Colorado Special Durable Power of Attorney for Bank Account Matters

Description

Key Concepts & Definitions

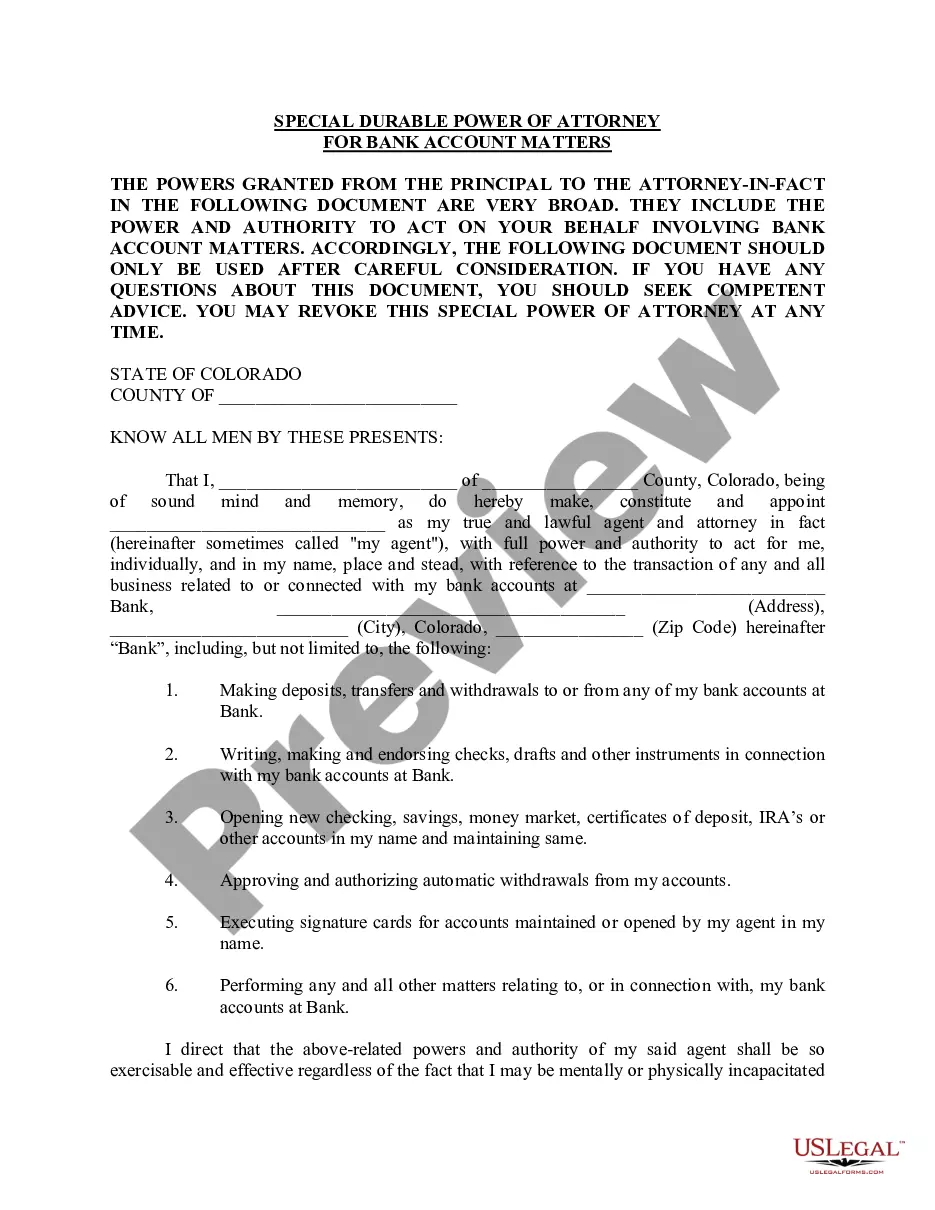

Special Durable Power of Attorney for Bank Account - This is a legal document that grants a designated person or 'agent' the authority to handle specific banking matters on behalf of the 'principal'. The 'durable' aspect indicates that the power remains effective even if the principal becomes incapacitated.

Step-by-Step Guide

- Choose an Agent: Select a trusted person who will act as your agent. This should be someone reliable and with some understanding of financial matters.

- Draft the Document: Either consult with a lawyer to draft a special durable power of attorney or use a legally approved template specific to your state.

- Define Powers: Specifically state which banking activities the agent is allowed to handle. This can include withdrawing money, writing checks, or managing bank accounts.

