This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

California Estate Planning Questionnaire and Worksheets

Description Estate Planning Form

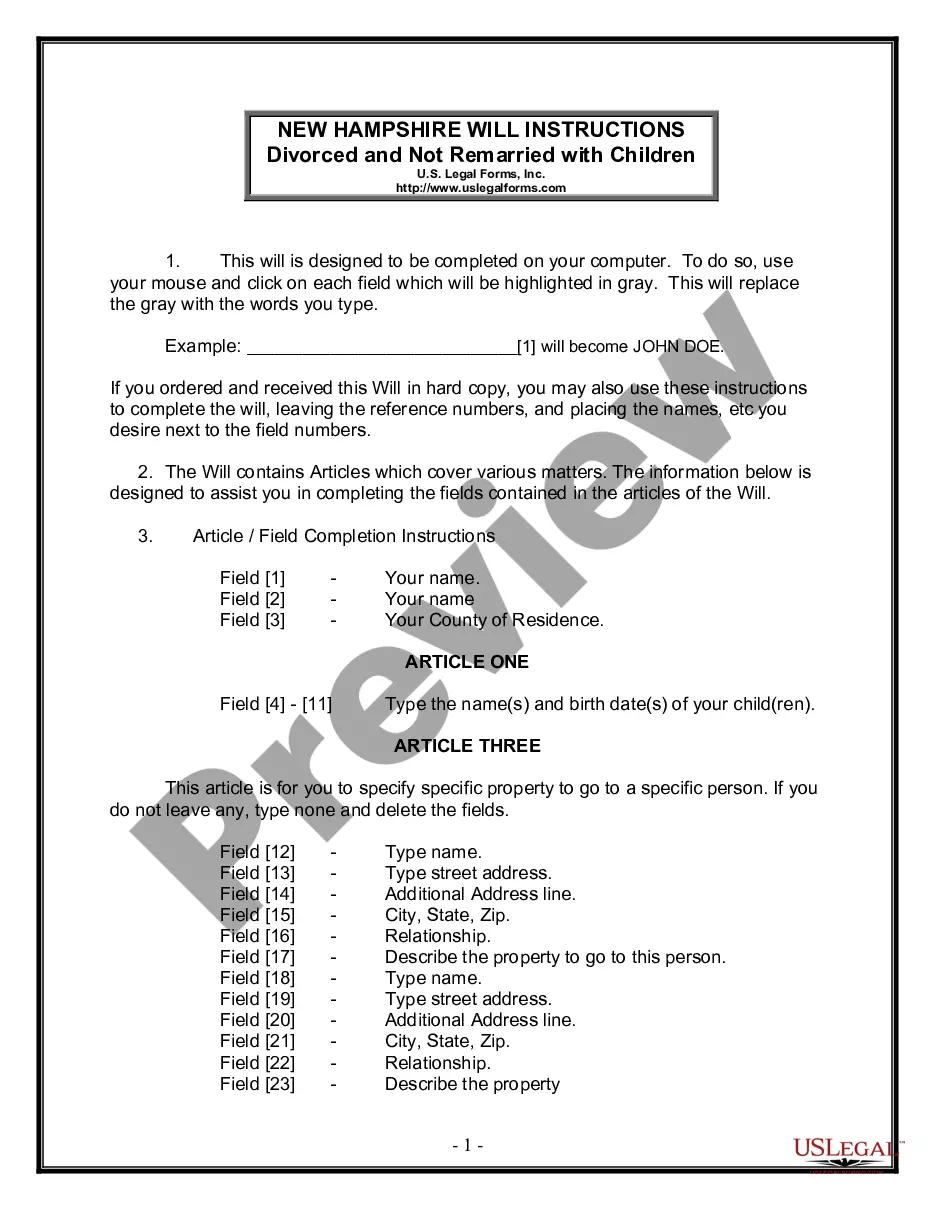

How to fill out Estate Planning Questionnaire Pdf?

If you're looking for accurate California Estate Planning Questionnaire and Worksheets documents, US Legal Forms is precisely what you require; access files produced and validated by state-certified legal experts.

Using US Legal Forms not only helps prevent issues related to legal documents; additionally, you save time, effort, and money! Downloading, printing, and completing a professional template is significantly more economical than hiring a lawyer to draft it for you.

And that’s all. In just a few easy steps, you possess an editable California Estate Planning Questionnaire and Worksheets. Once your account is created, all subsequent orders will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button found on the form's page. Then, whenever you need to utilize this document again, you will always be able to find it under the My documents section. Don’t waste your time and effort searching through countless forms on different websites. Acquire precise documents from a single trusted service!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to set up an account and obtain the California Estate Planning Questionnaire and Worksheets template to address your needs.

