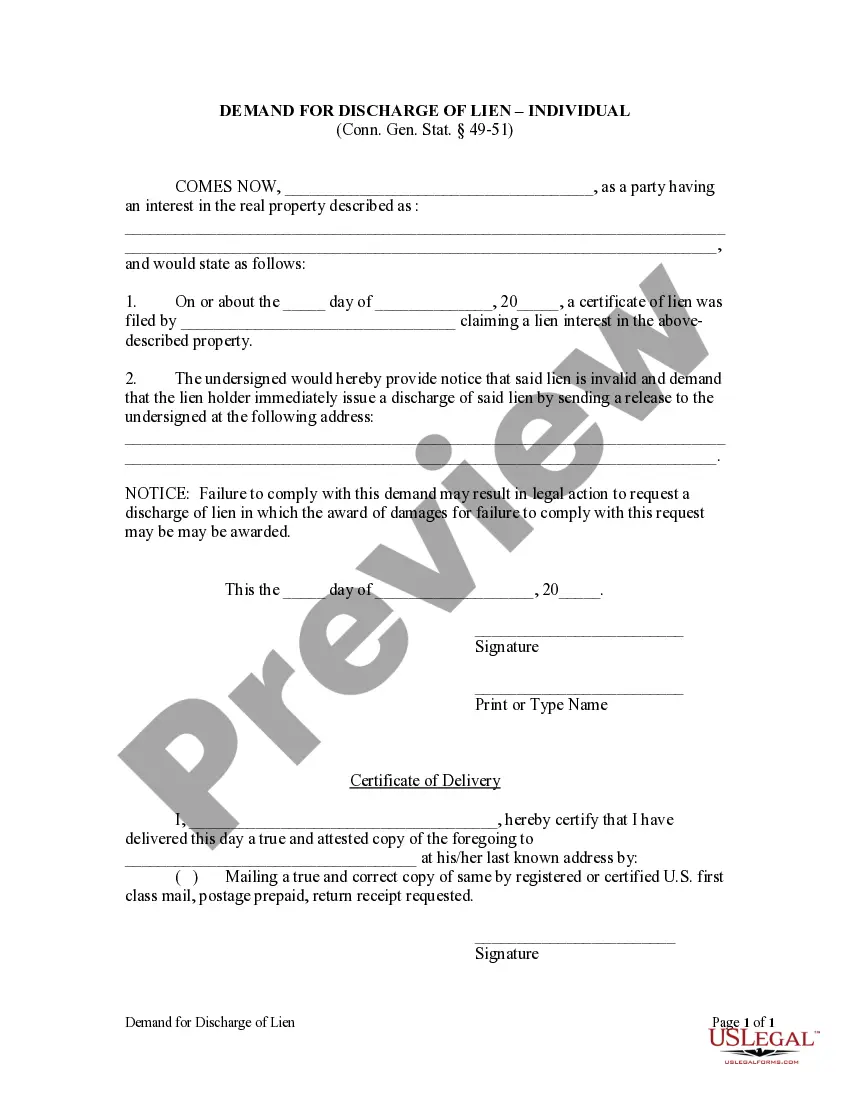

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Connecticut Demand for Discharge - Individual

Description

How to fill out Connecticut Demand For Discharge - Individual?

The greater the number of documents you need to create - the more anxious you get.

You can discover countless Connecticut Demand for Discharge - Individual templates on the internet, but you may be uncertain which ones to trust.

Eliminate the frustration of locating samples with US Legal Forms for easier access.

Click on Buy Now to begin the registration process and select a payment plan that suits your needs. Enter the necessary details to create your profile and complete your purchase with your PayPal or credit card. Choose a suitable file format and obtain your sample. You can find every template you acquire in the My documents section. Simply visit there to create a new copy of your Connecticut Demand for Discharge - Individual. Even when using well-prepared templates, it's still crucial to consider consulting a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Obtain expertly crafted documents designed to comply with state regulations.

- If you already have a subscription to US Legal Forms, Log In to your account, and you will see the Download option on the Connecticut Demand for Discharge - Individual page.

- If you haven't used our platform before, follow these steps to register.

- Make sure the Connecticut Demand for Discharge - Individual is applicable in your residing state.

- Double-check your selection by reading the product description or by using the Preview option if available for the file you've chosen.

Form popularity

FAQ

As for other IRS tax forms, you can print them on a white blank paper. For further information about the specifications in printing tax forms, you can visit the IRS website.

You must file a Connecticut income tax return if your gross income for the taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.

No, Post Offices do not have tax forms available for customers. However, you can view, download, and print specific tax forms and publications at the "Forms, Instructions & Publications" page of the IRS website.Your local government offices may have tax forms available for pickup.

You may need to file a nonresident tax return for each state in which you worked, but did not reside. For example, if you lived in one state and worked in another, you will usually need to file a resident return for the state in which you lived and a nonresident return for the state in which you worked.

If one spouse is a part-year resident and the other is a nonresident or a resident for the entire year, the spouse who is a part-year resident must file Form CT-1040NR/PY as a part-year resident using the filing status of married filing separately even if they file a joint federal income tax return.

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD. By Mail.

Connecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: www.ct.gov/drs/ Connecticut tax forms and publications are available at any DRS office and at most banks, libraries, post offices, and town halls during tax filing season.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)