Florida Living Trust for Husband and Wife with One Child

Description

How to fill out Florida Living Trust For Husband And Wife With One Child?

Obtain one of the most comprehensive collections of authorized documents. US Legal Forms is essentially a platform to locate any state-specific file in mere clicks, such as the Florida Living Trust for Married Couples with One Child templates.

No need to squander hours searching for a court-admissible example. Our certified professionals guarantee you receive up-to-date documents every time.

To take advantage of the forms library, select a subscription and create an account. If you have already registered, just Log In and then click Download. The Florida Living Trust for Married Couples with One Child document will automatically be stored in the My documents section (a section for each form you download from US Legal Forms).

That's it! You should complete the Florida Living Trust for Married Couples with One Child template and review it. To ensure that everything is correct, consult your local legal advisor for assistance. Sign up and easily access around 85,000 useful samples.

- If you intend to use a state-specific document, make sure you select the correct state.

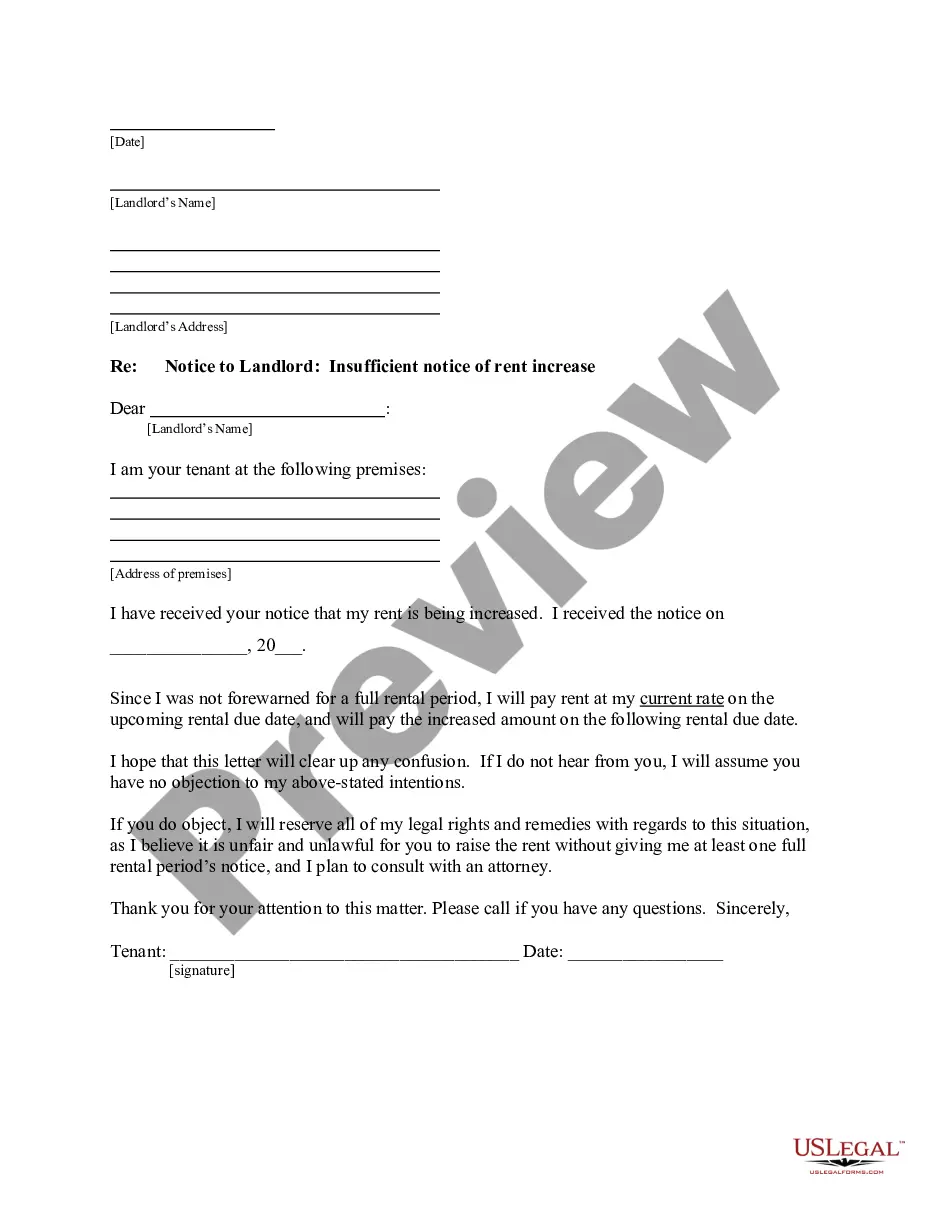

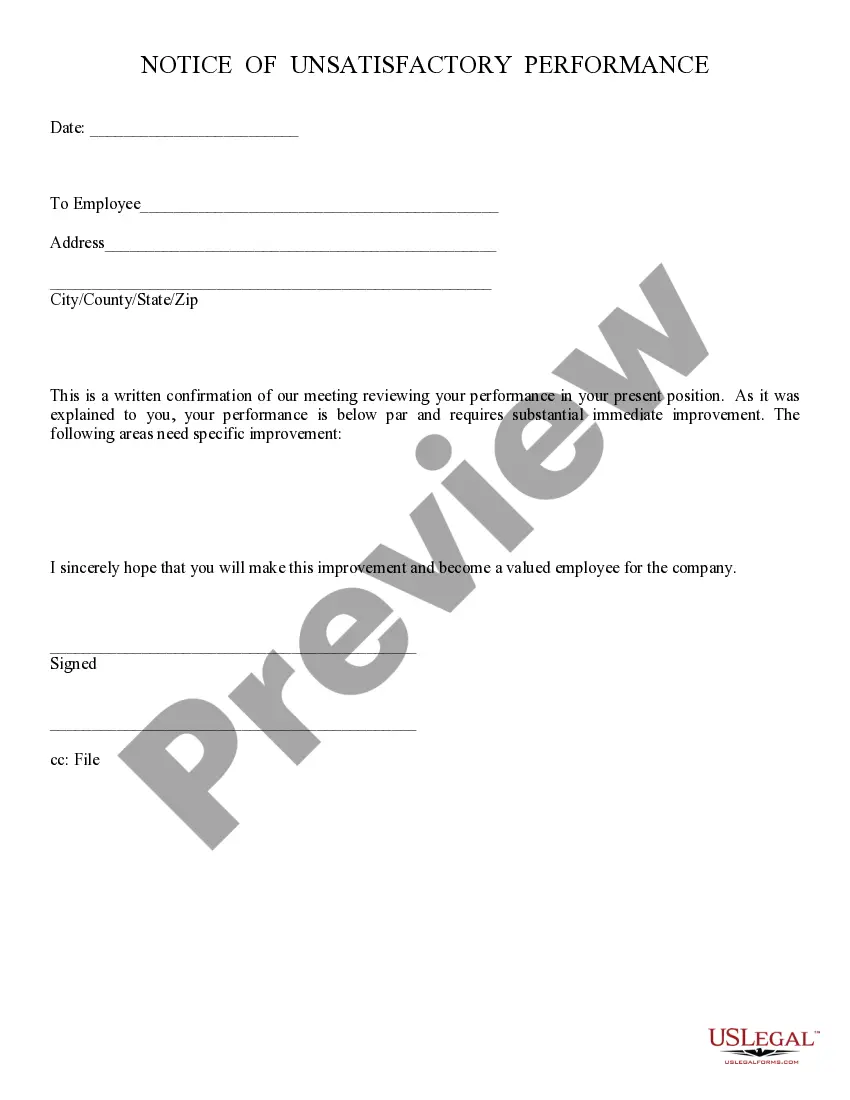

- If feasible, review the description to comprehend all the details of the form.

- Utilize the Preview feature if it's accessible to examine the content of the document.

- If everything is suitable, press the Buy Now button.

- After selecting a pricing plan, create an account.

- Make a payment using a credit card or PayPal.

- Save the document to your computer by clicking the Download button.

Form popularity

FAQ

Marriage does not automatically override a trust in Florida, but it can impact the trust's terms and administration. A Florida Living Trust for Husband and Wife with One Child is designed to account for both spouses' rights, ensuring that each partner's wishes carry weight in the event of a change in marital status. It’s wise for couples to regularly review their trusts to ensure they align with their current circumstances.

The best trust for a married couple often depends on their specific needs and circumstances. A Florida Living Trust for Husband and Wife with One Child is highly recommended for couples with a single child as it provides control over asset distribution, avoids probate, and can offer tax benefits. This type of trust allows couples to plan for their child's future while ensuring that both partners' wishes are honored.

In Florida, a trust can be considered marital property, especially when both spouses are involved in its creation or funding. If a Florida Living Trust for Husband and Wife with One Child includes assets acquired during the marriage, those assets typically fall under marital property laws. This means that both spouses have rights to the trust's benefits, which can be crucial for estate planning.

