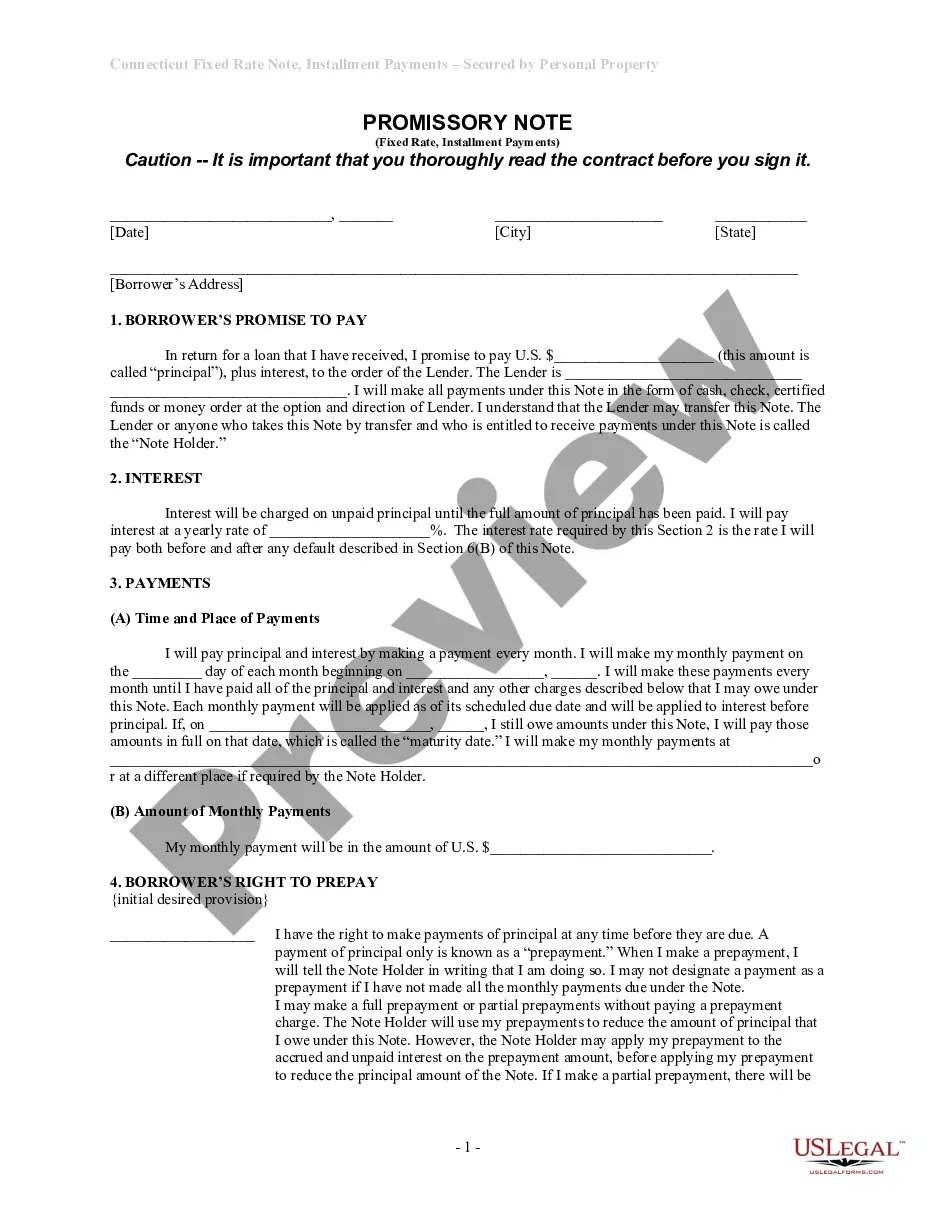

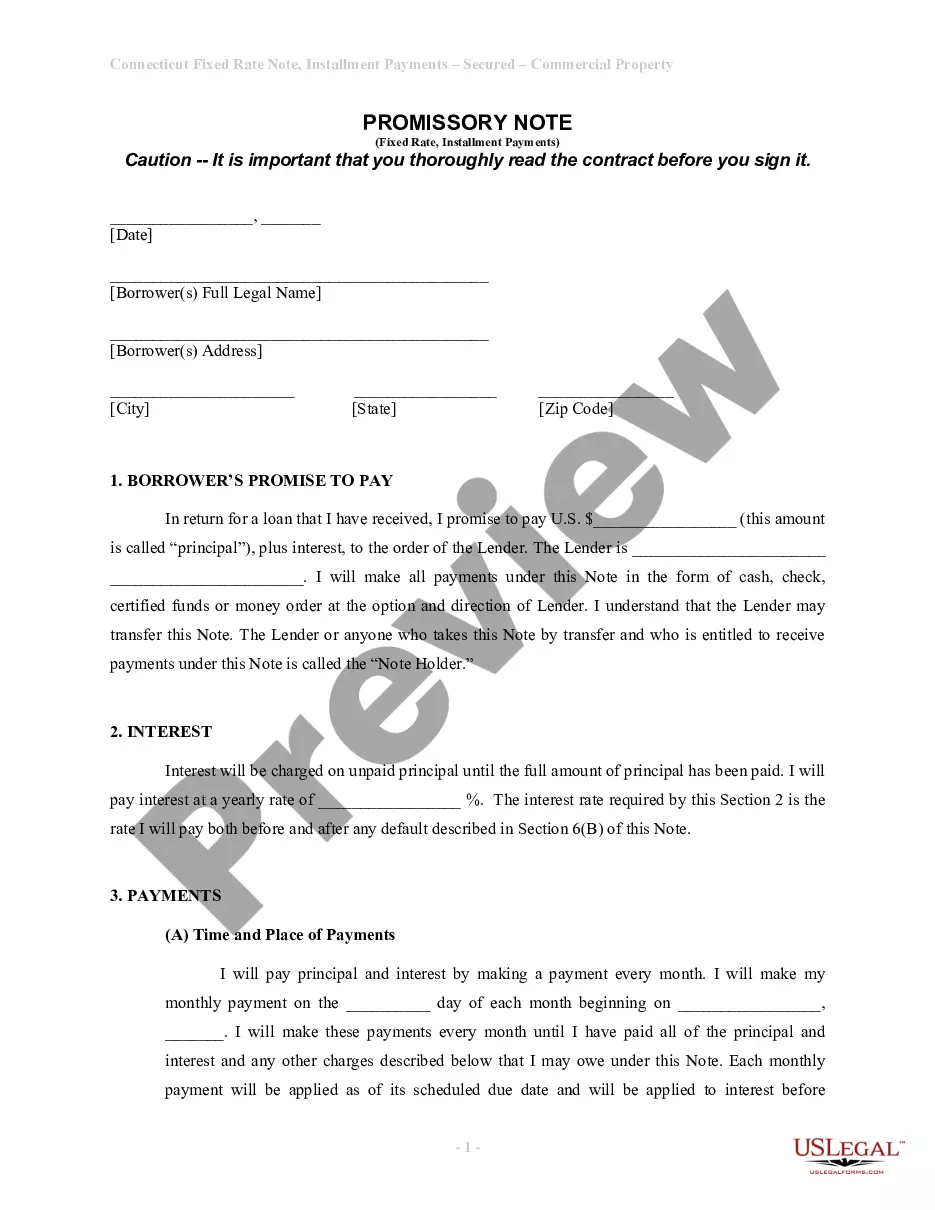

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Connecticut Unsecured Installment Payment Promissory Note For Fixed Rate?

The greater the documentation you need to compile - the more uneasy you become.

You can discover a vast array of Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate formats online, yet you are unsure which ones to rely on.

Remove the stress and simplify the process of locating examples by using US Legal Forms.

Simply click Buy Now to start the registration process and select a pricing plan that suits your requirements. Provide the requested information to create your profile and pay for the order using PayPal or a credit card. Choose a convenient file format and obtain your template. Access each document you receive in the My documents section. Simply navigate there to complete a new version of the Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate. Even when utilizing professionally drafted documents, it is still vital to consider consulting your local attorney to thoroughly review the filled sample to ensure your document is correctly completed. Achieve more for less with US Legal Forms!

- Obtain correctly prepared documents that comply with state regulations.

- If you already possess a US Legal Forms subscription, sign in to your account, and you will see the Download option on the webpage for the Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you haven't utilized our platform before, follow these steps to sign up.

- Confirm if the Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate is applicable in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

Form popularity

FAQ

A promissory note does not necessarily need collateral. An unsecured promissory note, like the Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate, does not require any asset backing. However, the absence of collateral may influence the interest rate and terms offered by lenders. It's crucial to consider your financial situation when deciding between secured and unsecured notes.

An installment note is a specific type of promissory note that outlines a repayment schedule in installments. While all installment notes are promissory notes, not all promissory notes involve installment payments. A Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate specifically details the installments and fixed interest rate repayments. Understanding this distinction can help you choose the right financial product.

You can obtain a copy of your promissory note from the lender who issued the note. If you used a platform like uslegalforms, you can quickly access your documents through their user-friendly interface. Keeping a copy handy is vital for both your records and to understand your repayment obligations. Always ensure you have clear documentation of your financial agreements.

