Indiana Quitclaim Deed from Corporation to Corporation

Overview of this form

The Quitclaim Deed from Corporation to Corporation is a legal document used to transfer ownership of property between two corporations. Unlike other deeds, a quitclaim deed does not guarantee the grantor's title to the property, making it crucial for situations where ownership history is not fully clear. This form is particularly useful in corporate transactions where companies need to assign property rights without extensive title warranties.

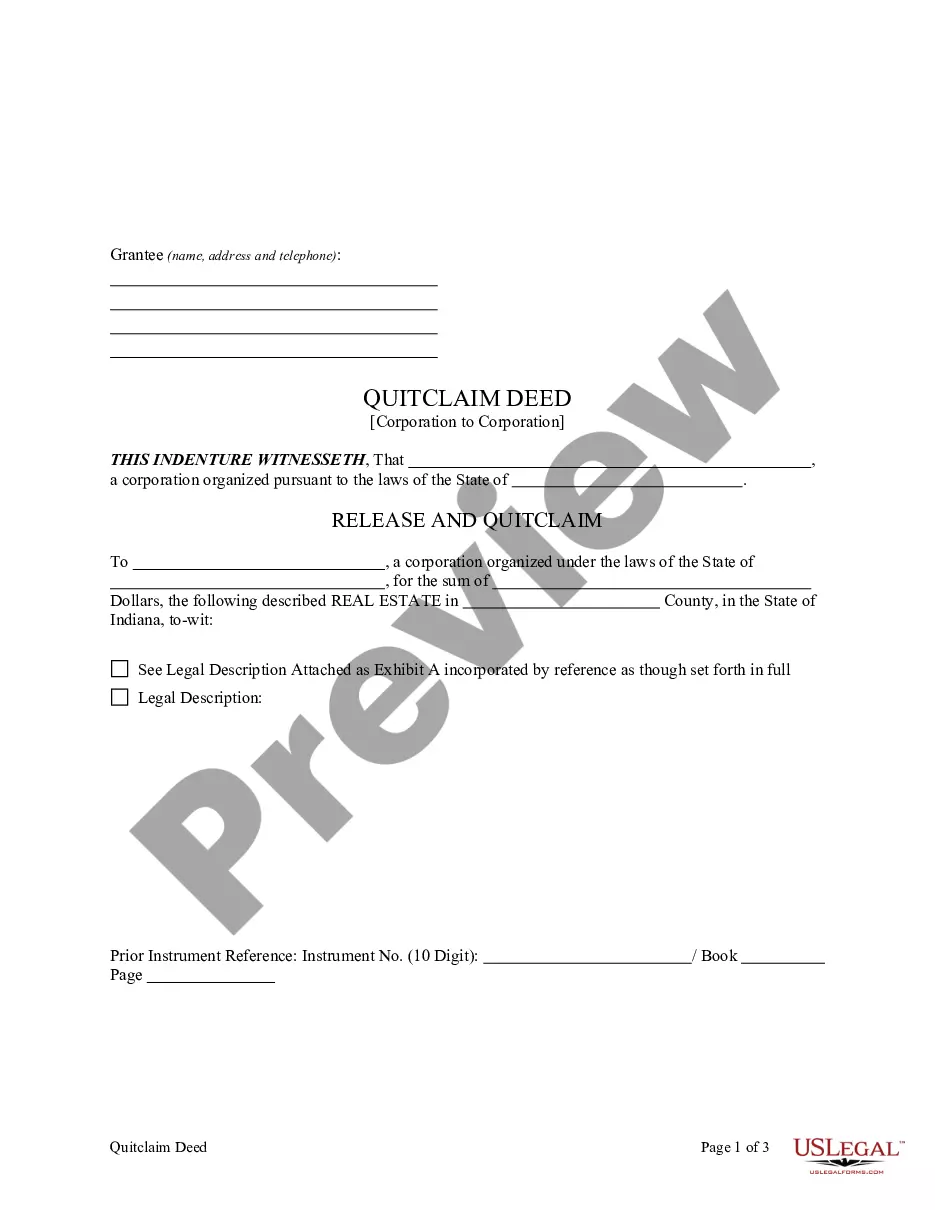

Main sections of this form

- Grantor and Grantee Identification: Details about the transferring corporation and the receiving corporation.

- Legal Description of Property: A precise description of the property being transferred.

- Consideration: The amount paid or the terms under which the property is transferred.

