Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

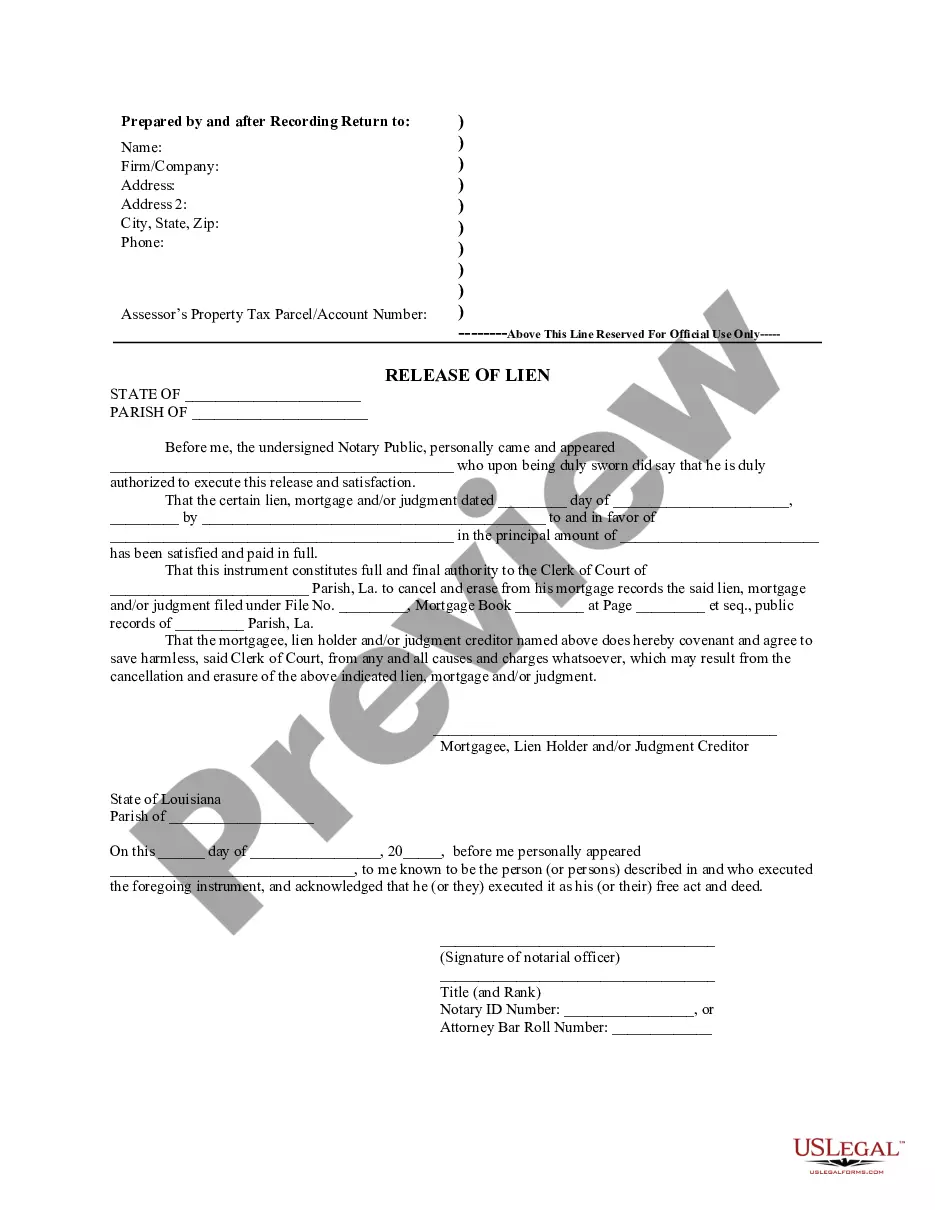

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Louisiana Law

Assignment: It is recommended that an assignment be in writing and recorded immediately.

Demand to Satisfy: Upon full payoff, mortgagor may make written request to mortgagee to produce the satisfied promissory note or an instrument of release in a form sufficient to bring about the cancellation of the inscription of the recorded mortgage to the mortgagor, whereupon mortgagee must do so within 30 days (60 days if domiciled outside of Louisiana) or suffer liability.