- Utilize the Preview option or review the file description (if provided) to ensure that the sample is what you require.

- Verify its compliance with your local regulations.

- Click on Buy Now to place your order.

- Select a suitable pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose a convenient format and save the document.

Ca Estate Planning Form popularity

Printable Estate Planning Forms Other Form Names

Ca Estate Planning Document FAQ

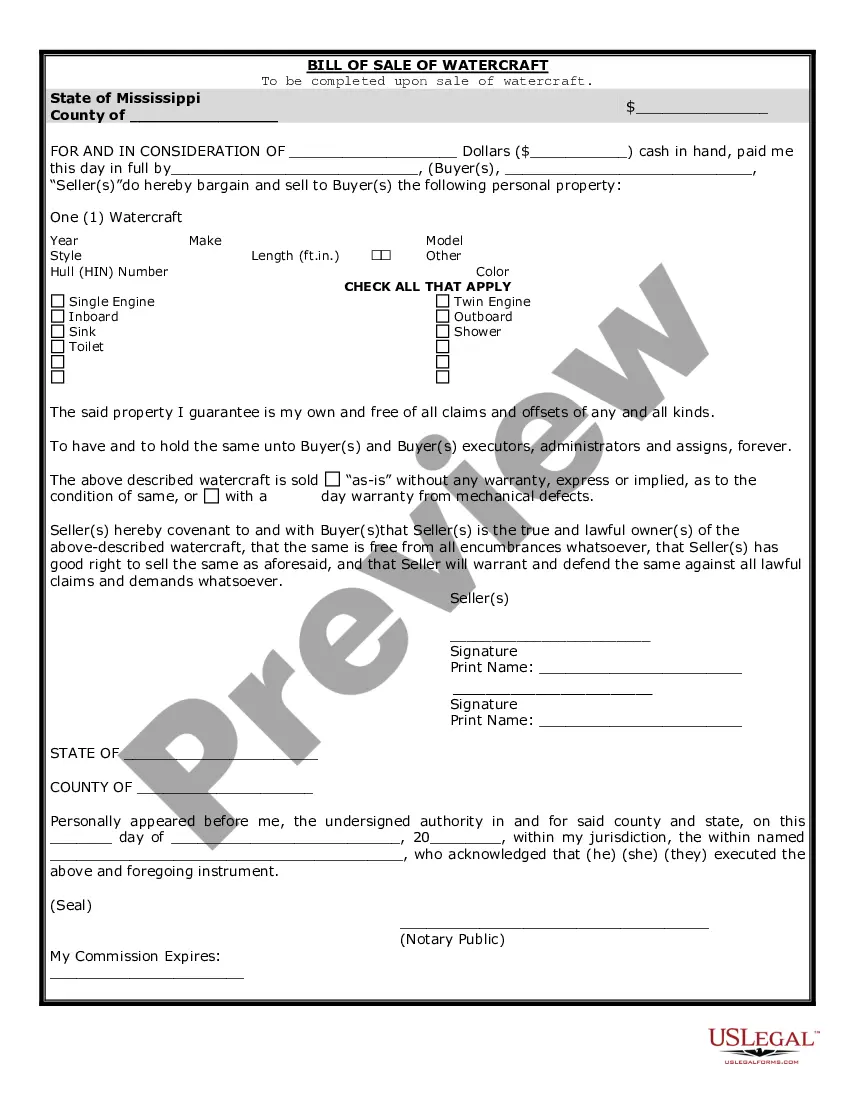

Avoid putting specific assets that need beneficiary designations, such as life insurance policies, joint accounts, or retirement funds, in your will. These assets typically have their own transfer methods that bypass probate. For other insights, the California Estate Planning Questionnaire and Worksheets can offer valuable information to help you make informed decisions.

One of the most significant mistakes in a will is failing to update it as life circumstances change, such as marriage, divorce, or the birth of children. Outdated wills can lead to unintended distributions and family conflicts. By utilizing the California Estate Planning Questionnaire and Worksheets, you can regularly reassess your will and keep it current.

