Colorado Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Colorado Last Will And Testament With All Property To Trust Called A Pour Over Will?

The larger the quantity of documents you need to compile - the more anxious you become.

You can discover countless Colorado Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will blanks online, yet, you may be uncertain about which to rely on.

Eliminate the stress of finding samples more effortlessly with US Legal Forms. Obtain professionally crafted documents that conform with state regulations.

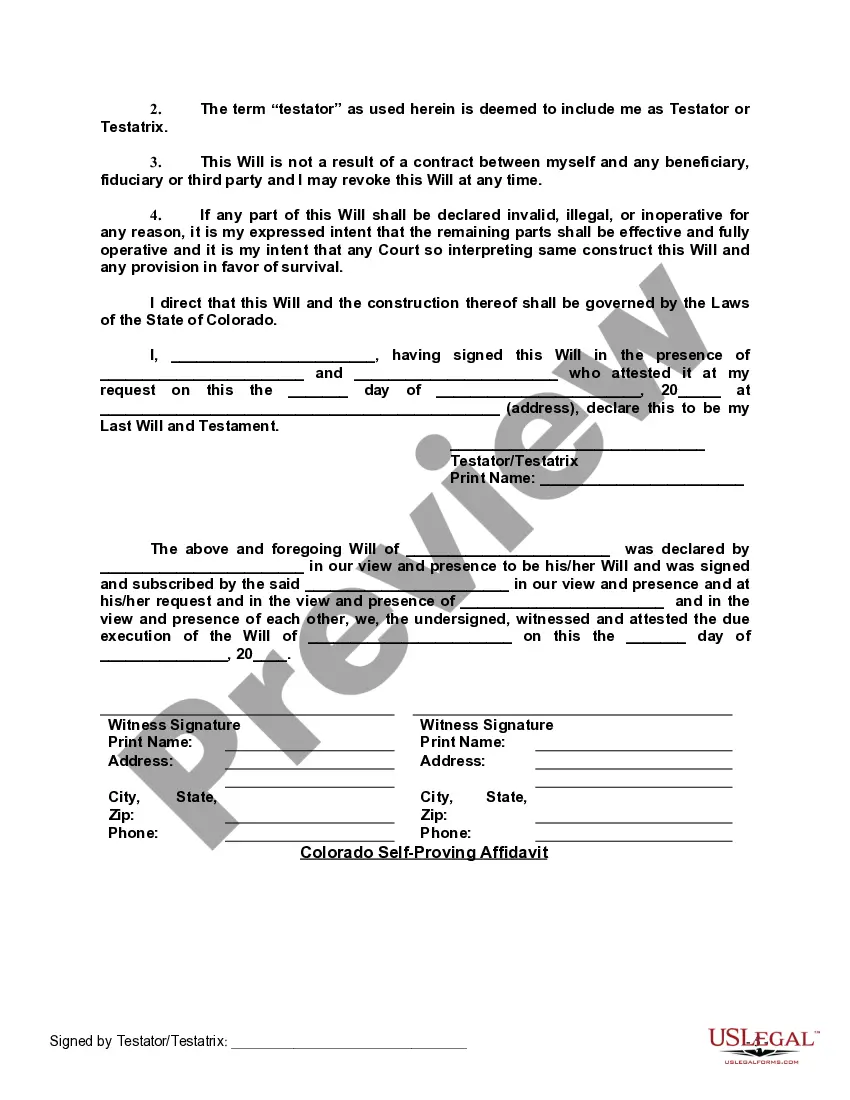

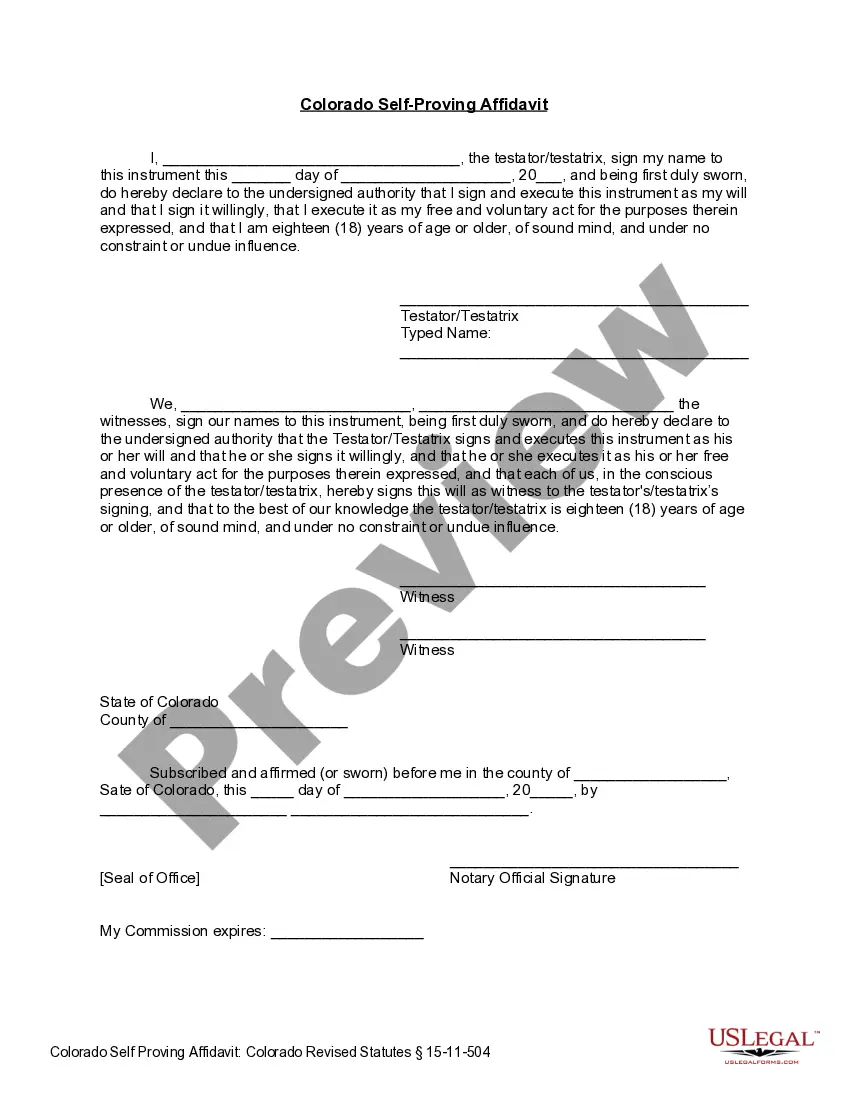

Provide the required details to set up your account and complete your payment using your PayPal or credit card. Select a suitable document format and obtain your copy. You can find every document you download in the My documents section. Simply visit there to prepare a new copy of the Colorado Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will. Even when preparing accurately drafted templates, it’s still crucial to consider consulting your local attorney to verify that your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you are currently a subscriber to US Legal Forms, Log In to your account, and you'll see the Download option on the webpage for the Colorado Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will.

- If you haven't used our platform before, complete the registration process by following these steps.

- Verify that the Colorado Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will is valid in your state.

- Double-check your selection by reviewing the description or utilizing the Preview mode if available for the selected document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that meets your needs.

Form popularity

FAQ

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

A Living Trust is a document that allows individual(s), or 'Grantor', to place their assets to the benefit of someone else at their death or incapacitation. Unlike a Will, a Trust does not go through the probate process with the court.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A will and a trust are separate legal documents that usually have a common goal of coordinating a comprehensive estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, in the event that there are issues between the two.

Spillover Trusts definition: Spillover trusts are established to hold any remaining assets after all other instructions from the will are carried out.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

A pour-over will is a just-in-case will that states that your living trust is the beneficiary for any property in your name that's not in the trust at the time of your death, thereby moving any forgotten or remaining assets into the trust.One of the main reasons to create a living trust is to avoid probate.