Michigan Dissolution Package to Dissolve Limited Liability Company LLC

Description Limited Liability Llc

How to fill out Michigan Llc Dissolution?

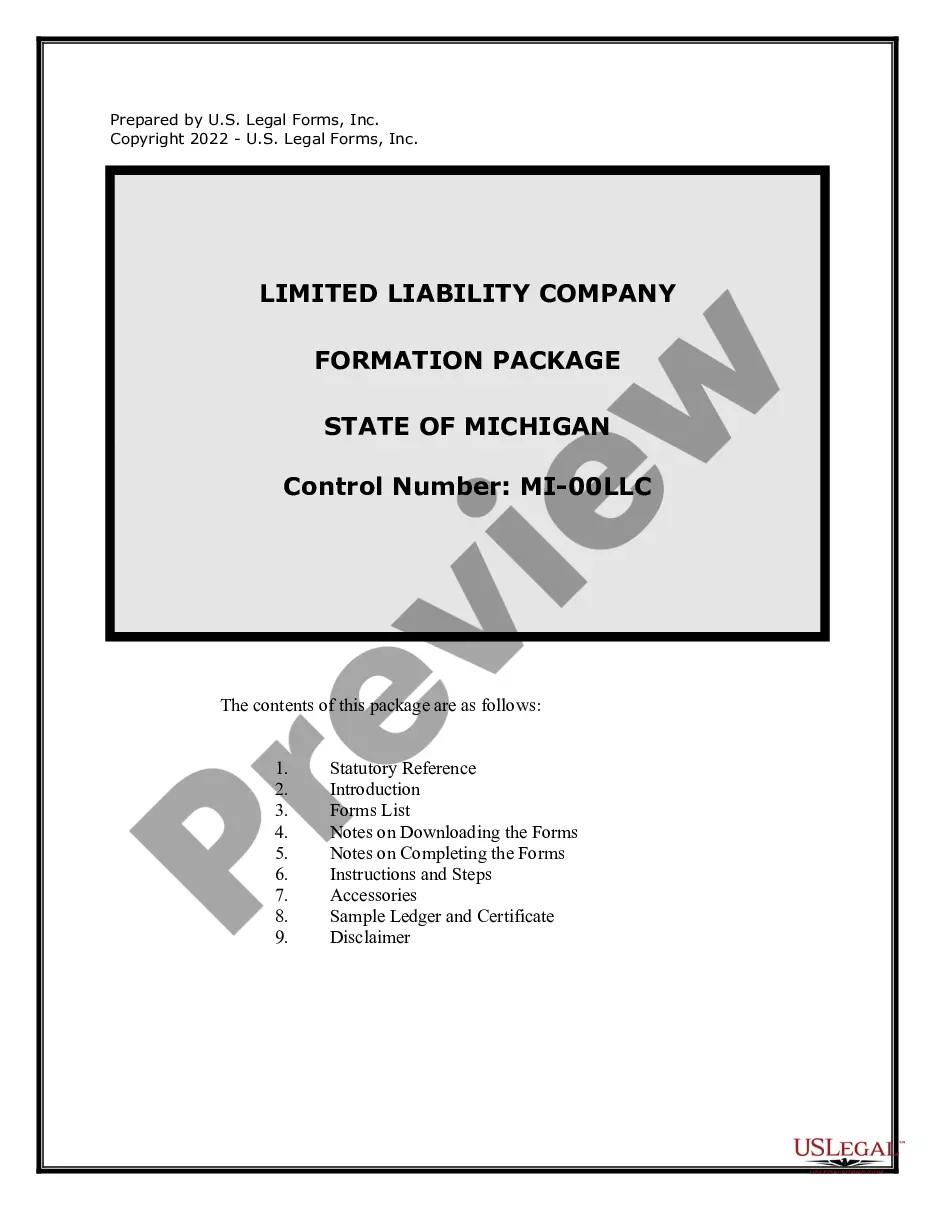

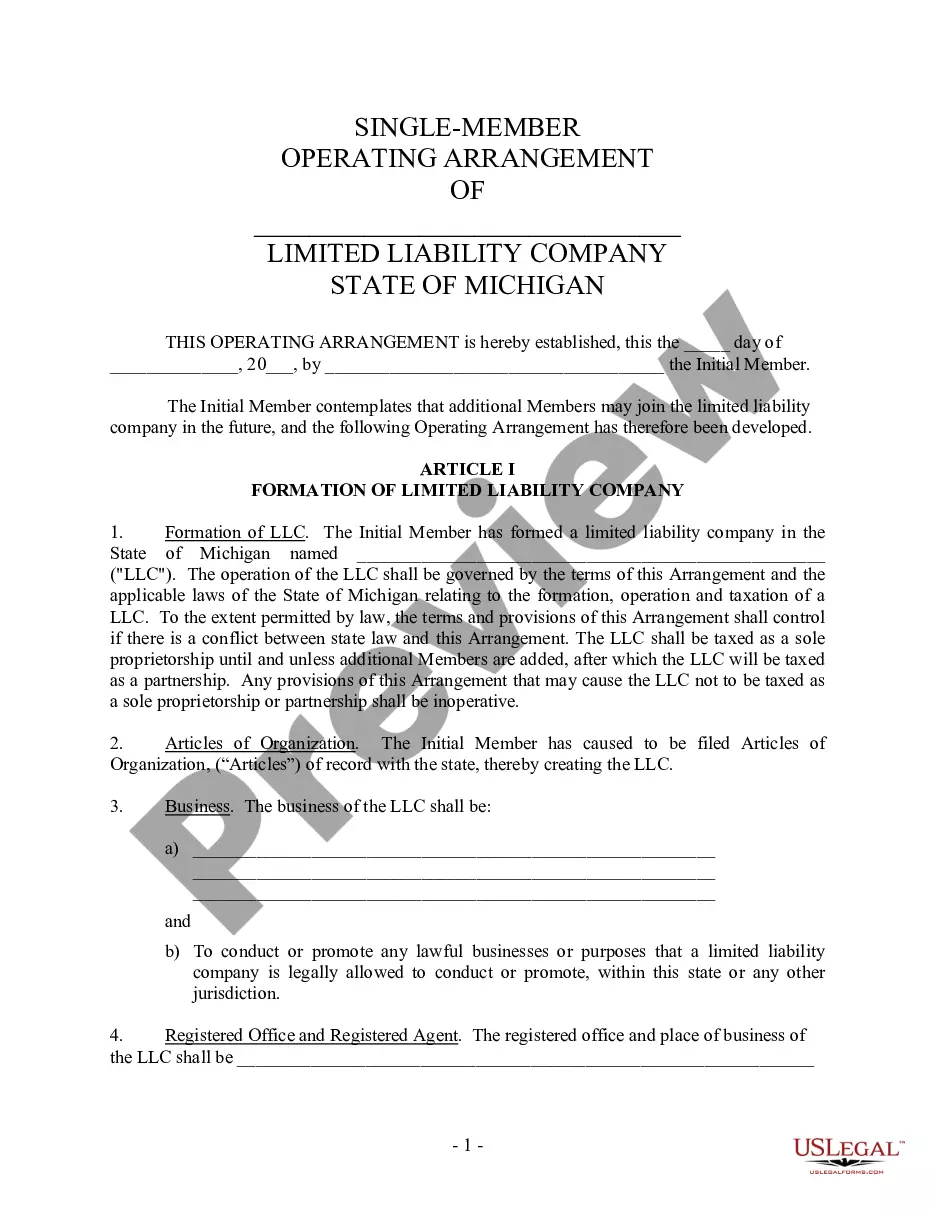

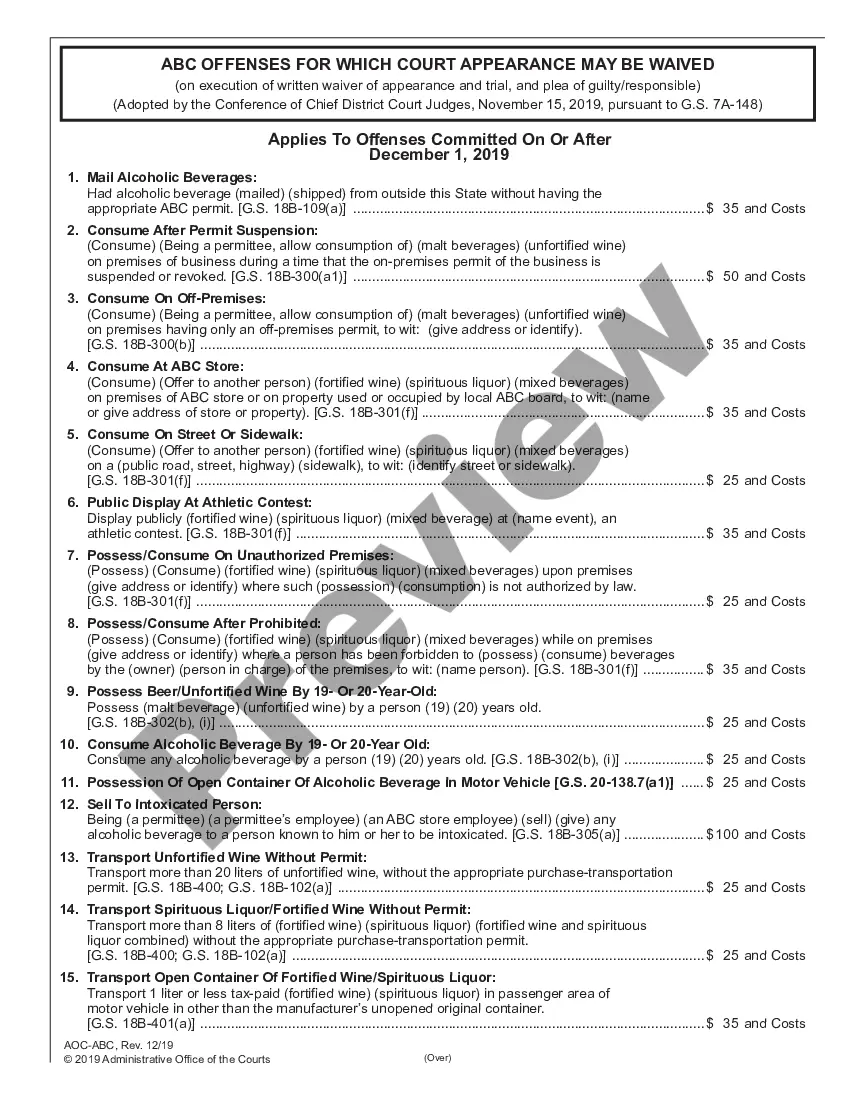

Get any template from 85,000 legal documents such as Michigan Dissolution Package to Dissolve Limited Liability Company LLC online with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you already have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Dissolution Package to Dissolve Limited Liability Company LLC you would like to use.

- Read description and preview the template.

- Once you are sure the template is what you need, click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The service provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Michigan Dissolution Package to Dissolve Limited Liability Company LLC easy and fast.

