Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Hawaii Installments Fixed Rate Promissory Note Secured By Personal Property?

Obtain one of the most comprehensive collections of legal documents.

US Legal Forms is truly a site where you can locate any state-specific form in just a few clicks, such as examples of Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property.

No need to waste several hours looking for a court-acceptable form.

After choosing a pricing plan, create your account. Pay using a credit card or PayPal. Download the document to your computer by clicking the Download button. That's all! You need to fill out the Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property template and review it. To confirm that everything is correct, consult your local legal advisor for assistance. Register and effortlessly browse through around 85,000 valuable templates.

- To gain access to the forms library, choose a subscription and create your account.

- If you've already set it up, simply Log In and then click Download.

- The Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property template will automatically be saved in the My documents section (a section for all forms you download on US Legal Forms).

- To establish a new account, refer to the brief instructions below.

- If you plan to use a state-specific template, be sure to select the correct state.

- If possible, review the description to understand all the details of the form.

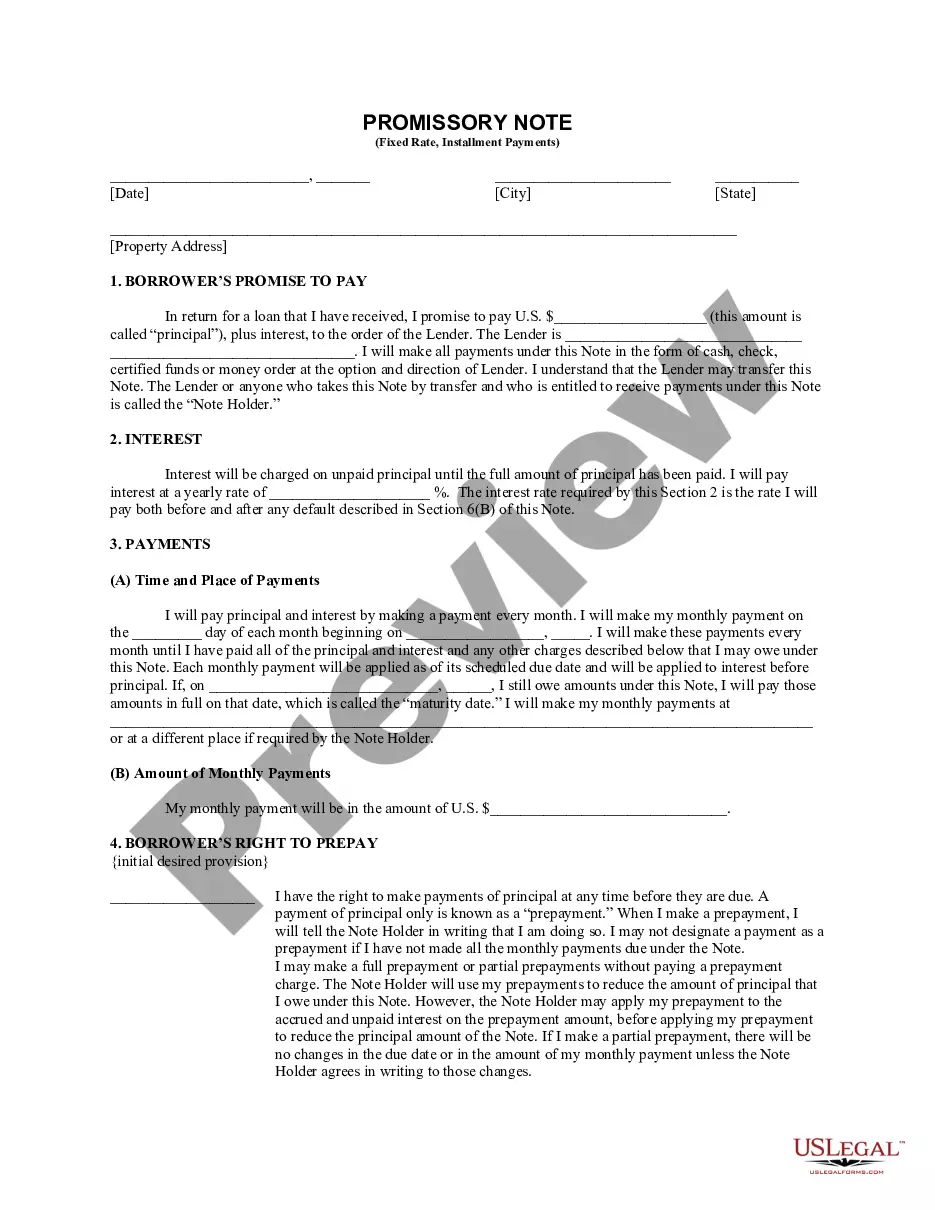

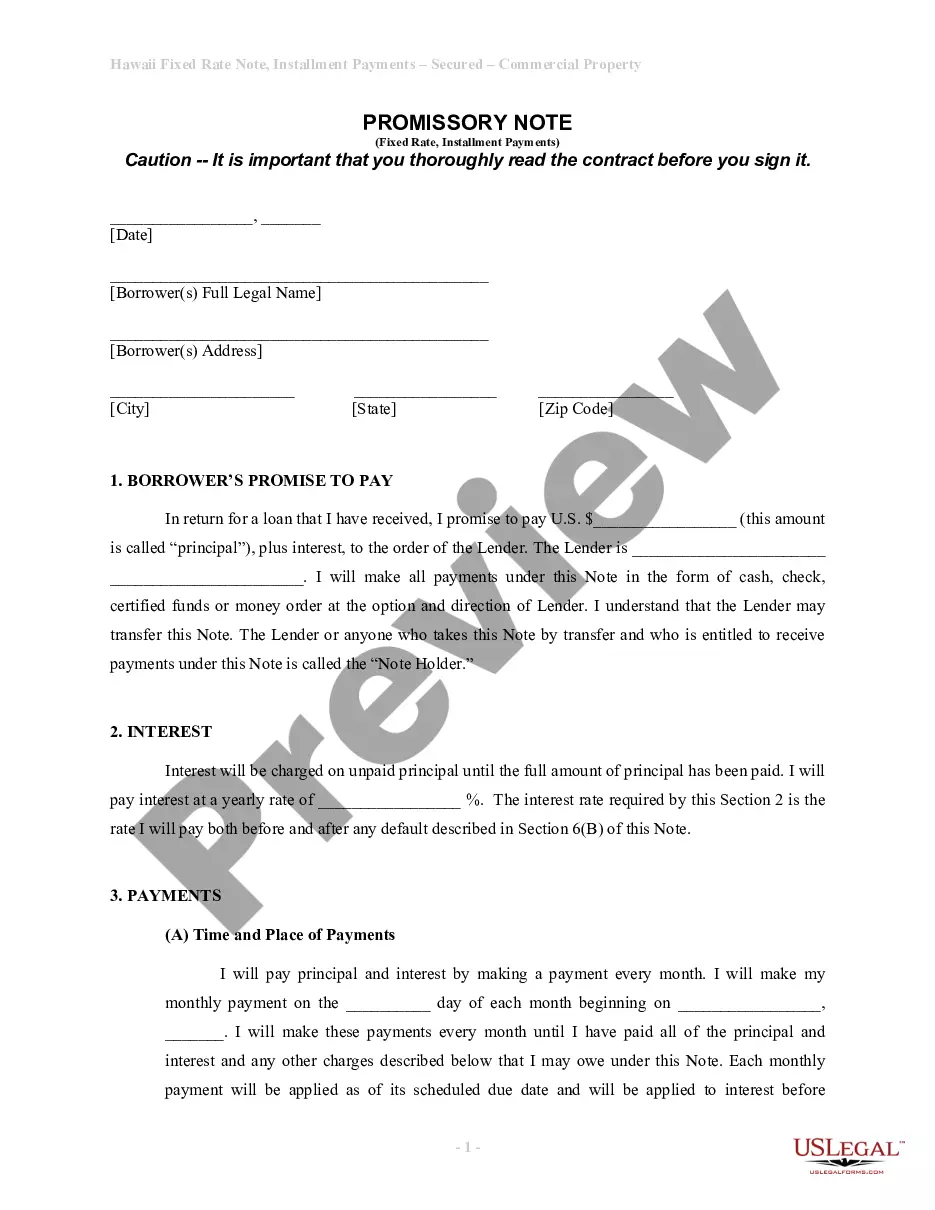

- Utilize the Preview option if it's available to examine the contents of the document.

- If everything looks good, click Buy Now.

Form popularity

FAQ

Yes, a promissory note can create a lien on a property when it is secured by the property itself. In the case of a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property, the note represents a legal obligation that allows the lender to claim the property if the borrower defaults. This means that the lender has the right to enforce the lien by taking possession of the secured personal property. If you're unsure how to structure these agreements, consider using USLegalForms to create a legally binding document tailored to your needs.

A promissory note, particularly the Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property, is secured by personal property assets. This arrangement offers a sense of security to lenders and encourages responsible borrowing. It is essential to document all terms clearly to protect all parties involved. Utilizing platforms like uslegalforms can aid in creating such documents efficiently.

