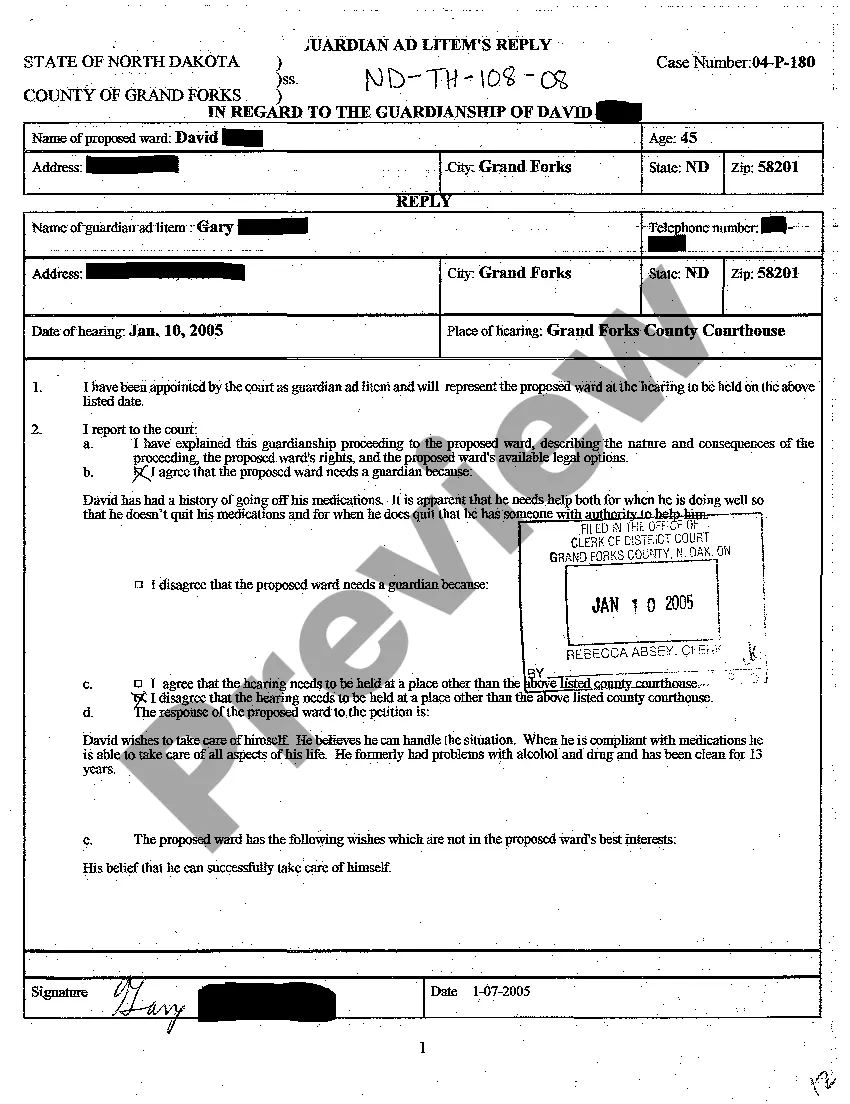

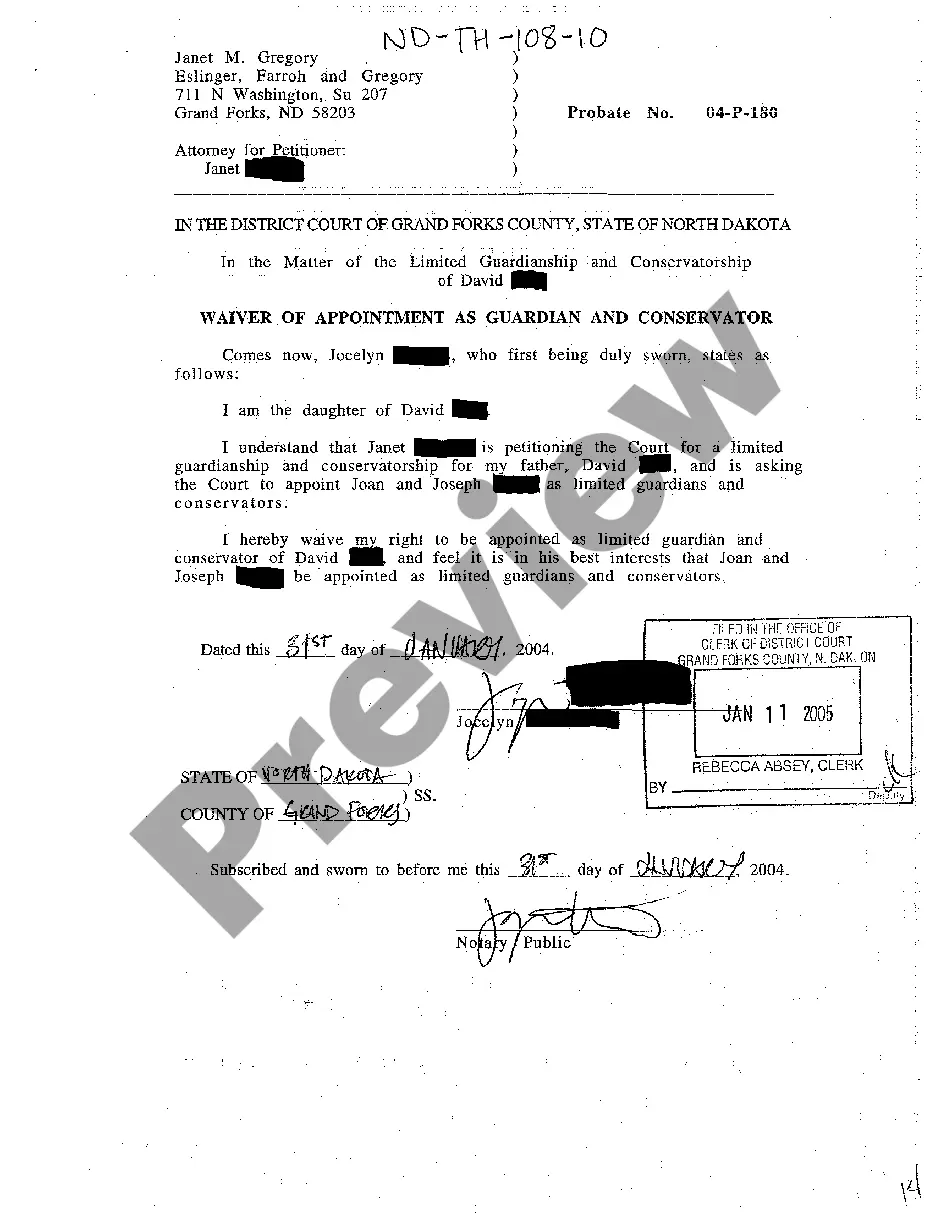

- Examine the document by perusing the description using the Preview feature.

Deed Real Estate Document Form popularity

Deed Fiduciary Other Form Names

Warranty Deed Form Template FAQ

The primary disadvantage of a warranty deed is the potential liability it imposes on the grantor. If any claims arise regarding the title or ownership after the transfer, the grantor must defend against those claims, which may involve additional legal costs. However, using a California Warranty Deed for Fiduciary can offer peace of mind, as it allows fiduciaries to fulfill their obligations while minimizing personal liability.

A fiduciary warranty deed is a specific type of warranty deed used by a fiduciary, such as an executor or trustee, to transfer property. This deed ensures that the fiduciary acts within their legal authority and protects the interests of the beneficiaries. When you opt for a California Warranty Deed for Fiduciary, you establish a strong legal foundation for the property transfer, ensuring compliance and security in the transaction.

The strongest form of deed is generally considered to be the warranty deed, as it provides the grantee with full legal protection against any claims to the property. Unlike other types of deeds, a warranty deed ensures that the seller guarantees clear title to the property and commits to defending against any future claims. When using a California Warranty Deed for Fiduciary, you receive additional benefits, as it carries forward these protections while allowing fiduciaries to act in compliance with legal standards.

A fiduciary deed serves to transfer property on behalf of another person, such as a trustee or an executor of an estate. This type of deed is crucial in estate planning and settling an estate, as it ensures that the property is properly handled according to the legal obligations of the fiduciary. Utilizing a California Warranty Deed for Fiduciary can provide the necessary legal backing to protect all parties involved in the transaction.

The key difference between a quitclaim deed and an Interspousal transfer deed in California lies in ownership transfer and the rights conveyed. A quitclaim deed transfers any interest the grantor has in the property, without assuming any warranty on the ownership. On the other hand, an Interspousal transfer deed is specifically designed for spouses to transfer property between each other, often with certain legal protections in place. If you are navigating property transfers, consider using a California Warranty Deed for Fiduciary for secure and efficient processing.

While a deed does not have to be recorded to be valid in California, recording it provides legal protection and public notice. By recording a California Warranty Deed for Fiduciary, you help prevent future disputes regarding property ownership. It is advisable to record your deed to ensure your rights are protected as the property owner.

In California, trust documents do not need to be recorded to be valid. However, recording a California Warranty Deed for Fiduciary associated with the trust can provide public notice of the trust's terms. This can protect the beneficiaries and ensure that the property is transferred according to your intentions. Consider recording relevant documents to maintain clarity and legality.

To record a deed of trust in California, first, complete the document with all necessary details. After that, you must find the local county recorder's office where the property is located. Submit the document along with the required fees, and ensure it includes the proper legal description of the property. Utilizing a well-drafted California Warranty Deed for Fiduciary can simplify this process.

To get the warranty deed for your property, you can visit your county’s recorder’s office or request a copy online, depending on your state’s regulations. If your property is in California and you require a California Warranty Deed for Fiduciary, consider using uslegalforms. Their platform can assist you in locating the correct forms and ensuring the deed is filled out properly.

To obtain a copy of your house deed in Missouri, you should contact the county recorder’s office where your property is situated. They can provide you with the necessary paperwork or facilitate an online request. If you need help navigating this process or looking for a specific deed type, uslegalforms has resources that can guide you effectively.