Recording Satisfaction: The recorder of mortgages for the parish of Orleans, and the clerk of court and ex-officio recorder of mortgages of any other parish of the state, shall cancel from the records of his office the inscription of a mortgage upon presentation to him by the debtor thereunder of the original note or sufficient reproduction thereof. (See below, sec. 9:5167)

Marginal Satisfaction: The recorder cancells the mortgage by certification written upon the note.

Penalty: If mortgagee fails to timely comply with written demand for satisfaction as described above (see, Demand to Satisfy), mortgagee is liable for all damages and costs resulting from said failure, including reasonable attorney fees.

Acknowledgment: An assignment or satisfaction must contain a proper Louisiana acknowledgment, or other acknowledgment approved by Statute.

Louisiana Statutes

9:5167.Cancellation of mortgage or vendor's privilege by affidavit of notary or title insurer where paraphed note or other evidence is lost or destroyed

A.(1) When a promissory note paraphed for identification with a mortgage or act creating a vendor's privilege on immovable property has been lost or destroyed after receipt by the notary public who satisfied the promissory note out of the proceeds of an act of sale or mortgage executed before him, or with funds given to him for that purpose, the clerk of court or recorder of mortgages may cancel the mortgage or vendor's privilege upon receipt of an affidavit from the notary public. The affidavit shall set forth all of the following:

(a) The name of the mortgagor or obligor of the privilege as it appears in the recorded mortgage or vendor's privilege and recordation information.

(b) A description of the paraphed promissory note and the property.

(c) A statement that the affiant or someone under his direction did satisfy the promissory note.

(d) That the affiant or someone under his direction:

(i) Received the note marked "Paid in Full" from the last holder of the note, and that the note was lost or destroyed while in the affiant's custody; or

(ii) Has confirmed that the last holder of the paraphed note received payment in full and sent the note and the note was never received.

(e) That the affiant agrees to be personally liable to and indemnify the recorder of mortgages and any person relying upon the cancellation by affidavit for any damages that they may suffer as a consequence of such reliance if the recorded affidavit contains materially false or incorrect statements that cause the recorder to incorrectly cancel the recordation of a mortgage or privilege.

(f) A statement that the affiant has made a due and diligent search for the note, the note cannot be located, and sixty days have elapsed since payment or satisfaction of the note.

(2) No mandamus proceeding is required to use the provisions of this Subsection.

(3) A person who signed an affidavit that is provided to the recorder of mortgages pursuant to this Subsection and that contains materially false or incorrect statements causing the recorder to incorrectly cancel the recordation of a mortgage or privilege is liable to and shall indemnify the recorder and any person relying upon the cancellation for any damages that they may suffer as a consequence of such reliance.

(4) The recorder of mortgages shall not be liable for any damages resulting to any person or entity as a consequence of canceling a mortgage or vendor's privilege pursuant to an affidavit which complies with this Subsection.

B.(1) When a paraphed promissory note or other evidence sufficient to cause a cancellation of a mortgage or vendor's privilege is lost or destroyed, and all obligations secured by the mortgage or vendor's privilege have been satisfied, the recorder of mortgages shall cancel the mortgage or vendor's privilege upon receipt of an affidavit from an officer of a licensed title insurer that has issued or issues a title insurance policy covering the immovable property encumbered by the mortgage or vendor's privilege. The affidavit shall set forth all of the following:

(a) A description of the instrument that was lost or destroyed and an affirmative statement that the instrument has been lost or destroyed.

(b) The name of the mortgagor or obligor of the privilege as it appears in the recorded mortgage or vendor's privilege, and recordation number or other appropriate recordation information.

(c) A statement that all obligations secured by the mortgage or vendor's privilege have been satisfied.

(d) A declaration that the title insurer agrees to be liable to and indemnify the recorder of mortgages and any person relying upon the cancellation by affidavit for any damages that they may suffer as a consequence of such reliance if the recorded affidavit contains materially false or incorrect statements that cause the recorder to incorrectly cancel the recordation of a mortgage or privilege.

