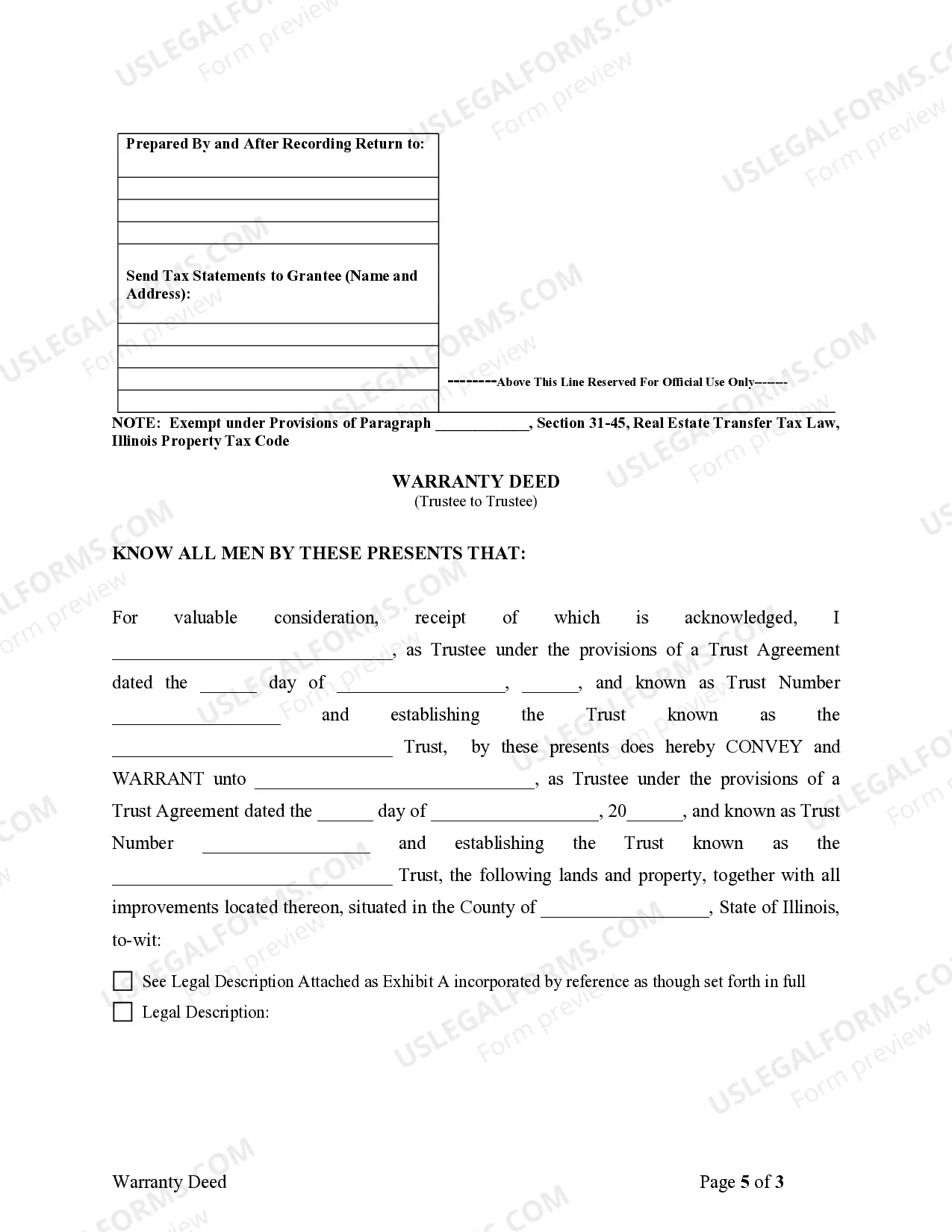

Illinois Warranty Deed from Trustee to Trustee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

