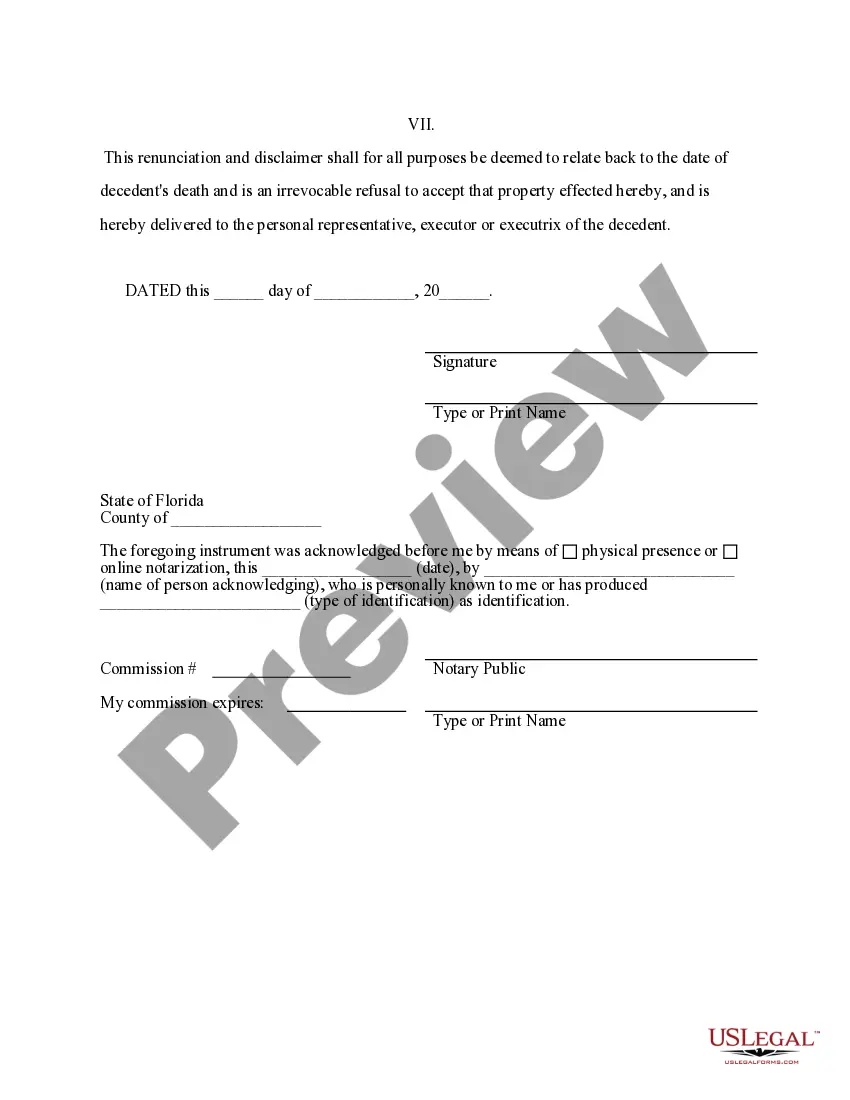

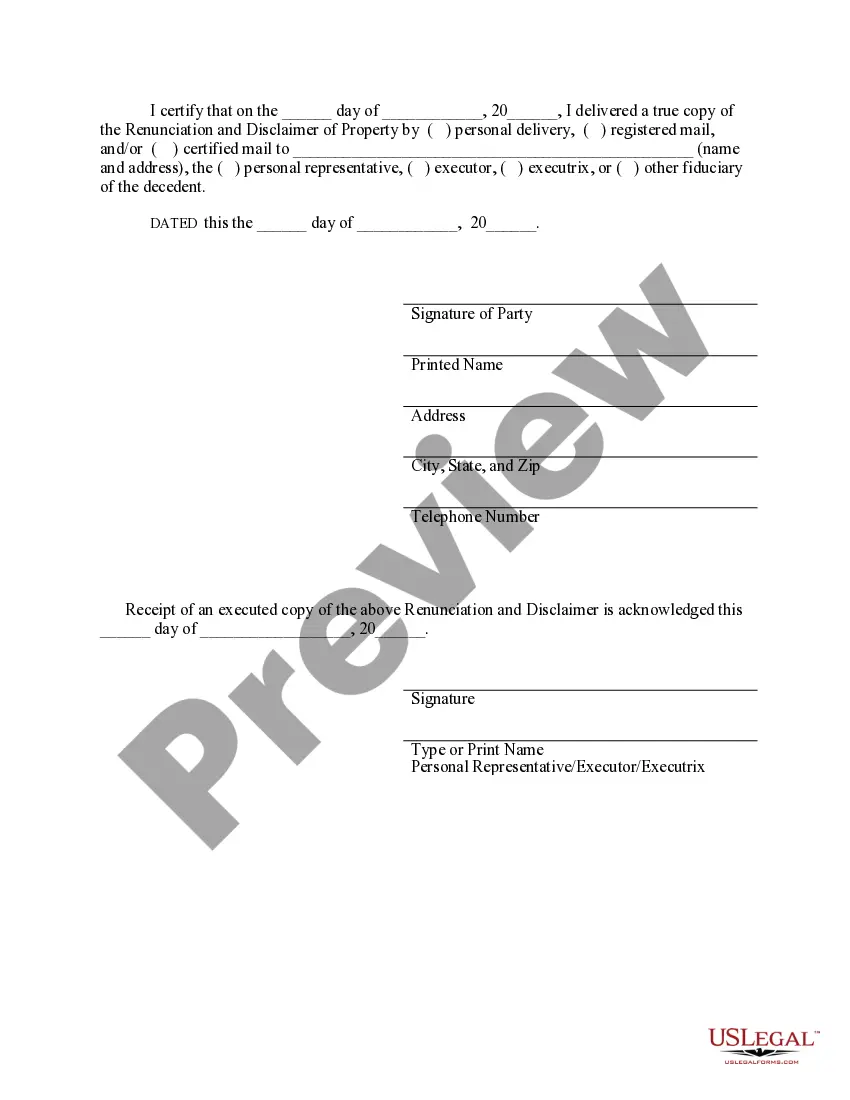

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Intestate Succession Florida

Description Property Succession Fillable

How to fill out Renunciation Form?

- Sign in to your US Legal Forms account if you're an existing user; ensure your subscription is active. If not, renew it according to your specified payment plan.

- If this is your first time, start by reviewing the Preview mode and form description to confirm you’ve selected the correct Florida Renunciation and Disclaimer of Property form that aligns with your jurisdiction.

- Use the Search tab to find alternative templates if needed, ensuring you select the appropriate paperwork for your situation.

- Click the 'Buy Now' button to purchase the document, choosing the subscription plan that best fits your needs and creating an account for library access.

- Complete your transaction using your credit card or PayPal account, and finalize your purchase.

- Download the form directly to your device, and visit the 'My Forms' section in your profile at any time for easy access.

In conclusion, US Legal Forms empowers individuals to tackle their legal needs efficiently with an extensive library, offering over 85,000 customizable legal documents. With access to expert assistance, you can ensure that your forms are both accurate and compliant with your legal requirements.

Get started today and take advantage of our robust offerings to navigate your estate planning with confidence!

Florida Intestate Form popularity

Disclaimer Property Fillable Other Form Names

Fl Property FAQ

Intestate succession specifically refers to the order in which spouses, children, siblings, parents, cousins, great-aunts/uncles, second cousins twice removed, etc. are entitled to inherit from a family member when no will or trust exists.

