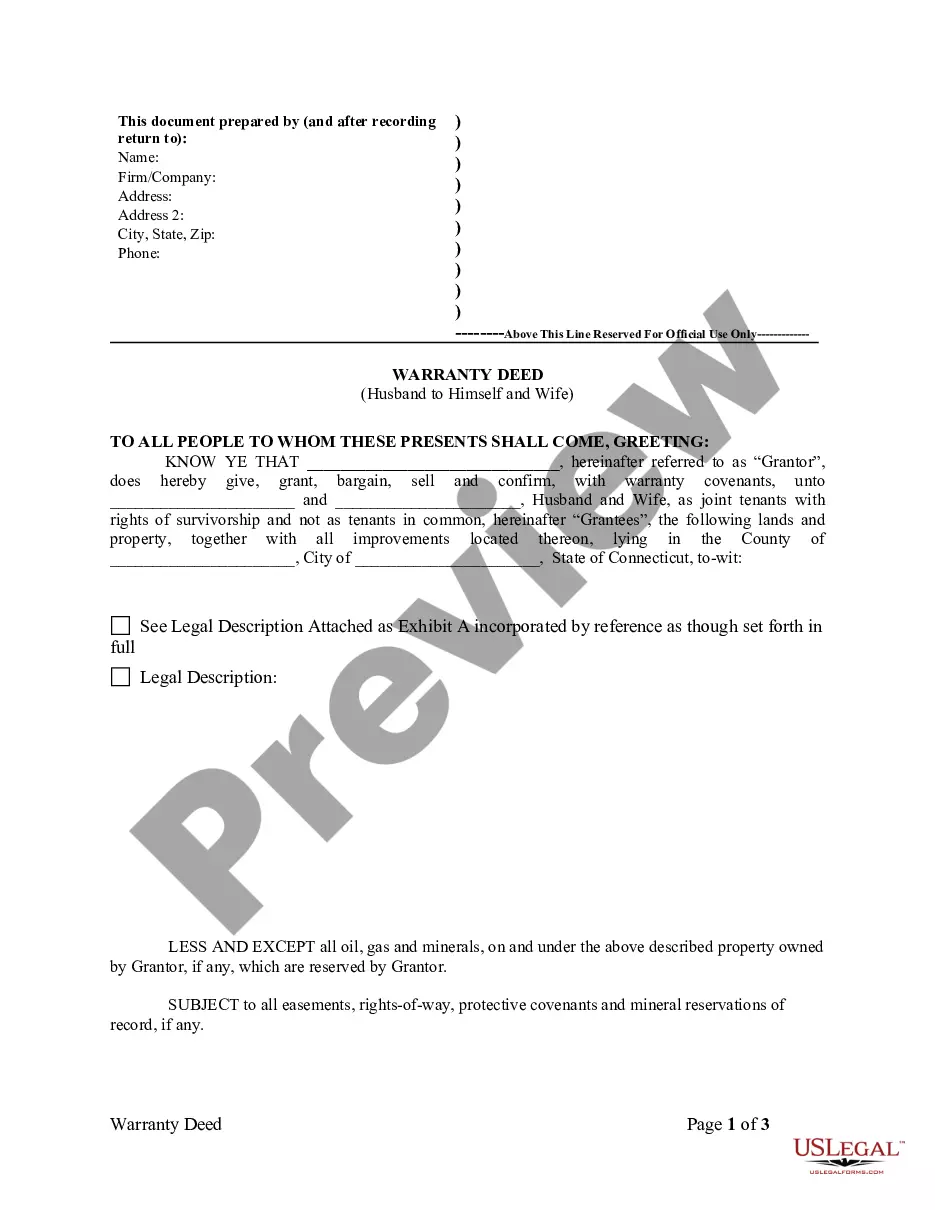

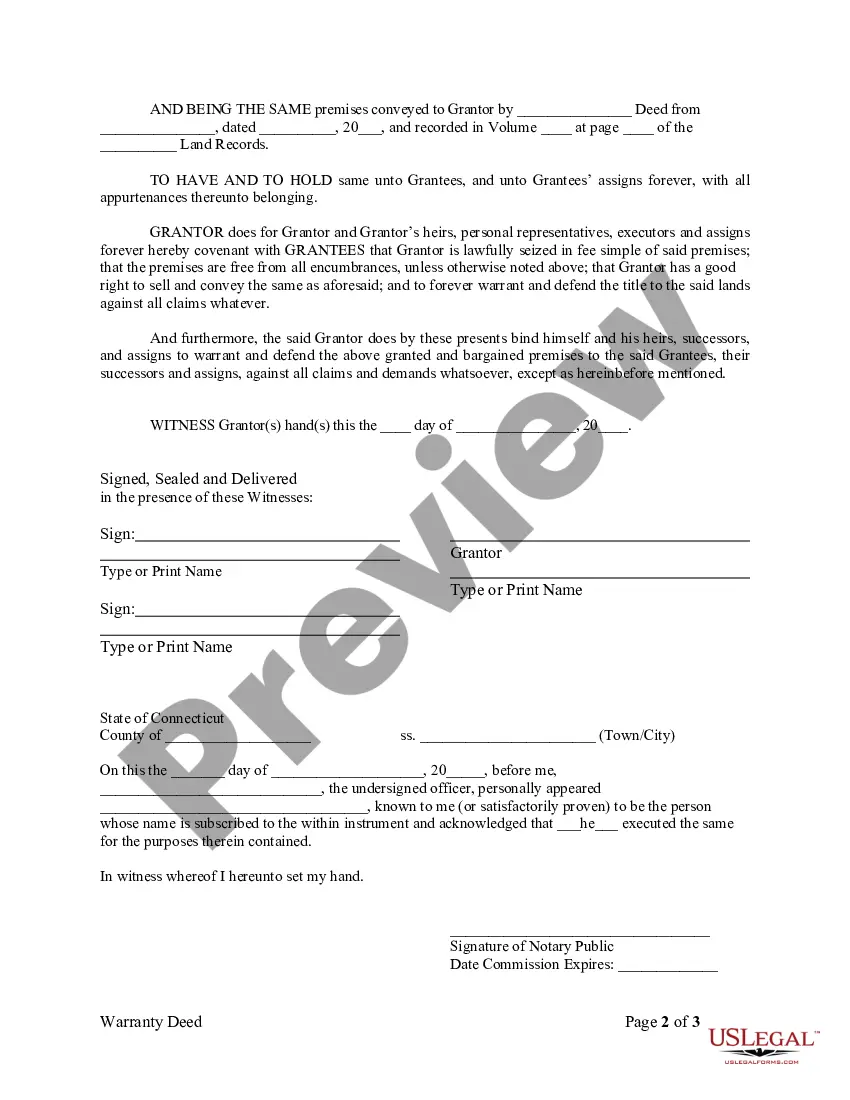

This form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Grantor conveys and warrants the described property to grantees as joint tenants with rights of survivorship less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Warranty Deed from Husband to Himself and Wife

Description

How to fill out Connecticut Warranty Deed From Husband To Himself And Wife?

The greater the number of documents you need to produce - the more anxious you become.

You can discover a vast array of Connecticut Warranty Deed from Husband to Himself and Wife templates online, yet you're uncertain which ones to rely on.

Eliminate the frustration and simplify the process of finding templates by using US Legal Forms.

Select a straightforward document format and retrieve your copy. Access each sample you download in the My documents section. Simply visit there to create a new copy of the Connecticut Warranty Deed from Husband to Himself and Wife. Even when dealing with professionally drafted templates, it remains crucial that you consider consulting your local attorney to verify that your document is accurately completed. Achieve more while spending less with US Legal Forms!

- Obtain properly prepared documents that are tailored to meet state regulations.

- If you are a US Legal Forms subscriber, Log In to your account, and you will observe the Download option on the Connecticut Warranty Deed from Husband to Himself and Wife’s page.

- If you haven’t utilized our website before, follow these steps to complete the registration process.

- Ensure that the Connecticut Warranty Deed from Husband to Himself and Wife is valid in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

Form popularity

FAQ

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

One of the simplest ways to add your wife to the home title is by using an interspousal deed. You can transfer the property from your sole and separate property to mutual tenancy, such as joint tenants with right of survivorship, with your wife.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.