Not all promissory notes are unsecured. Some notes are secured by assets, while others, like the Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate, are not backed by collateral. It's important to clarify the terms of your note to understand whether it falls under secured or unsecured categories. Knowing this can impact your financial obligations.

Yes, a promissory note can be unsecured. This means it is not backed by any collateral such as property or assets. A Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate allows borrowers to secure loans based solely on their creditworthiness. This type of note can be beneficial for individuals who may not have collateral to offer.

When considering a Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate, reasonable interest rates typically range from 4% to 10%. Factors like the borrower's creditworthiness and prevailing market rates influence the rate. It’s important to compare offers from multiple lenders to ensure you secure a fair rate. By doing this, you can establish a payment structure that works for both parties.

Different types of promissory notes include secured and unsecured notes, demand notes, installment notes, and balloon notes. Each type serves a specific purpose and has different repayment terms. A Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate falls under the unsecured category, making it a flexible option for borrowers seeking funds without collateral.

When a note is unsecured, it means that there is no collateral backing it. This type of note relies solely on the borrower's promise to repay, making it more flexible yet riskier for the lender. In the context of a Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate, the lender bases their decision on the borrower's creditworthiness rather than specific assets.

A written promise to repay a debt is typically a promissory note. This document outlines the borrower's commitment to return the borrowed amount with specified interest. The Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate serves this purpose by detailing repayment terms and providing equal protection for both parties. Having a clear written agreement helps establish trust and can serve as crucial evidence if disputes arise.

Reporting a promissory note on your taxes typically involves declaring interest income if you are the lender. You must report the interest received as income on your tax return annually. If you hold a Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate, the interest you earn may be taxable, so keeping accurate records is essential. If you're unsure, consulting a tax professional can provide clarity on your specific situation.