Kentucky Informal Adjustment Agreement and Order is a document that is used to resolve tax disputes between the taxpayer and the Kentucky Department of Revenue. This document outlines the agreement between the taxpayer and the department regarding the resolution of the dispute. Typically, the agreement includes information such as the amount of taxes owed, the payment plan for the taxes, and the terms of the agreement. There are three types of Kentucky Informal Adjustment Agreement and Order: 1) Installment Agreement, 2) Lump Sum Agreement, and 3) Compromise Agreement. An Installment Agreement allows the taxpayer to pay their taxes over a period of time. A Lump Sum Agreement requires the taxpayer to pay the full amount of taxes owed in one lump sum. A Compromise Agreement is used when the taxpayer and the department are unable to agree on the amount of taxes owed and are willing to compromise on the amount.

Kentucky Informal Adjustment Agreement and Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Informal Adjustment Agreement And Order?

How much time and resources do you frequently allocate to drafting formal documentation.

There’s a greater chance to obtain such forms than hiring legal professionals or spending hours searching the web for an appropriate template. US Legal Forms is the premier online repository that offers expertly crafted and validated state-specific legal documents for any purpose, like the Kentucky Informal Adjustment Agreement and Order.

Another benefit of our service is that you can access previously obtained documents that you safely store in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most dependable web services. Join us now!