(e) A statement that the affiant has made a due and diligent search for the lost or destroyed instrument, the lost or destroyed instrument cannot be located, and sixty days have elapsed since payment or satisfaction of the secured obligation.

(2) No mandamus proceeding is required to use the provisions of this Subsection.

(3) A title insurer whose officer has signed an affidavit that is provided to the recorder of mortgages pursuant to this Subsection and that contains materially false or incorrect statements causing the recorder to incorrectly cancel the recordation of a mortgage or privilege is liable to and shall indemnify the recorder and any person relying upon the cancellation for any damages that they may suffer as a consequence of such reliance.

(4) The recorder of mortgages shall not be liable for any damages resulting to any person or entity as a consequence of canceling a mortgage or vendor’s privilege pursuant to an affidavit which complies with this Subsection.

Acts 1988, No. 986, §1; Acts 2005, No. 169, §8, eff. July 1, 2006; Acts 2005, 1st Ex. Sess., No. 13, §1, eff. Nov. 29, 2005; Acts 2007, No. 337, §1.

5167.1. Cancellation of mortgage inscription by affidavit; penalties

A. A mortgagee shall execute and deliver sufficient acceptable documentation, as required by the clerk of court and ex officio recorder of mortgages for the cancellation of a mortgage, to the mortgagor or the mortgagor’s designated agent within sixty days after the date of receipt of full payment of the balance owed on the debt secured by the mortgage in accordance with a payoff statement. The payoff statement shall be furnished by the mortgagee or its mortgage servicer. If the mortgagee fails to execute and deliver acceptable documentation, an authorized officer of a title insurance business, the closing notary public, or the notary public for the person or entity which made the payment may, on behalf of the mortgagor or an owner of the property encumbered by the mortgage, execute an affidavit that complies with the requirements of this Section and record the affidavit in the mortgage records of each parish in which the mortgage was recorded.

B. An affidavit executed under this Section shall state that:

(1) The affiant is an authorized officer of a title insurance business, the closing notary public, or the attorney for the person or entity which made the payment.

(2) The affidavit is made on behalf of the mortgagor or an owner of the property encumbered by the mortgage.

(3) The mortgagee provided a payoff statement with respect to the loan secured by the mortgage.

(4) The affiant has ascertained that the mortgagee has received payment of the loan secured by the mortgage in accordance with the payoff statement, as evidenced by:

(a) A bank check, certified check, or escrow account check which has been negotiated by or on behalf of the mortgagee; or

(b) Other documentary evidence of the receipt of payment by the mortgagee, including but not limited to verification that the funds were wired to the mortgagee.

(5) More than sixty days have elapsed since the date payment was received by the mortgagee and the mortgagee has not returned documentary authorization for cancellation of the mortgage.

(6) The mortgagee has been given at least fifteen days notice in writing of the intention to execute and record an affidavit in accordance with this Section, with a copy of the proposed affidavit attached to the written notice.

C. The affidavit shall include the names of the mortgagor and the mortgagee, the date of the mortgage, and the book and page, or folio, or clerk’s file number of the immovable property records where the mortgage is recorded, together with similar information for a recorded assignment of the mortgage.

D. The affiant shall attach to the affidavit the documentary evidence that payment has been received by the mortgagee including a copy of the payoff statement. Evidence of payment may include a copy of the canceled check indicating endorsement by the mortgagee or other documentary evidence described in Subsection B.

E. An affidavit executed and recorded as provided by this Section shall constitute a release of and an authority to cancel the mortgage described in the affidavit. The clerk of court and ex officio recorder of mortgages may rely on the sworn statements contained within the affidavit and has no duty to traverse the contents thereof.

F. The clerk of court and ex officio recorder of mortgages shall index the affidavit in the names of the original mortgagee and the last assignee of the mortgage appearing of record as the grantors and in the name of the mortgagor as grantee, and shall cancel the inscription of the mortgage and assignments from the mortgage records.

