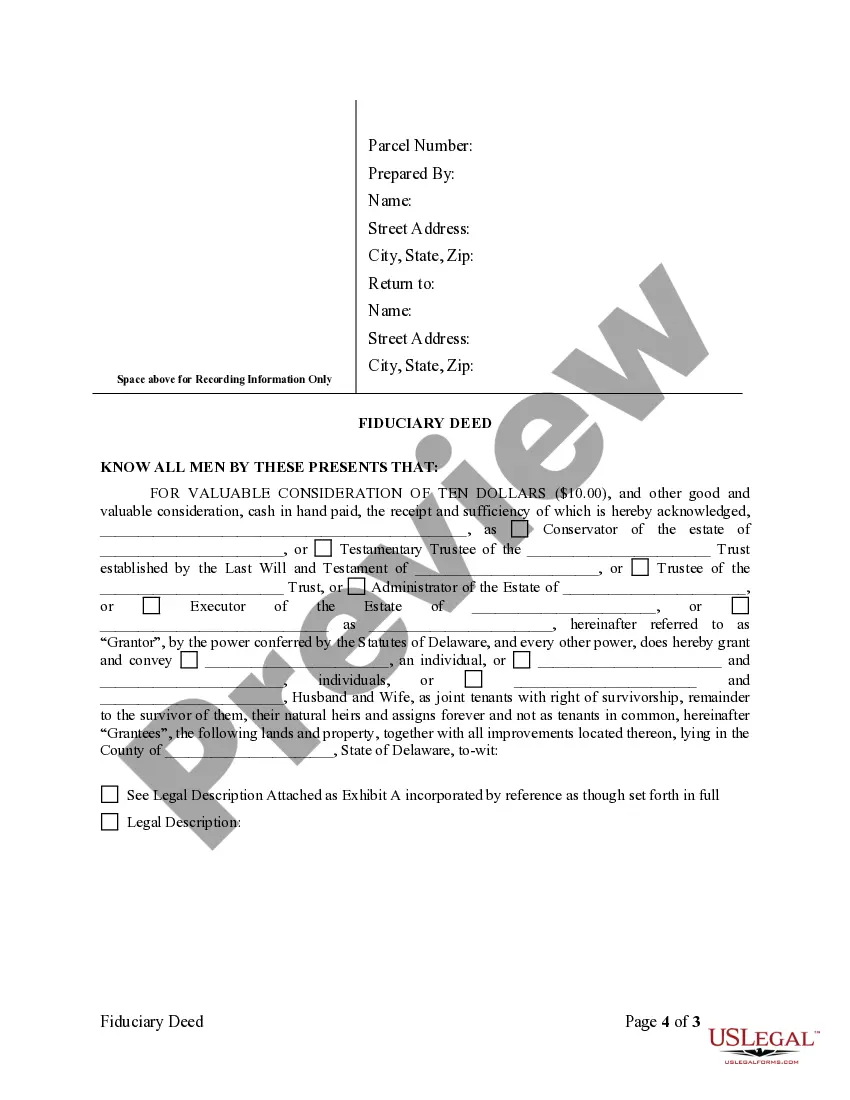

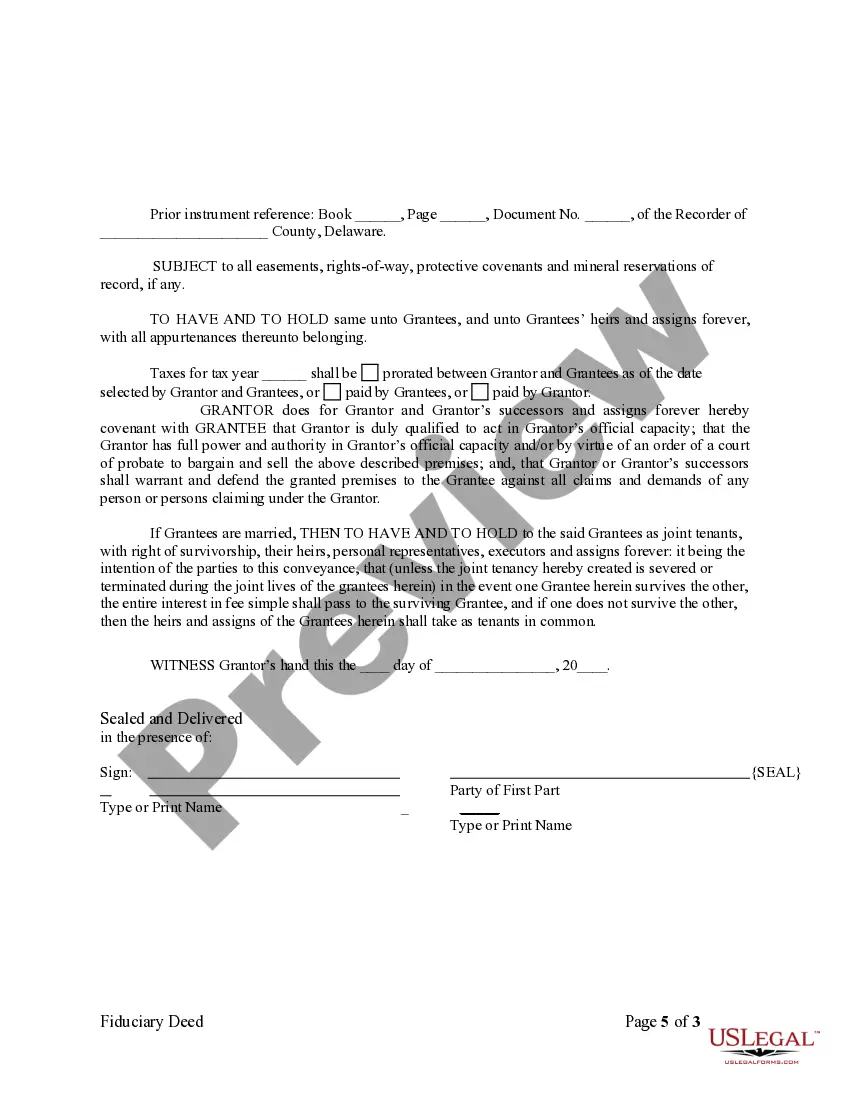

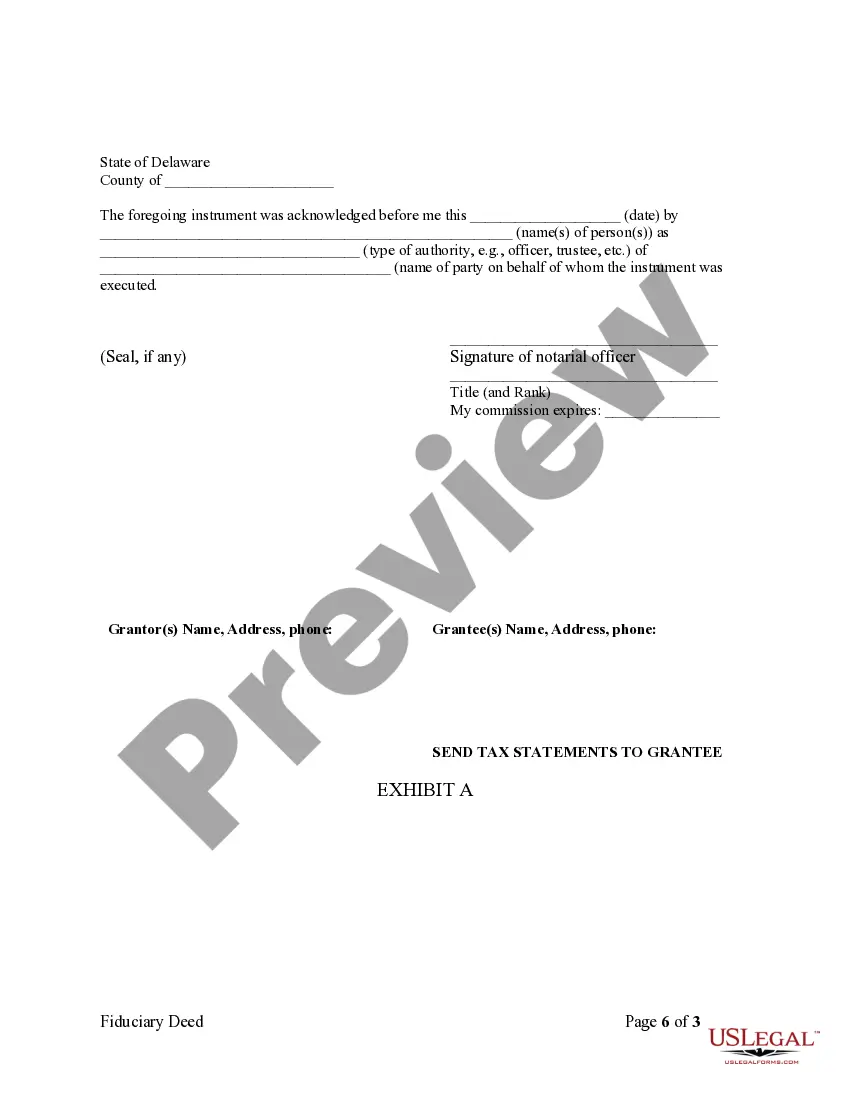

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Delaware Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among numerous paid and free samples that you find on the web, you can't be sure about their reliability. For example, who made them or if they are competent enough to deal with what you require these people to. Keep calm and use US Legal Forms! Locate Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries templates created by skilled lawyers and prevent the expensive and time-consuming process of looking for an lawyer and after that paying them to draft a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access all of your earlier acquired templates in the My Forms menu.

If you are making use of our platform for the first time, follow the instructions listed below to get your Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries easily:

- Make certain that the file you discover is valid where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another example using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you have signed up and bought your subscription, you can use your Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as many times as you need or for as long as it remains active in your state. Revise it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The trustee is typically responsible for filing a trust tax return. This individual must report all income generated by the trust and may need to distribute tax liabilities among beneficiaries. If you are involved in a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, understanding your obligations can help maintain compliance and protect the interests of the trust.