Yes, you can write your own living trust in Florida. However, crafting a Florida Living Trust for Husband and Wife with One Child requires careful consideration of legal requirements. It's essential to ensure that your trust meets state laws and effectively addresses your family's needs. Using a platform like US Legal Forms can simplify this process, providing templates and guidance tailored to your situation.

Yes, you can prepare your own living trust in Florida, particularly a Florida Living Trust for Husband and Wife with One Child. However, it's important to ensure that you understand the legal requirements and implications. Using a platform like US Legal Forms can simplify this process, offering easy-to-use templates and guidance to create a comprehensive trust that meets your family's needs.

A Florida Living Trust for Husband and Wife with One Child allows both spouses to jointly manage their assets within a single trust. By doing so, they can ensure that both partners have access and control over their shared property. Upon the passing of one spouse, the other retains full rights to the assets, simplifying the transition for their child. This arrangement provides both security and flexibility for the family's future.

While a Florida Living Trust for Husband and Wife with One Child offers many advantages, there are some downsides to consider. Setting up a trust can involve upfront costs and paperwork, which might seem daunting. Moreover, if not managed properly, the trust could incur taxes and fees over time. It’s essential to assess whether the benefits outweigh these potential drawbacks based on their unique situation.

While it is possible to create a Florida Living Trust for Husband and Wife with One Child without an attorney, having legal guidance can provide significant benefits. An experienced attorney can help ensure that your trust meets all legal requirements and aligns with your specific wishes. Additionally, they can offer valuable advice on how to structure the trust to best serve your family's needs. Using platforms like uslegalforms can also simplify the process, offering resources and templates tailored for your situation.

One of the biggest mistakes parents often make when setting up a Florida Living Trust for Husband and Wife with One Child is failing to clearly define their intentions. It is crucial to specify how the assets will be distributed to prevent disputes among heirs. Additionally, neglecting to keep the trust updated as family circumstances change can lead to confusion and unmet wishes. Taking proactive steps can ensure that your living trust accurately reflects your goals and protects your child’s future.