- US Legal Forms

-

Mississippi Notice of Dishonored Check - Civil - Keywords: bad check...

Forty Dollar Check

Description Dishonored Check

What Is Dishonored Check Related forms

Related legal definitions

How to fill out Bounced Check Definition?

Obtain a printable Mississippi Notice of Dishonored Check - Civil - Keywords: bad check, bounced check within just several mouse clicks from the most comprehensive catalogue of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of affordable legal and tax templates for US citizens and residents online starting from 1997.

Customers who already have a subscription, must log in in to their US Legal Forms account, download the Mississippi Notice of Dishonored Check - Civil - Keywords: bad check, bounced check see it stored in the My Forms tab. Customers who don’t have a subscription are required to follow the steps below:

- Make sure your form meets your state’s requirements.

- If available, look through form’s description to learn more.

- If offered, review the shape to view more content.

- As soon as you are sure the form meets your requirements, click on Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you’ve downloaded your Mississippi Notice of Dishonored Check - Civil - Keywords: bad check, bounced check, it is possible to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Received Notice From The Bank Of A Dishonored Check Form Rating

Notice Of Dishonored Check Form popularity

Notice Dishonored Check Other Form Names

Bounced Check Letters FAQ

What is the effect of lack of notice of dishonor on the instrument which is payable in installments? 1. No acceleration clause Failure to give notice of dishonor on a previous installment does not discharge drawers and indorsers as to succeeding installments.

Sec. 116. Notice of non-payment where acceptance refused. - Where due notice of dishonor by non-acceptance has been given, notice of a subsequent dishonor by non-payment is not necessary unless in the meantime the instrument has been accepted.

There are certain situations where we do not require a notice of dishonour, which are: When it is dispensed or waived by the entitled party. For e.g., if the endorser writes along with the instrument- 'notice of dishonour waived'. When the drawer himself cancels(countermands) the payment.

A notice of dishonor is a formal notice stating that the bank will not accept a check or draft presented to the institution. A notice of dishonor may be given to the holder or presenter of the instrument.

A bill of exchange is said to be dishonoured by non-acceptance when the drawee, or one of several drawees not being partners, makes default in acceptance upon being duly required to accept the bill, or where presentment is excused and the bill is not accepted.

A protest is a certificate of dishonor made by a United States consul, vice consul, or a notary public or other person authorized to administer oaths by law of the place where dishonor occurs. It may be made upon information satisfactory to that person.

Bounced Check Letter Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Mississippi

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Notice of Dishonored Check

Note: This summary is not intended to be an all-inclusive summary of the law of bad checks, but does contain basic and other provisions. CRIMINAL AND CIVIL PROVISIONS

Mississippi Code

TITLE 97 - CRIMES

CHAPTER 19 - FALSE PRETENSES AND CHEATS

§ 97-19-55. Bad checks and insufficient funds.

(1) It shall be unlawful for any person with fraudulent intent:

(a) To make, draw, issue, utter, deliver, or authorize any check, draft, electronically converted check, or electronic commercial debit to obtain money, delivery of other valuable property, services, the use of property or credit extended by any licensed gaming establishment drawn on any real or fictitious bank, corporation, firm or person, knowing at the time of making, drawing, issuing, uttering or delivering said check, draft order, electronically converted check, or electronic commercial debit that the maker, drawer or payor has not sufficient funds in or on deposit with such bank, corporation, firm or person for the payment of such check, draft, order, electronically converted check, or electronic commercial debit in full, and all other checks, drafts or orders, or electronic fund transfers upon such funds then outstanding;

(b) To close an account without leaving sufficient funds to cover all outstanding checks, electronically converted check, or electronic commercial debit written or authorized on such account.

(2) For purposes of Sections 97-19-55 through 97-19-69:

(a) "Check" includes a casino marker issued to any licensed gaming establishment.

(b) "Credit" means an arrangement or understanding with a bank, corporation, firm or person for the payment of a check or other instrument.

(c) "Electronically converted check" means a single entry electronic debit transaction initiated with a check and cleared through the ACH Network as an Accounts Receivable Entry, a Point of Purchase Entry, or a Back Office Conversion Entry.

(d) "Electronic commercial debit" means an electronic debit transaction initiated through the ACH Network by a person for commercial, and not consumer, purposes whereby (i) the payor has signed an agreement to pay the payee for goods or services provided, (ii) as part of that agreement and as a condition thereof the payor provides the payee its bank and account information for the purposes of initiating such a debit in payment for the service or goods provided, (iii) the payee delivers such goods or services to the payor in reliance upon the agreement and the payor's debit authorization, and (iv) the payee initiates such a debit for such purposes. This definition does not include a consumer transaction governed by the Federal Electronic Fund Transfer Act (15 USC Section 1693, et seq.) and its implementing Regulation E (12 CFR Part 205) or a credit transaction governed by Section 75-4A-101 et seq., Mississippi Code of 1972.

(e) "Payor" means the party making payment through the referenced transaction.

(f) "Payee" means the party receiving payment through the referenced transaction.

(g) "Payor bank" is the bank on whom the payor's funds are drawn for the purposes of making payment through the referenced transaction.

(h) "Payee bank" is the bank through which payee is collecting funds for deposit into the payee's account by using the referenced transaction.

HISTORY: SOURCES: Codes, 1942, § 2153-01; Laws, 1972, ch. 476, § 1; Laws, 1983, ch. 523, § 1; Laws, 1998, ch. 477, § 1; Laws, 2002, ch. 311, § 1; Laws, 2009, ch. 454, § 2; Laws, 2015, ch. 323, § 1, eff from and after July 1, 2015.

