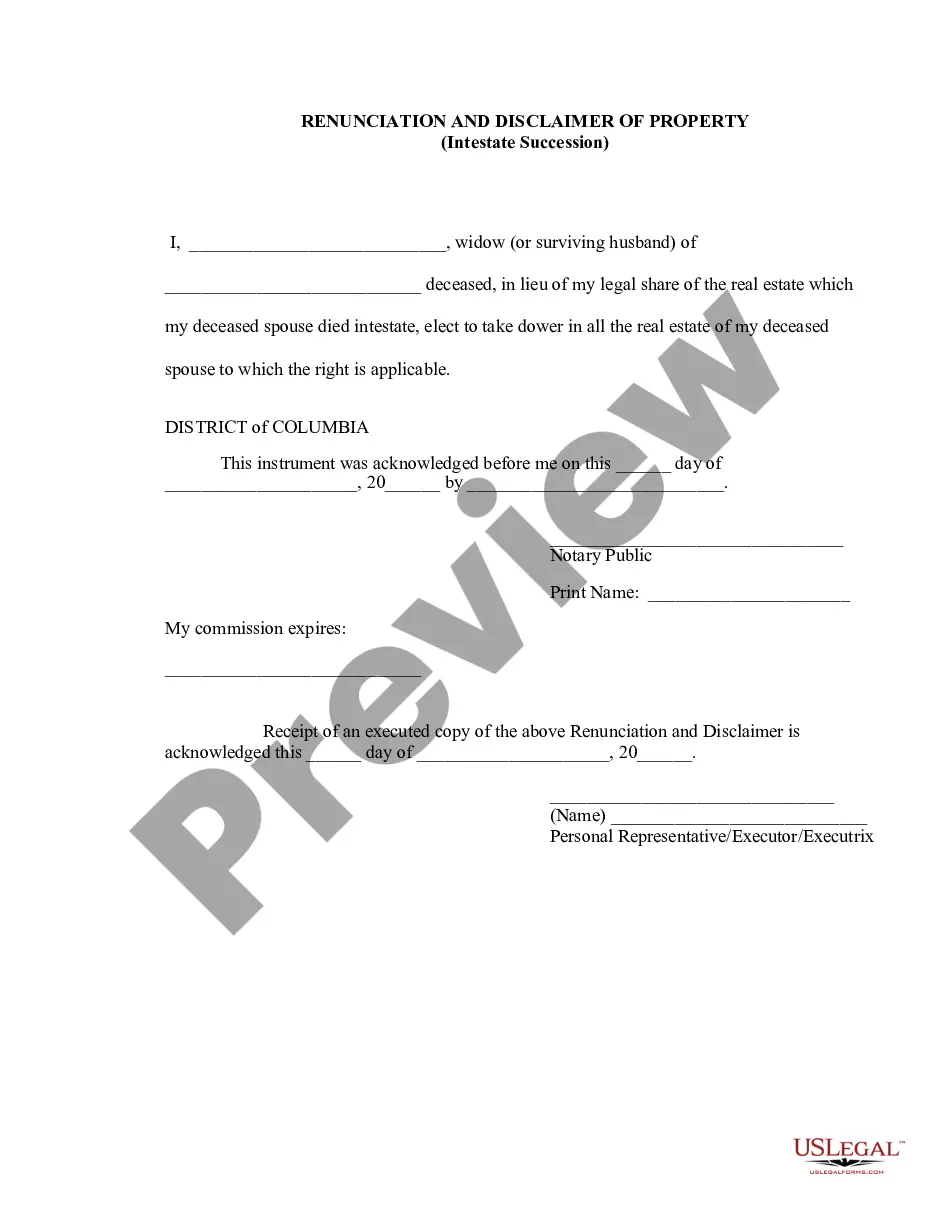

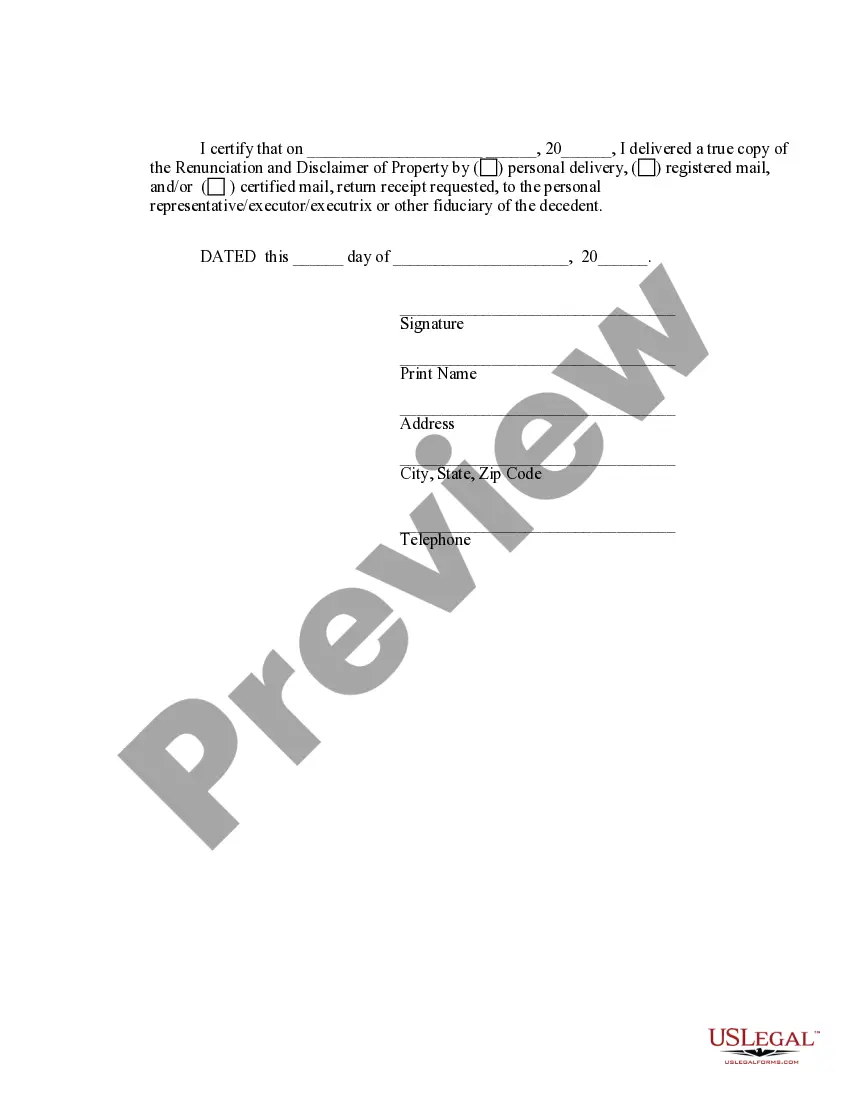

This form is a Renunciation and Disclaimer of Property through intestate succession. The decedent died intestate and the widow/widower has chosen to take dower in all the real estate of her/his late spouse, in lieu of her/his legal share of real estate. The form also contains a state specific acknowledgment and a certificate of delivery.

Dc Received Succession Complete

Description Died Surviving Executor

How to fill out Dc Intestate Succession?

The greater number of papers you should prepare - the more stressed you become. You can get thousands of District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession blanks on the internet, but you don't know which of them to have confidence in. Get rid of the hassle and make detecting exemplars more convenient using US Legal Forms. Get accurately drafted forms that are published to go with the state specifications.

If you already have a US Legal Forms subscribing, log in to the profile, and you'll find the Download option on the District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession’s page.

If you’ve never applied our website before, complete the registration process with the following instructions:

- Make sure the District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession is valid in your state.

- Double-check your option by reading the description or by using the Preview function if they’re available for the selected document.

- Click Buy Now to begin the registration procedure and select a rates program that fits your needs.

- Insert the requested data to create your profile and pay for your order with the PayPal or credit card.

- Select a convenient document type and take your sample.

Find every file you obtain in the My Forms menu. Simply go there to produce a fresh version of your District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession. Even when preparing properly drafted forms, it is nevertheless vital that you think about asking the local legal representative to double-check filled in form to be sure that your record is accurately filled in. Do much more for less with US Legal Forms!