Minnesota Quitclaim Deed from Individual to Individual

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument used to transfer an owner's interest in property from one person to another, without any warranties of ownership. Typically used between family members or within personal relationships where the level of trust is high.

Step-by-Step Guide on How to Use a Quitclaim Deed from Individual to Individual

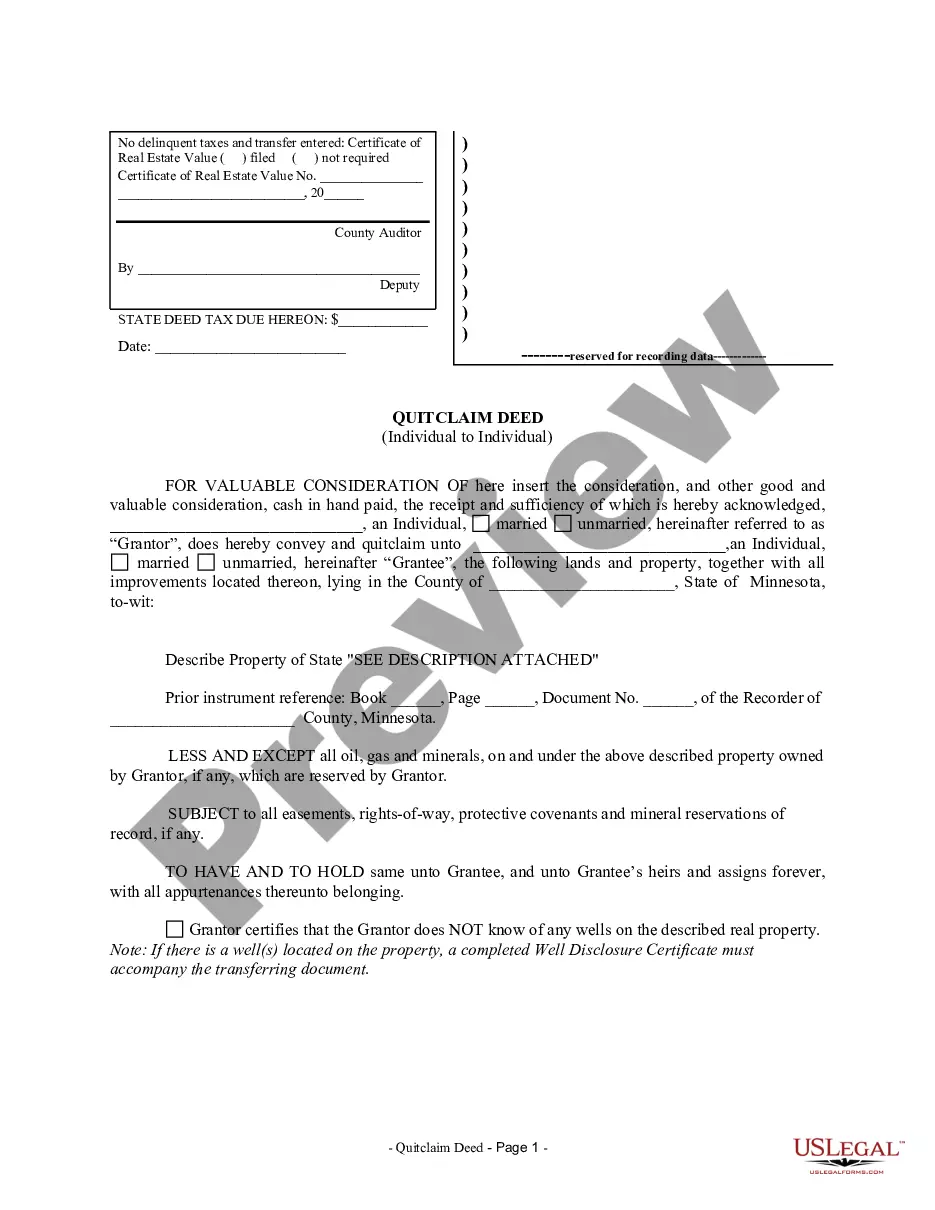

- Prepare the Quitclaim Deed Form: Start by obtaining a quitclaim deed form specific to your state or region in the United States. This form requires the legal description of the property, which includes the boundary lines, any easements, and other significant details.

- Fill Out the Form: Complete the form with the correct legal names of the grantor (current owner) and the grantee (new owner), along with the legal description of the property. Ensure all details align with property tax records.

- Signature and Notarization: Both parties sign the deed in the presence of a notary public to validate the identities of the parties involved.

- File the Quitclaim Deed: File the signed deed with the local county recorder or land registry office to make the transfer official. This may require a filing fee.

- Update Property Tax Records: Notify the local property tax office of the change in ownership to ensure the property tax bills are sent to the new owner.

Risk Analysis

Using a quitclaim deed involves certain risks such as no guarantee of a clear title, potential issues with future sales of the property, and possible disputes over property ownership. It's advisable for individuals to conduct thorough due diligence and possibly engage legal assistance before proceeding.

Common Mistakes & How to Avoid Them

- Inaccurate Legal Descriptions: Ensure the legal description on the quitclaim deed exactly matches the one in the property's current deed or tax records.

- Failing to File the Deed: Not filing the deed with the appropriate local office can result in invalidating the transfer.

- Lack of Legal Consultation: Not consulting with a real estate attorney can lead to overlooking important legal implications of transferring property ownership via a quitclaim deed.

Pros & Cons of Using Quitclaim Deeds

- Pros: Simple and cost-effective method to transfer property ownership; requires fewer documents and less time compared to other methods of property transfer.

- Cons: Provides no warranties on the title; may lead to complications if there are issues with the title or property disputes in the future.

FAQ

- What is a legal description of a property? A legal description provides detailed boundaries and measurements of a parcel of property, which are registered with the local municipality.

- Are quitclaim deeds reversible? Generally, once a quitclaim deed is executed and filed, the transfer of ownership is considered final, unless errors in the deed can be proven or both parties agree to reverse the transaction under specific conditions.

How to fill out Minnesota Quitclaim Deed From Individual To Individual?

Get any template from 85,000 legal documents such as Minnesota Quitclaim Deed from Individual to Individual online with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have already a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Quitclaim Deed from Individual to Individual you need to use.

- Read description and preview the template.

- As soon as you’re confident the sample is what you need, click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by bank card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the appropriate downloadable template. The platform will give you access to documents and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Quitclaim Deed from Individual to Individual fast and easy.

Form popularity

FAQ

A quitclaim deed transfers the owner's entire interest in the property to the person receiving the property but it only transfers what he actually owns, so if two people jointly own the property and one of them quitclaims his interest to his brother, he can only transfer his half of the ownership.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

If you own your own home, you are free to gift or sell an interest in the real property to someone else.You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances.