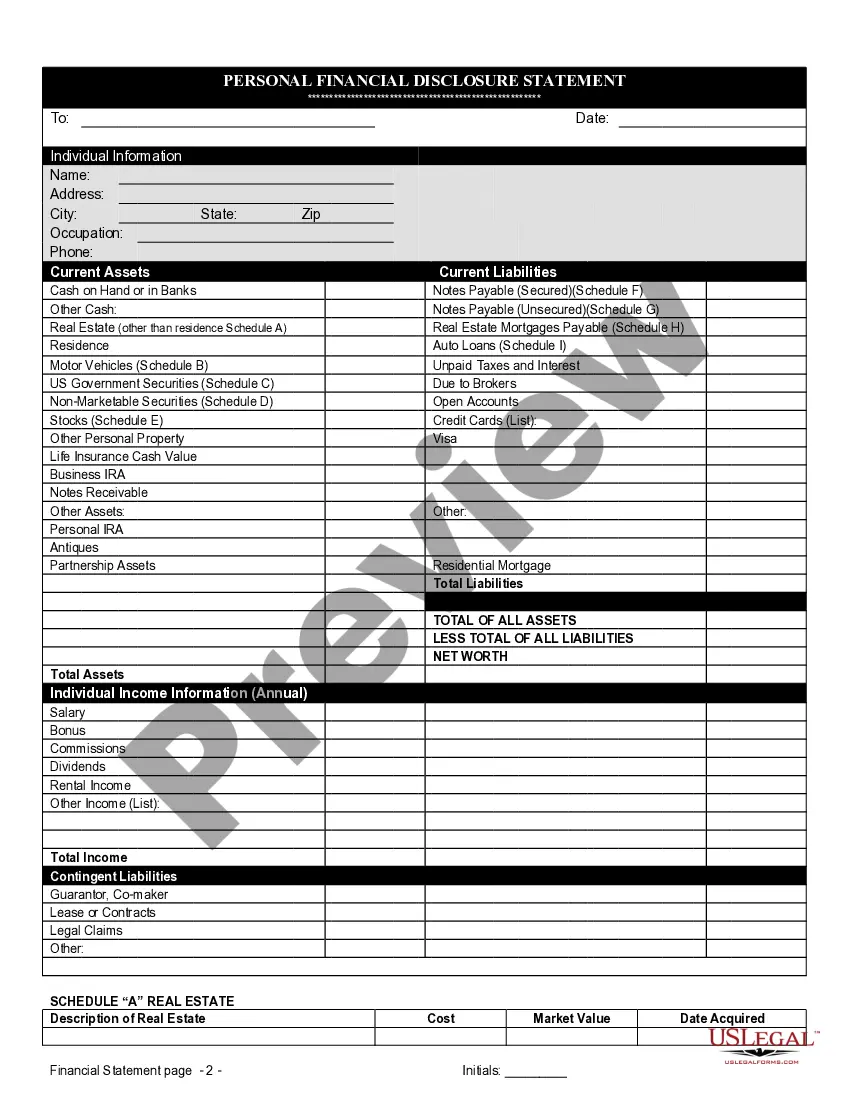

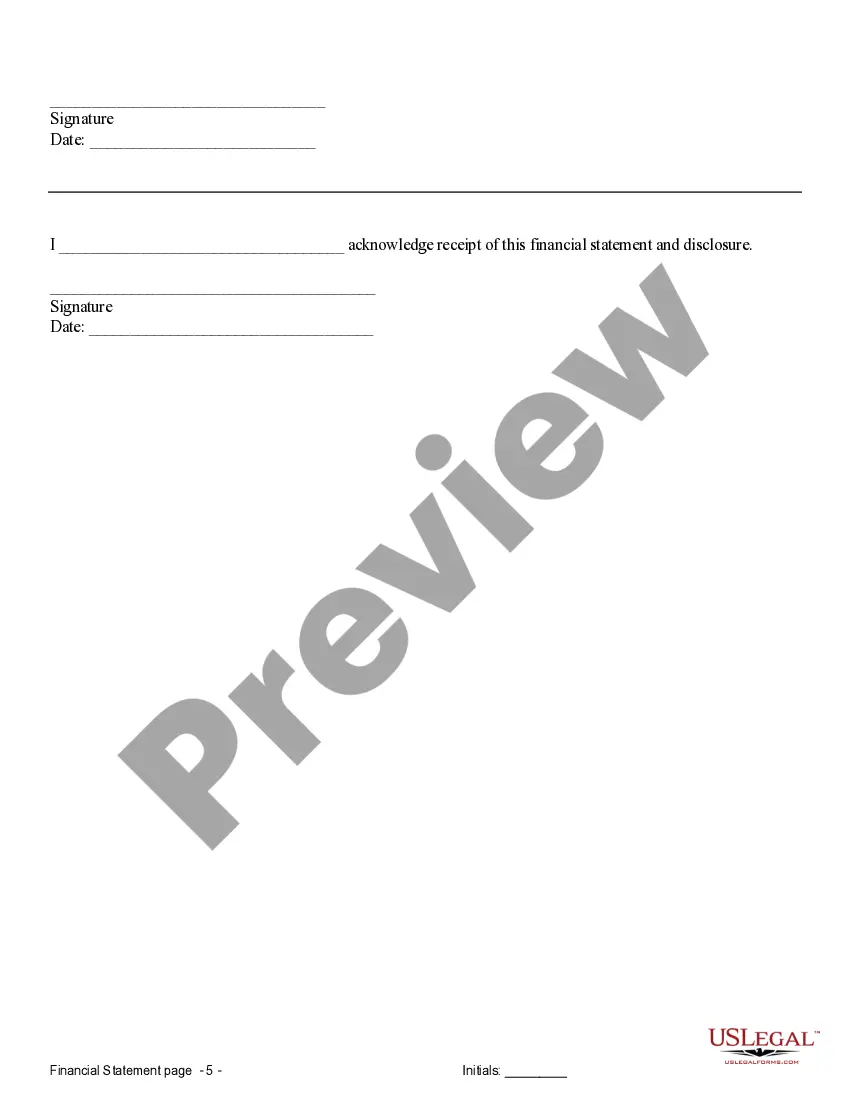

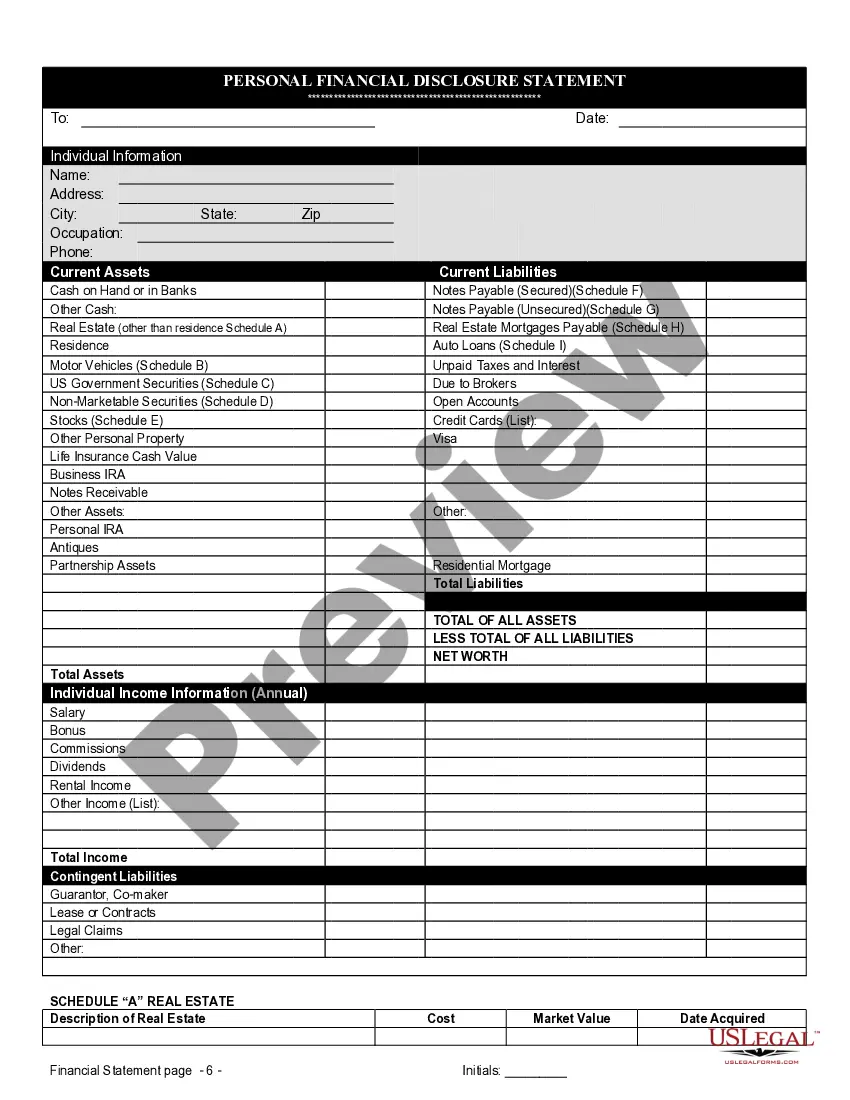

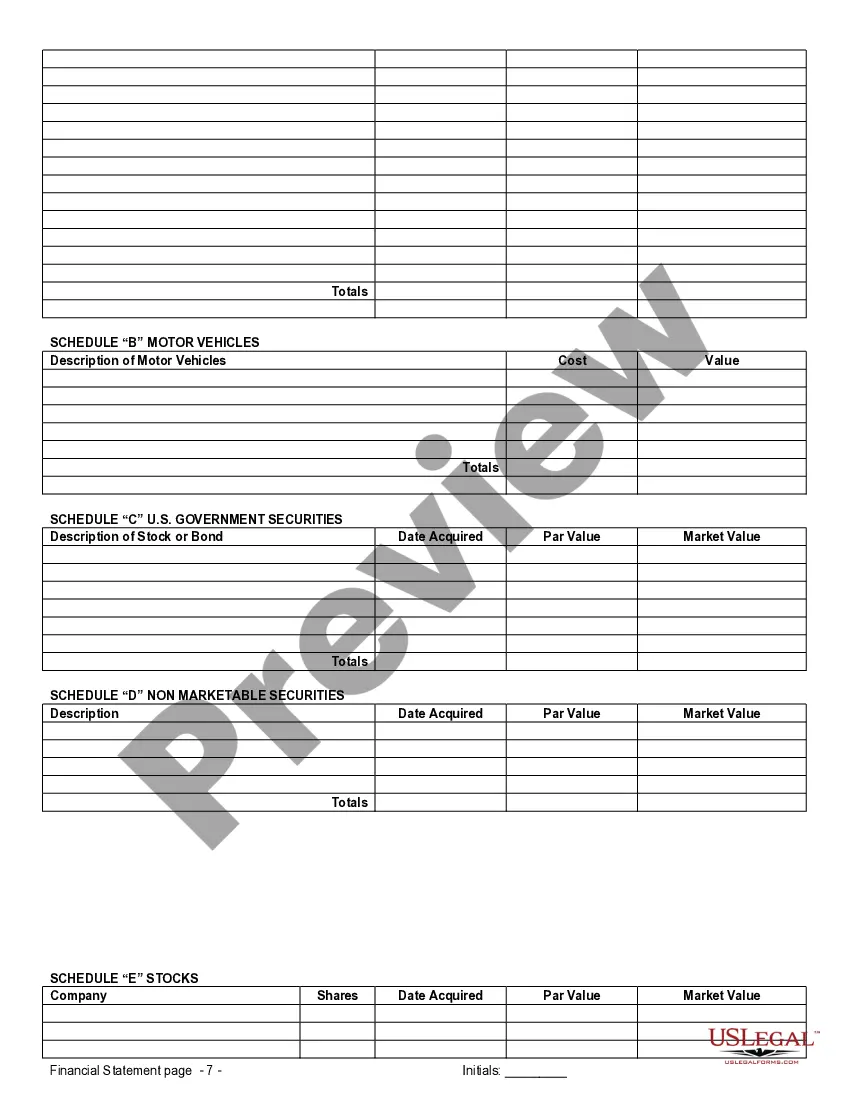

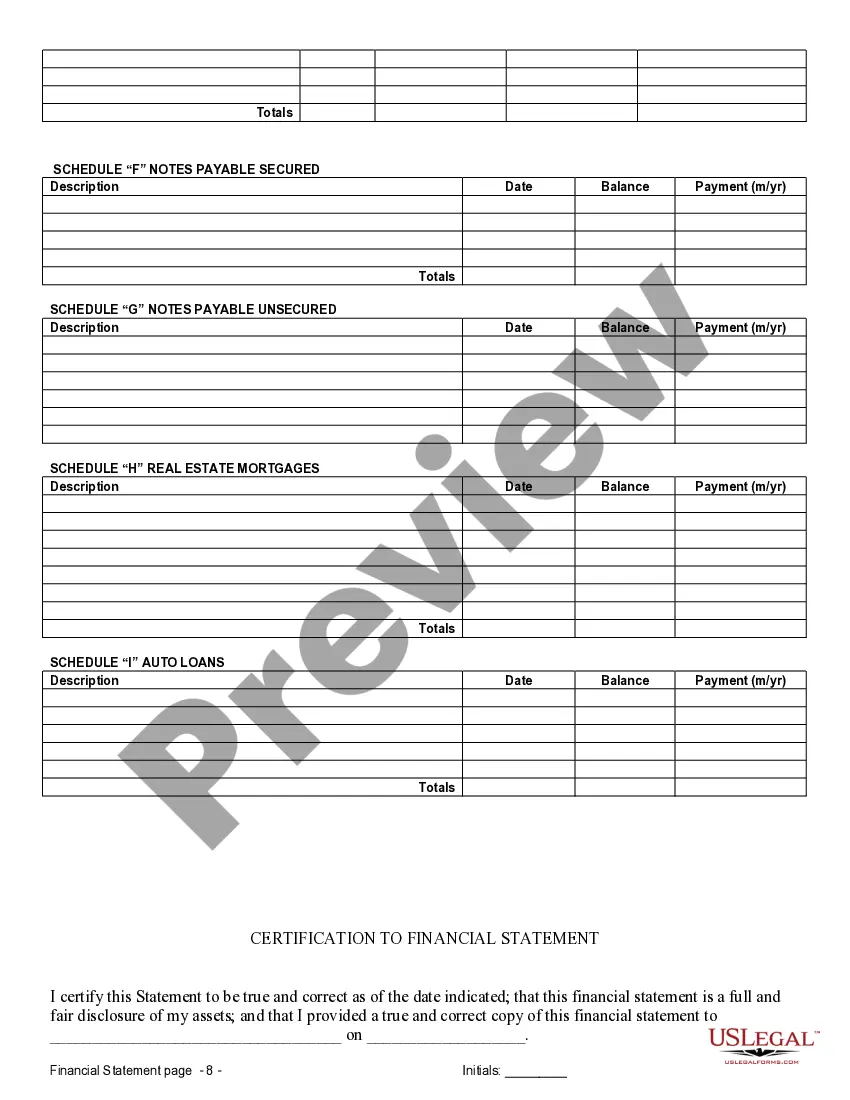

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

Key Concepts & Definitions

Financial Statements Only in Connection With: This phrase is commonly used in legal and financial contexts to describe the circumstance under which certain financial data, including balance sheets, income statements, and cash flow statements, can be disclosed or utilized. This generally pertains to specific transactions, legal requirements, or contractual conditions.

Step-by-Step Guide: How to Handle Financial Statements In Connection With Specific Transactions

- Identify the Requirement: Determine if the transaction requires sharing of financial statements.

- Gather Documentation: Collect all necessary financial documents like profit and loss statements and balance sheets.