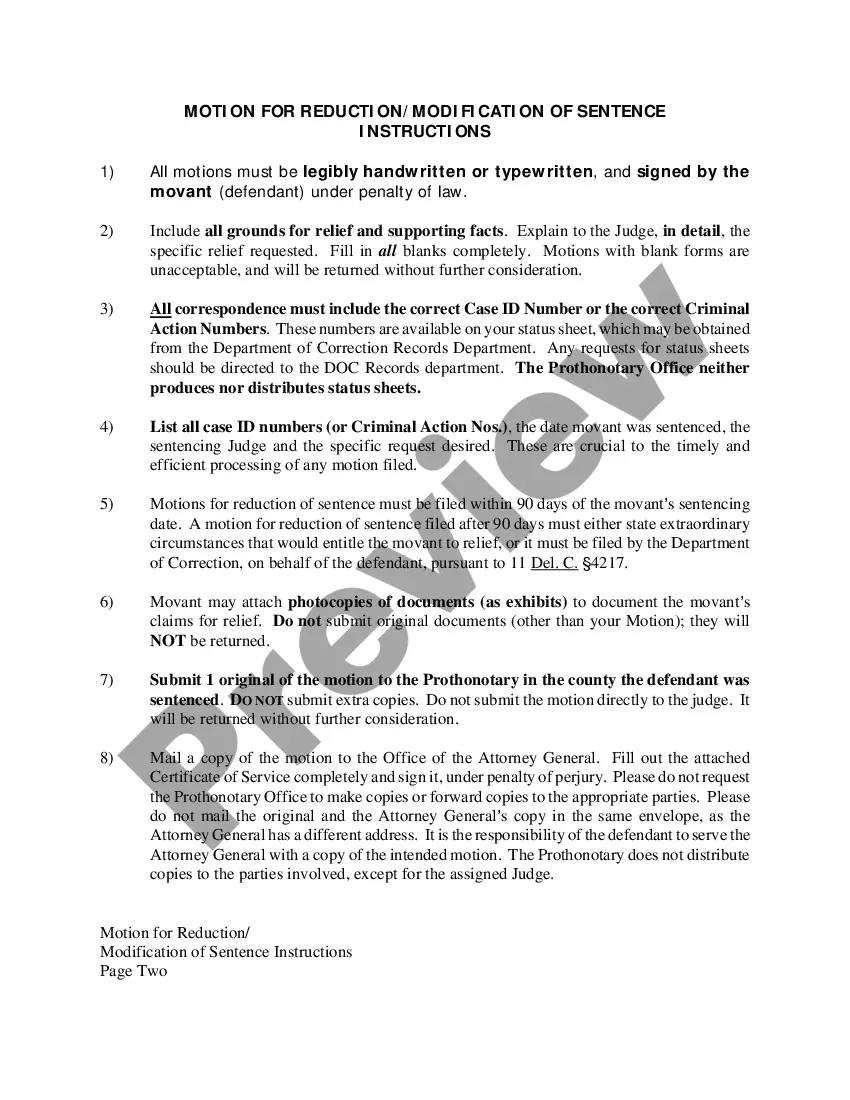

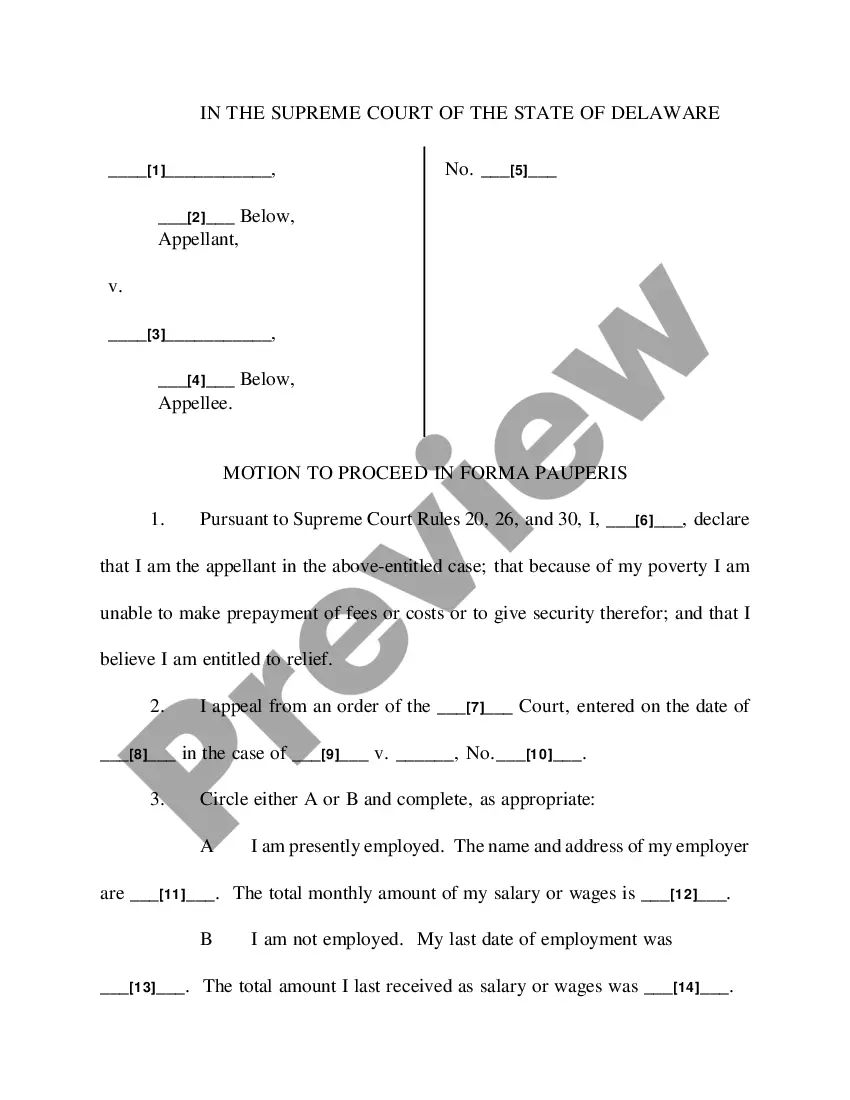

How to fill out Illinois Warranty Deed From Trustee To Trustee?

Among numerous paid and complimentary templates available online, you cannot guarantee their accuracy and trustworthiness.

For instance, the identity of the creators or their qualifications to assist with your needs remain unclear.

Stay composed and utilize US Legal Forms!