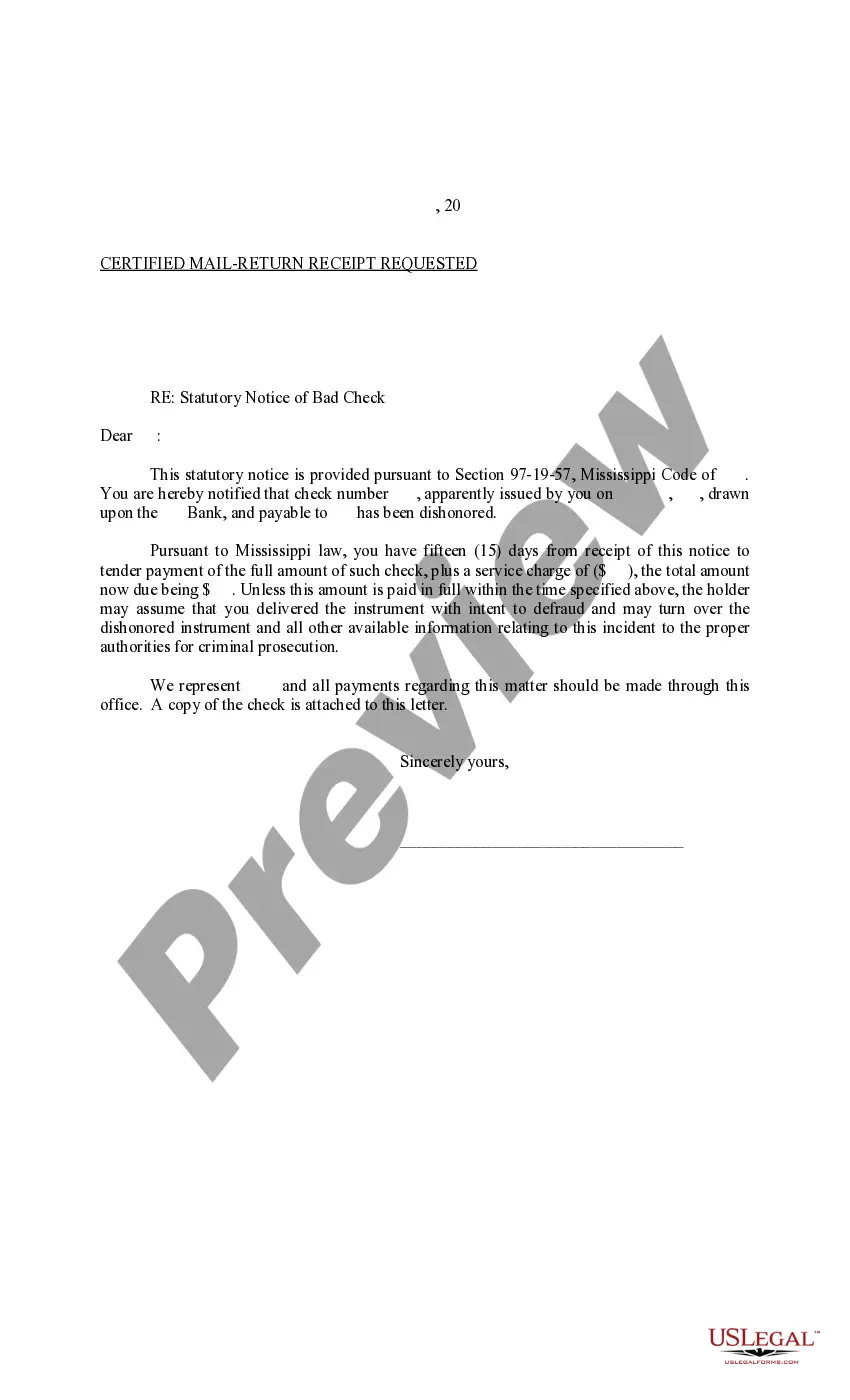

§ 97-19-57. Bad checks, electronically converted checks, electronic commercial debits; presumption of fraudulent intent; notice that check or electronic fund transfer has not been paid; notice returned undelivered as evidence of intent to defraud; transactions involving motor vehicles

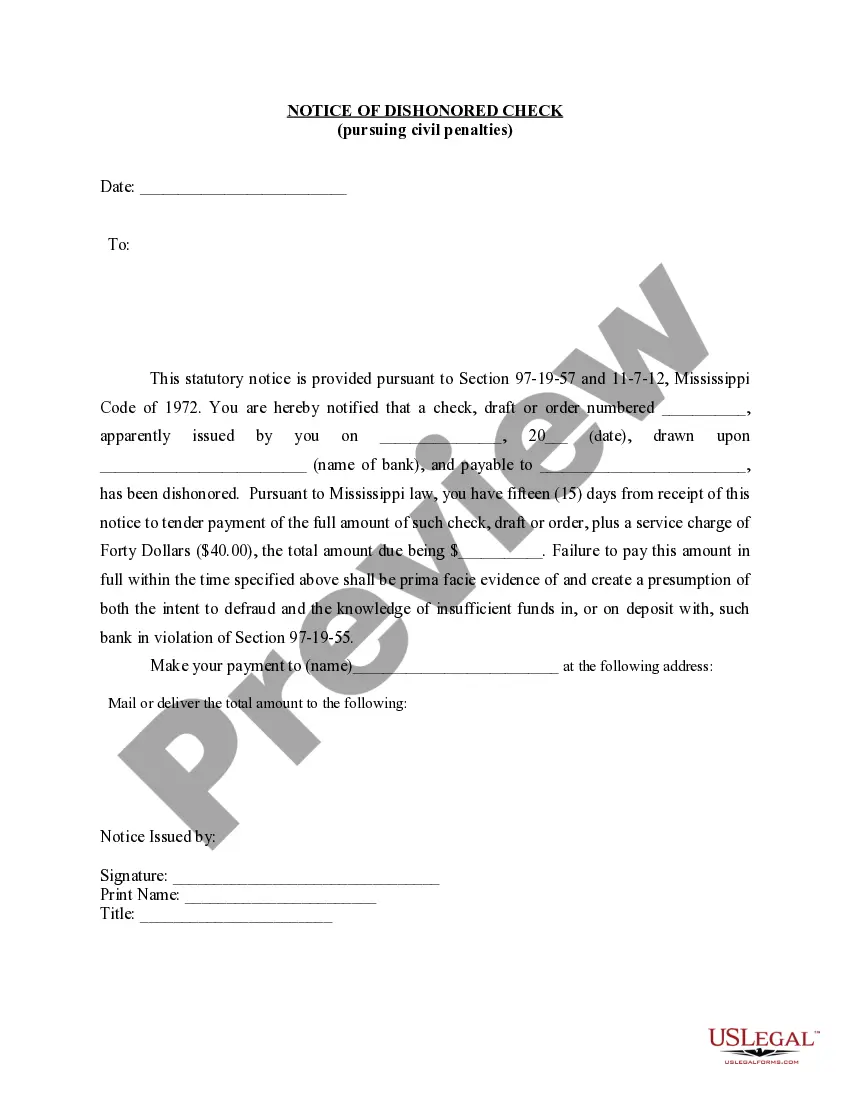

(1) As against the maker, drawer or payor thereof, the making, drawing, issuing, uttering, delivering, or initiation of a check, draft, order, electronically converted check, or electronic commercial debit payment of which is refused by the drawee, shall be prima facie evidence and create a presumption of intent to defraud and of knowledge of insufficient funds in, or on deposit with, such bank, corporation, firm or person, provided such maker, drawer or payor shall not have paid the holder or payee thereof the amount due thereon, together with a service charge of Forty Dollars ($ 40.00), within fifteen (15) days after receiving notice that such check, draft, order, electronically converted check, or electronic commercial debit has not been paid by the drawee or payor's bank.

(2) For purposes of Section 11-7-12, the form of the notice provided for in subsection (1) of this section for a check, draft, order, or electronically converted check shall be sent by regular mail and shall be substantially as follows: "This statutory notice is provided pursuant to Section 97-19-57, Mississippi Code of 1972. You are hereby notified that a check, draft, order, or electronically converted check numbered , apparently issued by you on (date), drawn upon (name of bank), and payable to , has been dishonored. Pursuant to Mississippi law, you have fifteen (15) days from receipt of this notice to tender payment of the full amount of such check, draft or order, or electronically converted check plus a service charge of Forty Dollars ($ 40.00), the total amount due being $ . Failure to pay this amount in full within the time specified above shall be prima facie evidence of and create a presumption of both the intent to defraud and the knowledge of insufficient funds in, or on deposit with, such bank in violation of Section 97-19-55."