- Ensure Compliance: Check data privacy laws and contractual agreements to confirm eligibility for sharing financial data.

- Secure Data: Use secure methods to transmit the financial data to the pertinent parties.

- Follow Up: Keep records of what was shared, with whom, and under what terms.

Risk Analysis

- Data Breach Risks: Sharing financial statements inadvertently or outside specific conditions may lead to data breaches.

- Legal Repercussions: Non-compliance with agreements or regulations around the usage of financial statements can result in legal issues.

- Misinterpretation: Misuse or wrongful interpretation of financial data might affect business decisions and stakeholder trust.

Best Practices

- Confidentiality Agreements: Always use confidentiality agreements when sharing financial statements.

- Clear Terms: Specify the terms under which the financial information is being shared in any agreement or contract.

- Regular Audits: Conduct regular audits to ensure that all financial sharing adheres to the stipulated guidelines.

Common Mistakes & How to Avoid Them

- Lack of Specificity: Avoid using broad clauses. Be specific about the 'in connection with' circumstances allowed for sharing financial statements.

- Poor Documentation: Maintain detailed records of who accessed the financial documents and under what conditions.

- Inadequate Security: Implement strong cybersecurity measures to protect shared financial data.

FAQ

- What transactions may require the use of financial statements? Major business transactions like mergers, acquisitions, or funding rounds typically require detailed financial statements.

- How can I protect financial statements shared for specific purposes? Use encrypted channels and ensure recipients are bound by confidentiality agreements.

- Are there penalties for improper sharing of financial statements? Yes, unauthorized sharing can lead to legal actions including fines and sanctions.

How to fill out Colorado Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you are seeking precise Colorado Financial Statements solely related to Prenuptial Premarital Agreement templates, US Legal Forms is what you require; obtain documents crafted and reviewed by state-approved attorneys.

Utilizing US Legal Forms not only saves you from issues regarding legal documents; you also save time, effort, and money! Downloading, printing, and completing a professional document is indeed more economical than hiring a lawyer to do it for you.

And that’s that. With just a few clicks, you possess an editable Colorado Financial Statements specifically related to Prenuptial Premarital Agreement. Once your account is created, all subsequent orders will be executed with greater ease. Having a US Legal Forms subscription, simply Log In to your profile and then click the Download button located on the form’s page. When you need to use this template again, you’ll always find it in the My documents section. Don’t squander time sifting through numerous forms across different platforms. Acquire accurate versions from one secure service!

- To begin, complete your registration by entering your email and creating a password.

- Follow the instructions below to set up your account and locate the Colorado Financial Statements specifically associated with Prenuptial Premarital Agreement template to address your needs.

- Utilize the Preview feature or check the file description (if available) to ensure that the template meets your needs.

- Verify its suitability in your state.

- Select Buy Now to place your order.

- Choose a preferred payment plan.

- Set up an account and make payment with your credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

Yes, a prenuptial agreement can help keep finances separate during and after the marriage. By outlining how each party will manage their financial assets, you can ensure clarity and protection for both individuals. Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement play a vital role in this process, as they provide a clear picture of each party's financial situation. Using platforms like USLegalForms, you can easily draft a solid prenup that addresses all your concerns and keeps your finances organized.

The prenup statute in Colorado is specified in the Uniform Premarital Agreement Act. This act outlines the requirements for a valid prenuptial agreement, including the necessity for a fair disclosure of assets. It is important to ensure that the agreement does not violate public policy and is executed voluntarily. For accurate assistance with Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement, leveraging platforms like USLegalForms can provide the guidance needed for compliance with these statutes.

Yes, Colorado recognizes prenuptial agreements as valid legal documents. These agreements can protect assets and establish financial responsibilities during and after marriage. To be enforceable, both parties must voluntarily agree to the terms and should fully disclose their financial situations. Incorporating Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement aids in this process, ensuring clarity and fairness.

While most states recognize prenuptial agreements, certain states have specific restrictions that can render a prenup invalid. For instance, some states may not uphold agreements that are deemed unconscionable or entered into under duress. It's vital to ensure that your prenup meets the legal standards of your state. Consulting legal resources like USLegalForms can help clarify the validity of Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement across different states.

