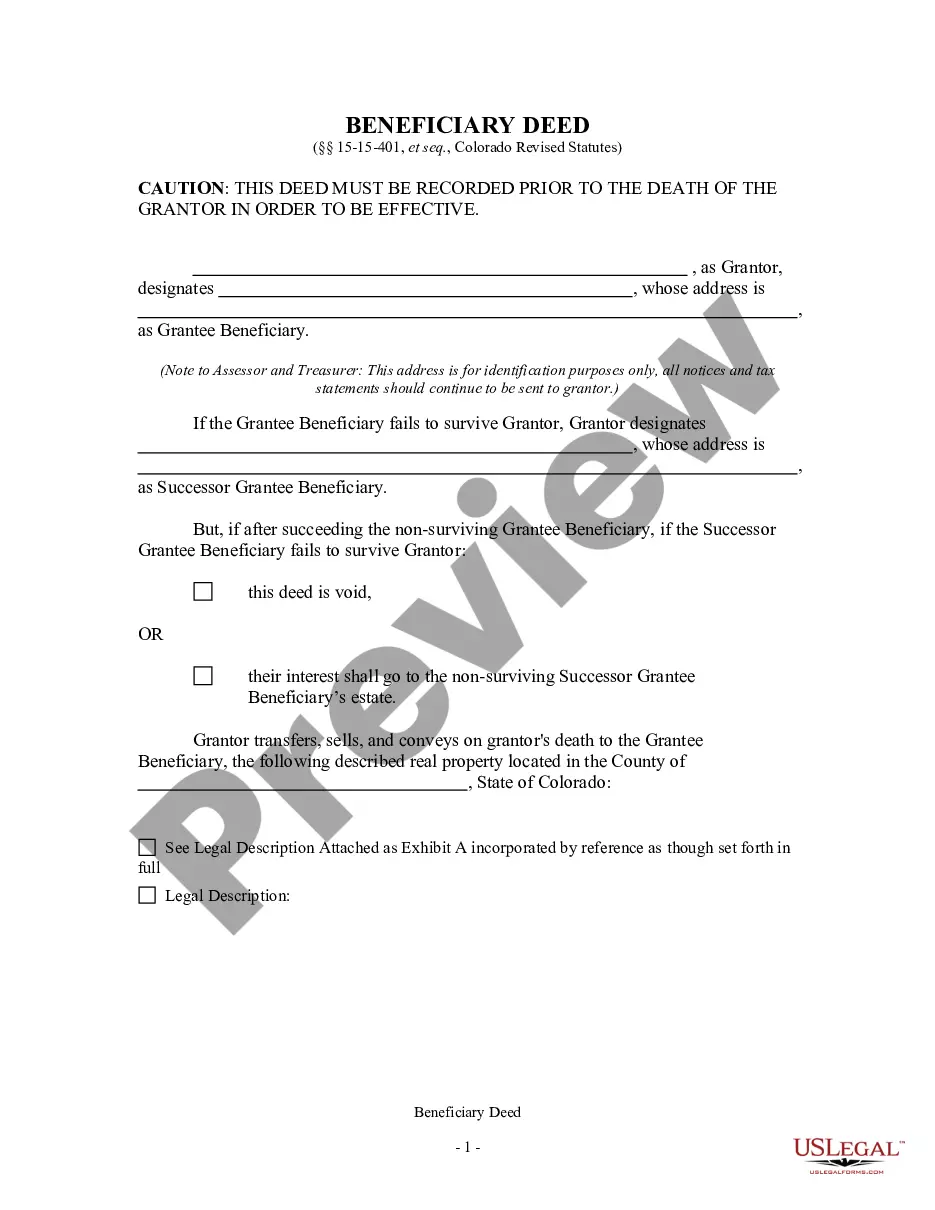

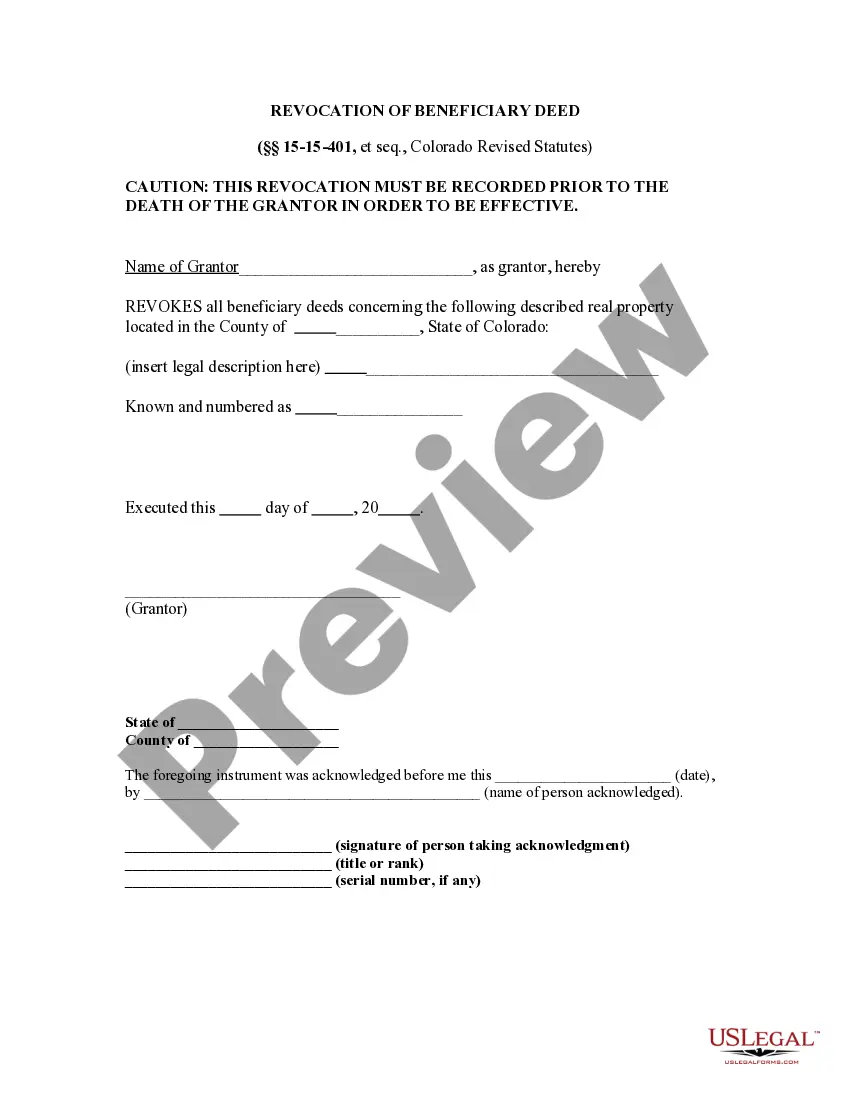

Revocation of Transfer on Death Deed - Colorado - This form is used to revoke a transfer on death beneficiary deed. An owner may revoke a beneficiary deed by executing an instrument that describes the real property affected, that revokes the deed, and that is recorded prior to the death of the owner in the office of the clerk and recorder in the county where the real property is located. The joinder, signature, consent, agreement of, or notice to, the grantee-beneficiary is not required for the revocation to be effective. A subsequent beneficiary deed revokes all prior grantee-beneficiary designations by the owner for the described real property in their entirety even if the subsequent beneficiary deed fails to convey all of the owner's interest in the described real property. The joinder, signature, consent, or agreement of, or notice to, either the original or new grantee-beneficiary is not required for the change to be effective. The most recently executed beneficiary deed or revocation of all beneficiary deeds or revocations that have been recorded prior to the owner's death shall control regardless of the order of recording. A beneficiary deed that complies with these requirements may not be revoked, altered, or amended by the provisions of the will of the owner.

Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed

Description

How to fill out Colorado Revocation Of Transfer On Death Deed Or TOD - Beneficiary Deed?

If you're looking to acquire accurate Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed copies, US Legal Forms is what you need; access documents offered and validated by state-certified lawyers.

