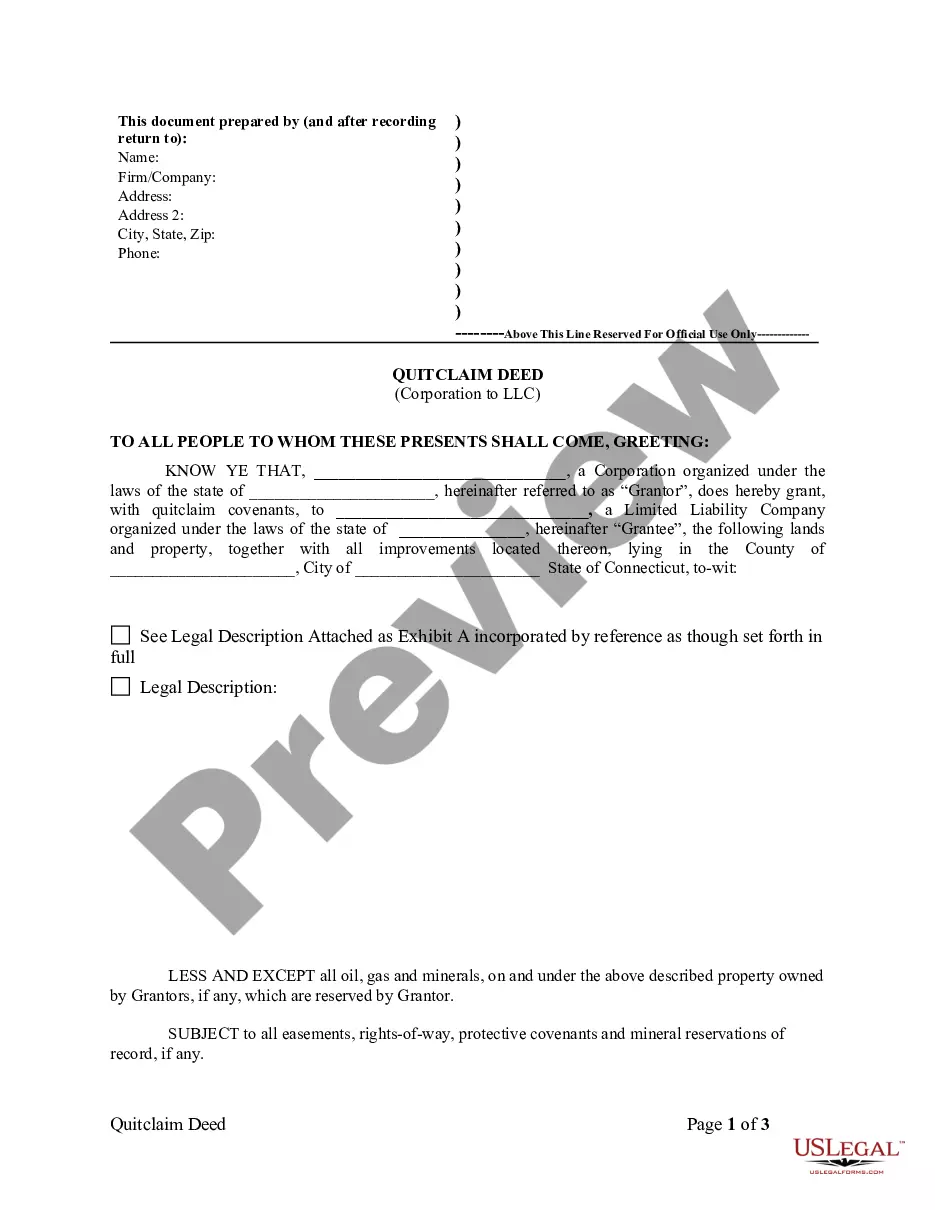

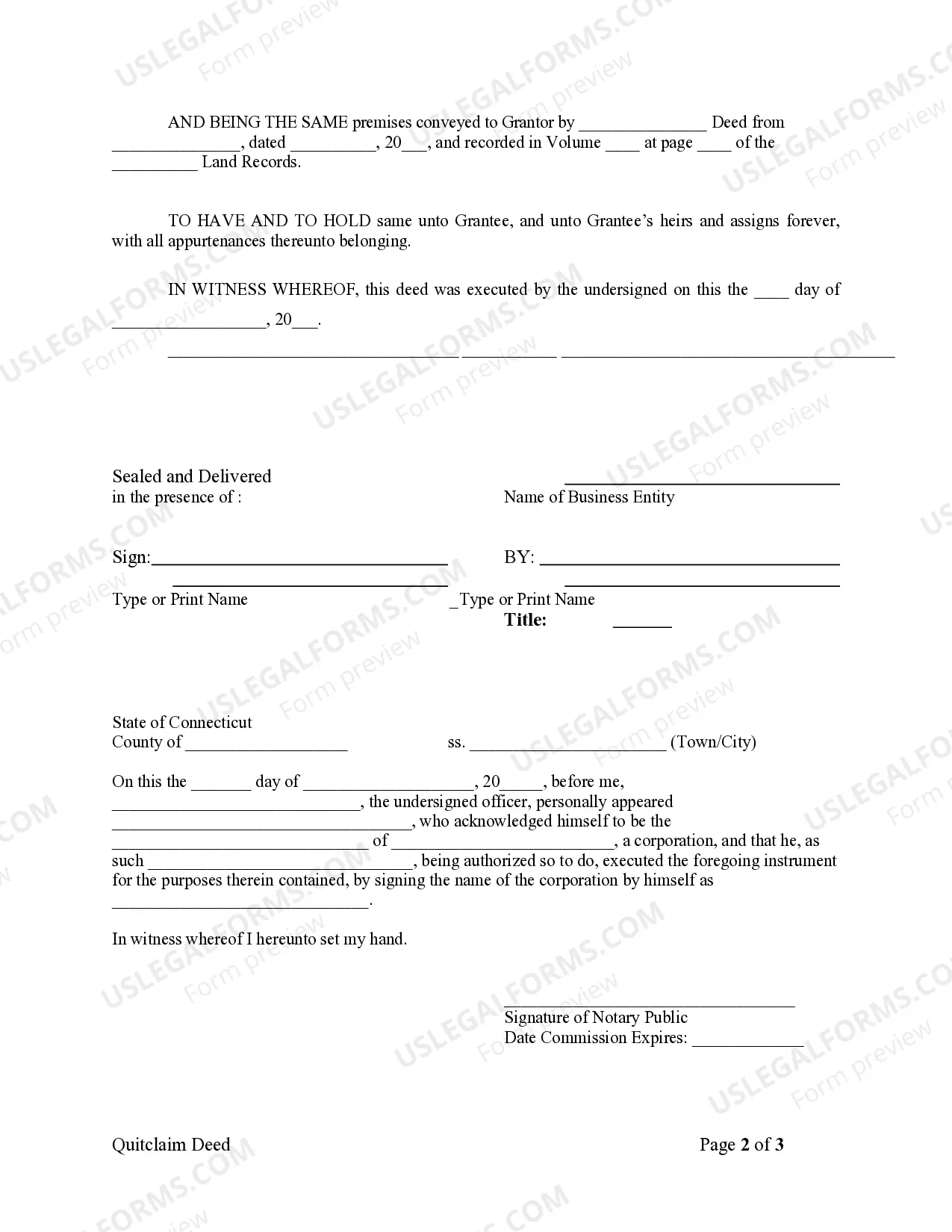

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from Corporation to LLC

Description

How to fill out Connecticut Quitclaim Deed From Corporation To LLC?

The greater the number of documents you need to create - the more stressed you become.

There is an extensive selection of Connecticut Quitclaim Deed from Corporation to LLC templates available online, but you may be unsure which ones to trust.

Simplify the process and make finding samples much easier by using US Legal Forms. Obtain professionally crafted documents that comply with state standards.

Input the required details to create your account and complete the payment using your PayPal or credit card. Choose a convenient file format and retrieve your copy. Access each template you download in the My documents section. Simply go there to complete a new copy of your Connecticut Quitclaim Deed from Corporation to LLC. Even with professionally prepared templates, it remains crucial to consider consulting a local attorney to verify that your form is accurately completed. Achieve more for less with US Legal Forms!

- If you already hold a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the Connecticut Quitclaim Deed from Corporation to LLC webpage.

- If you are new to our website, follow these steps to register.

- Ensure that the Connecticut Quitclaim Deed from Corporation to LLC is applicable in your state.

- Double-check your choice by reading the description or utilizing the Preview feature if available for the selected document.

- Click Buy Now to start the registration process and choose a pricing plan that meets your needs.

Form popularity

FAQ

A Connecticut (CT) quitclaim deed provides a fast and easy way to transfer ownership and interest in a property to another party. With a quitclaim deed in Connecticut, the seller (grantor) does not provide any guarantee that they own the property or that the title is clear when transferring it to the buyer (grantee).

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

When done properly, a deed is recorded anywhere from two weeks to three months after closing. However, there are many instances where deeds are not properly recorded. Title agents commit errors, lose deeds, and even go out of business. Even county offices sometimes fail to record deeds that were properly submitted.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

A quit claim deed in Connecticut is a docuent that transfers property from one person to another.In a quit claim deed transaction, the only thing that a buyer is assured is that the seller is giving up his or her interest on the property and can no longer return at a later date to claim interest on the house or land.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.