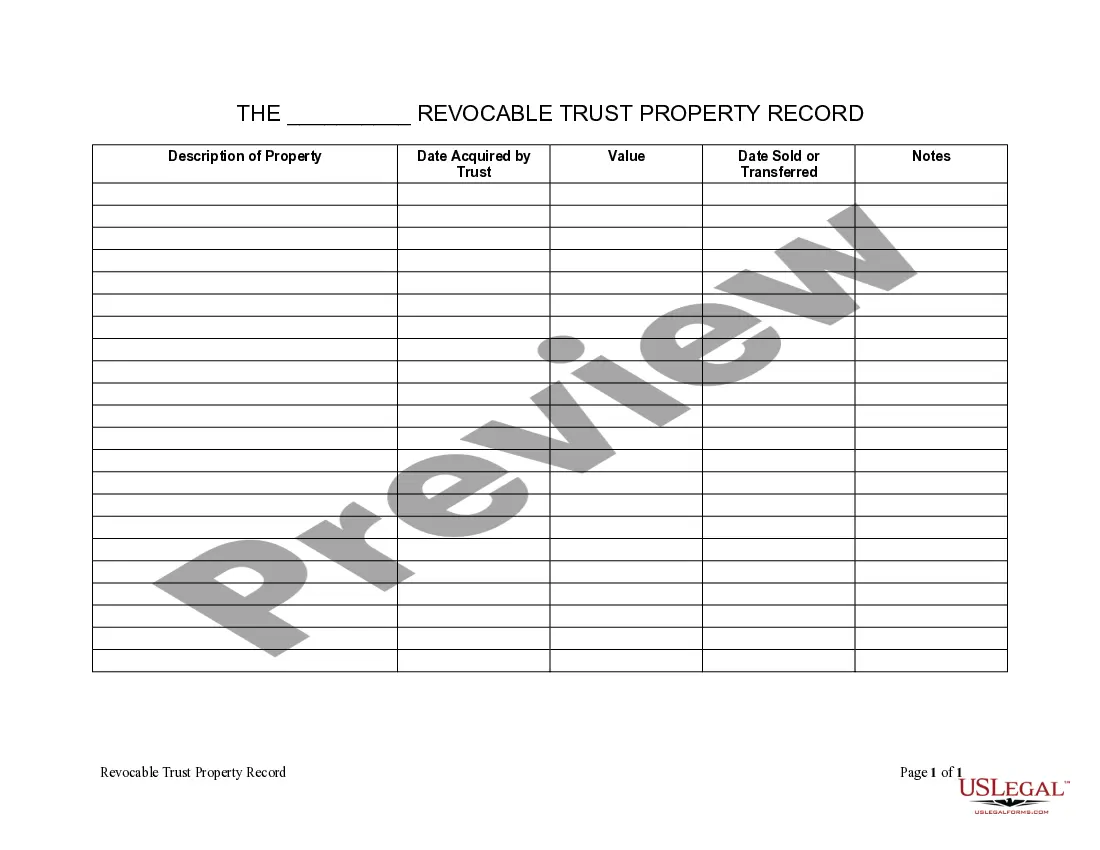

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