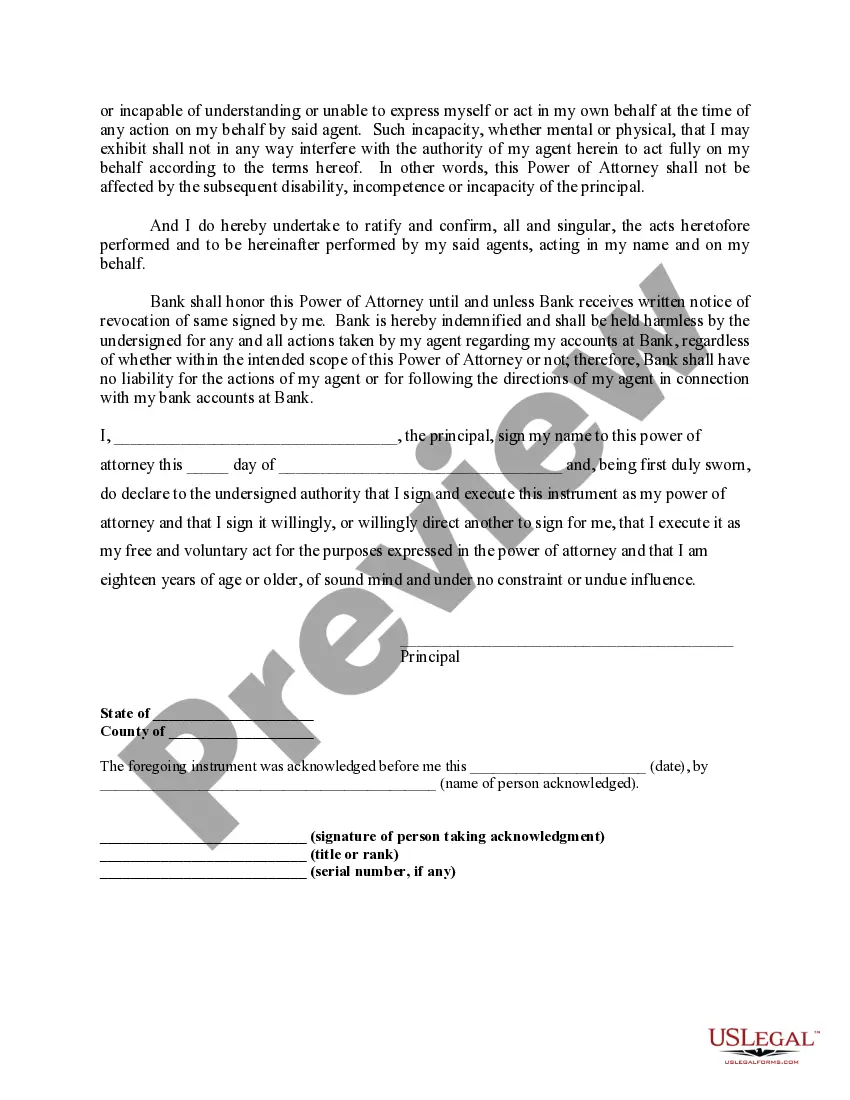

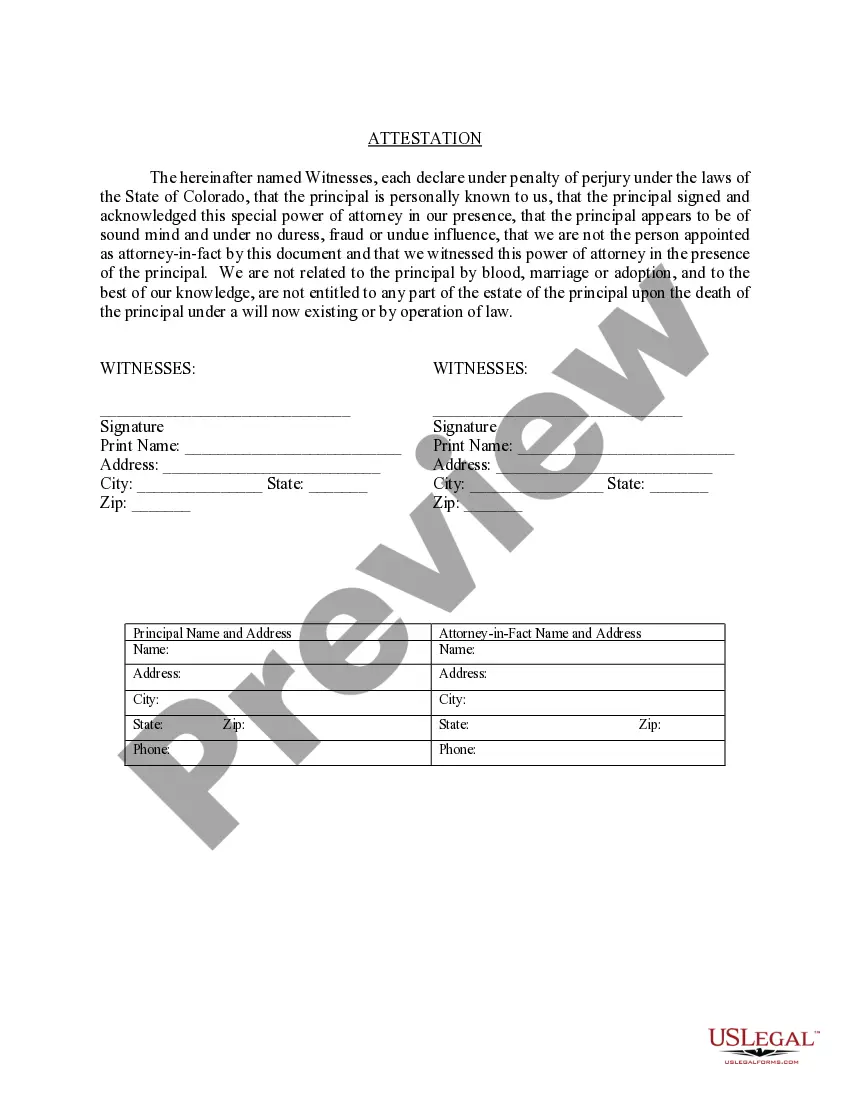

- Sign and Notarize: Sign the document in front of a notary to make it legally binding.

- Inform the Bank: Provide the bank with a copy of the notarized document so they recognize the authority of your agent.

Risk Analysis

- Financial Mismanagement: The agent might mismanage the bank account either unintentionally due to lack of expertise or intentionally, which can lead to financial losses.

- Legal Challenges: If not drafted properly, the power of attorney might be disputed or not recognized by the bank or other entities.

- Revocation Issues: If the principal wants to revoke the power, it must be done formally and all relevant parties must be informed to avoid further use of the granted powers.

Pros & Cons

- Pros:

- Allows financial management continuity in case the principal cannot manage their own affairs.

- Can be limited to specific functions, thereby reducing risks.

- Cons:

- Potential for abuse if the agent is not meticulously chosen.

- Legal fees involved in drafting and notarizing the document.

Key Takeaways

Important Points: Always choose a trustworthy agent, clearly define the powers granted, and ensure the document complies with state laws to avoid potential legal issues.

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

The higher volume of paperwork you need to generate - the more anxious you become.

You can find numerous templates for Colorado Special Durable Power of Attorney for Bank Account Matters online, however, you are unsure which ones to trust.

Eliminate the difficulty of locating samples by utilizing US Legal Forms. Obtain precisely drafted documents that comply with state requirements.