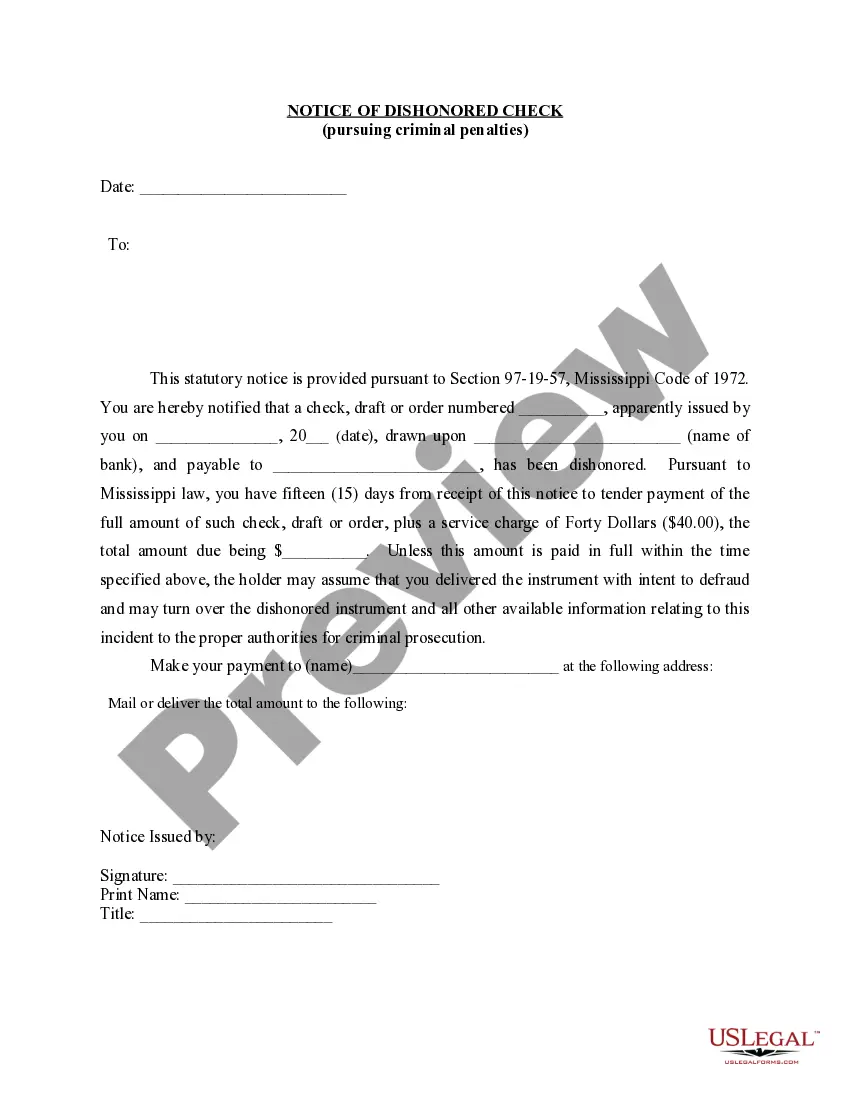

(3) For purposes of Section 97-19-67, the form of the notice provided for in subsection (1) of this section for a check, draft, order, or electronically converted check shall be sent by regular mail, supported by an affidavit of service by mailing, and shall be substantially as follows: "This statutory notice is provided pursuant to Section 97-19-57, Mississippi Code of 1972. You are hereby notified that a check, draft, order, or electronically converted check numbered , apparently issued by you on (date), drawn upon (name of bank), and payable to , has been dishonored. Pursuant to Mississippi law, you have fifteen (15) days from receipt of this notice to tender payment of the full amount of such check, draft or order, or electronically converted check plus a service charge of Forty Dollars ($ 40.00), the total amount due being $ . Unless this amount is paid in full within the time specified above, the holder may assume that you delivered the instrument with intent to defraud and may turn over the dishonored instrument and all other available information relating to this incident to the proper authorities for criminal prosecution."

(4) For purposes of Sections 11-7-12 and 97-19-67, the form of notice provided for in subsection (1) of this section for an electronic commercial debit shall be sent by regular mail, supported by an affidavit of service by mailing, and shall be substantially as follows: "This statutory notice is provided pursuant to Section 97-19-57, Mississippi Code of 1972. You are hereby notified that on (date) an electronic commercial debit was initiated by (name of payee bank) on behalf of (payee) to (name of payor bank) through the ACH Network requesting a payment in the amount of $ to (payee) from your account pursuant to invoice number and our agreement dated , but that payment has been dishonored. Pursuant to Mississippi law, because the payee delivered (goods or service) to you in reliance upon the agreement, you have fifteen (15) days from receipt of this notice to tender payment of the full amount of such electronic commercial debit plus a service charge of Forty Dollars ($ 40.00), the total amount due being $ . Failure to pay this amount in full within the time specified above shall be prima facie evidence of and create a presumption of both the intent to defraud and the knowledge of insufficient funds in, or on deposit with, such bank in violation of Section 97-19-55, and the payee may assume that you entered into such agreement with intent to defraud and may turn over all documentation related to the dishonored electronic commercial debit to the proper authorities for criminal prosecution.”<br />

<br />

(5) If any notice is returned undelivered to the sender after such notice was mailed to the address printed on the check, draft or order, or to the address given by the accused at the time of issuance of the instrument, such return shall be prima facie evidence of the maker’s or drawer’s intent to defraud.<br />

<br />

(6) Affidavit of service by mail shall be adequate if made in substantially the following form:<br />

<br />

“STATE OF<br />

<br />

COUNTY OF<br />

<br />

, being first duly sworn on oath, deposes and states that he/she is at least eighteen (18) years of age and that on (date) , 2 , he/she served the attached Notice of Dishonor by placing a true and correct copy thereof securely enclosed in an envelope addressed as follows:<br />

and deposited the same, postage prepaid, in the United States mail at .<br />

(signature)<br />

Subscribed to and sworn before me, this the day of , 2 .<br />

<br />

(Notary Public)<br />

My commission expires:<br />

(SEAL)”<br />

<br />

(7) Without in any way limiting the provisions of this section, this section shall apply to a draft for the payment of money given for a motor vehicle even if such payment is conditioned upon delivery of documents necessary for transfer of a valid title to the purchaser.<br />

<br />

HISTORY: SOURCES: Codes, 1942, § 2153-02; Laws, 1972, ch. 476, § 2; Laws, 1983, ch. 523, § 2; Laws, 1992, ch. 513, § 1; Laws, 1999, ch. 436, § 1; Laws, 2000, ch. 364, § 2; Laws, 2001, ch. 328, § 1; Laws, 2002, ch. 312, § 1; Laws, 2004, ch. 374, § 1; Laws, 2015, ch. 323, § 2, eff from and after July 1, 2015.<br />

<br />

§ 97-19-67. Bad checks, electronically converted checks, electronic commercial debits; penalties; restitution<br />

<br />

(1) Except as may be otherwise provided by subsection (2) of this section, any person violating Section 97-19-55, upon conviction, shall be punished as follows:<br />

<br />

(a) For the first offense of violating said section, where the check, draft, order, electronically converted check, or electronic commercial debit involved be less than One Hundred Dollars ($ 100.00), the person committing such offense shall be guilty of a misdemeanor and, upon conviction, shall be punished by a fine of not less than Twenty-five Dollars ($ 25.00), nor more than Five Hundred Dollars ($ 500.00), or by imprisonment in the county jail for a term of not less than five (5) days nor more than six (6) months, or by both such fine and imprisonment, in the discretion of the court.<br />

