A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Hawaii Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

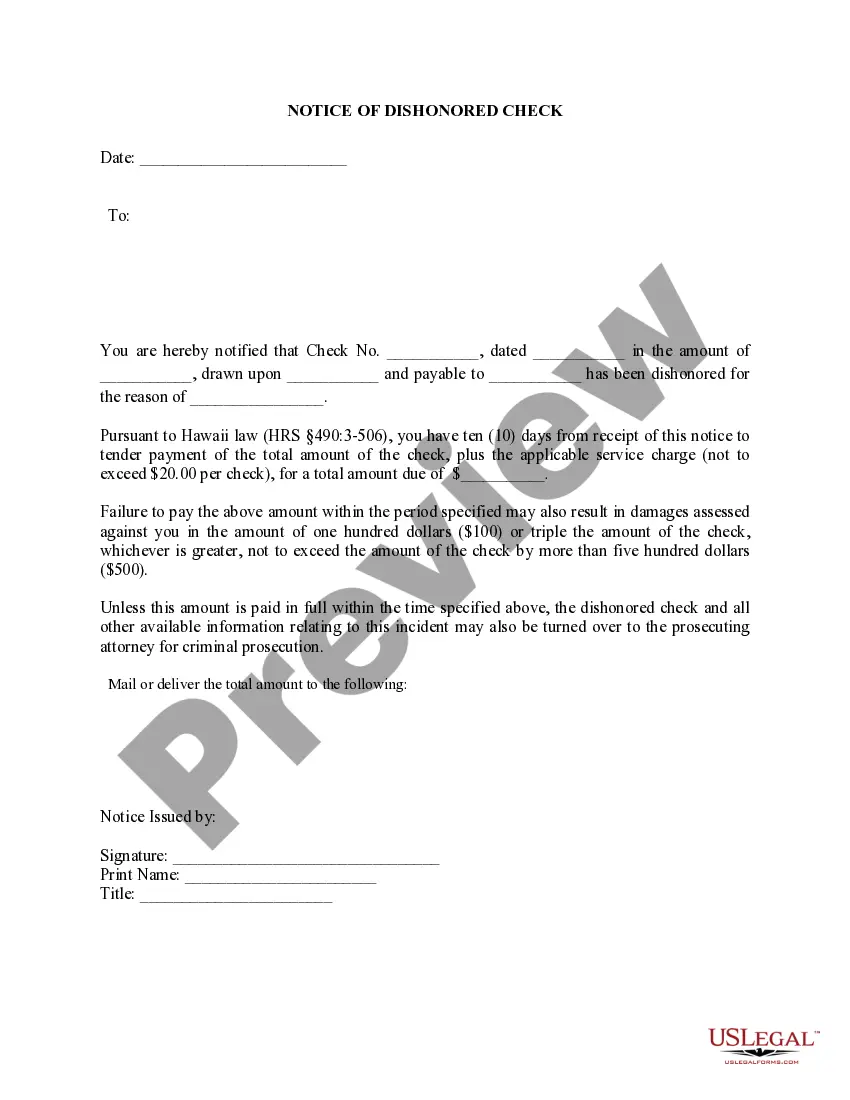

How to fill out Hawaii Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Access the most holistic catalogue of authorized forms. US Legal Forms is actually a platform where you can find any state-specific document in a few clicks, such as Hawaii Notice of Dishonored Check - Civil - Keywords: bad check, bounced check samples. No requirement to waste hrs of your time trying to find a court-admissible form. Our accredited specialists make sure that you get updated samples every time.

To leverage the forms library, choose a subscription, and sign up an account. If you registered it, just log in and click on Download button. The Hawaii Notice of Dishonored Check - Civil - Keywords: bad check, bounced check file will automatically get kept in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, look at simple guidelines below:

- If you're going to use a state-specific example, ensure you indicate the proper state.

- If it’s possible, go over the description to understand all the ins and outs of the form.

- Make use of the Preview option if it’s available to look for the document's content.

- If everything’s appropriate, click on Buy Now button.

- After picking a pricing plan, make an account.

- Pay by card or PayPal.

- Save the example to your device by clicking Download.

That's all! You should submit the Hawaii Notice of Dishonored Check - Civil - Keywords: bad check, bounced check template and double-check it. To make sure that all things are exact, contact your local legal counsel for help. Sign up and simply look through more than 85,000 helpful samples.

Form popularity

FAQ

According to federal laws, intentionally depositing a fake check to get money that is not yours is an act of fraud. Just like any other act of fraud, you can go to jail or face fines. The exact check fraud punishment typically depends on how much money a person fraudulently obtained.

Balance your checking account so that you know how much you have to spend. Review account balances before you spend. Use a budget so that you know where every dollar goes before you even get it. Stop electronic payments if they're tripping you up.

A bad check refers to a check that cannot be negotiated because it is drawn on a nonexistent account or has insufficient funds. Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Bouncing a check can happen to anyone. You might write one, or you might receive one.If you receive and deposit a check that bounces, you'll owe a fee to your bank for returning the check, in addition to having the headache of recovering the money you're due.

Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony.

Yes. It can be accepted by the bank. It really depends on the where it is torn, if any of the detail on the cheque is affected (date, Signature, Cheque number etc) it will not be accepted.

Check verification services: Businesses can use databases that track checking accounts and help to identify checks that are likely to bounce. They might even guarantee payment on bad checks for an extra fee.

Bouncing a check can happen to anyone. You might write one, or you might receive one. If you receive and deposit a check that bounces, you'll owe a fee to your bank for returning the check, in addition to having the headache of recovering the money you're due.