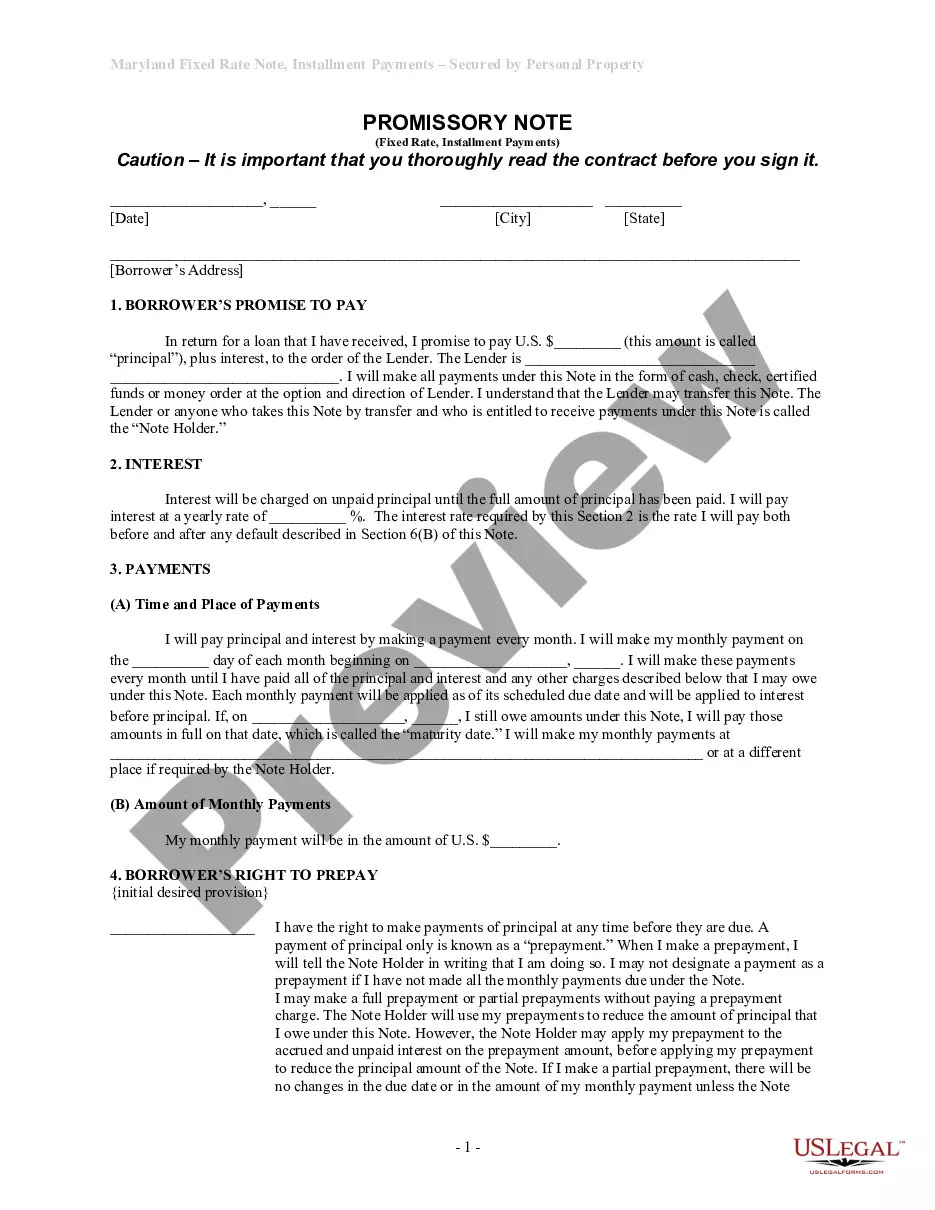

Maryland Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Personal Property?

Welcome to the greatest legal documents library, US Legal Forms. Here you can get any sample such as Maryland Installments Fixed Rate Promissory Note Secured by Personal Property forms and download them (as many of them as you want/need to have). Make official papers within a few hours, rather than days or even weeks, without having to spend an arm and a leg on an lawyer or attorney. Get your state-specific form in a couple of clicks and feel assured knowing that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Maryland Installments Fixed Rate Promissory Note Secured by Personal Property you need. Due to the fact US Legal Forms is web-based, you’ll always have access to your saved templates, no matter what device you’re using. See them within the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check out our guidelines listed below to get started:

- If this is a state-specific document, check out its applicability in the state where you live.

