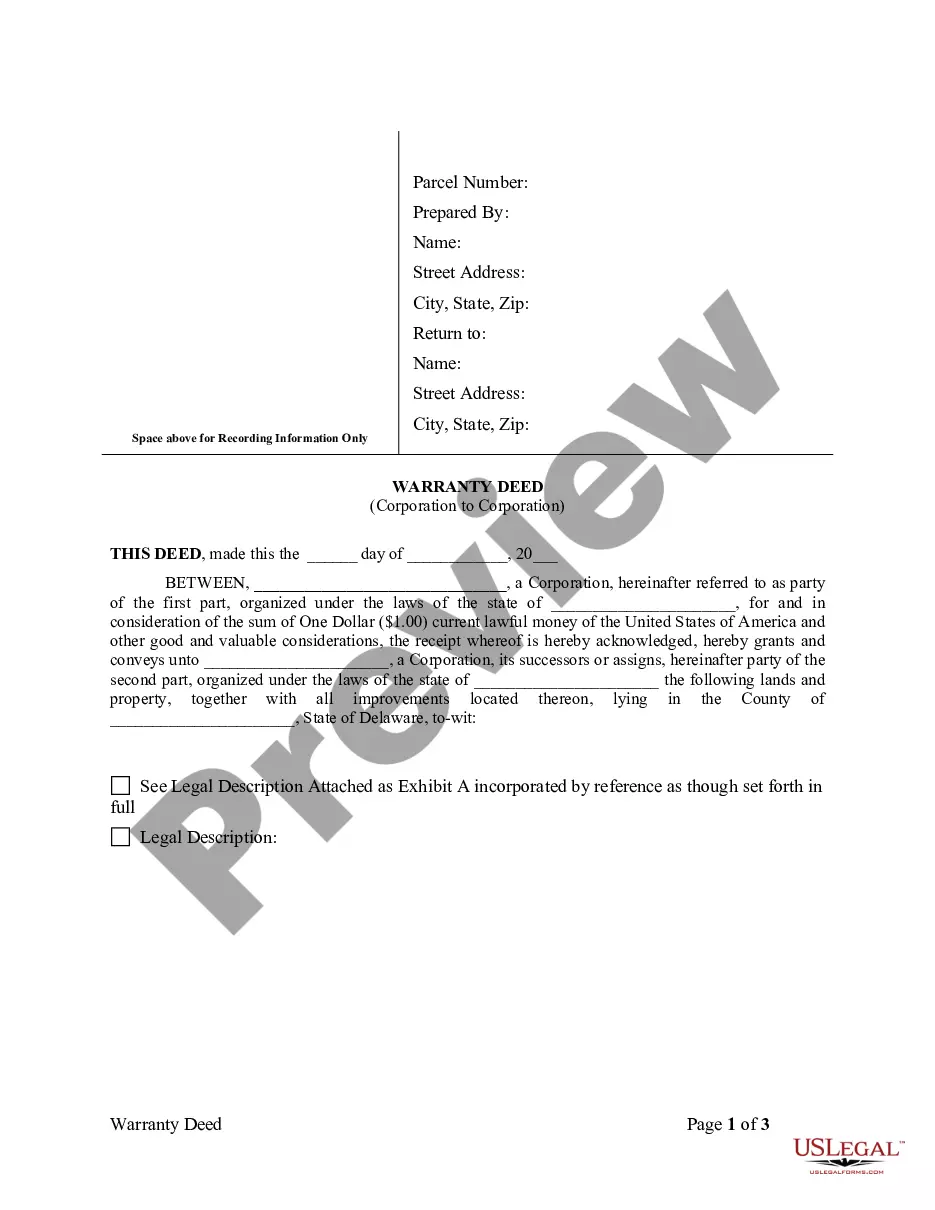

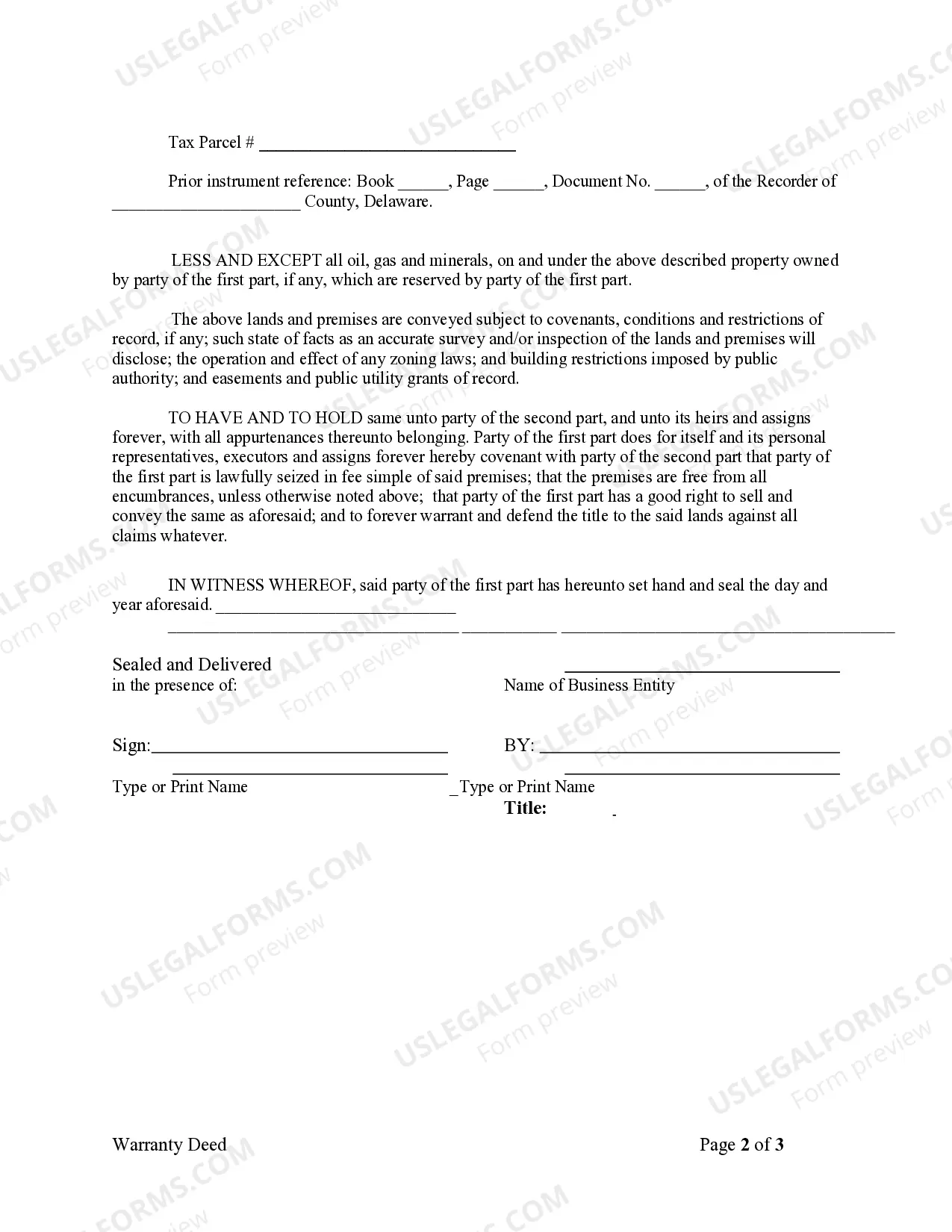

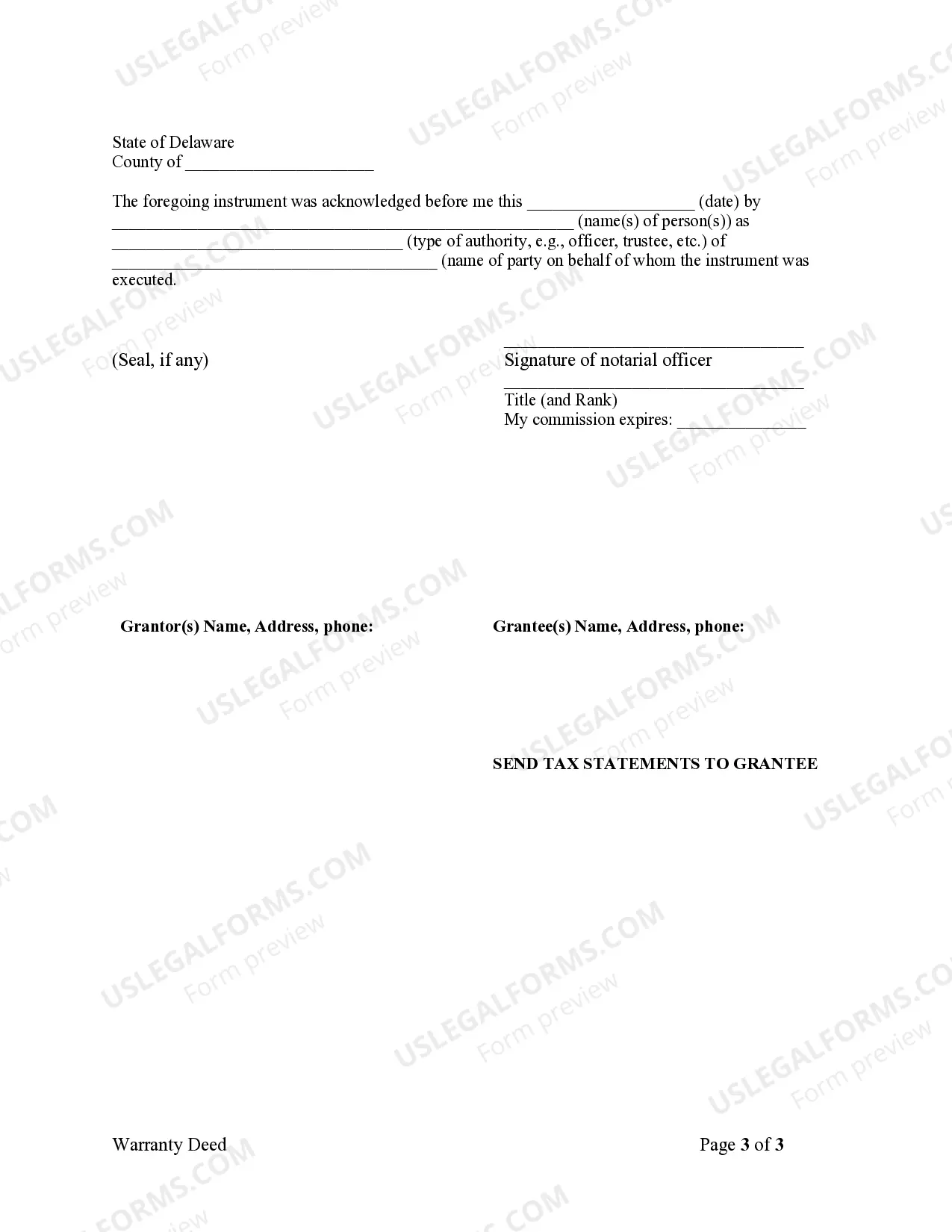

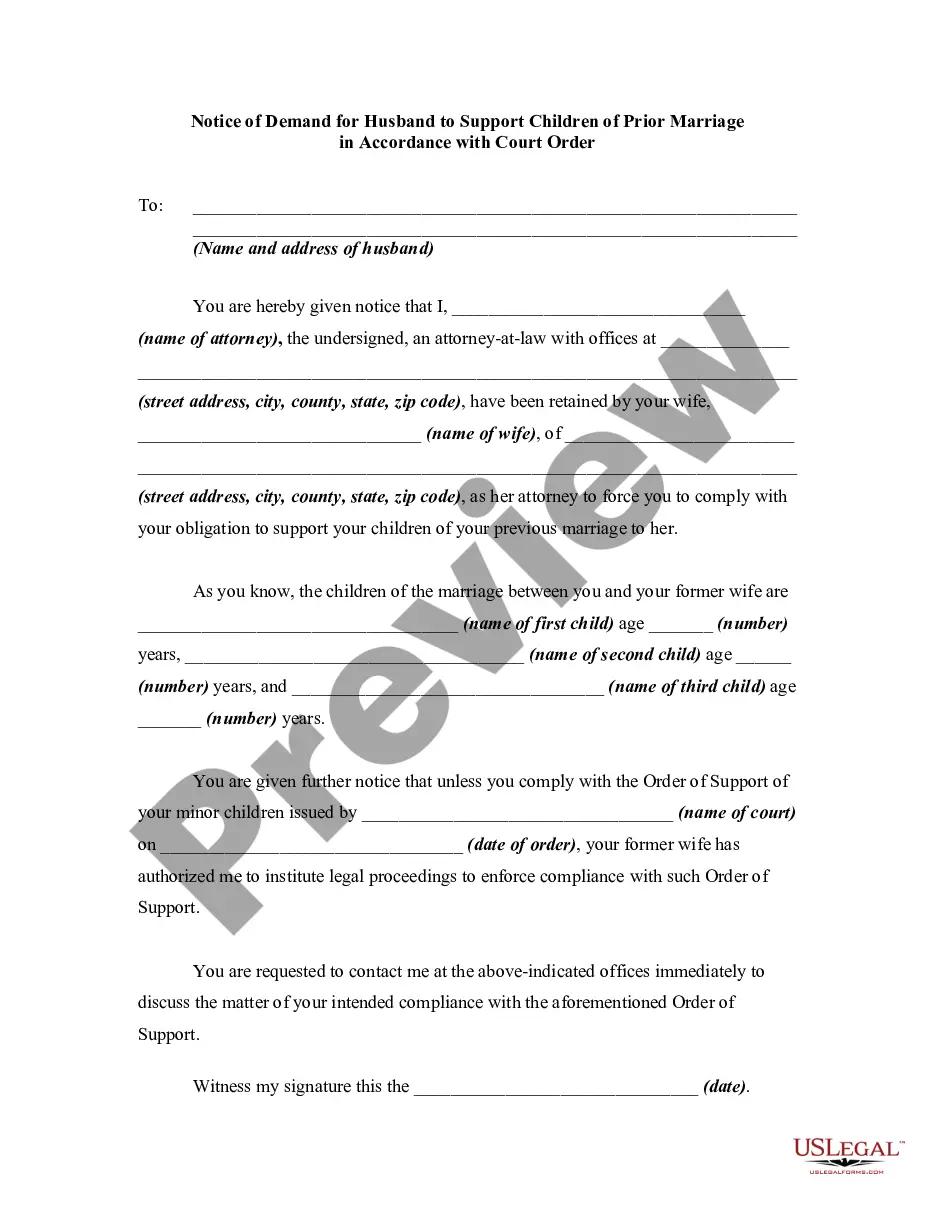

Delaware Warranty Deed from Corporation to Corporation

Description

How to fill out Delaware Warranty Deed From Corporation To Corporation?

The larger quantity of documents you are required to prepare - the more anxious you become.

You can find numerous Delaware Warranty Deed from Corporation to Corporation templates online, yet you are unsure which ones to trust.

Eliminate the inconvenience and simplify the process of locating samples with US Legal Forms. Obtain precisely drafted documents that are designed to meet state regulations.