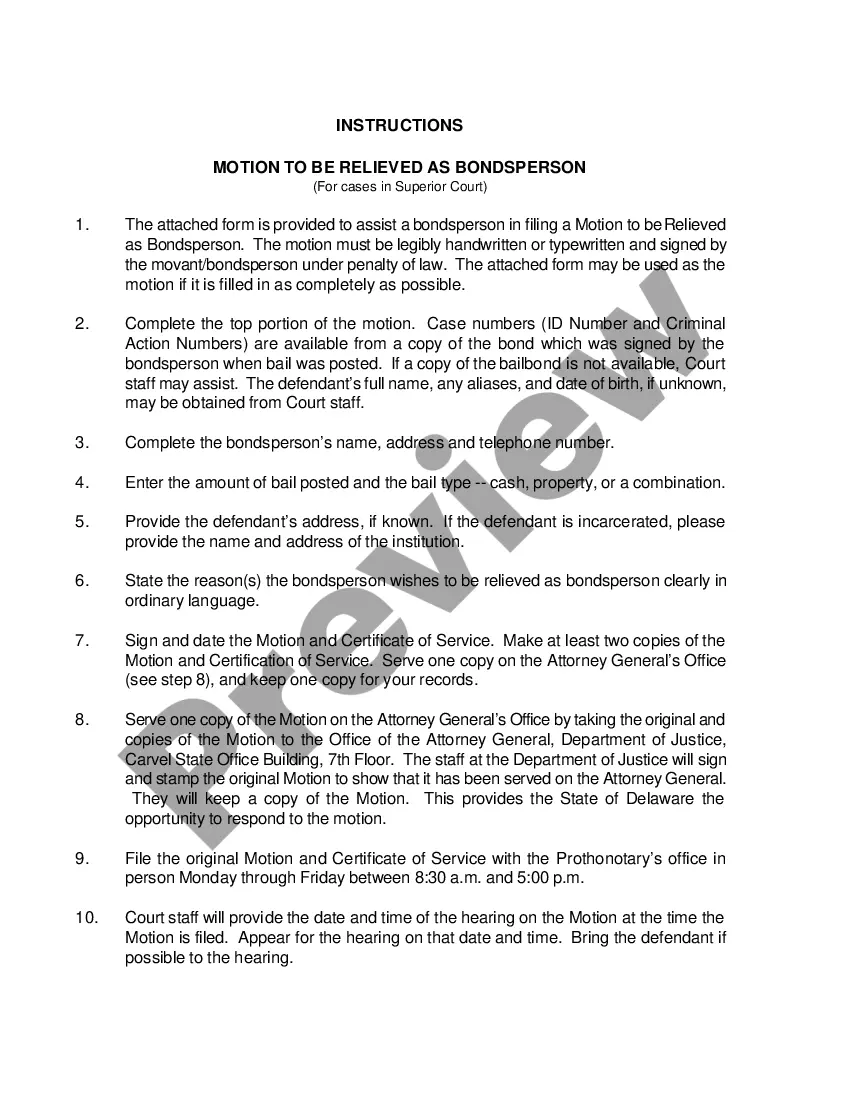

Review the file by examining the description using the Preview feature. Click Buy Now to initiate the purchasing process or locate another template using the Search field in the header. Choose a pricing plan and create an account. Complete the payment for the subscription with your credit/debit card or PayPal. Download the form in your desired file format. Once you have signed up and made your payment, you can use your Illinois Warranty Deed from Trustee to Trustee as often as necessary or for the duration of its validity in your area. Modify it in your chosen editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Obtain Illinois Warranty Deed from Trustee to Trustee templates crafted by proficient attorneys.

- Avoid the costly and lengthy task of searching for a lawyer and subsequently paying them to draft documents that you can readily find yourself.

- If you already possess a subscription, Log In to your account and locate the Download button next to the file you require.

- You will also have access to your previously saved documents in the My documents section.

- If this is your first time using our platform, follow the steps below to effortlessly obtain your Illinois Warranty Deed from Trustee to Trustee.

- Ensure that the document you find is valid in your state.