A prenuptial agreement is primarily designed to address premarital assets, but it can also address how future earnings and assets will be shared. Couples can include provisions for both existing and future assets in these agreements. Therefore, while its focus is on premarital assets, it offers flexibility for future financial planning. When drafting such agreements, including Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement can clarify each party's financial situation.

Post-nuptial agreements are generally recognized and can be binding in Colorado. These agreements are created after the marriage has taken place, and they outline the management of financial assets. For a post-nuptial agreement to be enforceable, it must be executed voluntarily and with full disclosure. Utilizing Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement can help provide the necessary transparency in these agreements.

Prenups generally hold up in court if they have been created correctly and comply with state laws. Courts typically uphold agreements that are fair, made voluntarily, and based on full financial disclosure. Utilizing Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement is essential to demonstrate transparency. If you ensure that your prenup meets these criteria, you can feel more secure in its enforceability.

Yes, Colorado honors prenuptial agreements as long as they are fair, voluntary, and executed properly. The state requires that both parties fully disclose their financial information. This disclosure is often in the form of Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement. By adhering to these guidelines, couples can confidently establish satisfactory agreements that hold legal weight.

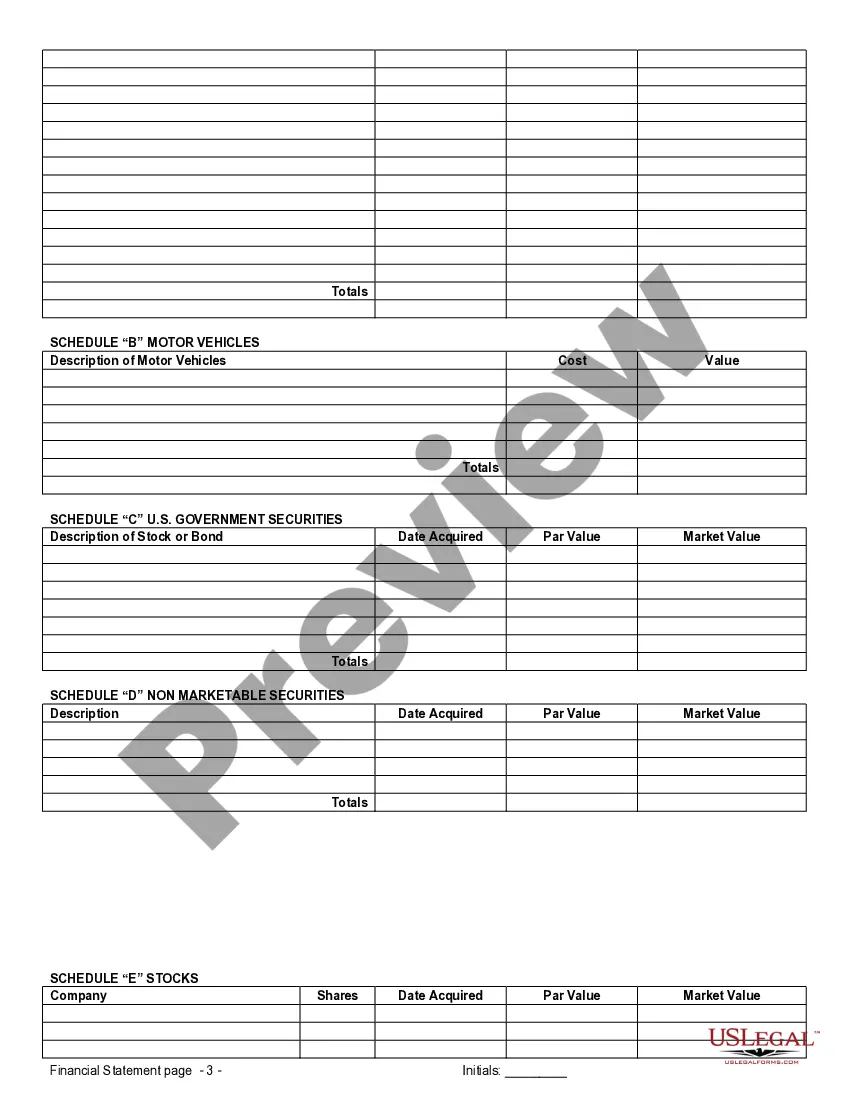

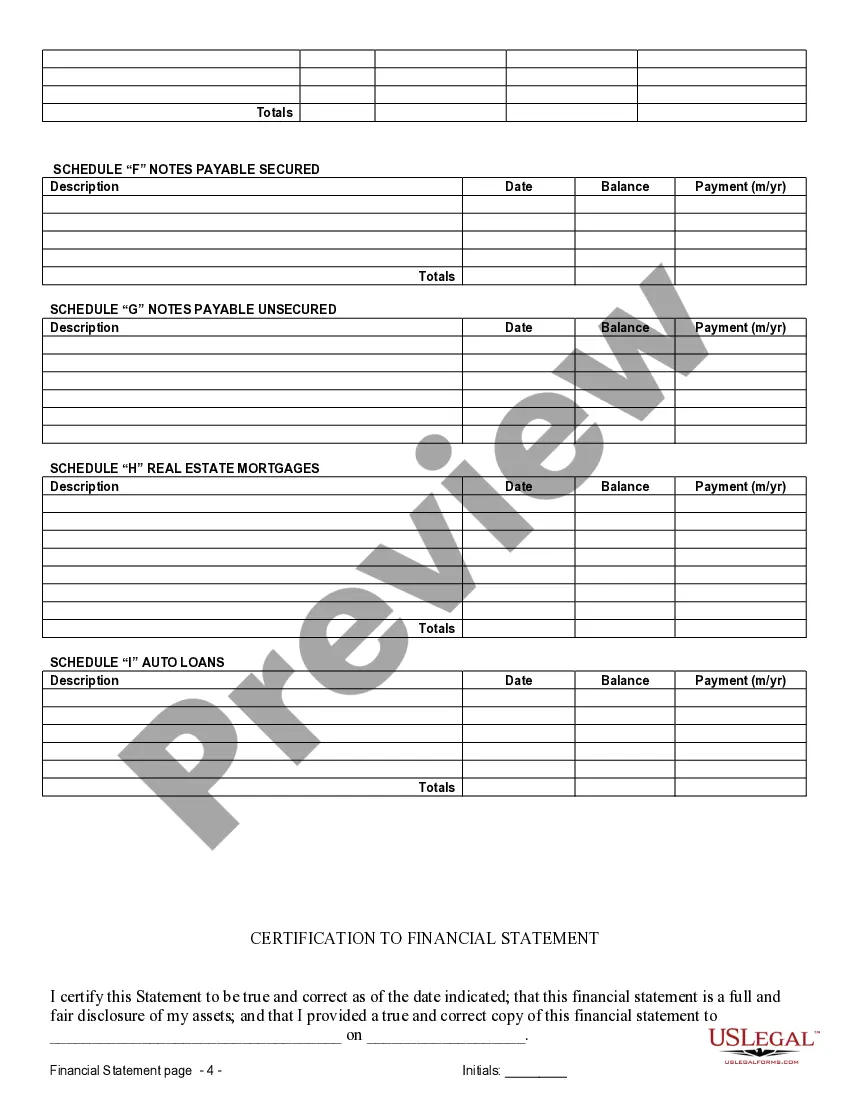

The financial statement of a prenuptial agreement outlines the financial situation of both parties before marriage. This document includes assets, liabilities, income, and anticipated expenses. In Colorado, providing detailed Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement is crucial for transparency and legal enforceability. It helps both partners to understand each other's financial landscape and agrees on terms more effectively.

Yes, prenups can hold up in Colorado if they are created with proper legal guidance. The state recognizes prenuptial agreements, provided they meet specific requirements. It is important to ensure that both parties fully disclose their financial information, which involves Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement. Consulting with a legal professional can strengthen the validity of your agreement.