Next of kin in Florida is defined in Florida's guardianship code section 744.102 as: those persons who would be heirs at law of the ward or alleged incapacitated person if the person were deceased and includes the lineal descendants of the ward or alleged incapacitated person.

State laws may vary slightly, but the typical scheme of most states, including Florida (§732.101 to A§732.111), is that intestate property passes in this order: spouse, descendants (children or grandchildren), parents, siblings (and children of deceased siblings).

Florida Intestacy Rules A surviving spouse of the decedent receives the entire estate if the decedent has no surviving lineal descendants (children, grandchildren, great-grandchildren, etc).If there are lineal descendents but no surviving spouse, then the estate is shared by the lineal descendants.

Someone who dies without a valid Will dies intestate. Even if the decedent dies intestate, the probate assets are rarely turned over to the state of Florida. The state would take the decedent's assets only if the decedent had no heirs.In that case, the surviving spouse receives all of the decedent's probate estate.

Someone who dies without a valid Will dies intestate. Even if the decedent dies intestate, the probate assets are rarely turned over to the state of Florida. The state would take the decedent's assets only if the decedent had no heirs.In that case, the surviving spouse receives all of the decedent's probate estate.

All estates do not go through probate in Florida. If a person passes away without a will or trust and has assets in their name ONLY, then probate is required to distribute property and monies.However, without a will or trust all assets must pass through probate court if no beneficiary or joint owner is named.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.