<br />

(b) Upon commission of a second offense of violating said section, where the check, draft, order, electronically converted check, or electronic commercial debit involved is less than One Hundred Dollars ($ 100.00), the person committing such offense shall be guilty of a misdemeanor and, upon conviction, shall be punished by a fine of not less than Fifty Dollars ($ 50.00) nor more than One Thousand Dollars ($ 1,000.00), or by imprisonment in the county jail for a term of not less than thirty (30) days nor more than one (1) year, or by both such fine and imprisonment, in the discretion of the court.<br />

<br />

(c) Upon commission of a third or any subsequent offense of violating said section, regardless of the amount of the check, draft, order, electronically converted check, or electronic commercial debit involved, and regardless of the amount of the checks, drafts or orders involved in the prior convictions, the person committing such offense shall be guilty of a felony and, upon conviction, shall be punished by imprisonment in the State Penitentiary for a term of not less than one (1) nor more than five (5) years.<br />

<br />

(d) Where the check, draft, order, electronically converted check, or electronic commercial debit involved shall be One Hundred Dollars ($ 100.00) or more, the person committing such offense, whether same be a first or second offense, shall be guilty of a felony and, upon conviction, shall be punished by a fine of not less than One Hundred Dollars ($ 100.00) nor more than One Thousand Dollars ($ 1,000.00), or by imprisonment in the State Penitentiary for a term of not more than three (3) years, or by both such fine and imprisonment, in the discretion of the court. Upon conviction of a third or any subsequent offense, the person convicted shall be punished as is provided in the immediately preceding paragraph hereof.<br />

<br />

(2) Where the conviction was based on a worthless check, draft, order, or electronically converted check given for the purpose of satisfying a preexisting debt or making a payment or payments on a past-due account or accounts, no imprisonment shall be ordered as punishment, but the court may order the convicted person to pay a fine of up to the applicable amounts prescribed in subsection (1)(a), (b) and (d) of this section; provided, however, that an electronic commercial debit initiated following the delivery of goods or services that were provided in reliance upon the agreement for payment through that means shall not be considered payment for a preexisting debt or a past-due account or accounts for the purposes of this section.<br />

<br />

(3) In addition to or in lieu of any penalty imposed under the provisions of subsection (1) or subsection (2) of this section, the court may, in its discretion, order any person convicted of violating Section 97-19-55 to make restitution in accordance with the provisions of Sections 99-37-1 through 99-37-23 to the holder or payee of any check, draft, order, electronically converted check, or electronic commercial debit for which payment has been refused.<br />

<br />

(4) Upon conviction of any person for a violation of Section 97-19-55, when the prosecution of such person was commenced by the filing of a complaint with the court by the district attorney under the provisions of Section 97-19-79, the court shall, in addition to any other fine, fee, cost or penalty which may be imposed under this section or as otherwise provided by law, and in addition to any order as the court may enter under subsection (3) of this section requiring the offender to pay restitution under Sections 99-37-1 through 99-37-23, impose a fee in the amount up to eighty-five percent (85%) of the face amount of the check, draft, order, electronically converted check, or electronic commercial debit for which the offender was convicted of drawing, making, issuing, uttering, delivering or authorizing in violation of Section 97-19-55.<br />

<br />

(5) It shall be the duty of the clerk or judicial officer of the court collecting the fees imposed under subsection (4) of this section to monthly deposit all such fees so collected with the State Treasurer, either directly or by other appropriate procedures, for deposit in the special fund of the State Treasury created under Section 99-19-32, known as the “Criminal Justice Fund.”<br />

<br />

(6) After the accused has complied with all terms of the statute and the complainant or victim has been paid, the district attorney’s check unit may dispose of the accused’s file after one (1) year has expired after the last audit.<br />

<br />

HISTORY: SOURCES: Codes, 1942, § 2153-06; Laws, 1972, ch. 476, § 6; Laws, 1983, ch. 523, § 5; Laws, 1988, ch. 551, § 6; Laws, 1994, ch. 389, § 1; Laws, 2015, ch. 323, § 7, eff from and after July 1, 2015<br />

<br />

TITLE 11. CIVIL PRACTICE AND PROCEDURE<br />

CHAPTER 7. PRACTICE AND PROCEDURE IN CIRCUIT COURTS<br />

<br />

§ 11-7-12. Civil penalty recoverable for violation of bad check statute; applicability to electronic transfers of funds<br />

<br />

(1) If a check, draft or order is made, drawn, issued, uttered or delivered in violation of Section 97-19-55, the payee, endorser or his assignee shall be entitled to collect, in addition to the face amount of the check, draft or order, a service charge of Forty Dollars ($ 40.00).<br />

<br />

(2) In any civil action founded on a check, draft or order made, drawn, issued, uttered or delivered in violation of Section 97-19-55, the plaintiff, if he be a payee, endorser, holder or assignee, shall be entitled to recover, in addition to the face amount of the check, draft or order, damages in the following amount:<br />

<br />

(a) If the amount of the check, draft or order is up to and including Twenty-five Dollars ($ 25.00), then the additional damages shall be:<br />

<br />

(i) A service charge of Thirty Dollars ($ 30.00); and<br />

<br />

(ii) In the event suit is filed by a licensed attorney, reasonable attorney’s fees as determined by the judge.<br />

<br />

(b) If the amount of the check, draft or order is above Twenty-five Dollars, then the additional damages shall be:<br />

<br />

(i) A service charge of Forty Dollars ($ 40.00); and<br />

<br />

(ii) In the event suit is filed by a licensed attorney, reasonable attorney’s fees as determined by the judge.<br />

<br />

(c) The payee, endorser, holder or assignee of a check, draft or order may claim in a single civil action all checks, drafts or orders made, drawn, issued, uttered or delivered in violation of Section 97-19-55 by a single drawer without regard to venue or the identity or number of payees on those instruments.<br />

<br />

(d) The provisions of this section shall also apply to electronic transfers of funds.<br />

<br />

HISTORY: SOURCES: Laws, 1976, ch. 454; Laws, 2000, ch. 364, § 1; Laws, 2004, ch. 374, § 2; Laws, 2007, ch. 451, § 1, eff from and after July 1, 2007.