Enter the required information to set up your account and complete your order with PayPal or a credit card. Choose a suitable document format and download your copy. You can find all files you download in the My documents section. Simply access it to prepare a new version of the Colorado Special Durable Power of Attorney for Bank Account Matters. Even when utilizing professionally prepared templates, it is still important to consider consulting your local attorney to verify that your completed form is accurate. Achieve more for less with US Legal Forms!

- If you possess a subscription to US Legal Forms, Log In to your account, and you will see the Download option on the webpage for the Colorado Special Durable Power of Attorney for Bank Account Matters.

- If this is your first time using our website, follow the registration steps provided below.

- Ensure that the Colorado Special Durable Power of Attorney for Bank Account Matters is valid in your state.

- Verify your choice by reviewing the description or using the Preview feature if available for the chosen file.

- Click Buy Now to initiate the registration process and select a payment plan that meets your requirements.

Form popularity

FAQ

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

Bank Pays Price for Refusing to Honor Request Made Under a Power of Attorney.But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.

The Achilles heel of powers of attorney is that banks and other financial institutions sometimes refuse to honor them.When the power of attorney becomes necessary, it's often because the principal has become incapacitated.

Colorado law does not require a power of attorney to be witnessed or notarized. Despite the law, it is considered best practice to have the document signed, notarized, and witnessed by two people.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.