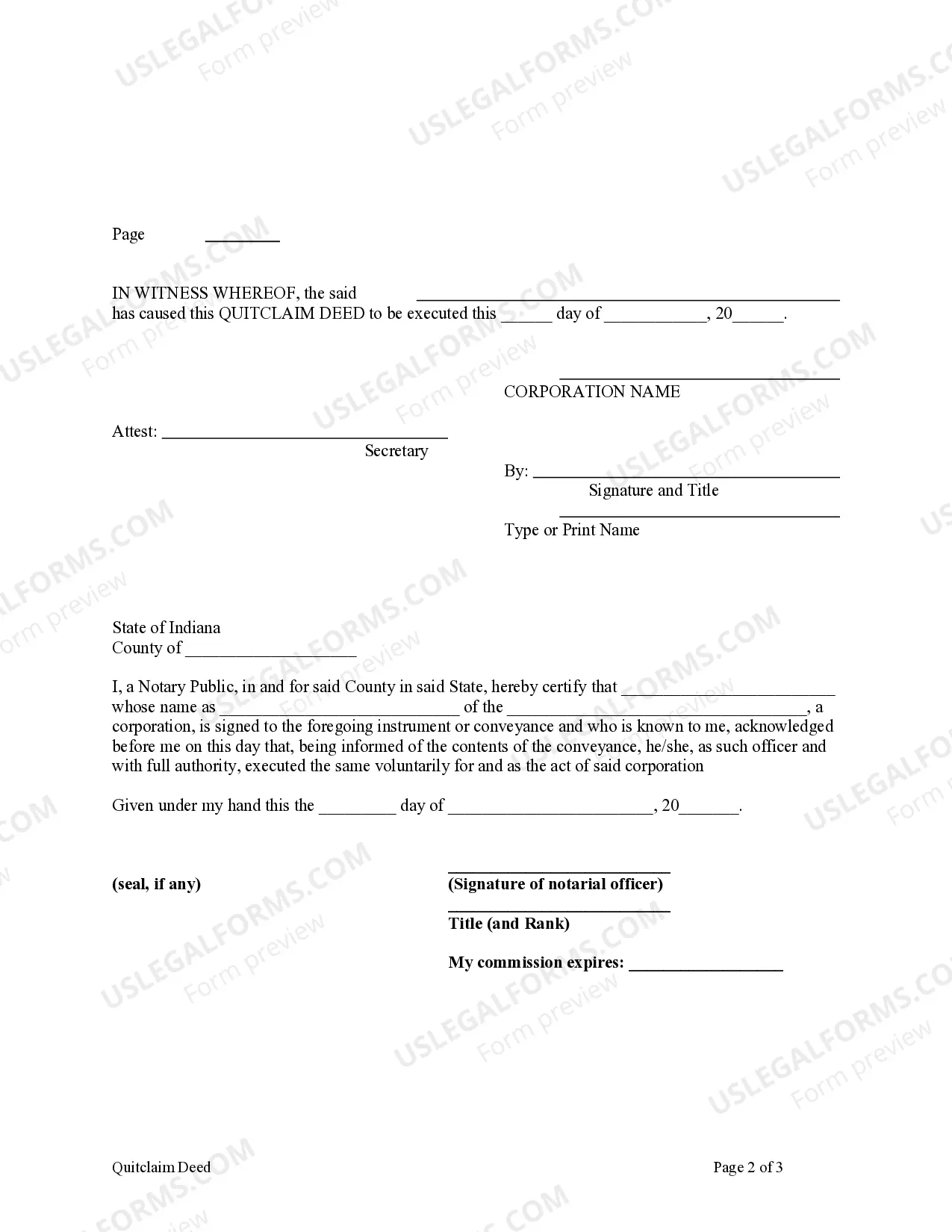

- Signatures: Authorized signatures from both corporations to validate the transfer.

- Date of Transfer: The date when the transfer of property becomes effective.

When to use this document

This form is commonly used when one corporation needs to relinquish its claim to a property and transfer any rights to another corporation. Examples include mergers, acquisitions, or when a corporation is reassigning its assets to a subsidiary or another affiliated company.

Intended users of this form

This form is suitable for:

- Corporations transferring property to another corporation.

- Business entities involved in real estate transactions.

- Corporate lawyers managing asset transfers.

How to prepare this document

- Identify the parties involved: Fill in the names of the selling corporation (grantor) and the purchasing corporation (grantee).

- Specify the property: Provide a detailed legal description of the property being transferred.

- Enter consideration: State the amount or terms under which the property is being conveyed.

