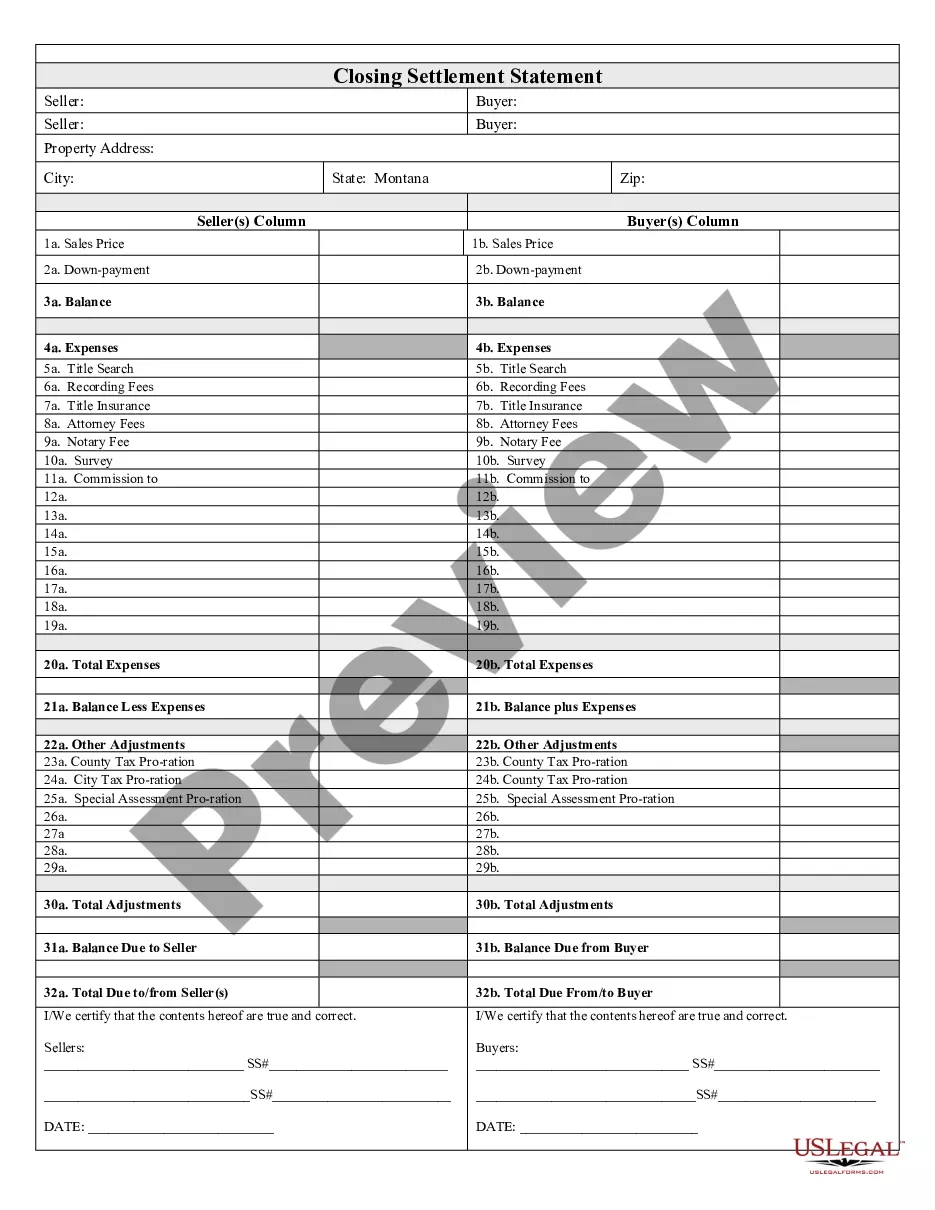

Closing Settlement Statement Form

Description Montana Closing Costs

How to fill out Montana Closing Statement?

- Log into your account if you're a returning user. Ensure your subscription is current to access essential documents.

- For first-time users, explore the available forms by checking the preview and descriptions to find the relevant Montana closing statement that meets your legal needs.

- If necessary, utilize the search function to locate other templates that may better suit your requirements.

- Once you find the appropriate form, click 'Buy Now' to select your preferred subscription plan, and create an account to access the extensive library.

- Provide your payment information and complete the purchase through either credit card or PayPal.

- Download your Montana closing statement and save it on your device. You can also access it anytime under 'My Forms' in your account.

With US Legal Forms, individuals and attorneys gain a significant advantage through our extensive library of over 85,000 legal documents, making it the most robust collection available at an affordable cost. Each form is designed to be easily fillable and editable, catering to your specific needs.

In conclusion, obtaining your Montana closing statement is easy with US Legal Forms. You can ensure your documents are precise and legally sound by taking these straightforward steps. Start your journey today and experience the efficiency of our premium legal services!

Form popularity

FAQ

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

A closing statement is an accounting, in writing, prepared at the close of escrow which sets forth the charges and credits of your account.

Cleared to Close (3 days)Getting the all clear to close is the last step before your final loan documents can be drawn up and delivered to you for signing and notarizing. A final Closing Disclosure detailing all of the loan terms, costs and other details will be prepared by your lender and provided to you for review.

Estimated Escrow: Some lenders collect the money needed for recurring expenses (such things as property taxes, homeowners insurance and association fees) in advance and pay those bills on your behalf. To see which bills your lender escrows for, look at the Other Costs tab on Page 2 of the form.

Normally the seller purchases title insurance for the new buyer in the amount of the purchase price and the borrower purchases title insurance for the lender in the amount of the mortgage. When the mortgage is paid off, the lender's title insurance contract expires.

While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing.

The Closing Disclosure is meant to help you understand your loan before you get to the closing table. In essence, it means your loan is clear to close, but it also means that you have time to go over the fees on your loan.

YOUR CLOSING STATEMENT IS "IMPORTANT": When your escrow has closed you will receive a closing statement which is a summary of the costs and financial settlement of your real estate transaction. This closing statement will be important for future tax needs and other possible considerations.

Closing Notice means a written notice duly executed by an authorized officer of Seller that is delivered by Seller to Buyer exercising its right to require the Closing of the transactions contemplated hereby in accordance with Article 6.