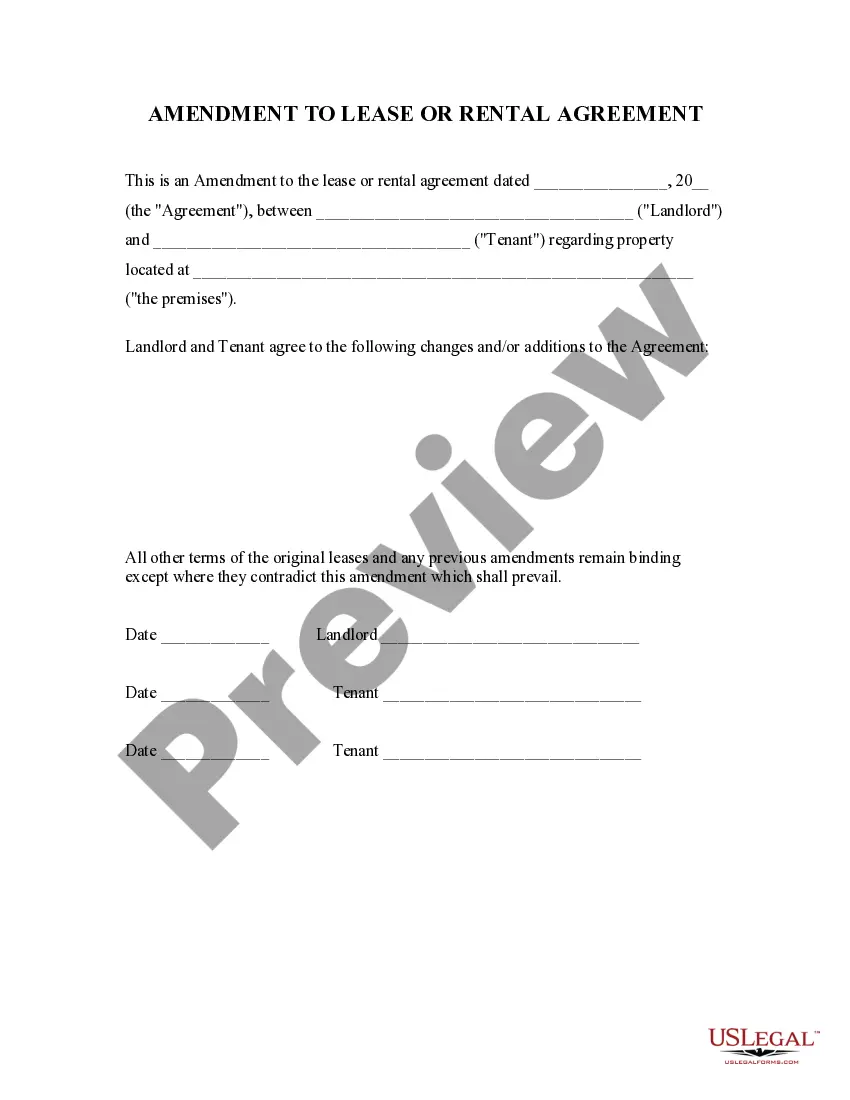

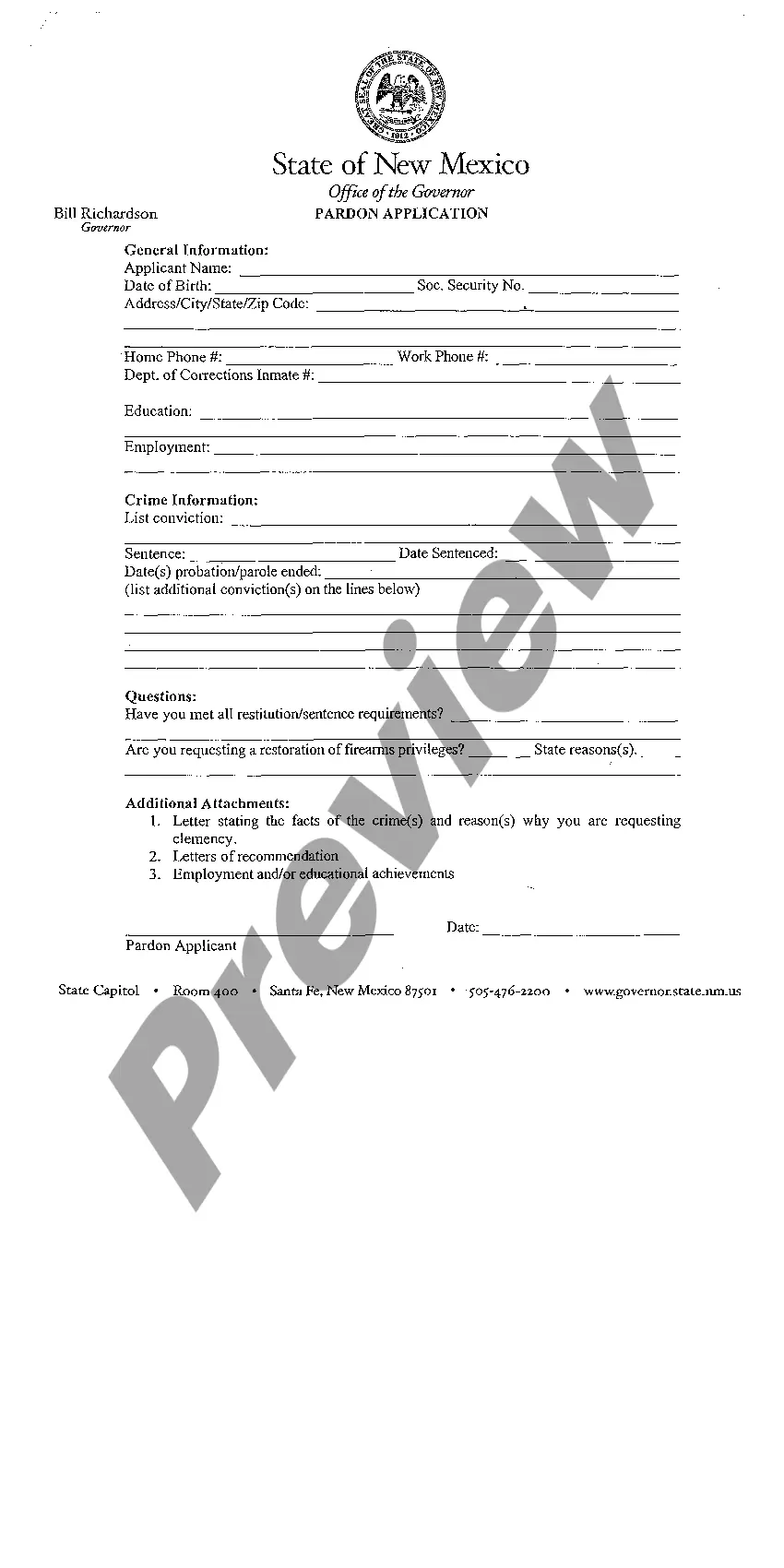

- Review the form content to ensure it meets your state requirements. To do this, examine the form description or use the Preview option.

- If your legal template does not fulfill your requirements, find another one using the search bar at the top of the page.

- If you are already registered with us, Log In and download the Kentucky Informal Adjustment Agreement and Order. If not, move on to the next steps.

- Click Buy now once you locate the correct template. Choose the subscription plan that fits you best to access the full offerings of our library.

- Sign up for an account and pay for your subscription. You can complete your payment using your credit card or via PayPal - our service is completely secure for that.

- Download your Kentucky Informal Adjustment Agreement and Order to your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

An informal adjustment hearing is conducted by a Deputy Juvenile Officer (a ?JDO?). If you've received a notice for an informal adjustment hearing, what you have been charged with is not likely to be serious. They are common in cases of school truancy, where children runaway or break curfew or some other minor offense.

The Informal Adjustment/Prevention Plan (hereafter referred to as IA) is a written agreement that is filed with the court, which outlines the steps the parent, guardian, or custodian must complete to ensure the safety and well-being of the child.

?Informal adjustment? means the child has admitted committing the offense and agreed to the terms of behavior set out in a written informal adjustment agreement with the juvenile court officer (JCO).

The Indiana Department of Child Services (DCS) will make assessment findings no later than 40 days from the date the Preliminary Report of Alleged Child Abuse or Neglect (SF 114) (310) was received.

?Informal adjustment? means the child has admitted committing the offense and agreed to the terms of behavior set out in a written informal adjustment agreement with the juvenile court officer (JCO).

Informal adjustment alternatives are counseling and adjustment, counseling and advisement, referral to counseling and individualized agreements that may include mediation.

DCS defines exigent circumstances as situations that would cause a reasonable person to believe that a timely interview with the child is necessary due to concerns for the child's well- being and safety, and that seeking parental, guardian, or custodian consent first may cause harm to the child or place the child at