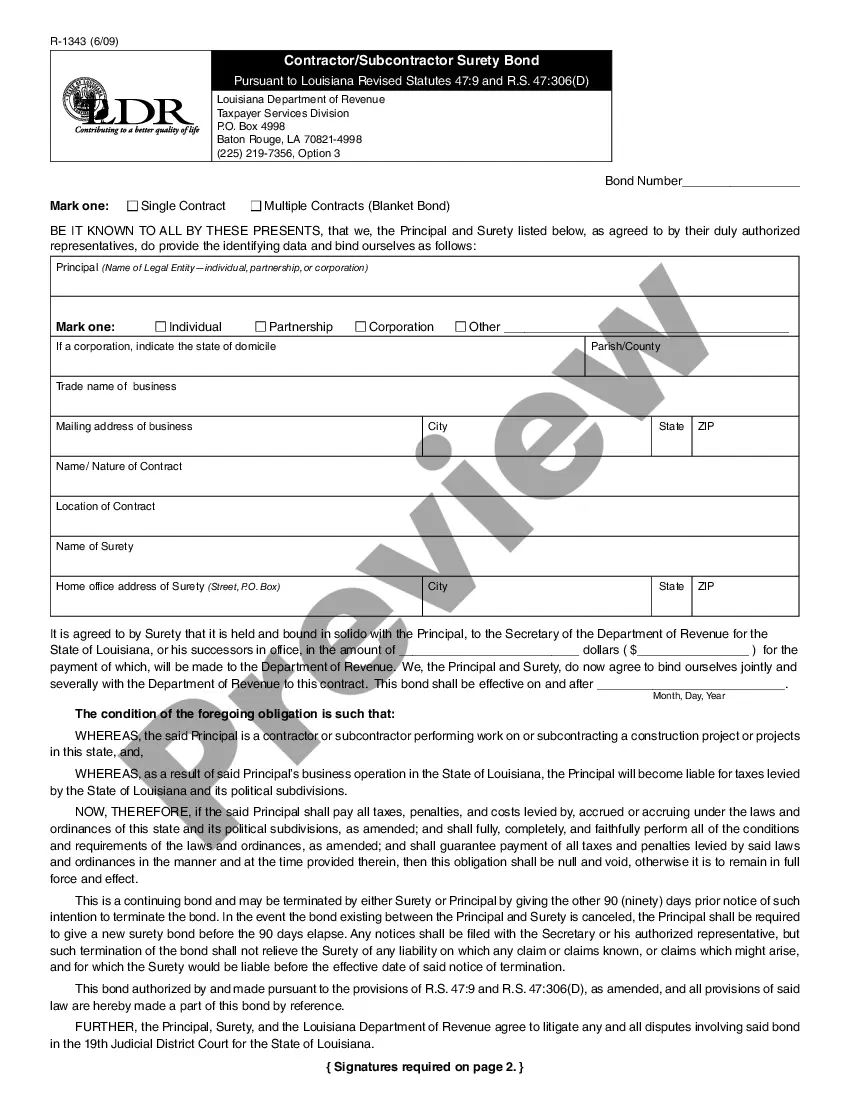

An estate planning questionnaire is a tool designed to help individuals collect and organize their essential estate-related information. It typically asks about assets, debts, family members, and personal wishes. Using the California Estate Planning Questionnaire and Worksheets ensures you have a comprehensive understanding of your estate.

Certain assets, such as retirement accounts, life insurance benefits, and property held in trust, cannot be included in a will. These assets pass directly to named beneficiaries and do not undergo probate. For a clearer picture, refer to the California Estate Planning Questionnaire and Worksheets.

Items like directly owned life insurance policies, retirement accounts, and joint property should not be included in a will since they have designated beneficiaries. It’s crucial to differentiate between assets that can and cannot be included. This understanding will be enhanced by using the California Estate Planning Questionnaire and Worksheets.

The 5 and 5 rule in estate planning allows individuals to gift up to $15,000 per recipient without incurring gift taxes, while also permitting a total of $5,000 to be gifted to any individual or charity during one's lifetime. Understanding this rule can help you maximize your estate's value. Utilize the California Estate Planning Questionnaire and Worksheets to navigate these complex rules.

The 5 D's of estate planning include death, divorce, disability, disinheritance, and disagreement. Each of these factors can significantly impact your estate and require careful consideration during the planning process. Exploring the California Estate Planning Questionnaire and Worksheets will help address these issues effectively.

Filling out an estate planning questionnaire involves gathering essential information about your financial situation and your wishes for asset distribution. Start by listing your assets, debts, and beneficiaries. Using California Estate Planning Questionnaire and Worksheets can guide you through this organized process, ensuring you don’t miss important details.

Assets that typically aren't listed in a will include those with designated beneficiaries, such as retirement accounts and life insurance policies. Additionally, assets held in joint tenancy or living trusts bypass probate and will not be part of your will. Make sure to review the California Estate Planning Questionnaire and Worksheets to understand the implications of these asset types.

The 5 by 5 rule is an estate planning guideline that allows trustees to distribute a specific amount to beneficiaries each year. Beneficiaries can withdraw the greater of $5,000 or 5% of the trust's value, making this a helpful tool in managing trust distributions. To make the most of this rule in your estate plan, consider utilizing a California Estate Planning Questionnaire and Worksheets. This resource can help clarify your options and optimize your estate planning efforts.