Minnesota Business Credit Application

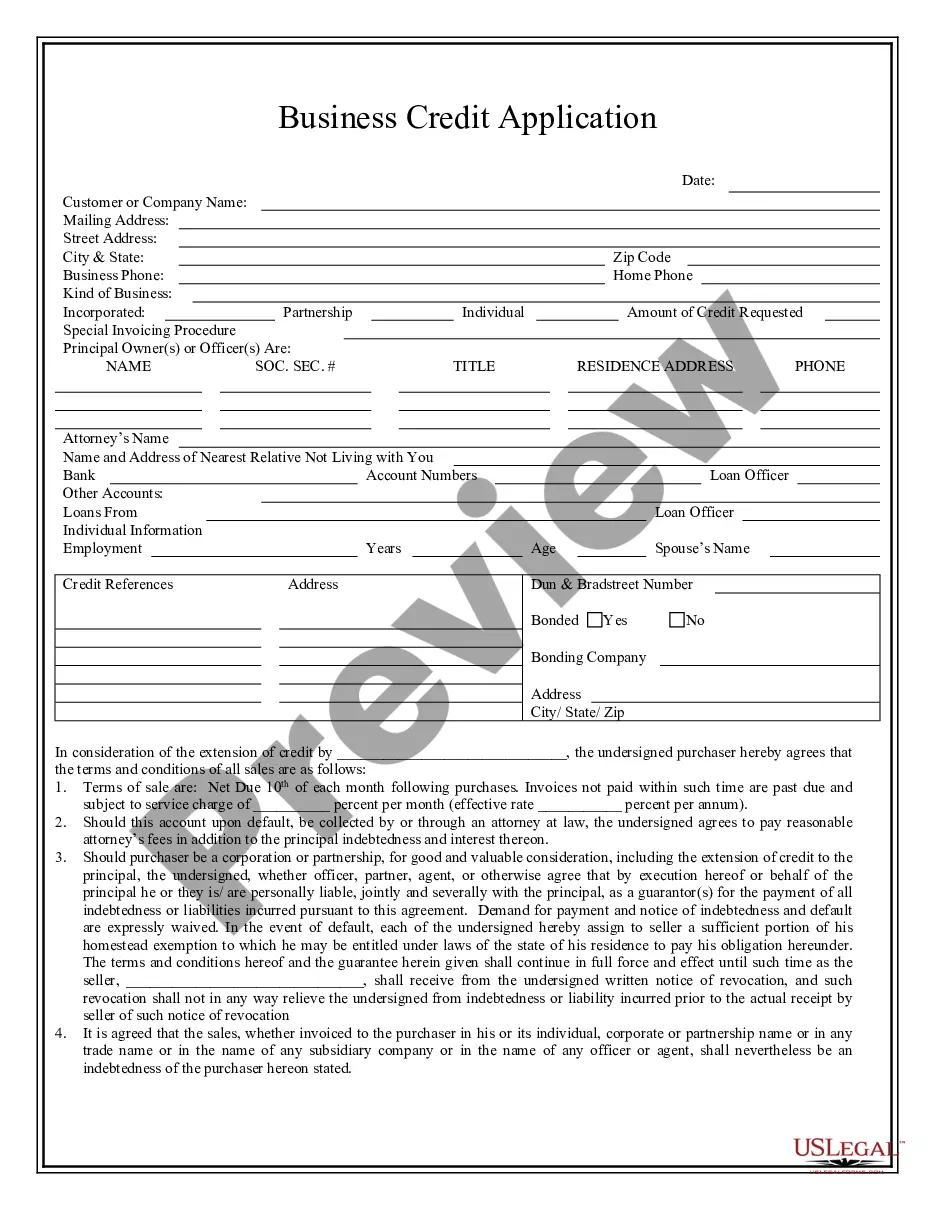

Description

How to fill out Minnesota Business Credit Application?

Obtain any template from 85,000 legal documents such as the Minnesota Business Credit Application available online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. Once on the form’s page, click the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the steps outlined below: Check the state-specific criteria for the Minnesota Business Credit Application you wish to use. Review the description and view the sample. Once you are confident the template meets your needs, simply click Buy Now. Select a subscription plan that fits your budget. Create a personal account. Make a payment through one of two suitable methods: by credit card or via PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the file to the My documents tab. Once your reusable form is prepared, print it out or save it to your device.

- With US Legal Forms, you will always have instant access to the correct downloadable template.

- The service grants you access to forms and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Minnesota Business Credit Application swiftly and effortlessly.

Form popularity

FAQ

Filling out a letter of credit application form requires specific information about your transaction. Begin by detailing the beneficiary's information and the amount of credit needed. Include the terms and conditions of the transaction, as well as any documents required for the Minnesota Business Credit Application. For streamlined processing, consider using resources from uslegalforms, which can guide you through the necessary steps.