To find your Indiana state tax ID number, you can check your previous tax returns or business documents if applicable. Alternatively, you can contact the Indiana Department of Revenue for assistance. If you are managing a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, having this information readily available helps ensure smooth operations.

Yes, Delaware does accept federal extensions for individual tax filings. This means if you file for an extension with the IRS, you can apply that extension to your Delaware tax return as well. For fiduciaries utilizing a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, knowing these details can help in planning tax obligations effectively.

Yes, the term 'fid' is often used interchangeably with tax ID. Both refer to the identification number assigned by the IRS for tax reporting purposes. For fiduciaries managing assets under a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, understanding this distinction is crucial for accurate tax filings.

FID stands for Federal Identification Number, which the IRS uses for tax purposes. This number is required when filing taxes for estates and trusts. For executors and trustees dealing with a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, having the correct FID can ensure compliance with tax laws.

The Delaware Code 3339 relates to the powers of fiduciaries when conducting transactions involving wills and trusts. Understanding this code is essential for anyone dealing with a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries. It outlines specific authorities and responsibilities, ensuring fiduciaries act within the scope of the law. Familiarizing yourself with this code allows for more effective estate management.

Typically, an executor in Delaware has up to one year to settle an estate. However, various factors, including the complexity of the estate and any disputes, can affect this timeframe. Adhering to the requirements of a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can help streamline the process. Being organized and knowledgeable about your duties will enable you to fulfill the estate’s obligations efficiently.

Delaware trusts are becoming increasingly popular due to their favorable laws, which offer flexibility and asset protection. Many individuals are turning to the Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries as an essential tool for estate planning. The benefits include privacy, tax advantages, and protection from creditors. This growing interest reflects a desire for secure financial planning and trust management.

The Delaware Code 3313 deals with the formalities of a Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries. This code specifies the necessary documentation and procedures to validate gifts or transfers of property to trusts. Understanding this code is vital for fiduciaries to ensure they are following proper legal channels. By adhering to these guidelines, fiduciaries can effectively manage assets with transparency and legality.

In Delaware, inheritance law governs how assets are distributed upon death, including provisions related to wills and trusts. The Delaware Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries plays a crucial role in this process. Understanding these laws helps you ensure that the deceased's wishes are honored while complying with state regulations. If you are managing an estate, knowing these laws can significantly simplify your journey.