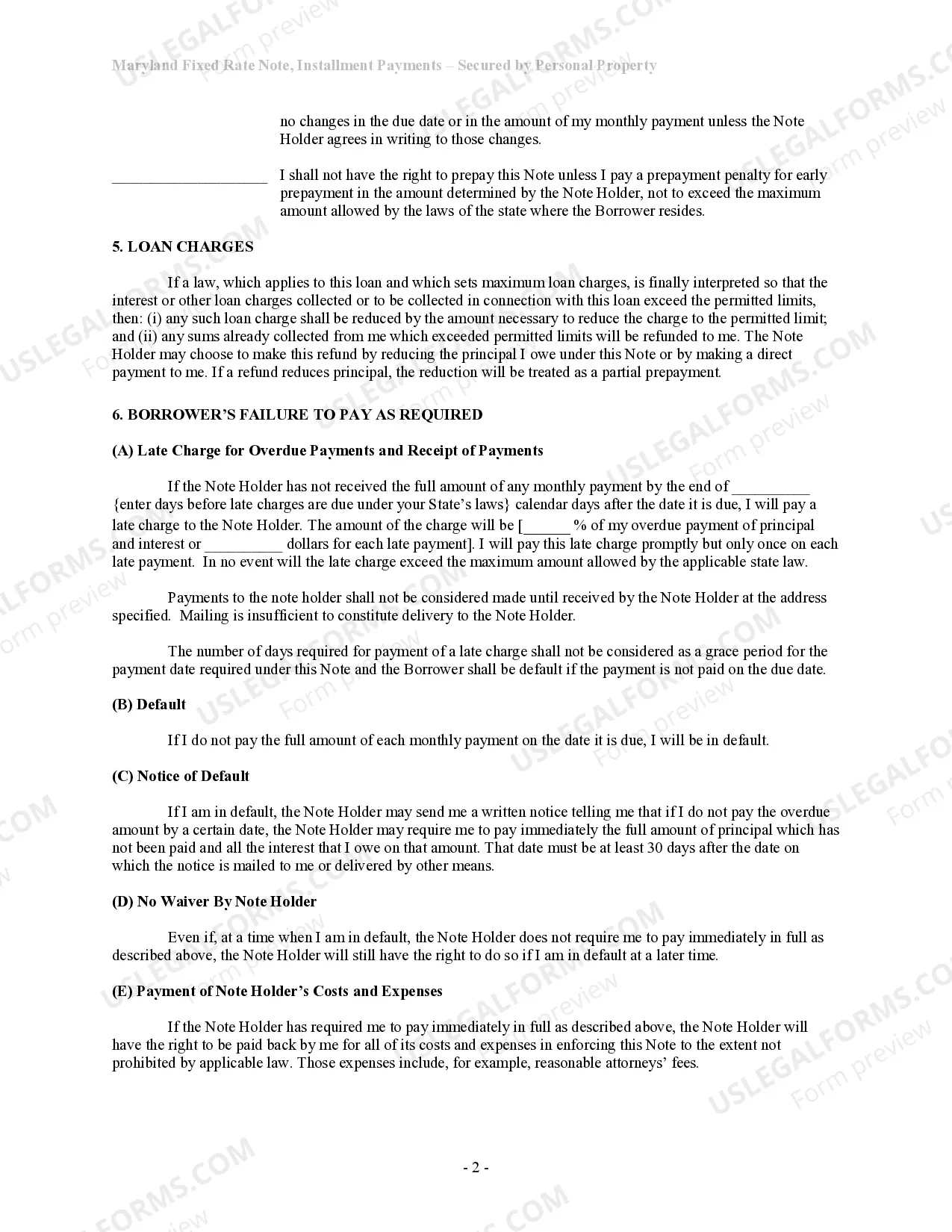

- See the description (if accessible) to understand if it’s the proper example.

- See much more content with the Preview feature.

- If the sample matches all your requirements, click Buy Now.

- To make an account, select a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the template in the format you need (Word or PDF).

- Print the document and fill it out with your/your business’s information.

Once you’ve filled out the Maryland Installments Fixed Rate Promissory Note Secured by Personal Property, send it to your legal professional for confirmation. It’s an additional step but an essential one for making sure you’re completely covered. Sign up for US Legal Forms now and access a large number of reusable samples.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Whether a promissory note is a security is one of the most vexatious issues in US securities laws.In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.