Dissolve Llc Michigan Form popularity

Michigan Dissolve Llc Other Form Names

Michigan Dissolution Llc Form FAQ

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

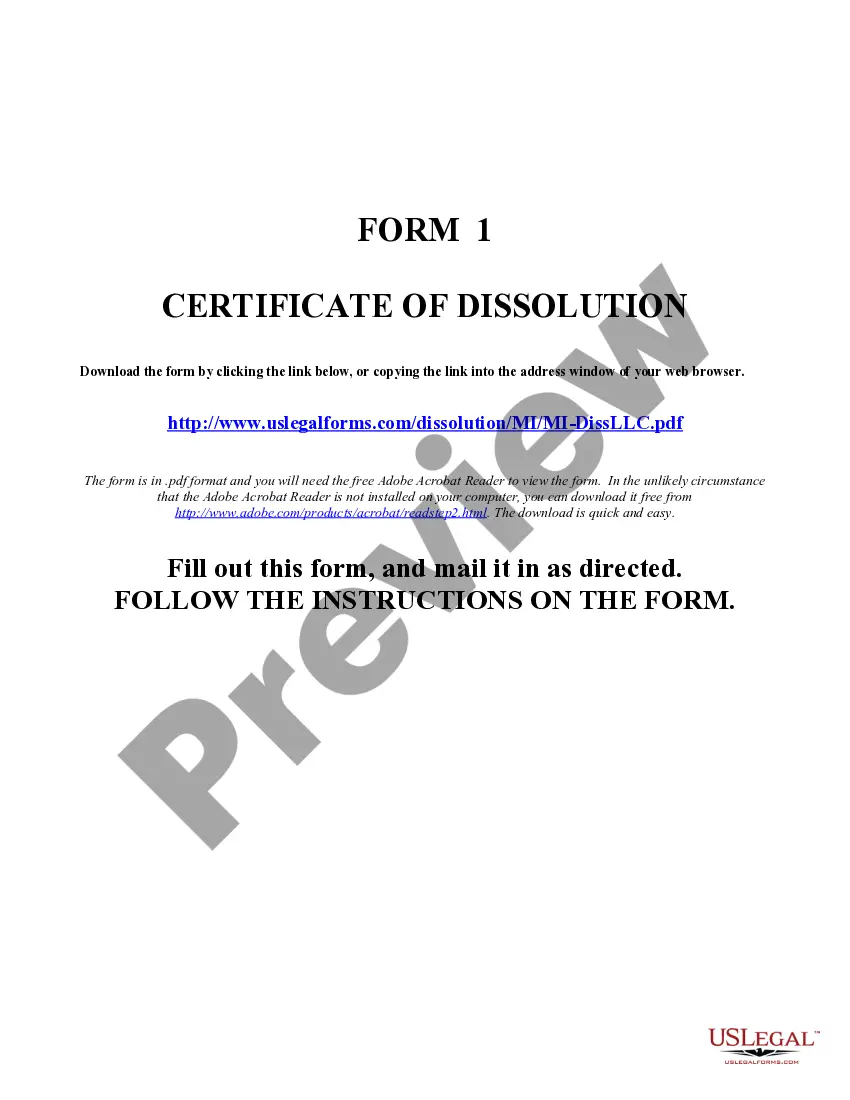

The dissolution is effected by executing and filing a Certificate of Dissolution (form CSCL/CD-531) on behalf of the corporation with the Corporations Division. The certificate must state the name of the corporation and that the corporation is dissolved pursuant to an agreement under section 488.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