Notice of Dishonored Check

Note: This summary is not intended to be an all-inclusive summary of the law of bad checks, but does contain basic and other provisions. CRIMINAL AND CIVIL PROVISIONS

Mississippi Code

TITLE 97 - CRIMES

CHAPTER 19 - FALSE PRETENSES AND CHEATS

§ 97-19-55. Bad checks and insufficient funds.

(1) It shall be unlawful for any person with fraudulent intent:

(a) To make, draw, issue, utter, deliver, or authorize any check, draft, electronically converted check, or electronic commercial debit to obtain money, delivery of other valuable property, services, the use of property or credit extended by any licensed gaming establishment drawn on any real or fictitious bank, corporation, firm or person, knowing at the time of making, drawing, issuing, uttering or delivering said check, draft order, electronically converted check, or electronic commercial debit that the maker, drawer or payor has not sufficient funds in or on deposit with such bank, corporation, firm or person for the payment of such check, draft, order, electronically converted check, or electronic commercial debit in full, and all other checks, drafts or orders, or electronic fund transfers upon such funds then outstanding;

(b) To close an account without leaving sufficient funds to cover all outstanding checks, electronically converted check, or electronic commercial debit written or authorized on such account.

(2) For purposes of Sections 97-19-55 through 97-19-69:

(a) "Check" includes a casino marker issued to any licensed gaming establishment.

(b) "Credit" means an arrangement or understanding with a bank, corporation, firm or person for the payment of a check or other instrument.

(c) "Electronically converted check" means a single entry electronic debit transaction initiated with a check and cleared through the ACH Network as an Accounts Receivable Entry, a Point of Purchase Entry, or a Back Office Conversion Entry.

(d) "Electronic commercial debit" means an electronic debit transaction initiated through the ACH Network by a person for commercial, and not consumer, purposes whereby (i) the payor has signed an agreement to pay the payee for goods or services provided, (ii) as part of that agreement and as a condition thereof the payor provides the payee its bank and account information for the purposes of initiating such a debit in payment for the service or goods provided, (iii) the payee delivers such goods or services to the payor in reliance upon the agreement and the payor's debit authorization, and (iv) the payee initiates such a debit for such purposes. This definition does not include a consumer transaction governed by the Federal Electronic Fund Transfer Act (15 USC Section 1693, et seq.) and its implementing Regulation E (12 CFR Part 205) or a credit transaction governed by Section 75-4A-101 et seq., Mississippi Code of 1972.

(e) "Payor" means the party making payment through the referenced transaction.

(f) "Payee" means the party receiving payment through the referenced transaction.

(g) "Payor bank" is the bank on whom the payor's funds are drawn for the purposes of making payment through the referenced transaction.

(h) "Payee bank" is the bank through which payee is collecting funds for deposit into the payee's account by using the referenced transaction.

HISTORY: SOURCES: Codes, 1942, § 2153-01; Laws, 1972, ch. 476, § 1; Laws, 1983, ch. 523, § 1; Laws, 1998, ch. 477, § 1; Laws, 2002, ch. 311, § 1; Laws, 2009, ch. 454, § 2; Laws, 2015, ch. 323, § 1, eff from and after July 1, 2015.

§ 97-19-57. Bad checks, electronically converted checks, electronic commercial debits; presumption of fraudulent intent; notice that check or electronic fund transfer has not been paid; notice returned undelivered as evidence of intent to defraud; transactions involving motor vehicles

(1) As against the maker, drawer or payor thereof, the making, drawing, issuing, uttering, delivering, or initiation of a check, draft, order, electronically converted check, or electronic commercial debit payment of which is refused by the drawee, shall be prima facie evidence and create a presumption of intent to defraud and of knowledge of insufficient funds in, or on deposit with, such bank, corporation, firm or person, provided such maker, drawer or payor shall not have paid the holder or payee thereof the amount due thereon, together with a service charge of Forty Dollars ($ 40.00), within fifteen (15) days after receiving notice that such check, draft, order, electronically converted check, or electronic commercial debit has not been paid by the drawee or payor's bank.

(2) For purposes of Section 11-7-12, the form of the notice provided for in subsection (1) of this section for a check, draft, order, or electronically converted check shall be sent by regular mail and shall be substantially as follows: "This statutory notice is provided pursuant to Section 97-19-57, Mississippi Code of 1972. You are hereby notified that a check, draft, order, or electronically converted check numbered , apparently issued by you on (date), drawn upon (name of bank), and payable to , has been dishonored. Pursuant to Mississippi law, you have fifteen (15) days from receipt of this notice to tender payment of the full amount of such check, draft or order, or electronically converted check plus a service charge of Forty Dollars ($ 40.00), the total amount due being $ . Failure to pay this amount in full within the time specified above shall be prima facie evidence of and create a presumption of both the intent to defraud and the knowledge of insufficient funds in, or on deposit with, such bank in violation of Section 97-19-55."