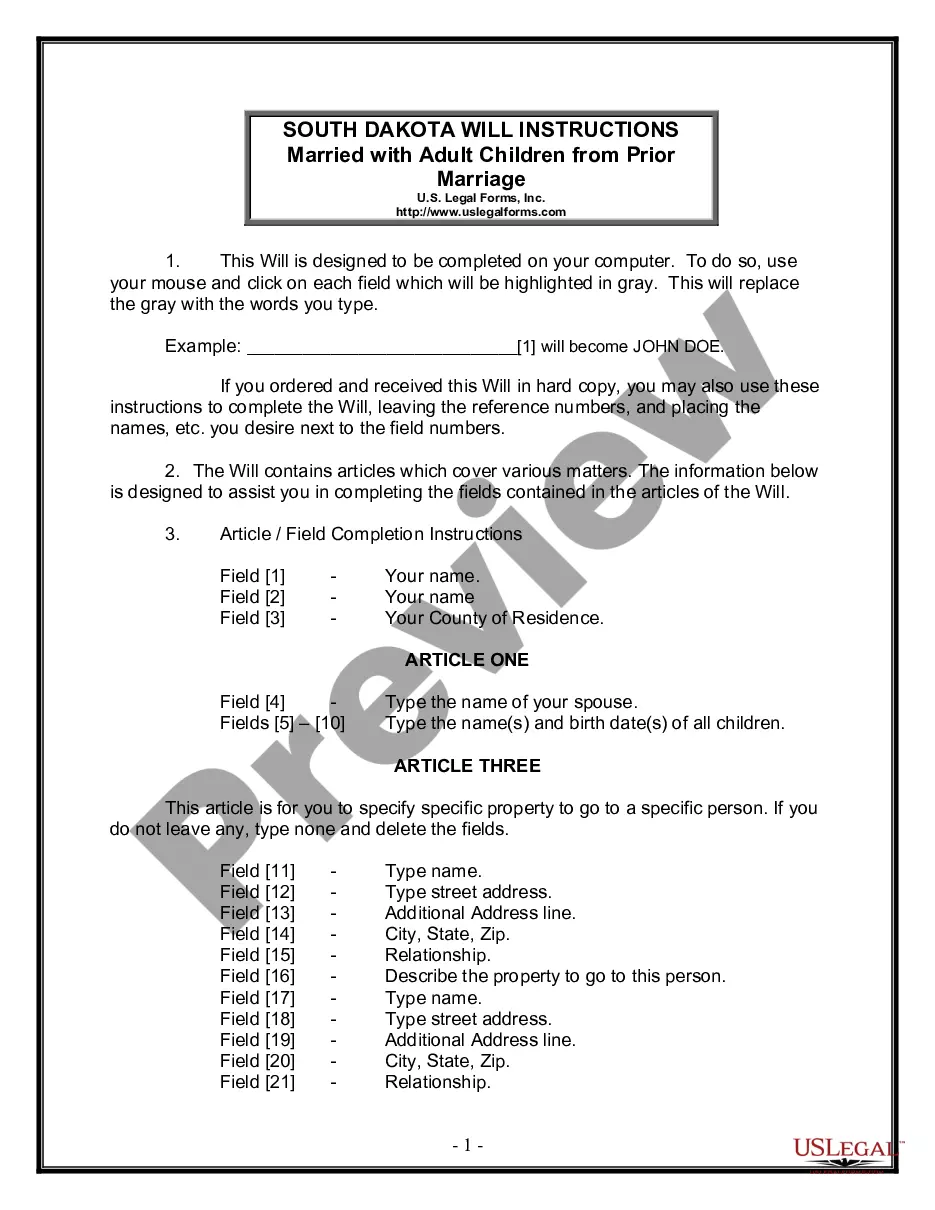

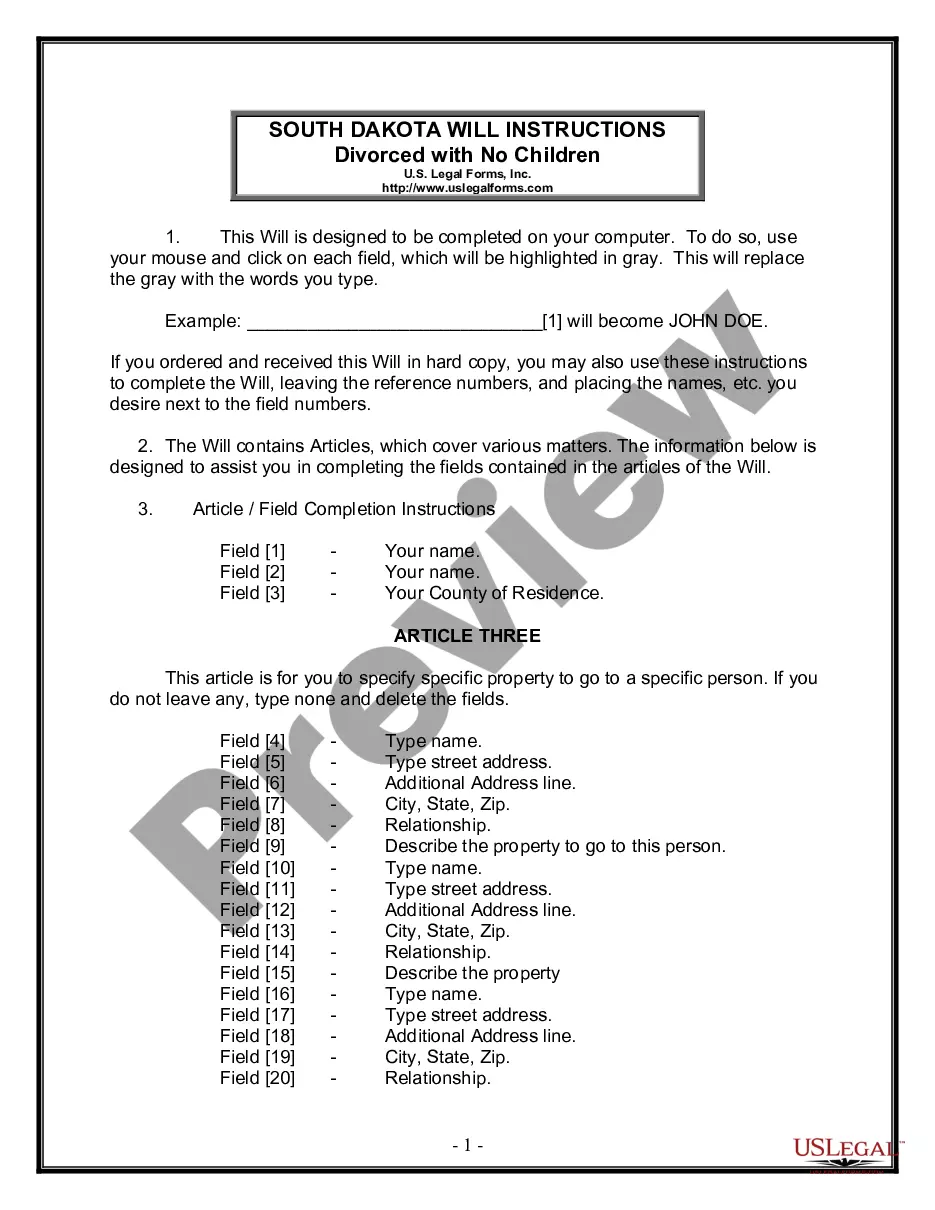

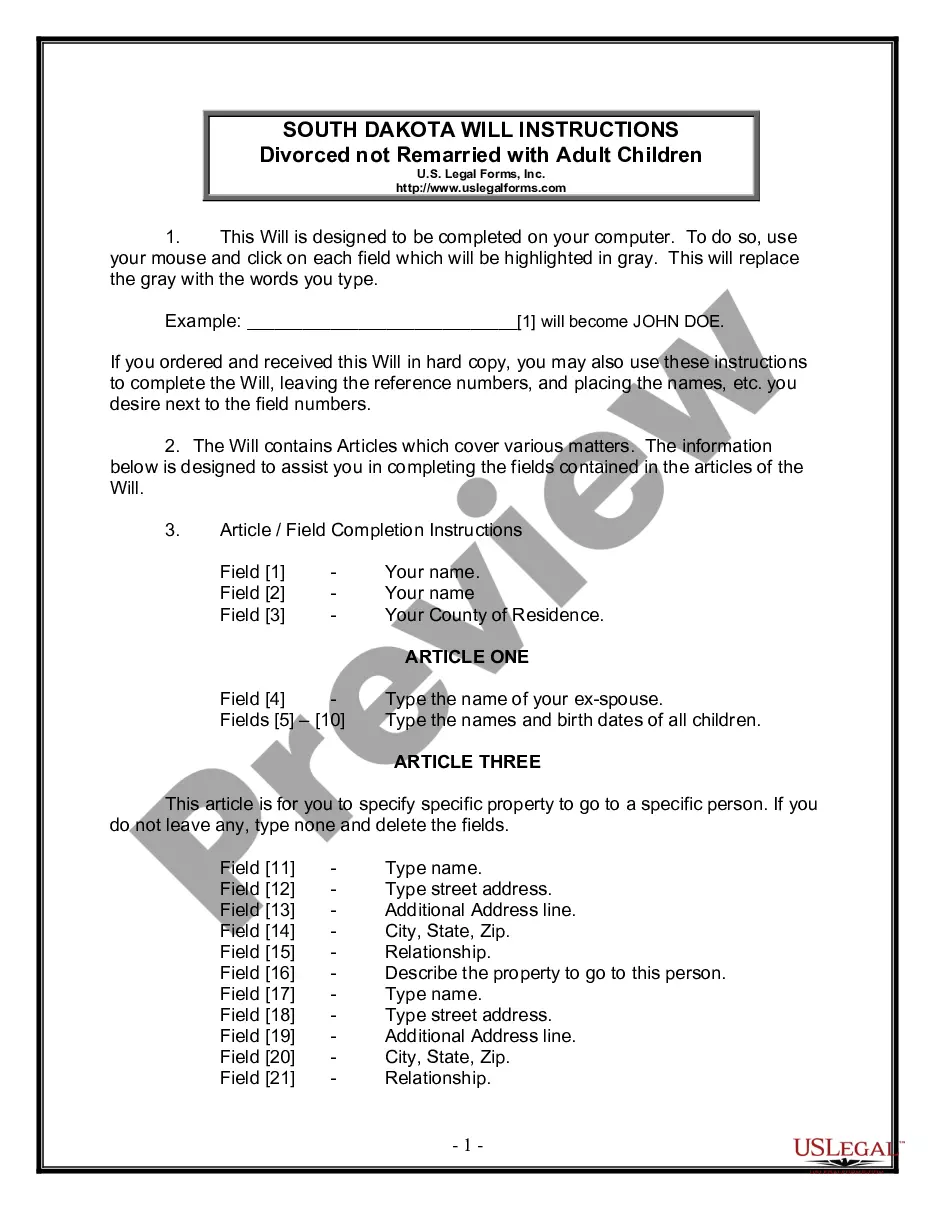

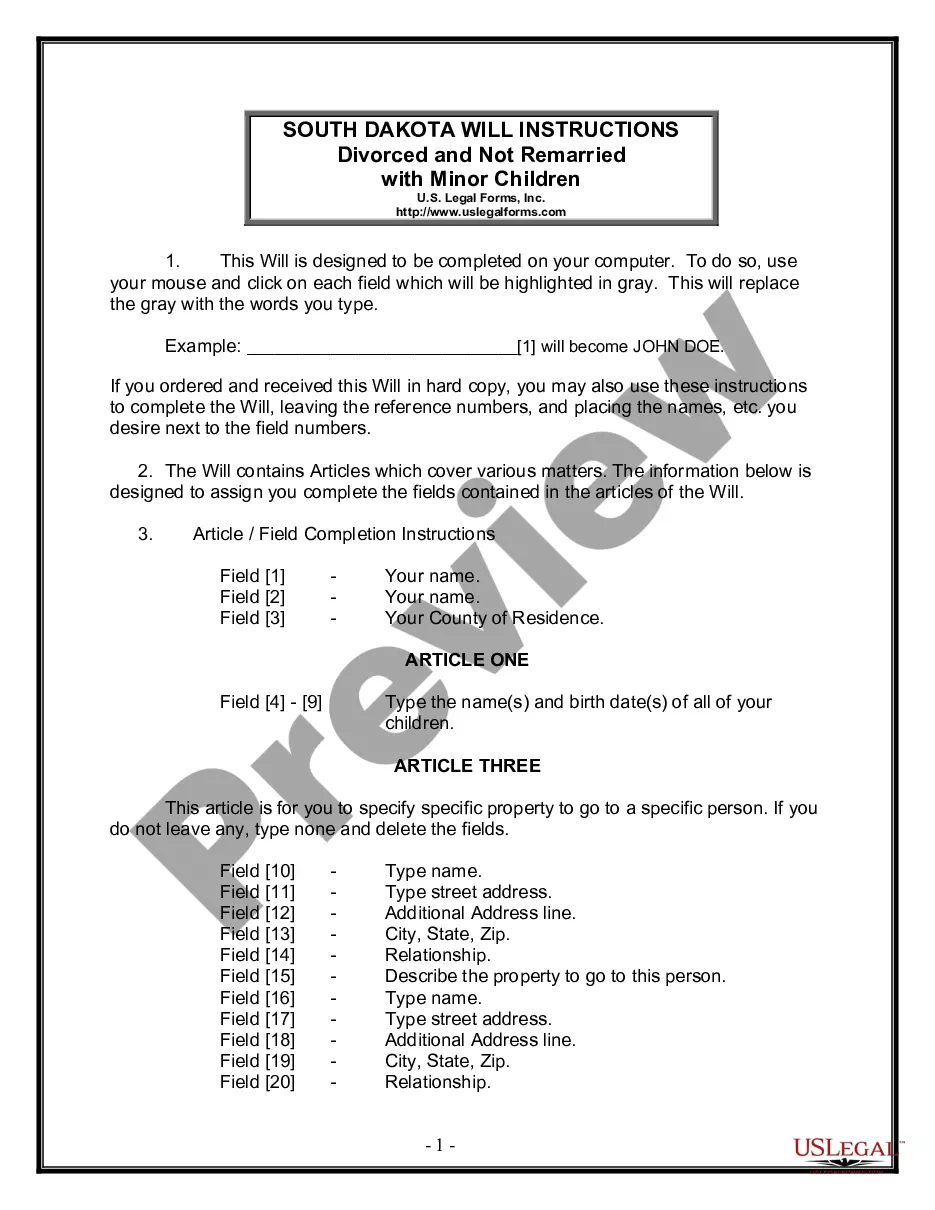

Delaware Living Trust Property Record

Description

How to fill out Delaware Living Trust Property Record?

The greater number of papers you need to create - the more stressed you become. You can get a huge number of Delaware Living Trust Property Record blanks on the internet, still, you don't know which ones to have confidence in. Eliminate the hassle to make detecting samples less complicated with US Legal Forms. Get accurately drafted forms that are published to satisfy state specifications.

If you have a US Legal Forms subscription, log in to the account, and you'll find the Download button on the Delaware Living Trust Property Record’s page.

If you have never tried our website before, finish the registration process with the following recommendations:

- Check if the Delaware Living Trust Property Record applies in the state you live.

- Double-check your option by reading the description or by using the Preview functionality if they are available for the chosen file.

- Click Buy Now to begin the signing up procedure and choose a costs plan that meets your expectations.

- Insert the asked for data to make your profile and pay for the order with the PayPal or credit card.

- Pick a convenient document format and obtain your duplicate.

Access each document you get in the My Forms menu. Simply go there to prepare fresh copy of your Delaware Living Trust Property Record. Even when preparing expertly drafted templates, it’s still vital that you consider asking the local lawyer to re-check completed sample to ensure that your document is accurately filled out. Do much more for less with US Legal Forms!

Form popularity

FAQ

One major mistake parents make is not clearly communicating their intentions and plans regarding the trust fund to their children. This lack of clarity can lead to confusion and disputes later on. Ensuring that the Delaware Living Trust Property Record is fully understood by all parties helps foster transparency and trust within the family.

One significant downside of placing assets in a trust is the potential loss of control over those assets by the original owner, especially in complex trusts. Additionally, there can be costs associated with setting them up and maintaining them. It's crucial to weigh these factors while considering how a Delaware Living Trust Property Record aligns with overall estate planning goals.

Some people view trusts negatively due to misconceptions about their purpose. Trusts can seem complicated and intimidating, leading to confusion about their benefits. However, when established correctly, they often enhance estate planning and provide a solid strategy for managing the Delaware Living Trust Property Record effectively.

Trust funds can have some drawbacks, including potential complexities in administration and management. They may incur legal fees and require ongoing oversight, which can be burdensome. Additionally, certain types of trusts may limit access to funds or assets, making financial flexibility challenging at times.

Filling out a certification of trust form is straightforward when you follow the correct steps. First, gather necessary details such as the trust's name, date, and the names of trustees. Next, you will need to provide information about the Delaware Living Trust Property Record to ensure it reflects the most accurate account of the trust’s assets and responsibilities.

It's a good idea for your parents to consider a trust for their assets, especially to manage their Delaware Living Trust Property Record effectively. A trust can provide benefits like avoiding probate, ensuring privacy, and allowing for easy distribution of assets. Ultimately, each family’s situation is unique, so exploring options and seeking professional advice is wise.

People set up trusts in Delaware for several reasons, including favorable tax laws and strong asset protection features. Delaware's legal system is well-known for its business-friendly environment and established precedents related to trusts. By establishing a trust in Delaware, you can effectively manage your Delaware Living Trust Property Record, ensuring your assets are distributed according to your wishes while minimizing complications.

Yes, you can often look up trust documents online, but the availability varies by state and the specific trust. Many jurisdictions maintain databases for public records, including some Delaware Living Trust Property Records, which can provide access to these documents. However, private trust documents may not be publicly accessible, emphasizing the importance of maintaining accurate records through reliable platforms like U.S. Legal Forms.

One downside of a living trust is that it does not provide tax benefits during your lifetime, unlike some other estate planning tools. Additionally, there may be upfront costs involved in setting it up, and if your assets are not correctly transferred into the trust, it may not function as intended. Nevertheless, a properly structured living trust can greatly enhance your Delaware Living Trust Property Record and simplify your estate management.

Yes, you can transfer your mortgage to a trust, but it requires careful planning. Often, lenders must approve this transfer, which involves reviewing the trust documents. By doing so, you may protect your Delaware Living Trust Property Record, ensuring that your assets are safeguarded for your beneficiaries.