The power of the Secretary of State, however, is broad, and in many states, an LLC can be dissolved for nearly any reason the Secretary deems fit. Voluntary dissolution is the result of members willingly choosing to close their business.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

All Michigan nonprofit organizations must obtain a letter from the Attorney General in order to file a Certificate of Dissolution with the Department of Licensing and Regulatory Affairs (LARA), Corporations Division.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

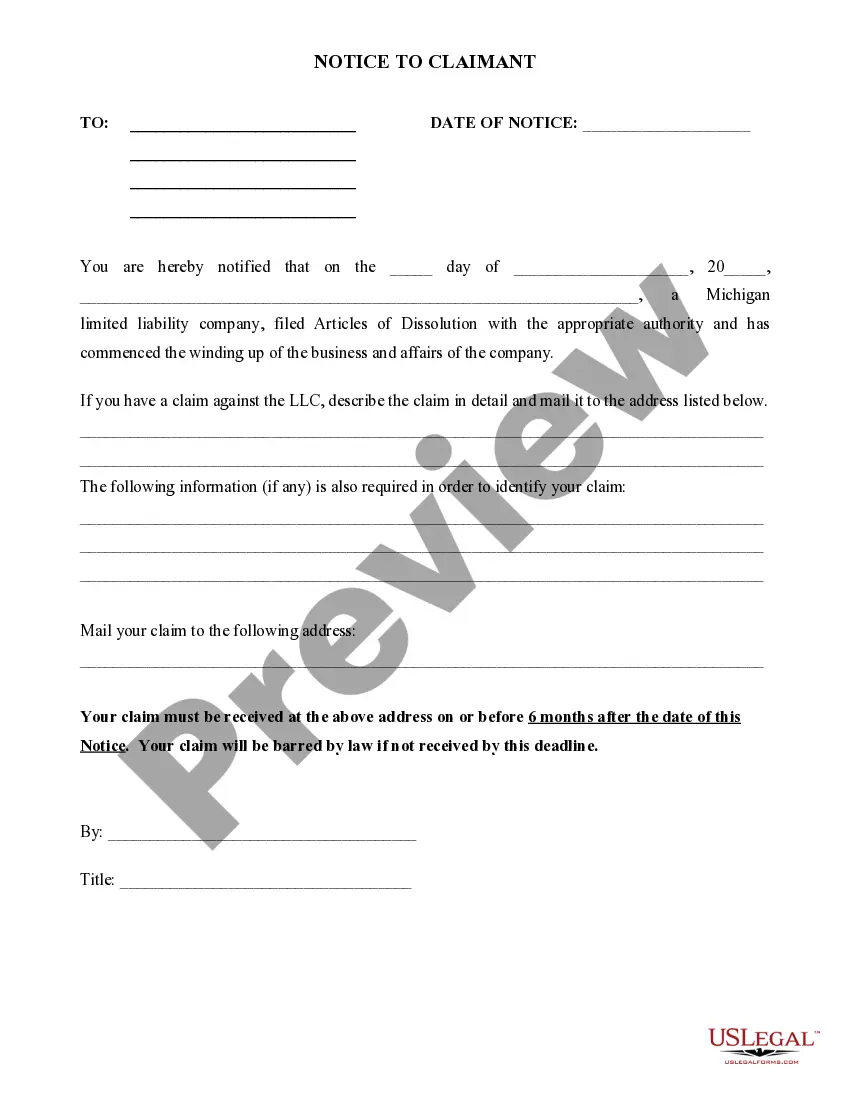

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.