Form popularity

FAQ

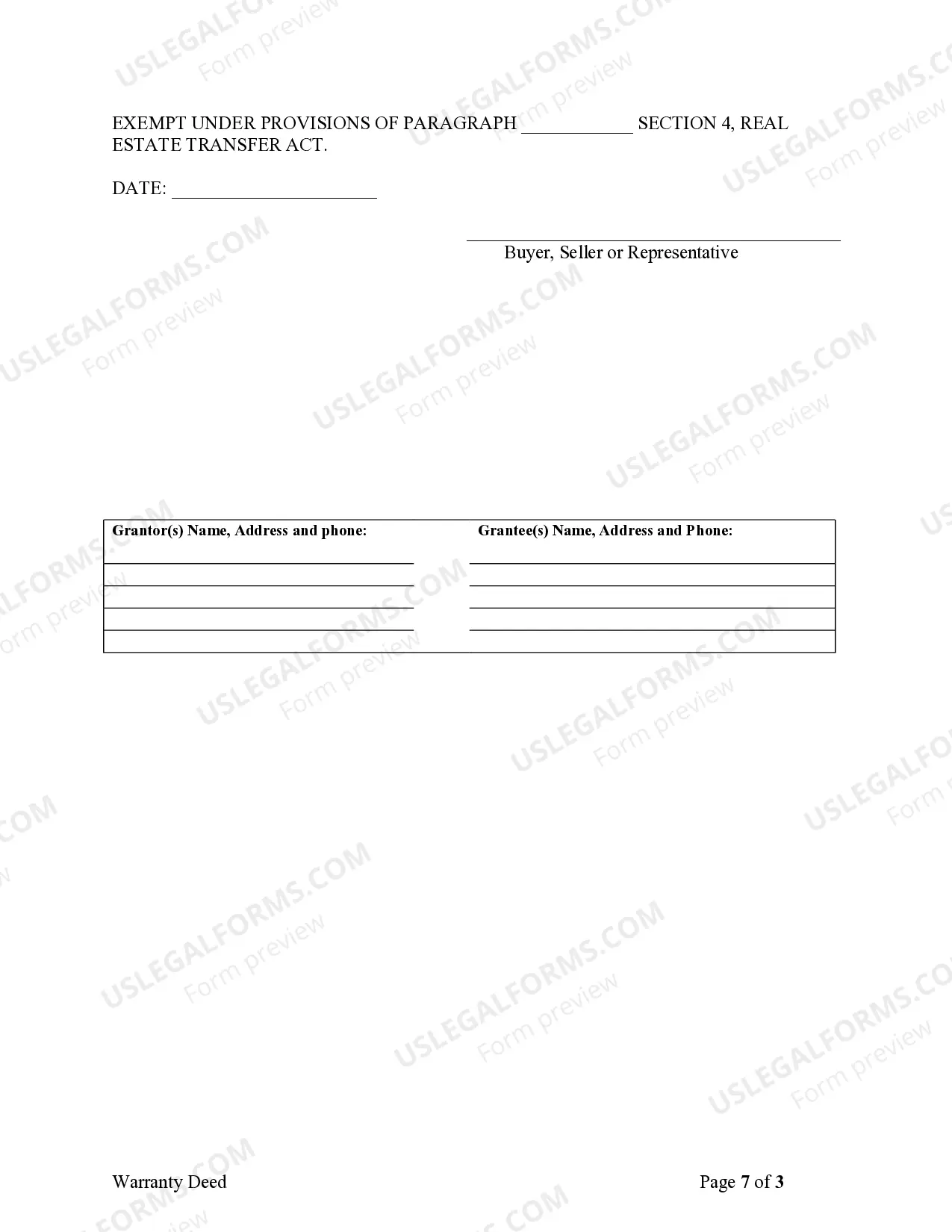