Utilizing US Legal Forms not only spares you from hassles regarding legal documentation; it also saves effort, time, and money! Downloading, printing, and completing a professional template is significantly less expensive than hiring a lawyer to do it for you.

And that’s it. In just a few simple clicks, you obtain an editable Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed. After creating your account, all future transactions will be even simpler. With a US Legal Forms subscription, just Log In and click the Download button you find on the form’s page. Then, when you need to access this template again, you can always find it in the My documents section. Don’t waste your time searching through numerous forms on various web sources. Purchase professional templates from one reliable service!

- First, complete your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and locate the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed template to address your needs.

- Utilize the Preview option or review the document details (if available) to ensure that the template is the one you desire.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a preferred pricing option.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

One potential problem with transfer on death (TOD) accounts is the risk of disputes among heirs when the account owner passes away. Additionally, if not updated regularly, beneficiaries may be named who no longer reflect the account owner's wishes. It's also important to note that TOD accounts can be subject to creditor claims. To avoid complications, regular reviews of your estate plan using solutions like US Legal Forms can keep your designations aligned with your intentions.

A transfer on death (TOD) deed can be a good idea for simplifying property transfer upon death. It allows for an easy transition of property to beneficiaries while avoiding the complexities of probate. However, it is essential to consider your specific circumstances, including your overall estate plan and family dynamics. Engaging with legal tools from US Legal Forms can clarify if a TOD is suitable for you.

One drawback of a transfer on death (TOD) deed is that it may not cater to all estate planning needs. While it avoids probate, it doesn't address issues like creditor claims against the estate. Additionally, if the beneficiary predeceases the owner, the deed may become void unless designated otherwise. Consequently, it's wise to evaluate your overall estate plan using platforms like US Legal Forms to ensure proper provisions.

A transfer on death (TOD) deed does not inherently avoid capital gains tax in Colorado. Upon the sale of the property, capital gains tax may apply based on the property's appreciated value. It's crucial for beneficiaries to be aware of potential tax implications upon inheriting the property. Consulting with a tax professional can help you understand how the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed affects your tax situation.

Yes, a beneficiary deed in Colorado allows property to pass directly to the named beneficiary upon the owner's death, thereby avoiding probate. This process simplifies the transfer of property and reduces costs associated with estate settlement. However, ensure the deed is properly drafted and recorded to be effective. Utilizing resources like US Legal Forms can help you create a valid beneficiary deed.

Yes, a beneficiary deed can be contested in Colorado, just like any other part of a will or estate plan. Individuals may challenge the deed on grounds such as lack of capacity or undue influence. It’s essential to understand how the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed fits within your overall estate strategy, and using a reliable platform like uslegalforms can ease the process of drafting and executing your deed, potentially minimizing disputes.

Removing someone from a deed in Colorado usually requires executing a new deed that specifies the removal. This process often includes drafting a Quitclaim Deed, which effectively transfers any interest the remaining parties may hold. When dealing with the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed, it’s advisable to consult a legal professional to navigate the nuances of property law and ensure that your updates are legally binding.

To revoke a beneficiary designation, you'll need to follow specific procedures outlined in Colorado's laws regarding the Revocation of Transfer on Death Deed or TOD - Beneficiary Deed. This usually involves creating and executing a new deed that explicitly states the revocation or making written amendments to your original deed. You may also want to consult a legal expert to ensure that all necessary steps are met to avoid confusion in your estate plan.

While both the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed function to smoothly transfer property ownership, a Transfer on Death Deed typically refers to the direct transfer upon death without a probate process. In contrast, a beneficiary deed, although often interchangeable in common use, generally emphasizes the beneficiary's role in receiving the property's title. Understanding these differences can help you make informed decisions about your estate plan.

A beneficiary deed, including the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed, does not serve as proof of ownership during the grantor's lifetime. Instead, it ensures that property transfers automatically to the designated beneficiary upon the grantor's death. While it clarifies intentions for inheritance, it is not a title document until that transfer occurs. It's important to understand the deed's role in the broader context of estate planning.