Getting business credit involves several steps. First, establish a legal business entity and obtain an Employer Identification Number (EIN). Then, open a business bank account and apply for a Minnesota Business Credit Application with different lenders to build your credit history. Lastly, maintain a good payment history and monitor your credit score to improve your chances of obtaining favorable credit terms.

To fill out a Minnesota Business Credit Application, start by gathering your business information, including your legal business name, address, and tax identification number. Next, provide details about your business structure, such as whether you're a sole proprietorship, LLC, or corporation. Ensure you include your financial information, like annual revenue and existing debts, as this helps lenders assess your creditworthiness.

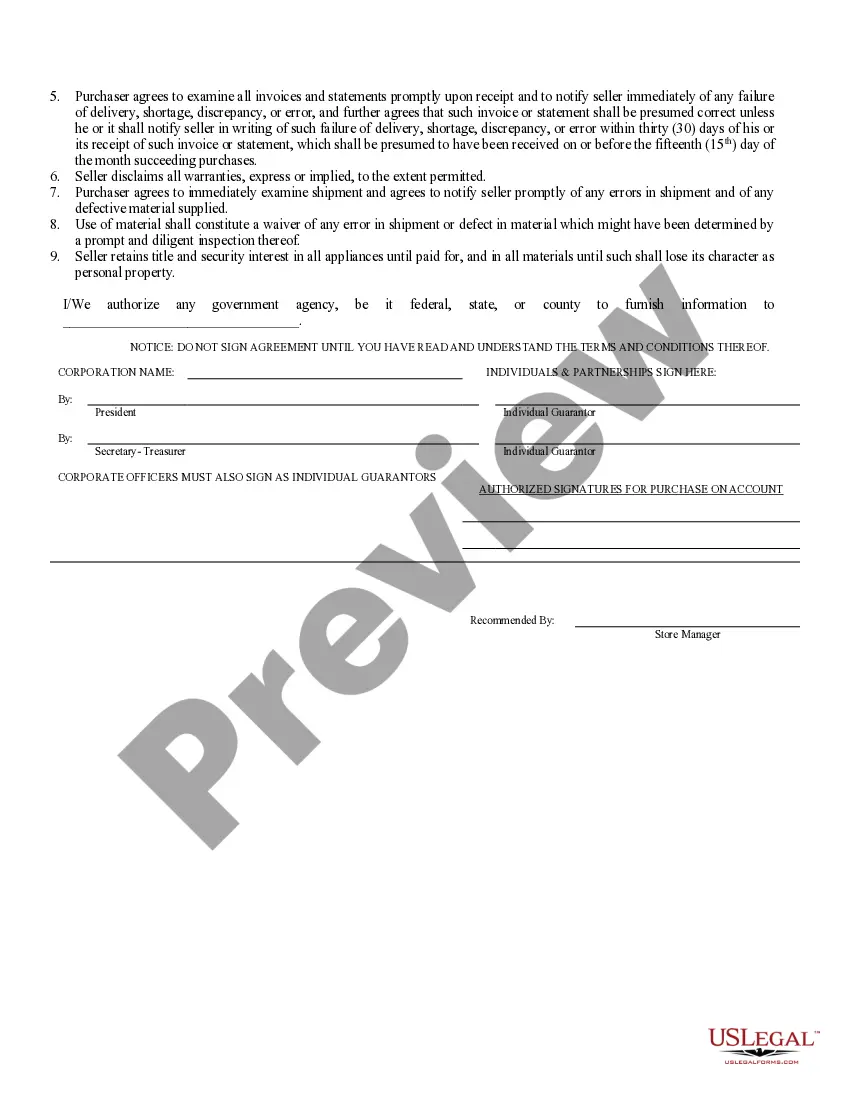

A credit application form for a business is a document that collects essential information about your company to evaluate its creditworthiness. This form typically includes details such as your business's legal structure, financial history, and references. By submitting a Minnesota Business Credit Application, you allow lenders to assess the risk of extending credit to your business. Using US Legal Forms can simplify this process, ensuring you have a clear and compliant application ready for lenders.

In Minnesota, grants for small businesses aim to support local entrepreneurs and stimulate economic growth. These grants can assist with various expenses, including startup costs, equipment purchases, and operational expenses. To access these funds, many business owners complete a Minnesota Business Credit Application, which helps demonstrate their financial needs and business plans. Utilizing platforms like US Legal Forms can streamline the application process and ensure you meet all necessary requirements.

To secure credit for a startup, an LLC must build its credit history. You can start by applying for a Minnesota Business Credit Application, which includes essential information about your business. Additionally, working with US Legal Forms can streamline this process and provide valuable resources to establish your business credit effectively.

Yes, a new LLC can obtain a business credit card. However, it's essential to establish your business credit profile first. You will need to provide details about your business, including your Employer Identification Number (EIN) and your Minnesota Business Credit Application. Platforms like US Legal Forms can guide you through the application process and help you gather the necessary documentation.