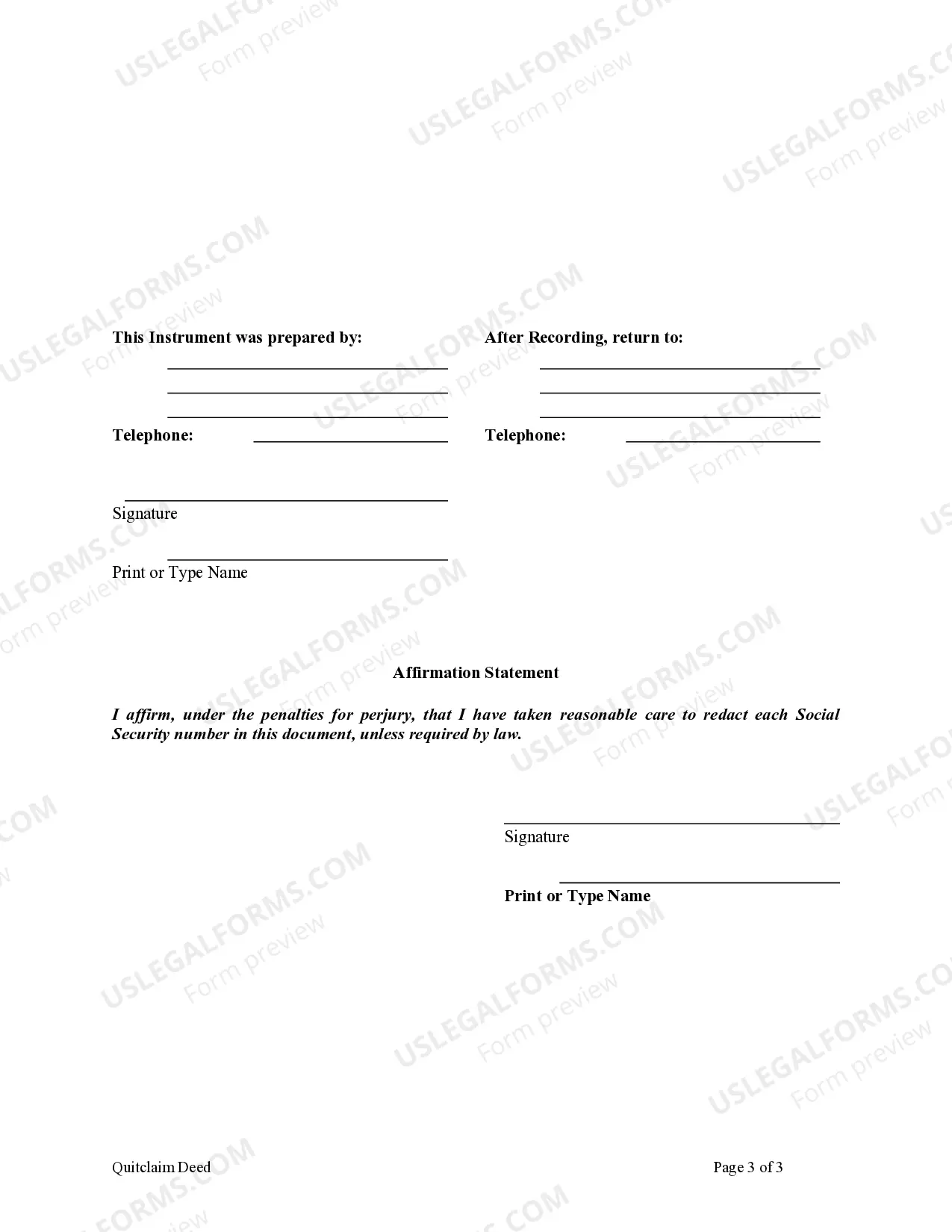

- Obtain signatures: Ensure that authorized representatives from both corporations sign the form.

- Record the date: Fill in the effective date of the transfer for legal documentation purposes.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Mistakes to watch out for

- Failing to provide accurate legal descriptions of the property, leading to disputes.

- Not obtaining proper signatures from authorized individuals.

- Leaving out the consideration amount or terms, which may affect legality.

Benefits of completing this form online

- Convenient access: Download the form easily from anywhere at any time.

- Editability: Customize the form to fit your specific transaction needs.

- Reliability: Forms are developed by licensed attorneys, ensuring legal validity.

Main things to remember

- The Quitclaim Deed facilitates property transfer between corporations without title warranties.

- Correctly completing all sections is vital to avoid legal complications.

- Ensure to understand local laws regarding notarization and property transfers.

Form popularity

FAQ

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Step 1: Find your IN quitclaim deed form. Step 2: Gather the information you need. Step 3: Enter the information about the parties. Step 4: Enter the legal description of the property. Step 5: Have the grantor sign the document in the presence of a Notary Public.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.