G. The intentional falsification of information by the affiant in an affidavit filed in the office of the recorder of mortgages is subject to the provisions of R.S. 14:132, governing the crime of injuring public records. The affiant shall also be liable for any damages, attorney fees, and expenses occasioned by a fraudulently executed affidavit.

H. As used in this Section:

(1) Attorney for the person or entity making payment is an attorney licensed to practice law in this state who certifies in the affidavit that he is authorized to make the affidavit on behalf of the person or entity making payment.

(2) Closing shall have the same meaning as provided in R.S. 22:512(2) and (15).

(3) Closing notary public is the duly commissioned notary public who executes the required documents or performs notarial functions at the closing.

(4) Payoff statement is the statement of the following:

(a) The unpaid balance of a loan secured by a mortgage, including principal, interest, and other charges properly assessed under the loan documentation of the mortgage.

(b) The interest on a per diem basis for the unpaid balance.

(5) Title insurance business shall have the same meaning as provided in R.S. 22:512(17).

Acts 1999, No. 869, §1; Acts 2008, No. 415, §2, eff. Jan. 1, 2009.

9:5174.Liability for incorrect or false request for cancellation

A. Any person who requests the recorder to cancel recordation of a mortgage or privilege and who knows or should have known that an act or declaration that he provided to the recorder pursuant to this Title contains materially false or incorrect statements that cause the recorder to incorrectly cancel the recordation of a mortgage or privilege is personally liable to and shall indemnify the recorder and any person relying upon the cancellation for any damages suffered as a consequence of such reliance.

B. Any person signing any act or declaration that is presented to the recorder pursuant to this Title containing materially false or incorrect statements causing the recorder to incorrectly cancel the recordation of a mortgage or privilege is personally liable to and shall indemnify the recorder and any person relying upon the cancellation for any damages suffered as a consequence of such reliance.

C. Any person who knowingly provides or executes the materially false or incorrect statement is also guilty of false swearing under the provisions of R.S. 14:125.

Acts 2005, No. 169, §6, eff. July 1, 2006; Acts 2005, 1st Ex. Sess., No. 13, §1, eff. Nov. 29, 2005; Acts 2007, No. 337, §2; Redesignated from R.S. 44:110 by Acts 2010, No. 284, §1, eff. Jan. 1, 2011.

9:5385. Satisfaction of mortgage; production of promissory note or release for cancellation; liability

A. When the obligation secured by a mortgage has been fully satisfied, the mortgagee, the servicing agent, or any holder of the note shall, within thirty days of receipt of written demand by the person providing full satisfaction, produce the satisfied promissory note or an instrument of release in a form sufficient to bring about the cancellation of the inscription of the recorded mortgage to the person providing full satisfaction. However, if the note is held by a federal agency or instrumentality, or a federally sponsored or supported lender, or any nonoriginating secondary mortgage market lender domiciled outside the state of Louisiana, the holder of the note shall, within sixty days after receipt of notice of the satisfaction from the servicing agent, produce the satisfied promissory note or an instrument of release to the servicing agent.

B. If the mortgagee, the servicing agent, or any holder of the note fails to produce the satisfied promissory note or an instrument of release in a form sufficient to bring about cancellation of the mortgage within thirty days after receipt of written demand by the person providing full payment of the balance of the note, the mortgagee and the servicing agent or the mortgagee and any holder of the note shall be liable in solido to the person providing full satisfaction for all damages and costs resulting therefrom, including reasonable attorney fees. However, if the note is held by a federal agency or instrumentality, or a federally sponsored or supported lender, or any nonoriginating secondary mortgage market lender domiciled outside the state of Louisiana, the servicing agency shall, within thirty days of receipt of the satisfied promissory note or an instrument of release from the holder of the note, produce the note or instrument to the person providing full satisfaction.

C. For purposes of this Section, person shall include the mortgagor acting in his own behalf, or a notary public or any person, firm, or corporation acting in place of or on behalf of the mortgagor.

Acts 1986, No. 974, §1; Acts 1987, No. 705, §1; Acts 1992, No. 647, §1; Acts 1995, No. 1087, §3.