(3) For purposes of Section 97-19-67, the form of the notice provided for in subsection (1) of this section for a check, draft, order, or electronically converted check shall be sent by regular mail, supported by an affidavit of service by mailing, and shall be substantially as follows: "This statutory notice is provided pursuant to Section 97-19-57, Mississippi Code of 1972. You are hereby notified that a check, draft, order, or electronically converted check numbered , apparently issued by you on (date), drawn upon (name of bank), and payable to , has been dishonored. Pursuant to Mississippi law, you have fifteen (15) days from receipt of this notice to tender payment of the full amount of such check, draft or order, or electronically converted check plus a service charge of Forty Dollars ($ 40.00), the total amount due being $ . Unless this amount is paid in full within the time specified above, the holder may assume that you delivered the instrument with intent to defraud and may turn over the dishonored instrument and all other available information relating to this incident to the proper authorities for criminal prosecution."

(4) For purposes of Sections 11-7-12 and 97-19-67, the form of notice provided for in subsection (1) of this section for an electronic commercial debit shall be sent by regular mail, supported by an affidavit of service by mailing, and shall be substantially as follows: "This statutory notice is provided pursuant to Section 97-19-57, Mississippi Code of 1972. You are hereby notified that on (date) an electronic commercial debit was initiated by (name of payee bank) on behalf of (payee) to (name of payor bank) through the ACH Network requesting a payment in the amount of $ to (payee) from your account pursuant to invoice number and our agreement dated , but that payment has been dishonored. Pursuant to Mississippi law, because the payee delivered (goods or service) to you in reliance upon the agreement, you have fifteen (15) days from receipt of this notice to tender payment of the full amount of such electronic commercial debit plus a service charge of Forty Dollars ($ 40.00), the total amount due being $ . Failure to pay this amount in full within the time specified above shall be prima facie evidence of and create a presumption of both the intent to defraud and the knowledge of insufficient funds in, or on deposit with, such bank in violation of Section 97-19-55, and the payee may assume that you entered into such agreement with intent to defraud and may turn over all documentation related to the dishonored electronic commercial debit to the proper authorities for criminal prosecution.”<br />

<br />

(5) If any notice is returned undelivered to the sender after such notice was mailed to the address printed on the check, draft or order, or to the address given by the accused at the time of issuance of the instrument, such return shall be prima facie evidence of the maker’s or drawer’s intent to defraud.<br />

<br />

(6) Affidavit of service by mail shall be adequate if made in substantially the following form:<br />

<br />

“STATE OF<br />

<br />

COUNTY OF<br />

<br />

, being first duly sworn on oath, deposes and states that he/she is at least eighteen (18) years of age and that on (date) , 2 , he/she served the attached Notice of Dishonor by placing a true and correct copy thereof securely enclosed in an envelope addressed as follows:<br />

and deposited the same, postage prepaid, in the United States mail at .<br />

(signature)<br />

Subscribed to and sworn before me, this the day of , 2 .<br />

<br />

(Notary Public)<br />

My commission expires:<br />

(SEAL)”<br />

<br />

(7) Without in any way limiting the provisions of this section, this section shall apply to a draft for the payment of money given for a motor vehicle even if such payment is conditioned upon delivery of documents necessary for transfer of a valid title to the purchaser.<br />

<br />

HISTORY: SOURCES: Codes, 1942, § 2153-02; Laws, 1972, ch. 476, § 2; Laws, 1983, ch. 523, § 2; Laws, 1992, ch. 513, § 1; Laws, 1999, ch. 436, § 1; Laws, 2000, ch. 364, § 2; Laws, 2001, ch. 328, § 1; Laws, 2002, ch. 312, § 1; Laws, 2004, ch. 374, § 1; Laws, 2015, ch. 323, § 2, eff from and after July 1, 2015.<br />

<br />

§ 97-19-67. Bad checks, electronically converted checks, electronic commercial debits; penalties; restitution<br />

<br />

(1) Except as may be otherwise provided by subsection (2) of this section, any person violating Section 97-19-55, upon conviction, shall be punished as follows:<br />

<br />

(a) For the first offense of violating said section, where the check, draft, order, electronically converted check, or electronic commercial debit involved be less than One Hundred Dollars ($ 100.00), the person committing such offense shall be guilty of a misdemeanor and, upon conviction, shall be punished by a fine of not less than Twenty-five Dollars ($ 25.00), nor more than Five Hundred Dollars ($ 500.00), or by imprisonment in the county jail for a term of not less than five (5) days nor more than six (6) months, or by both such fine and imprisonment, in the discretion of the court.<br />

<br />

(b) Upon commission of a second offense of violating said section, where the check, draft, order, electronically converted check, or electronic commercial debit involved is less than One Hundred Dollars ($ 100.00), the person committing such offense shall be guilty of a misdemeanor and, upon conviction, shall be punished by a fine of not less than Fifty Dollars ($ 50.00) nor more than One Thousand Dollars ($ 1,000.00), or by imprisonment in the county jail for a term of not less than thirty (30) days nor more than one (1) year, or by both such fine and imprisonment, in the discretion of the court.<br />

