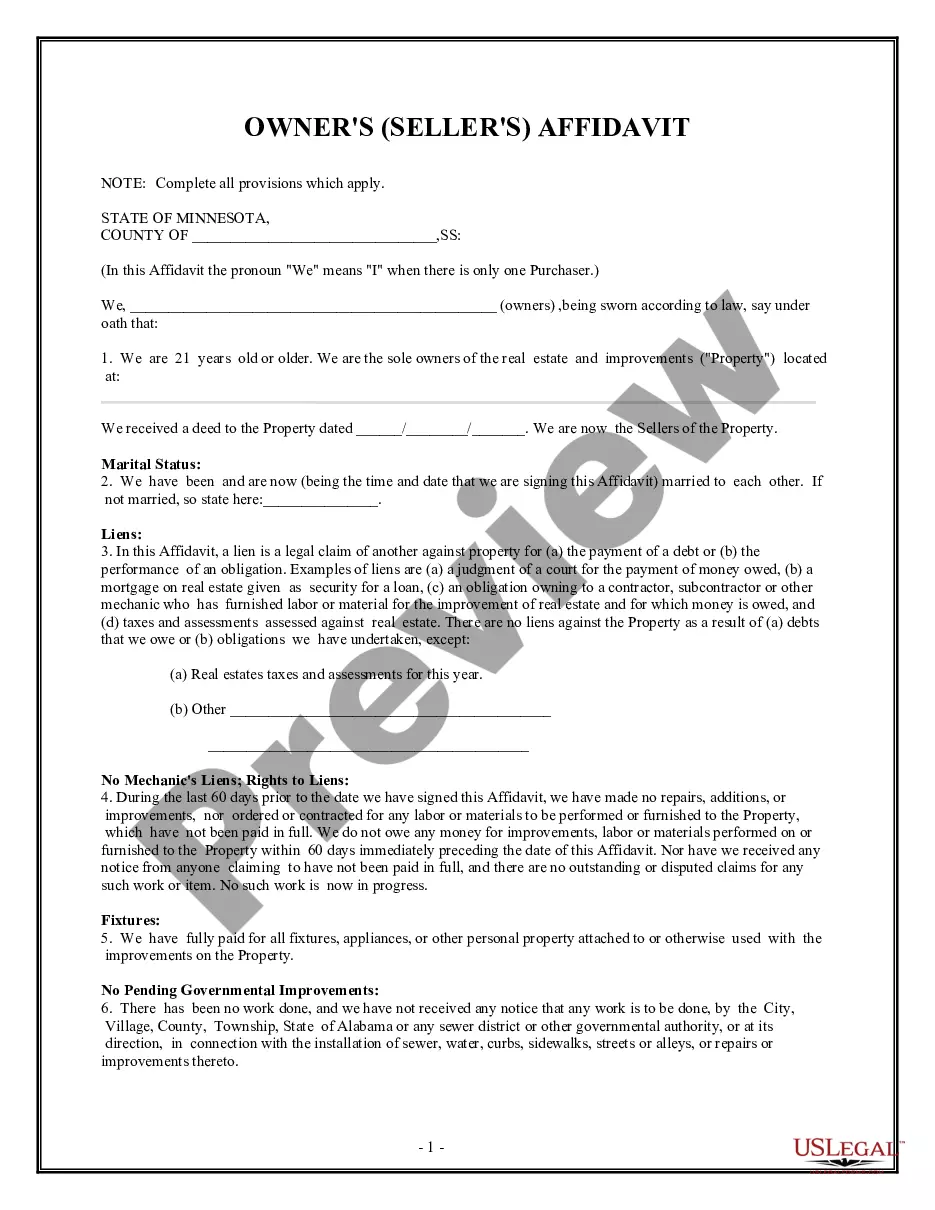

Minnesota Owner's or Seller's Affidavit of No Liens

Description

How to fill out Minnesota Owner's Or Seller's Affidavit Of No Liens?

Obtain any variation from 85,000 lawful documents, including Minnesota Owner's or Seller's Affidavit of No Liens, online with US Legal Forms. Each template is composed and refreshed by state-authorized legal experts.

If you already possess a subscription, Log In. Once you’re on the form’s page, hit the Download button and navigate to My documents to gain access to it.

If you haven’t subscribed yet, follow the guidelines below: Check the state-specific prerequisites for the Minnesota Owner's or Seller's Affidavit of No Liens you intend to utilize. Examine the description and preview the template. When you’re confident the sample is what you require, click on Buy Now. Select a subscription plan that truly fits your financial plan. Establish a personal account. Make a payment using one of two convenient methods: by card or through PayPal. Select a format to download the document in; two choices are available (PDF or Word). Download the document to the My documents section. Once your reusable form is ready, either print it out or save it to your device.

- With US Legal Forms, you will consistently have instant access to the appropriate downloadable template.

- The platform provides you with access to forms and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Minnesota Owner's or Seller's Affidavit of No Liens easily and promptly.

Form popularity

FAQ

Scope Out the Competition (Be A Nosey Neighbor) Give Minnesota Buyers What They Want. Analyze Minnesota's Real Estate Market Data for a Correct Listing Price. Make Sure Your Real Estate Photographs Don't Suck.

Key takeaways of buying a house in MinnesotaYou'll need a solid credit score and debt-to-income ratio, an appropriate down payment, and enough savings to cover closing costs and homeownership expenses.

Before you decide to sell your home without an agent, however, keep in mind that the process is far from easy. You'll have to invest a lot of time in doing the work a realtor would ordinarily handle, which includes everything from showing and marketing your home to negotiating the final price.

Scope Out the Competition (Be A Nosey Neighbor) Give Minnesota Buyers What They Want. Analyze Minnesota's Real Estate Market Data for a Correct Listing Price. Make Sure Your Real Estate Photographs Don't Suck.

Minimum credit score of 620 for conventional loans; 580 for FHA loans. Good credit history. Proof of reliable source of income. Debt-to-income ratio below 50%

Key takeaways of buying a house in Minnesota You'll need a solid credit score and debt-to-income ratio, an appropriate down payment, and enough savings to cover closing costs and homeownership expenses.

Step 1: Prepare Your House to Be Marketed. Step 2: Price Your Home Competitively, to Sell. Step 3: Get a Flat Fee Listing from the Multiple Listing Service (MLS) Step 4: Market Your Property. Step 5: Hold an Open House. Step 6: Know the Selling Points of Your Property. Step 7: Negotiate With the Buyer Yourself.

Step 1: Determine the fair market value of your home. You must get this step right. Step 2: Prepare the home for sale. Step 3: Market the home for sale. Step 4: Negotiate the sale. Step 5: Handle the closing.

Step 1: Evaluate your financial situation. Step 2: Choose the right neighborhood. Step 3: Find a great real estate agent in Minnesota. Step 4: Get pre-approved for a mortgage. Step 5: Start house hunting in Minnesota. Step 6: Make offers. Step 7: Inspections and appraisals. Step 8: Final walkthrough and closing!