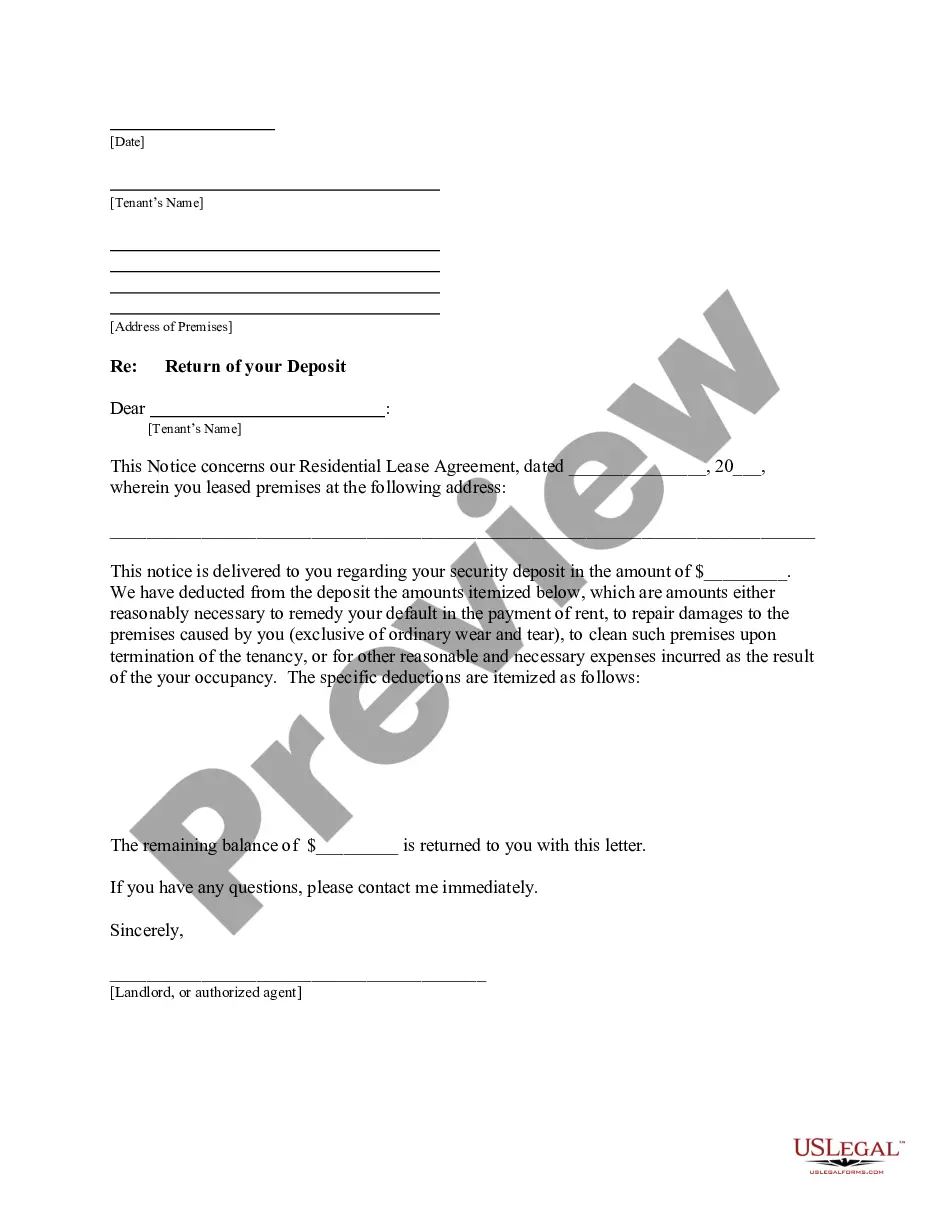

Iowa Security Deposit

Description Letter Landlord Returning Deposit

How to fill out Iowa Letter From Landlord To Tenant Returning Security Deposit Less Deductions?

- If you're an existing user, simply log in to your account and find the required form template. Ensure your subscription is active; if not, please renew it as per your chosen payment plan.

- For first-time users, start by previewing the form description to confirm it fits your needs according to local laws.

- If there’s an issue with the template, use the Search tab to locate the correct form that meets Iowa's requirements.

- Purchase the form by clicking the Buy Now button and choosing your preferred subscription plan. You'll need to register to access our extensive resources.

- Complete your payment using a credit card or your PayPal account to finalize the purchase.

- Once purchased, download the template to your device for easy access. You can also find it anytime in your My Forms section.

US Legal Forms stands out with its extensive collection of over 85,000 customizable legal forms, setting it apart from competitors and ensuring you can find exactly what you need.

By utilizing US Legal Forms, you gain access to premium resources and expert assistance for completing your legal documents accurately. Start your journey towards hassle-free legal documentation today!

Form popularity

FAQ

Generally, a landlord may retain all or part of the security deposit to pay for damages to the unit that occurred during the tenants' occupancy, except for those resulting from normal wear and tear. Usually, the landlord can deduct other costs, such as late fees, unpaid rent, and unpaid utility bills.

Concisely review the main facts and lay out the reasons your landlord owes you money. Include copies of relevant letters and agreements, such as your notice to move out. Ask for exactly what you want, such as the full amount of your deposit within ten days. Cite state security deposit law.

5 Times a Landlord Does Not Have to Return a Tenant's Security Deposit. Breaking or Terminating a Lease Early. Nonpayment of Rent. Damage to the Property. Cleaning Costs. Unpaid Utilities.

If you didn't get your deposit back that way, ask your landlord to return it. If they refuse, you can you can call the Ontario government's Rental Housing Enforcement Unit (RHEU) at 1-888-772-9277 (toll-free) or 416-585-7214.

Your landlord can still deduct from your deposit to cover the cleaning bill if the property is not cleaned to the level it was at and can prove it, though. So, it's still important to clean the property thoroughly before you move out.

The landlord is entitled to deduct from the rental deposit any expenses incurred repairing any damage to the property which occurred during the tenancy. The remainder of the money must then be refunded to the tenant no later than 14 days after the restoration of the property as dictated by the Act.

Fill out the Request for Return of Security Deposit form (not interactive; you must print, then fill out the form). Send the form to your former landlord. Keep a photo-copy of the form for yourself. Hold on to the Return Receipt when it comes back in the mail.

Unpaid rent at the end of the tenancy. Unpaid bills at the end of the tenancy. Stolen or missing belongings that are property of the landlord. Direct damage to the property and it's contents (owned by the landlord) Indirect damage due to negligence and lack of maintenance.

Security deposits are assets or liabilities, so you cannot deduct them as expenses as a tenant and you need not declare them as income on income tax returns as a landlord until you use them.