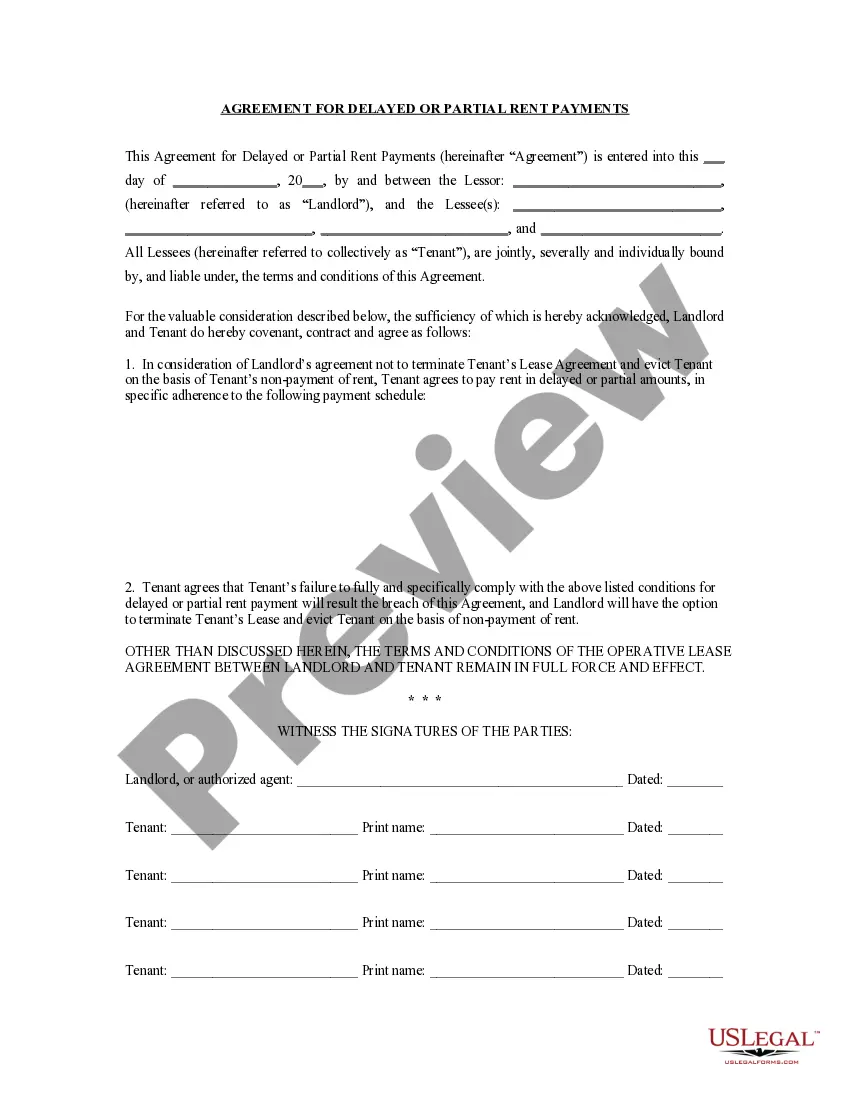

A trustee deed offers no such warranties about the title.