Access each document you acquire in the My documents section. Simply navigate there to generate a new version of your Delaware Warranty Deed from Corporation to Corporation. Even with expertly drafted documents, it remains crucial to consider consulting your local legal advisor to double-check the completed form to ensure that your record is accurately filled out. Achieve more for less with US Legal Forms!

- Verify if the Delaware Warranty Deed from Corporation to Corporation is acceptable in your jurisdiction.

- Reconfirm your choice by reviewing the description or utilizing the Preview feature if available for the chosen file.

- Press Buy Now to initiate the enrollment process and choose a pricing plan that fits your requirements.

- Fill in the requested details to create your account and settle your payment using PayPal or a credit card.

- Select a convenient document type and obtain your copy.

Form popularity

FAQ

Section 145 of the Delaware corporate law provides the legal framework for the indemnification and advancement of expenses for corporate directors, officers, and certain employees. Essentially, it protects these individuals against liabilities incurred while performing their duties. Understanding this section is crucial for corporations involved in transfers, such as via a Delaware Warranty Deed from Corporation to Corporation, to ensure their leaders are safeguarded against unforeseen legal issues.

In Delaware, a quorum is the minimum number of members required to hold a meeting and make decisions binding on the corporation. For most corporations, a majority of the outstanding shares or members meets this requirement. It’s vital to maintain proper records during these meetings, and having a Delaware Warranty Deed from Corporation to Corporation can aid in documenting important transactions.

A sale of substantially all assets refers to a transaction where a corporation sells most of its assets, which may include inventory, real estate, and intellectual property. In Delaware, this process often requires shareholder approval and must adhere to specific legal guidelines. Utilizing a Delaware Warranty Deed from Corporation to Corporation can facilitate the asset transfer smoothly, ensuring all legal requirements are met.

To dissolve a nonprofit in Delaware, the organization must first hold a meeting to vote on the dissolution. After obtaining approval, the nonprofit must then file a Certificate of Dissolution with the Delaware Secretary of State. If there are assets to distribute, ensure compliance with the Delaware Warranty Deed from Corporation to Corporation to transfer and settle assets appropriately.

You do not need a personal Delaware address for your LLC, but you must have a registered agent with a physical address in the state. This requirement helps ensure that your LLC can receive important legal documents in a timely manner. By choosing the right services, like those offered by uslegalforms, you can handle your Delaware Warranty Deed from Corporation to Corporation effortlessly.

Yes, you can use a virtual address for your LLC in Delaware as long as it is tied to your registered agent's address. A registered agent must have a physical address in Delaware to receive service of process on your behalf. This allows you to maintain a professional appearance and manage your business operations without needing a physical office in the state.

You do not need a personal Delaware address to incorporate in the state. However, your corporation must have a registered agent who has a physical address in Delaware. This registered agent will handle important legal documents and notifications. Delaware's friendly incorporation laws make it easy for non-residents to establish a corporation.

Yes, you can incorporate in Delaware even if you do not reside there. Many business owners choose Delaware for its favorable laws and regulations regarding corporations. You will need to appoint a registered agent with a physical address in Delaware to receive legal documents on behalf of your corporation. This does not require you to live in the state.

Section 262 of the Delaware corporation law provides shareholders with appraisal rights in the event of certain mergers and acquisitions. This means shareholders can seek a judicial appraisal of their shares under specified conditions. When utilizing a Delaware Warranty Deed from Corporation to Corporation during a sale, being aware of Section 262 is crucial for ensuring fair dealings with existing shareholders.

Changing ownership of your business typically involves negotiating with potential buyers and drafting a sale agreement outlining the terms. It's vital to document the transition formally and maintain compliance with state laws. A Delaware Warranty Deed from Corporation to Corporation can effectively facilitate the legal transfer of ownership, ensuring clarity and protection for all parties.