Yes, a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property is indeed secured by collateral. This means that personal property is pledged to ensure repayment of the note. Such security provides peace of mind for lenders while potentially lowering interest rates for borrowers. Always confirm the specifics of the collateral in the note agreement.

An unsecured promissory note typically does not qualify as a security. Since it lacks collateral, it poses a greater risk to lenders. However, a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property is different because it involves secured personal assets. This distinction is important in understanding the note's legal status.

A promissory note is often backed by collateral, which can include personal property. In the case of a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property, the note is specifically secured by personal assets. This backing provides an added layer of security for lenders. Understanding the collateral's value can be crucial for all parties involved.

One disadvantage of a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property is the potential for default. If the borrower cannot repay, it may involve legal proceedings. Additionally, managing and enforcing the terms of the note can become complicated. Consider using uslegalforms to navigate and create effective promissory notes.

A promissory note itself is not considered real property; it is a financial document evidencing a debt. However, when it is secured by a mortgage or deed of trust, it can be tied to real property. In the context of a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property, understanding the distinction can clarify your rights and responsibilities. This clarity aids in navigating legal scenarios involving debts and the collateral securing them.

The document that secures the promissory note to real property is typically a mortgage or deed of trust. When dealing with a Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property, this document outlines the lender’s interest in the property. It effectively protects the lender's investment, ensuring they can claim the property if necessary. Familiarizing yourself with these terms is essential for anyone entering this agreement.

Yes, a promissory note can be secured by real property. In such cases, the Hawaii Installments Fixed Rate Promissory Note Secured by Personal Property establishes a connection between the debt and the real estate asset. This means that if the borrower fails to meet repayment terms, the lender may have the right to seize the property. It's a mechanism for lending that offers extra security for lenders.