<br />

(c) Upon commission of a third or any subsequent offense of violating said section, regardless of the amount of the check, draft, order, electronically converted check, or electronic commercial debit involved, and regardless of the amount of the checks, drafts or orders involved in the prior convictions, the person committing such offense shall be guilty of a felony and, upon conviction, shall be punished by imprisonment in the State Penitentiary for a term of not less than one (1) nor more than five (5) years.<br />

<br />

(d) Where the check, draft, order, electronically converted check, or electronic commercial debit involved shall be One Hundred Dollars ($ 100.00) or more, the person committing such offense, whether same be a first or second offense, shall be guilty of a felony and, upon conviction, shall be punished by a fine of not less than One Hundred Dollars ($ 100.00) nor more than One Thousand Dollars ($ 1,000.00), or by imprisonment in the State Penitentiary for a term of not more than three (3) years, or by both such fine and imprisonment, in the discretion of the court. Upon conviction of a third or any subsequent offense, the person convicted shall be punished as is provided in the immediately preceding paragraph hereof.<br />

<br />

(2) Where the conviction was based on a worthless check, draft, order, or electronically converted check given for the purpose of satisfying a preexisting debt or making a payment or payments on a past-due account or accounts, no imprisonment shall be ordered as punishment, but the court may order the convicted person to pay a fine of up to the applicable amounts prescribed in subsection (1)(a), (b) and (d) of this section; provided, however, that an electronic commercial debit initiated following the delivery of goods or services that were provided in reliance upon the agreement for payment through that means shall not be considered payment for a preexisting debt or a past-due account or accounts for the purposes of this section.<br />

<br />

(3) In addition to or in lieu of any penalty imposed under the provisions of subsection (1) or subsection (2) of this section, the court may, in its discretion, order any person convicted of violating Section 97-19-55 to make restitution in accordance with the provisions of Sections 99-37-1 through 99-37-23 to the holder or payee of any check, draft, order, electronically converted check, or electronic commercial debit for which payment has been refused.<br />

<br />

(4) Upon conviction of any person for a violation of Section 97-19-55, when the prosecution of such person was commenced by the filing of a complaint with the court by the district attorney under the provisions of Section 97-19-79, the court shall, in addition to any other fine, fee, cost or penalty which may be imposed under this section or as otherwise provided by law, and in addition to any order as the court may enter under subsection (3) of this section requiring the offender to pay restitution under Sections 99-37-1 through 99-37-23, impose a fee in the amount up to eighty-five percent (85%) of the face amount of the check, draft, order, electronically converted check, or electronic commercial debit for which the offender was convicted of drawing, making, issuing, uttering, delivering or authorizing in violation of Section 97-19-55.<br />

<br />

(5) It shall be the duty of the clerk or judicial officer of the court collecting the fees imposed under subsection (4) of this section to monthly deposit all such fees so collected with the State Treasurer, either directly or by other appropriate procedures, for deposit in the special fund of the State Treasury created under Section 99-19-32, known as the “Criminal Justice Fund.”<br />

<br />

(6) After the accused has complied with all terms of the statute and the complainant or victim has been paid, the district attorney’s check unit may dispose of the accused’s file after one (1) year has expired after the last audit.<br />

<br />

HISTORY: SOURCES: Codes, 1942, § 2153-06; Laws, 1972, ch. 476, § 6; Laws, 1983, ch. 523, § 5; Laws, 1988, ch. 551, § 6; Laws, 1994, ch. 389, § 1; Laws, 2015, ch. 323, § 7, eff from and after July 1, 2015<br />

<br />

TITLE 11. CIVIL PRACTICE AND PROCEDURE<br />

CHAPTER 7. PRACTICE AND PROCEDURE IN CIRCUIT COURTS<br />

<br />

§ 11-7-12. Civil penalty recoverable for violation of bad check statute; applicability to electronic transfers of funds<br />

<br />

(1) If a check, draft or order is made, drawn, issued, uttered or delivered in violation of Section 97-19-55, the payee, endorser or his assignee shall be entitled to collect, in addition to the face amount of the check, draft or order, a service charge of Forty Dollars ($ 40.00).<br />

<br />

(2) In any civil action founded on a check, draft or order made, drawn, issued, uttered or delivered in violation of Section 97-19-55, the plaintiff, if he be a payee, endorser, holder or assignee, shall be entitled to recover, in addition to the face amount of the check, draft or order, damages in the following amount:<br />

<br />

(a) If the amount of the check, draft or order is up to and including Twenty-five Dollars ($ 25.00), then the additional damages shall be:<br />

<br />

(i) A service charge of Thirty Dollars ($ 30.00); and<br />

<br />

(ii) In the event suit is filed by a licensed attorney, reasonable attorney’s fees as determined by the judge.<br />

<br />

(b) If the amount of the check, draft or order is above Twenty-five Dollars, then the additional damages shall be:<br />

<br />

(i) A service charge of Forty Dollars ($ 40.00); and<br />

<br />

(ii) In the event suit is filed by a licensed attorney, reasonable attorney’s fees as determined by the judge.<br />

<br />

(c) The payee, endorser, holder or assignee of a check, draft or order may claim in a single civil action all checks, drafts or orders made, drawn, issued, uttered or delivered in violation of Section 97-19-55 by a single drawer without regard to venue or the identity or number of payees on those instruments.<br />

<br />

(d) The provisions of this section shall also apply to electronic transfers of funds.<br />

<br />

HISTORY: SOURCES: Laws, 1976, ch. 454; Laws, 2000, ch. 364, § 1; Laws, 2004, ch. 374, § 2; Laws, 2007, ch. 451, § 1, eff from and after July 1, 2007.