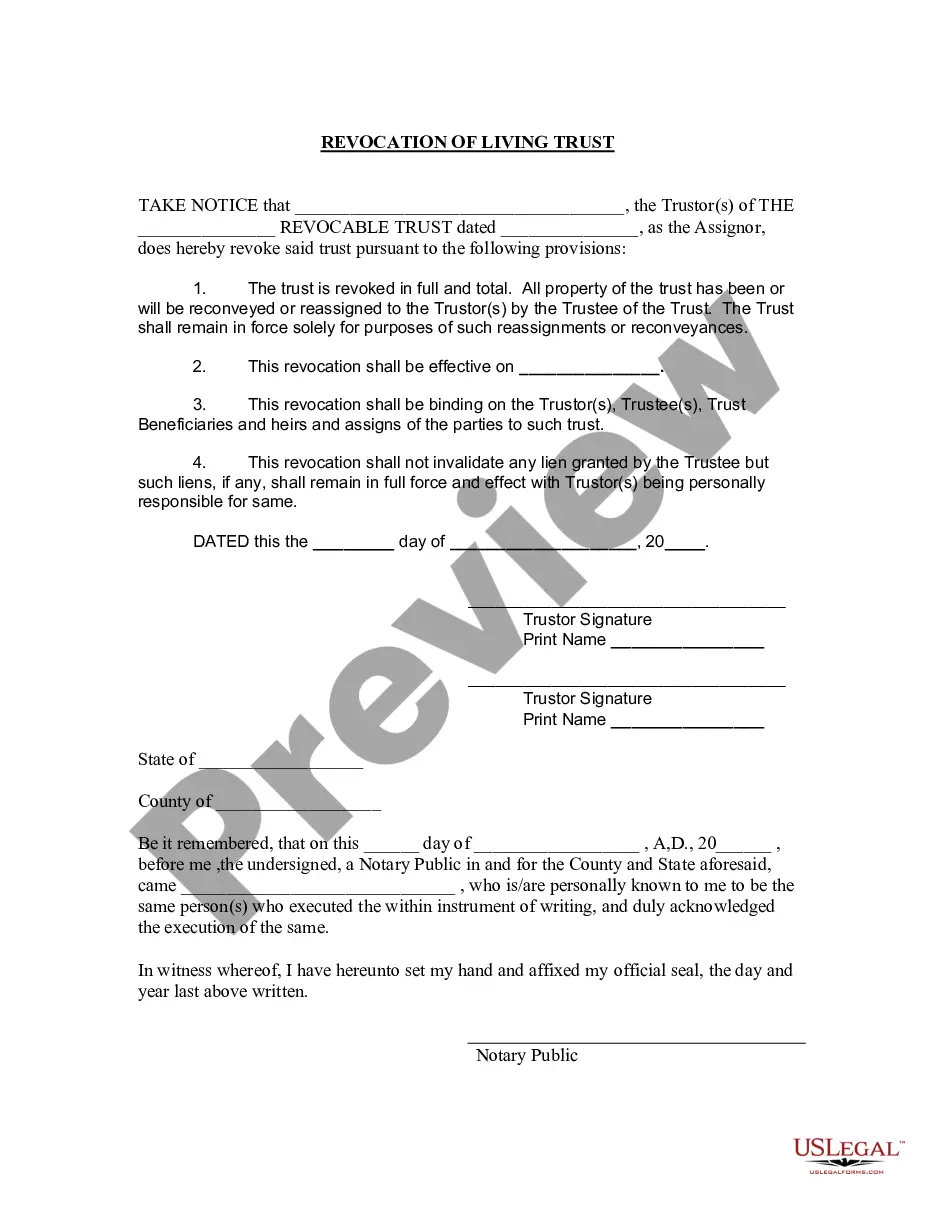

Kansas Revocation of Living Trust

Description

How to fill out Kansas Revocation Of Living Trust?

- If you have used US Legal Forms previously, log in to your account to access your documents easily. Make sure your subscription is active; renew it if necessary.

- For new users, start by checking the Preview mode and form descriptions to confirm you’ve selected the correct document that fulfills your requirements.

- If any discrepancies arise, utilize the Search feature to find the appropriate template before proceeding.

- Click on the Buy Now button to choose your preferred subscription plan and create an account to access the extensive library.

- Complete your purchase using your credit card or PayPal for a quick, secure transaction.

- Download your form directly to your device and access it anytime through the My Forms menu for future needs.

US Legal Forms stands out with its robust collection of legal documents, offering more options than competitors at a similar cost. With over 85,000 fillable and editable legal forms, users can find what they need efficiently.

Experience the convenience and legal assurance that comes with using US Legal Forms to manage your Kansas Revocation of Living Trust. Start accessing your necessary documents today!

Form popularity

FAQ

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.Such documents, often called a trust revocation declaration or revocation of living trust," can be downloaded from legal websites; local probate courts may also provide copies of them.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Dissolving irrevocable trusts if you're a beneficiary or trustee. State trust law may also permit a trust beneficiary or trustee to petition the court if they want to dissolve (or amend) the trust. The court may grant approval based on reasons cited above.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.