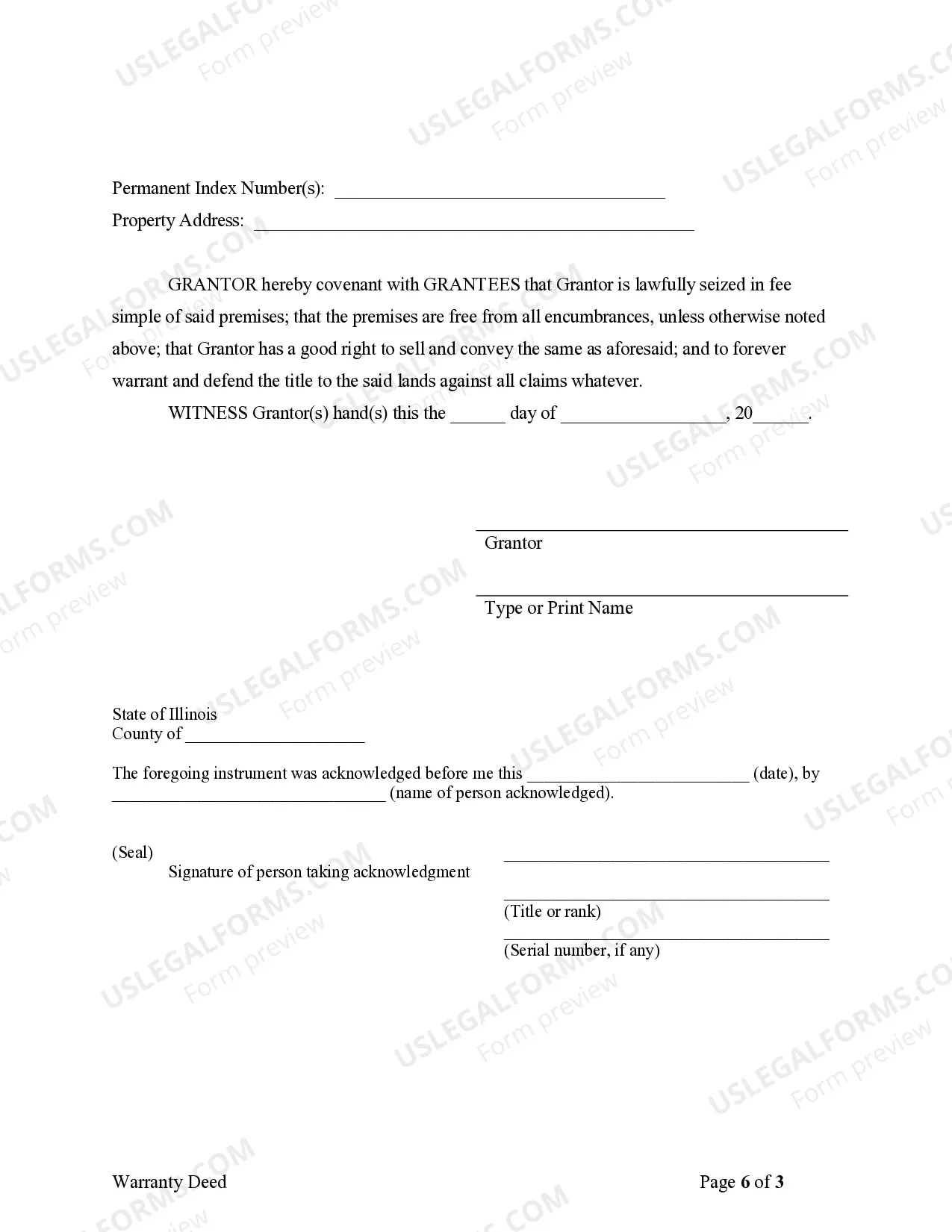

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Warranty Deed Vs Deed of Trust. Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another.As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

In Illinois, a special warranty deed transfers title in fee simple to the grantee with warranties and covenants of title that are limited to only the acts of the grantor or that result from the acts of the grantor and is the form of deed customarily used in commercial real estate transactions.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

In Illinois, a trustee's deed is used to transfer real property out of a trust.The trustee's deed establishes basic information about the trust, such as the name and date of the trust document. The trustee serves as the grantor in the deed, and transfers the title into the grantee's name.