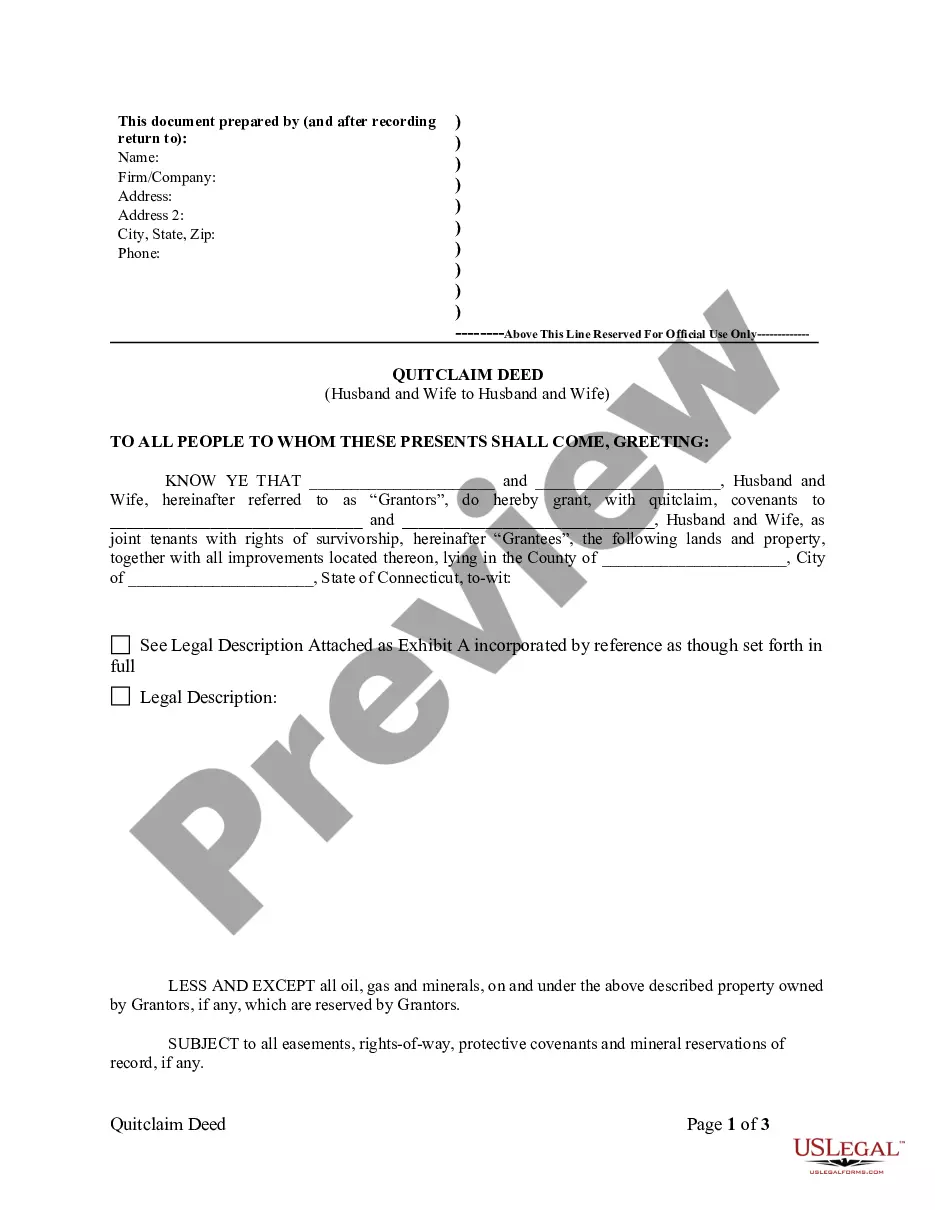

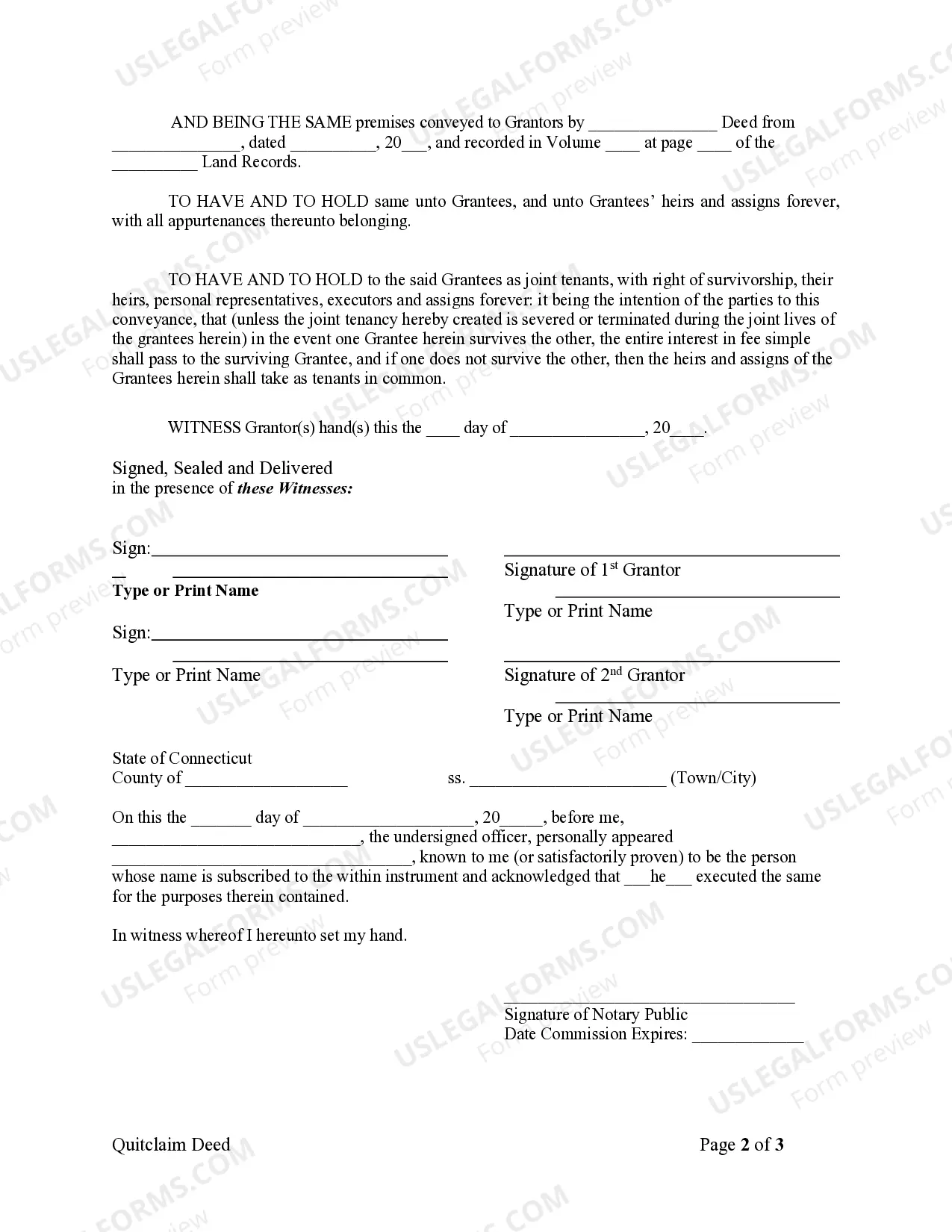

This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from Husband and Wife to Husband and Wife

Description

How to fill out Connecticut Quitclaim Deed From Husband And Wife To Husband And Wife?

The greater the quantity of documents you need to ready, the more anxious you become.

You can find a vast array of Connecticut Quitclaim Deed from Spouse to Spouse forms online, but discerning which ones are reliable can be challenging.

Eliminate the hassle to simplify acquiring samples by utilizing US Legal Forms.

Simply click Buy Now to initiate the sign-up process and select a payment plan that suits your needs.

- Obtain forms professionally created to meet state regulations.

- If you already possess a US Legal Forms membership, Log In to your account, and you will locate the Download button on the Connecticut Quitclaim Deed from Spouse to Spouse page.

- If you haven't previously utilized our service, follow the ensuing steps to complete registration.

- Confirm that the Connecticut Quitclaim Deed from Spouse to Spouse is permissible in your jurisdiction.

- Verify your choice by reviewing the description or using the Preview feature if available for the selected document.

Form popularity

FAQ

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

A quit claim deed in Connecticut is a docuent that transfers property from one person to another.In a quit claim deed transaction, the only thing that a buyer is assured is that the seller is giving up his or her interest on the property and can no longer return at a later date to claim interest on the house or land.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.